Bank of America’s 17.8% return over the past six months has outpaced the S&P 500 by 7%, and its stock price has climbed to $57.31 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Bank of America, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Do We Think Bank of America Will Underperform?

Despite the momentum, we don't have much confidence in Bank of America. Here are three reasons why BAC doesn't excite us and a stock we'd rather own.

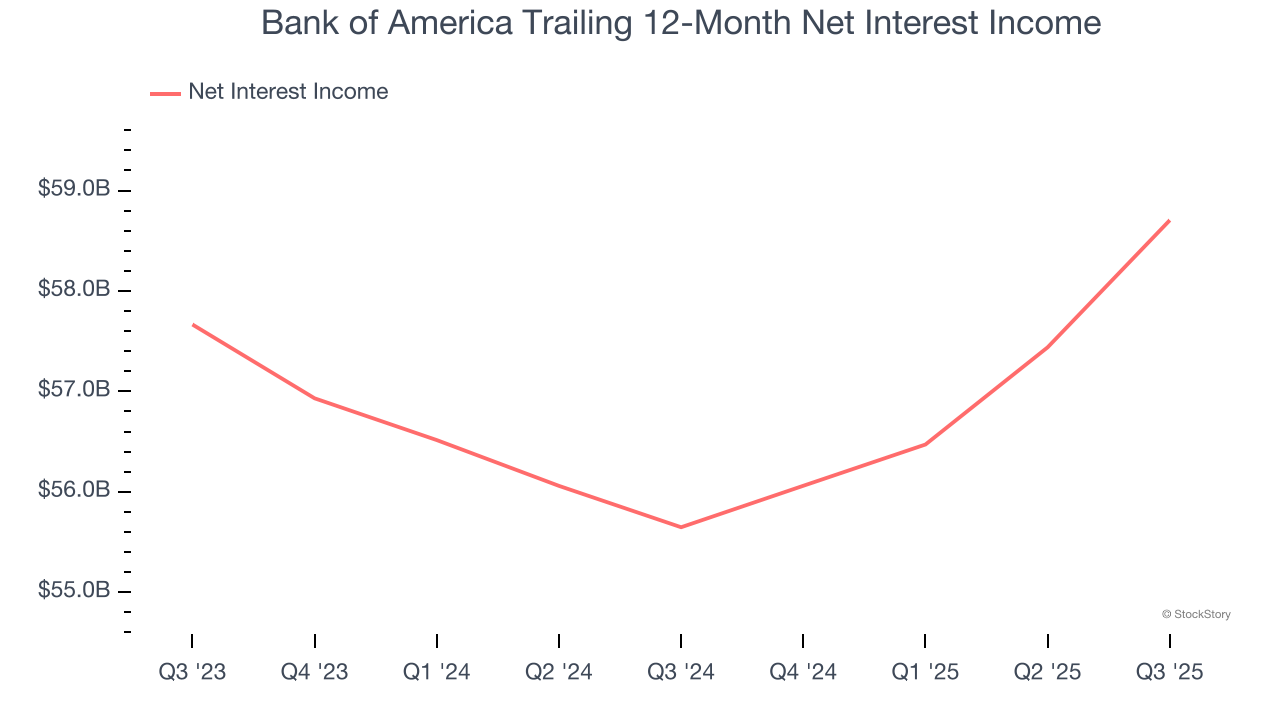

1. Net Interest Income Points to Soft Demand

Our experience and research show the market cares primarily about a bank’s net interest income growth as one-time fees are considered a lower-quality and non-recurring revenue source.

Bank of America’s net interest income has grown at a 5.3% annualized rate over the last five years, much worse than the broader banking industry. Its growth was driven by an increase in its outstanding loans as its net interest margin, which represents how much a bank earns in relation to its outstanding loan book, was flat throughout that period.

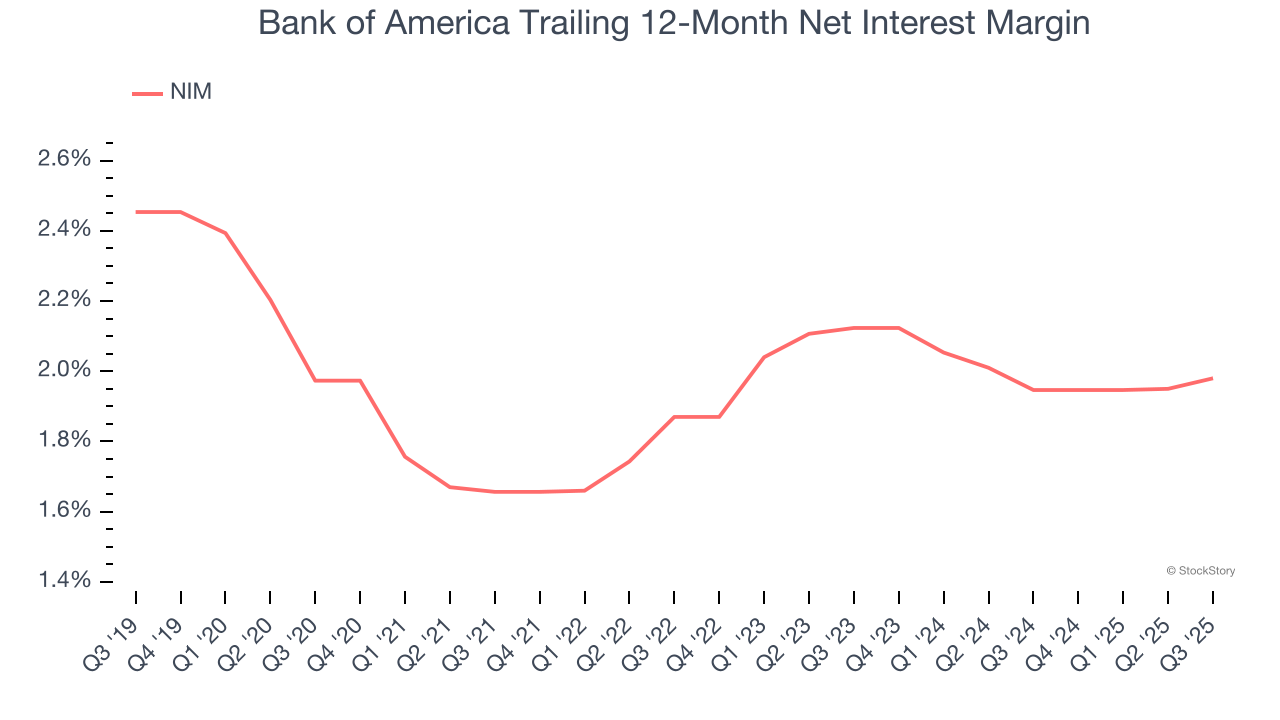

2. Low Net Interest Margin Reveals Weak Loan Book Profitability

Net interest margin (NIM) serves as a critical gauge of a bank's fundamental profitability by showing the spread between interest income and interest expenses. It's essential for understanding whether a firm can sustainably generate returns from its lending operations.

Over the past two years, we can see that Bank of America’s net interest margin averaged a poor 2%. This metric is well below other banks, signaling its loans aren’t very profitable.

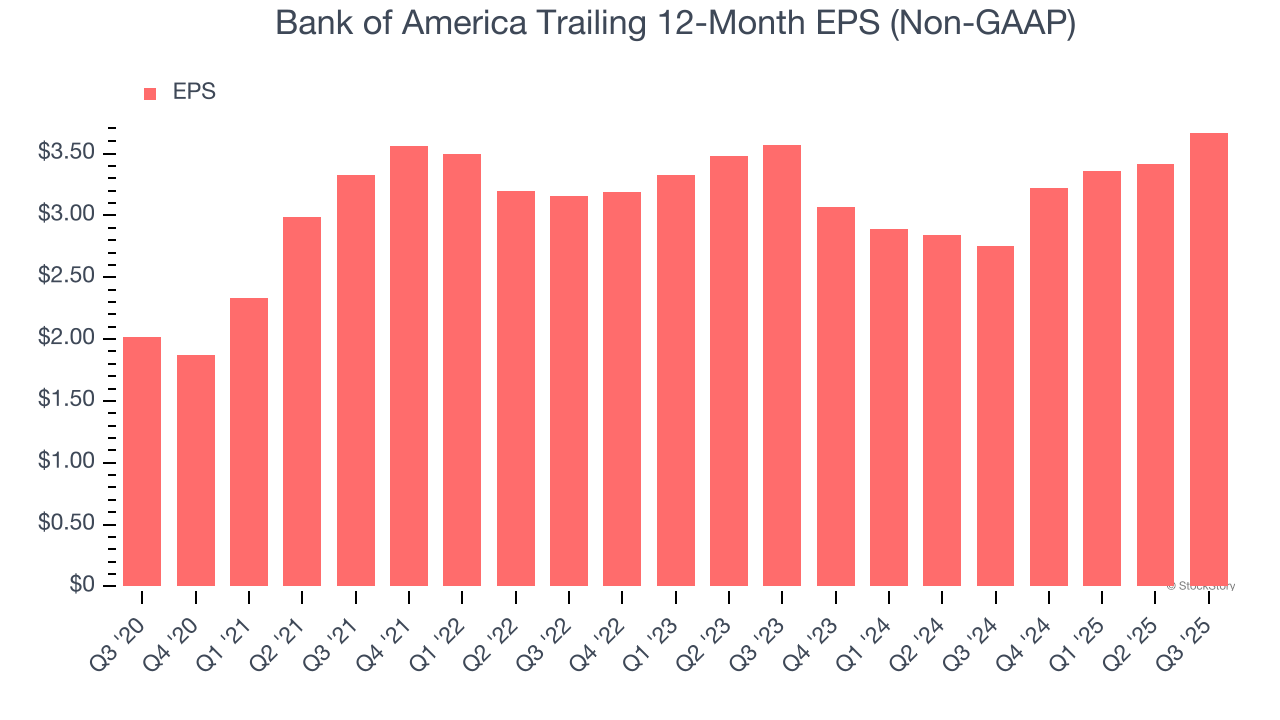

3. Recent EPS Growth Below Our Standards

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Bank of America’s weak 1.4% annual EPS growth over the last two years aligns with its revenue trend. This tells us it maintained its per-share profitability as it expanded.

Final Judgment

We see the value of companies driving economic growth, but in the case of Bank of America, we’re out. With its shares beating the market recently, the stock trades at 1.5× forward P/B (or $57.31 per share). This valuation tells us a lot of optimism is priced in - we think other companies feature superior fundamentals at the moment. We’d recommend looking at the most entrenched endpoint security platform on the market.

Stocks We Like More Than Bank of America

Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.