Over the past six months, Global Industrial’s shares (currently trading at $31.85) have posted a disappointing 7.7% loss, well below the S&P 500’s 10.2% gain. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Global Industrial, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Do We Think Global Industrial Will Underperform?

Even with the cheaper entry price, we're cautious about Global Industrial. Here are three reasons why GIC doesn't excite us and a stock we'd rather own.

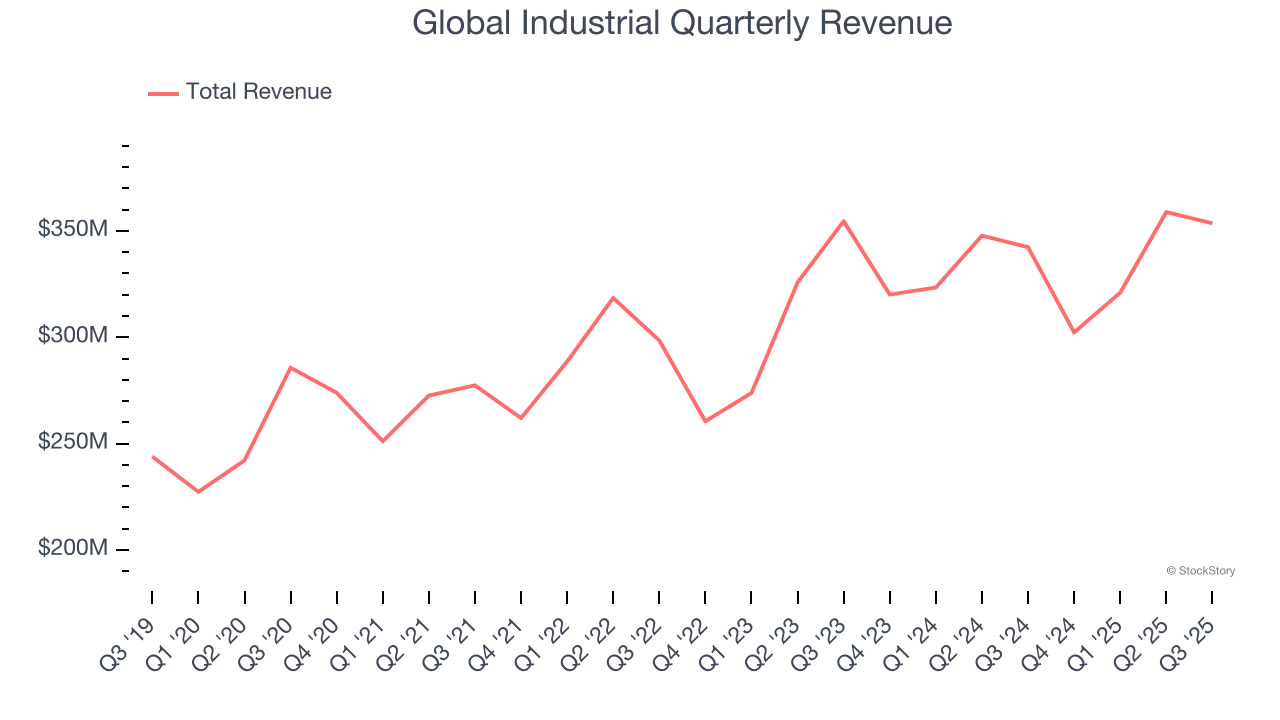

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Global Industrial’s 6.5% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the industrials sector.

2. EPS Barely Growing

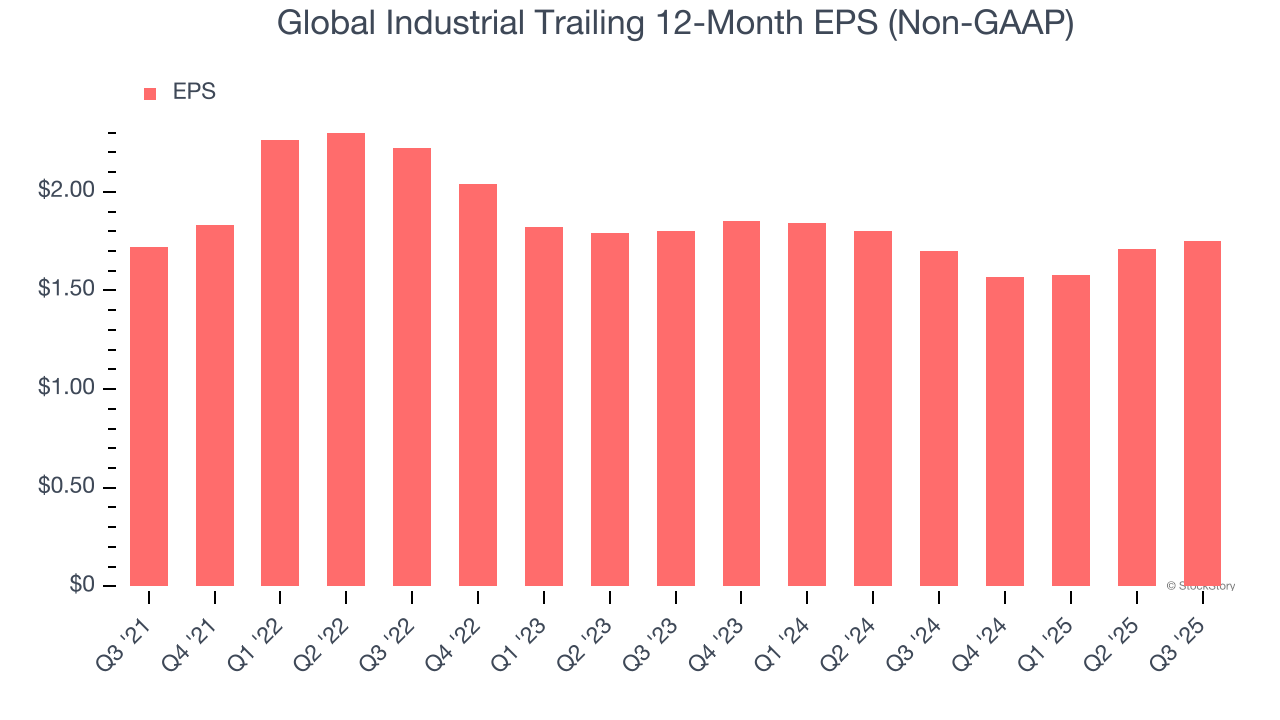

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Global Industrial’s unimpressive 6.9% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

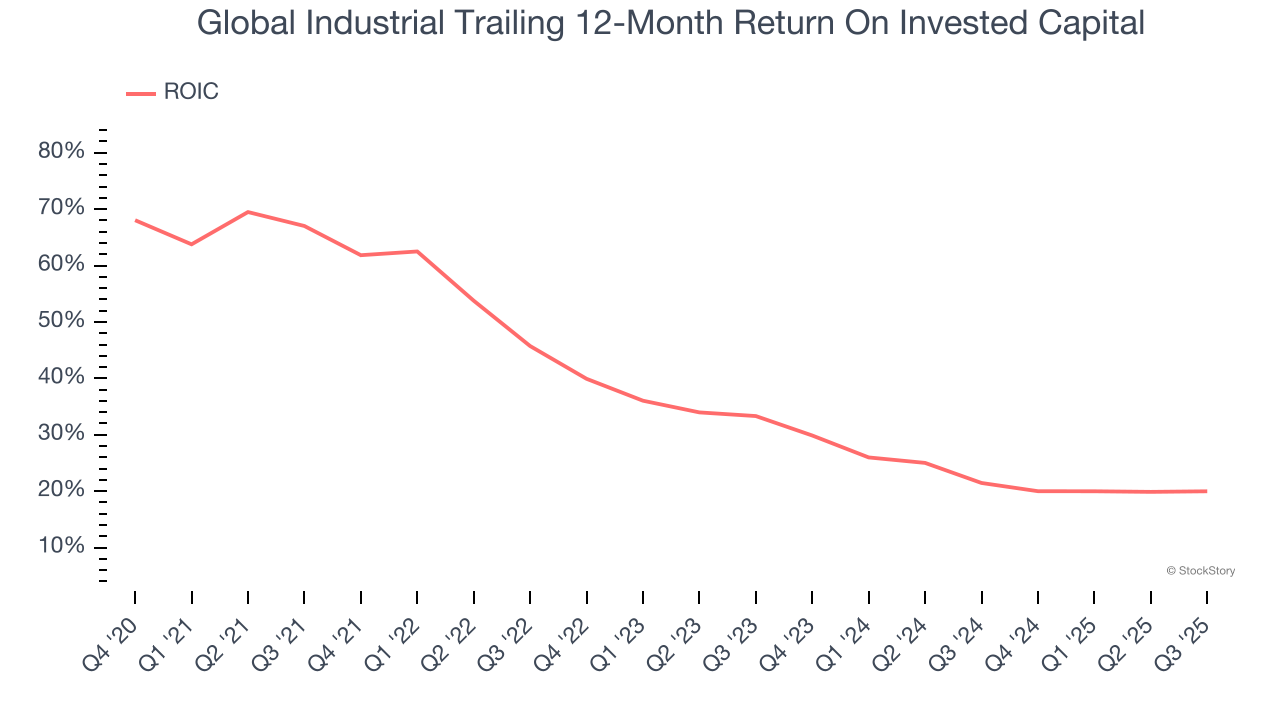

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Global Industrial’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

We see the value of companies helping their customers, but in the case of Global Industrial, we’re out. After the recent drawdown, the stock trades at 16.3× forward P/E (or $31.85 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are superior stocks to buy right now. We’d recommend looking at our favorite semiconductor picks and shovels play.

Stocks We Like More Than Global Industrial

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.