Concerns over aggressive interest rate hikes by the Federal Reserve to tame the surging inflation and a consequent economic slump have led to the stock markets witnessing a relentless sell-off recently. The Nasdaq Composite has entered the bear market territory, as it is down 25.4% year-to-date, while the S&P 500 and the Dow Jones Industrial Average have lost 16.1% and 12% year-to-date, respectively.

Even after the intense sell-off this year, strategists think that there are still good shorting opportunities. Shorting, or short-selling is a speculative trading strategy in which a trader opens up a short position by borrowing shares of a company, betting on its price decline, allowing the trader to buy them at a lower price and profit.

That’s why today we're highlighting 3 exciting stocks from our Top 10 Shorts screen, which is just 1 of the 10 screens in our POWR Screens 10 service (more on that below). Given the possibility of further market corrections, Lightning eMotors, Inc. (ZEV), Bionano Genomics, Inc. (BNGO), and QuantumScape Corporation (QS) could be ideal candidates to short, as they are trading at lofty valuations, despite possessing weak fundamentals.

Lightning eMotors, Inc. (ZEV)

ZEV designs, manufactures, and sells zero-emission commercial fleet vehicles and powertrains to commercial fleets, large enterprises, original equipment manufacturers, and governments in the United States. It offers zero-emission class 3 to 7 battery-electric and fuel cell electric vehicles. Its vehicles comprise cargo and passenger vehicles, school buses, ambulances, shuttle buses, work trucks, city buses, and motorcoaches. It also offers charging systems and charging infrastructure solutions.

ZEV’s forward EV/S of 2.43x is 54.7% higher than the industry average of 1.57x. In terms of its forward P/S, the stock is currently trading at 3.29x, 158.9% above the industry average of 1.27x. Also, its 18.60x trailing-12-month P/B is 675.5% higher than the industry average of 2.40x.

ZEV’s adjusted net loss increased 173.8% year-over-year to $18.69 million for the first quarter ended March 31, 2022. The company’s adjusted EBITDA loss increased 184.3% year-over-year to $14.47 million. Also, its total current assets declined 8.4% to $182.56 million, compared to $199.39 million for the fiscal year ended December 31, 2021.

Analysts expect ZEV’s EPS to remain negative in fiscal 2022 and 2023. Over the past nine months, the stock has lost 57.6% to close the last trading session at $3.82.

ZEV’s weak fundamentals are reflected in its POWR Ratings. It has an overall rating of F, equating to a Strong Sell in our proprietary rating system. The POWR Ratings are calculated by considering 118 different factors, with each factor weighted to an optimal degree.

It has an F grade for Stability and Quality and a D grade for Growth, Value, and Sentiment. It is ranked #67 out of 69 stocks in the F-rated Auto & Vehicle Manufacturers industry. Click here to see the other rating of ZEV for Momentum.

Bionano Genomics, Inc. (BNGO)

BNGO provides genome analysis software solutions. It offers Saphyr, a sample-to-result solution for structural variation analysis by optical genome mapping for genome analysis and understanding of genetic variation and function; Saphyr instrument, a single-molecule imager; Saphyr Chip, a consumable that packages the nanochannel arrays for DNA linearization; and Bionano Prep Kits and DNA labeling kits.

BNGO’s forward EV/S of 10.07x is 188.1% higher than the industry average of 3.50x. In terms of its forward P/S, the stock is currently trading at 17.91x, 323.4% above the industry average of 4.23x.

For the fiscal first quarter ended March 31, 2022, BNGO’s gross margin came in at 15%, compared to 33% in the year-ago period. The company’s non-GAAP operating expenses increased 105.9% year-over-year to $24.28 million. Also, its cost of revenue increased 127.5% year-over-year to $4.83 million. In addition, its net loss widened 201.1% year-over-year to $29.95 million.

For fiscal 2022 and 2023, BNGO’s EPS is expected to remain negative. It failed to surpass Street EPS estimates in each of the trailing four quarters. Over the past nine months, the stock has declined 71.5% to close the last trading session at $1.62.

BNGO’s POWR Ratings reflect these weak prospects. It has an overall F rating, equating to a Strong Sell in our proprietary rating system.

It has an F rating for Stability and Quality and a D grade for Growth, Value, Momentum, and Sentiment. Within the F-rated Biotech industry, it is ranked last out of 388 stocks. To see more of BNGO’s component grades, click here.

QuantumScape Corporation (QS)

QS is engaged in developing battery technology for EVs and other applications. The company focuses on developing and commercializing its solid-state lithium metal batteries. Also, it aims to revolutionize energy storage to enable a sustainable future.

In terms of forward P/B, QS’ 3.89x is 62.6% higher than the industry average of 2.39x.

QS’ total current assets for the first quarter ended March 31 declined 6.9% to $1.36 billion, compared to its total current assets of $1.46 million for the fiscal year ended December 31, 2021. The company’s total operating expenses increased 103% year-over-year to $90.65 million. Also, its net loss widened 20% year-over-year to $90.35 million.

Analysts expect QS’ EPS to remain negative in fiscal 2022 and 2023. It failed to surpass consensus EPS estimates in each of the trailing four quarters. Over the past six months, the stock has lost 68.1% to close the last trading session at $12.36.

QS’ bleak prospects are reflected in its POWR Ratings. It has an overall rating of F, which equates to a Strong Sell.

It has an F grade for Growth, Stability, and Sentiment and a D grade for Value, Momentum, and Quality. It is ranked #68 out of 69 stocks in the C-rated Auto Parts industry. To access all of QS’ grades, click here.

Want more stocks like these?

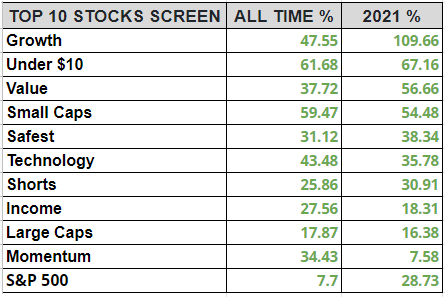

These three stocks are just a fraction of what you will find in our coveted Top 10 Shorts strategy. And the shorts strategy is just a fraction of what you get with our popular service; POWR Screens 10.

POWR Screens provides 10 market beating strategies with exactly 10 stocks each. Truly something for every investor with verified performance.

Learn More About POWR Screens 10 >>

ZEV shares were trading at $3.93 per share on Monday afternoon, up $0.11 (+2.88%). Year-to-date, ZEV has declined -34.61%, versus a -15.06% rise in the benchmark S&P 500 index during the same period.

About the Author: Dipanjan Banchur

Since he was in grade school, Dipanjan was interested in the stock market. This led to him obtaining a master’s degree in Finance and Accounting. Currently, as an investment analyst and financial journalist, Dipanjan has a strong interest in reading and analyzing emerging trends in financial markets.

The post 3 Stocks to Short in May, Despite the Recent Market Sell-Off appeared first on StockNews.com