Hilltop Holdings trades at $35.39 per share and has stayed right on track with the overall market, gaining 12.9% over the last six months. At the same time, the S&P 500 has returned 10%.

Is there a buying opportunity in Hilltop Holdings, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think Hilltop Holdings Will Underperform?

We're sitting this one out for now. Here are three reasons there are better opportunities than HTH and a stock we'd rather own.

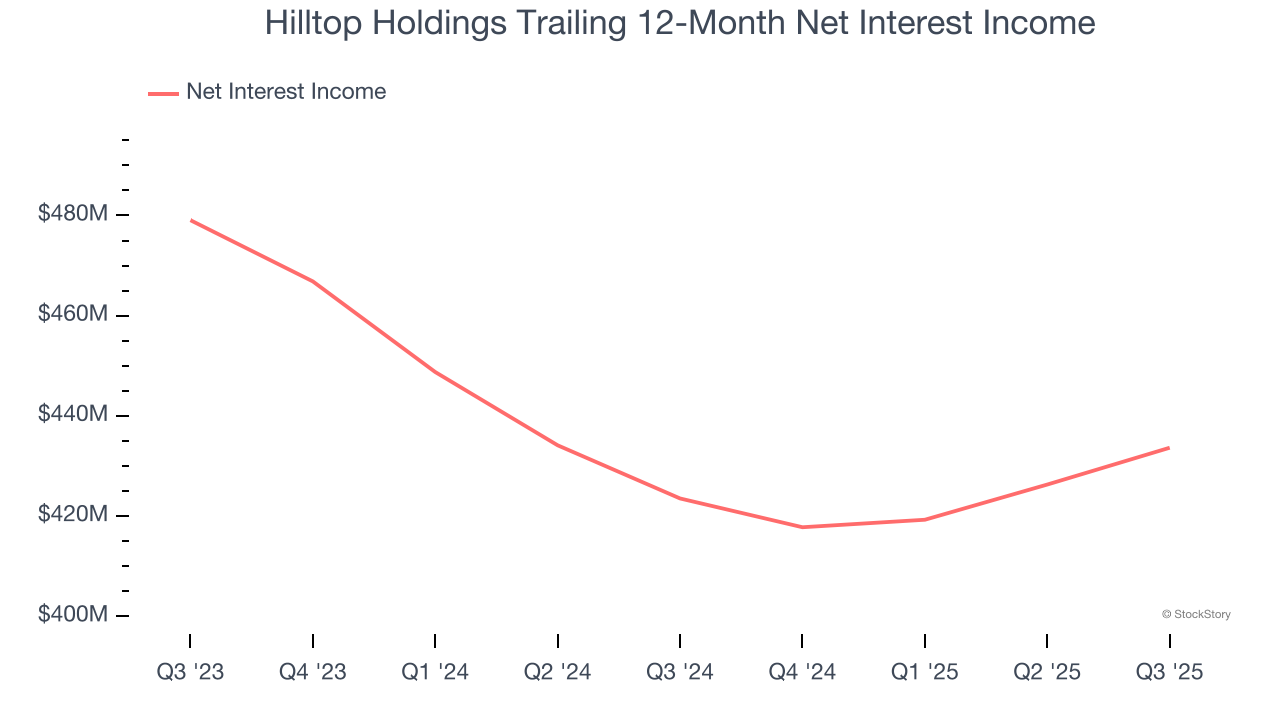

1. Net Interest Income Hits a Plateau

Markets consistently prioritize net interest income over non-recurring fees, recognizing its superior quality compared to the more unpredictable revenue streams.

Hilltop Holdings’s net interest income was flat over the last five years, much worse than the broader banking industry. A silver lining is that lending outperformed its other business lines.

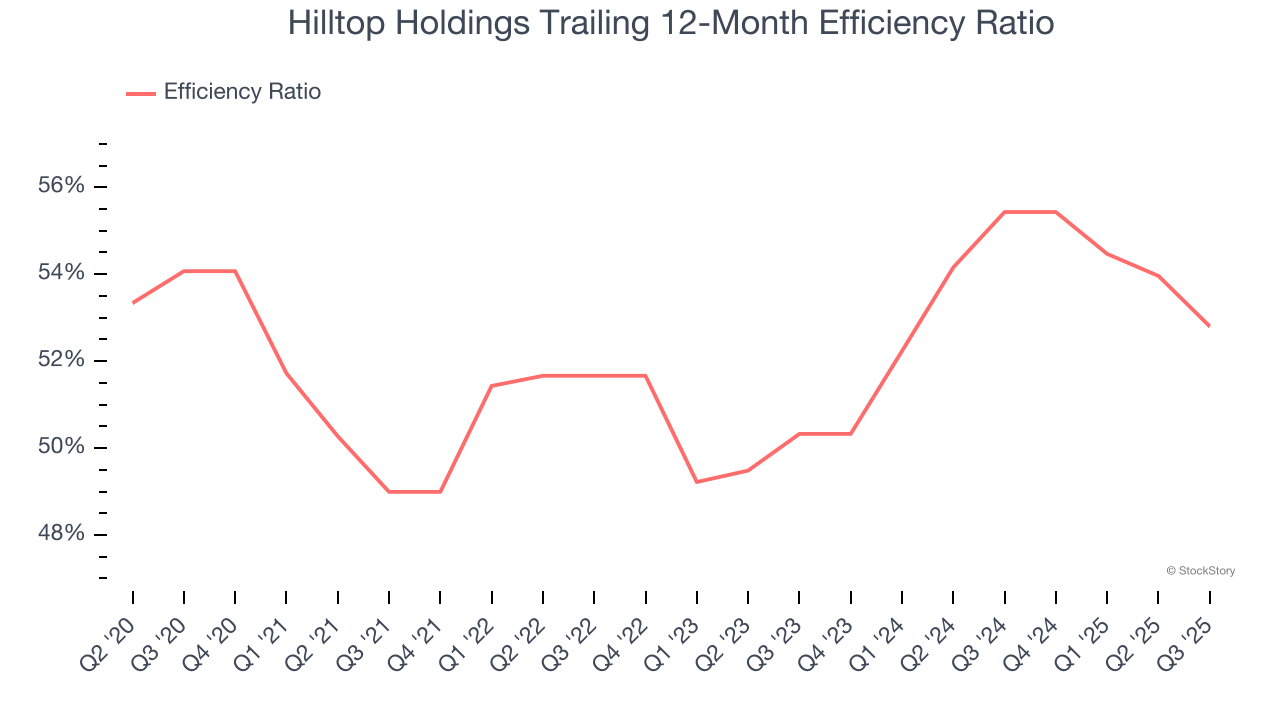

2. Efficiency Ratio Expected to Falter

Topline growth is certainly important, but the overall profitability of this growth matters for the bottom line. For banks, we look at efficiency ratio, which is non-interest expense (salaries, rent, IT, marketing, excluding interest paid out to depositors) as a percentage of total revenue.

Investors place greater emphasis on efficiency ratio movements than absolute values, understanding that expense structures reflect revenue mix variations. Lower ratios represent better operational performance since they show banks generating more revenue per dollar of expense.

For the next 12 months, Wall Street expects Hilltop Holdings to become less profitable as it anticipates an efficiency ratio of 85.7% compared to 52.8% over the past year.

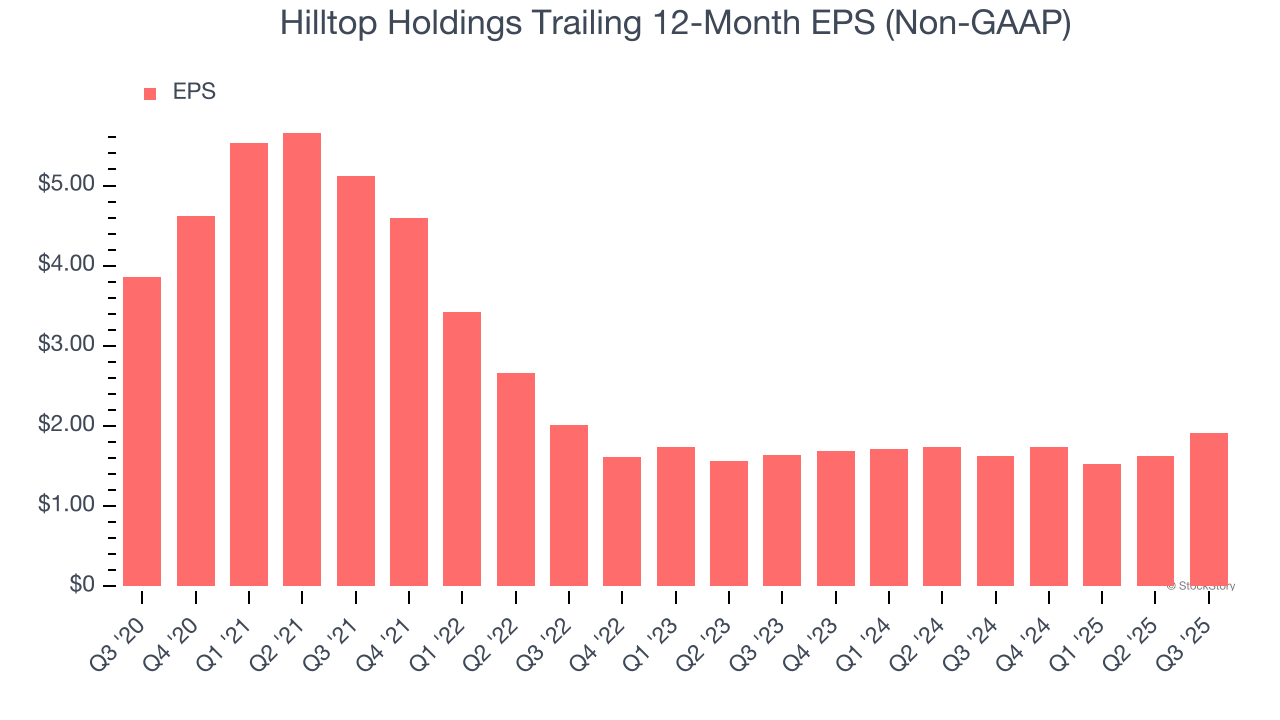

3. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Hilltop Holdings, its EPS declined by 13.1% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Final Judgment

Hilltop Holdings doesn’t pass our quality test. That said, the stock currently trades at 1× forward P/B (or $35.39 per share). At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now. We’d suggest looking at one of our top software and edge computing picks.

Stocks We Would Buy Instead of Hilltop Holdings

Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.