Headquartered in Luxembourg, Adecoagro S.A. (AGRO) is an agro-industrial company that operates across South America. The company owns more than 220,000 hectares of farmland and several industrial facilities in Argentina, Brazil, and Uruguay. It produces more than 1.9 million tons of diversified agricultural products annually.

Shares of AGRO have been benefiting from soaring global food prices of late.

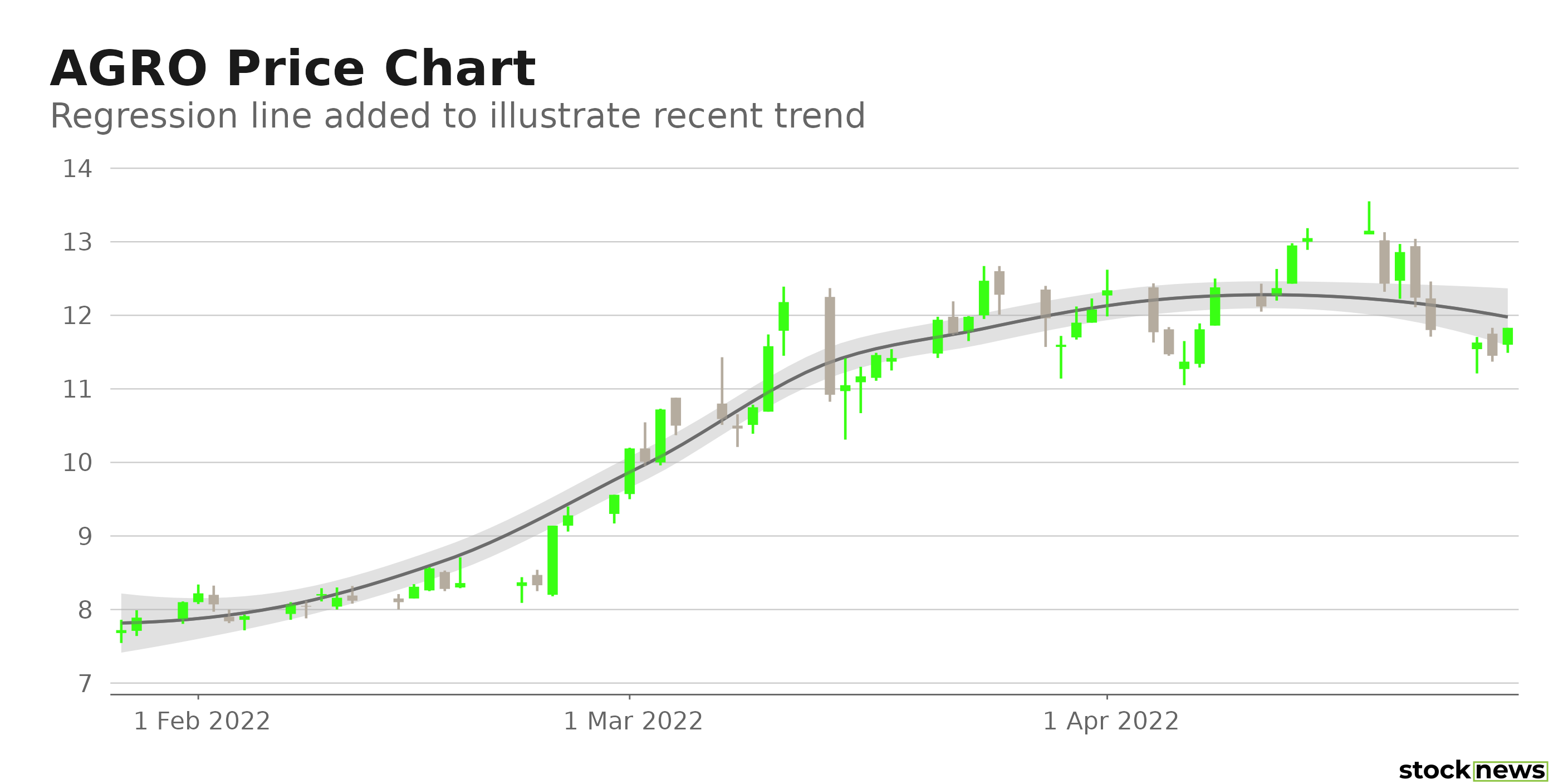

The stock has surged 51.2% in price year-to-date to close yesterday’s trading session at $11.45. Also, the stock gained 28.1% over the past year.

Here is what could shape AGRO’s performance in the near term:

Robust Financials

AGRO’s gross sales increased 33.5% year-over-year to $1.10 billion in its fiscal year 2021 (ended December 31). Its adjusted EBITDA for its sugar, ethanol, and energy business improved 31.9% from the same period last year to $334.90 million. This can be attributed to a $38.30 million year-over-year gain in mark-to-market harvest cane prices. Its adjusted EBITDA for its farming and land transformation business rose 15.8% from the year-ago value to $123.80 million. And for its fiscal fourth quarter, ended Dec. 31, 2021, its net income rose 24.2% year-over-year to $58.80 million.

Inorganic Growth

In its 2021 annual report, AGRO stated that it signed an agreement with Viterra Limited. Under this deal, AGRO is set to acquire Viterra’s rice production operations in Uruguay and Argentina, including all biological assets and inventories of processed and rough rice. AGRO is expected to benefit from geographical diversification through this acquisition, thereby limiting its weather risk. Also, Uruguayan rice is internationally considered to be of the highest standard and, hence, is expected to be heavily demanded.

AGRO’s current rice production capacity is projected to rise by 230,000 tons through this acquisition.

Low Valuation

In terms of forward non-GAAP P/E, AGRO is currently trading at 9.16x, which is 49.9% lower than the 18.30x industry average. Its 4.44 forward EV/EBITDA multiple is 64.2% lower than the 12.39 industry average. In addition, the stock’s forward Price/Sales and Price/Book ratios of 0.97 and 1.15, respectively, are significantly lower than the 1.25 and 3.01 industry averages.

Furthermore, AGRO’s 1.68 forward EV/Sales multiple is 10.5% lower than the 1.88 industry average. The stock is currently trading 3.65 times its trailing-12-month cash flows, which is 75.1% lower than the 14.65 industry average.

POWR Ratings Reflect Rosy Prospects

AGRO has an overall B rating, which equates to Buy in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

AGRO has a B grade for Value, Growth, and Sentiment. The stock’s discounted valuation compared to its peers justifies the Value grade. In addition, AGRO’s revenues and EBIT have increased at CAGRs of 12.3% and 18.7%, respectively, over the past three years, in sync with its Growth grade. Also, analysts expect AGRO’s revenues to rise 13.3% year-over-year to $1.27 billion in its fiscal 2022, matching the Sentiment grade.

Among the 32 stocks in the Agriculture industry, AGRO is ranked #6.

Beyond what I have stated above, view AGRO ratings for Momentum, Stability, and Quality here.

Bottom Line

As global food price inflation surges amid worsening supply chain disruptions and the Ukraine-Russia war, AGRO is expected to witness an uptick in its profit margins. In its latest annual report, the company stated that it is well-positioned to benefit from the surging food prices and 76% of its expected sugar production and 100% of ethanol production remain unhedged. Thus, we think AGRO is an ideal investment bet now.

How Does Adecoagro S.A. (AGRO) Stack Up Against its Peers?

While AGRO has a B rating in our proprietary rating system, one might want to consider looking at its industry peers, Golden Agri-Resources Ltd (GARPY) and Nutrien Ltd. (NTR), which have an A (Strong Buy) rating.

Want More Great Investing Ideas?

AGRO shares were trading at $11.80 per share on Wednesday morning, up $0.35 (+3.06%). Year-to-date, AGRO has gained 53.65%, versus a -11.62% rise in the benchmark S&P 500 index during the same period.

About the Author: Aditi Ganguly

Aditi is an experienced content developer and financial writer who is passionate about helping investors understand the do’s and don'ts of investing. She has a keen interest in the stock market and has a fundamental approach when analyzing equities.

The post Is Adecoagro S.A. a Good Stock to Own in 2022? appeared first on StockNews.com