What a brutal six months it’s been for Inspire Medical Systems. The stock has dropped 24.3% and now trades at $94.73, rattling many shareholders. This might have investors contemplating their next move.

Following the pullback, is now a good time to buy INSP? Find out in our full research report, it’s free.

Why Does INSP Stock Spark Debate?

Offering an alternative for the millions who struggle with traditional CPAP machines, Inspire Medical Systems (NYSE: INSP) develops and sells an implantable neurostimulation device that treats obstructive sleep apnea by stimulating nerves to keep airways open during sleep.

Two Positive Attributes:

1. Increasing Number of Domestic Medical Centers Leads to More Shots On Goal

Sales growth for companies like Inspire Medical Systems can be broken down into the number of facilities/providers and the revenue for each. While both are important, the latter is the lifeblood of a successful Medical Devices & Supplies - Specialty company because there’s a ceiling to how many facilities and providers one can secure.

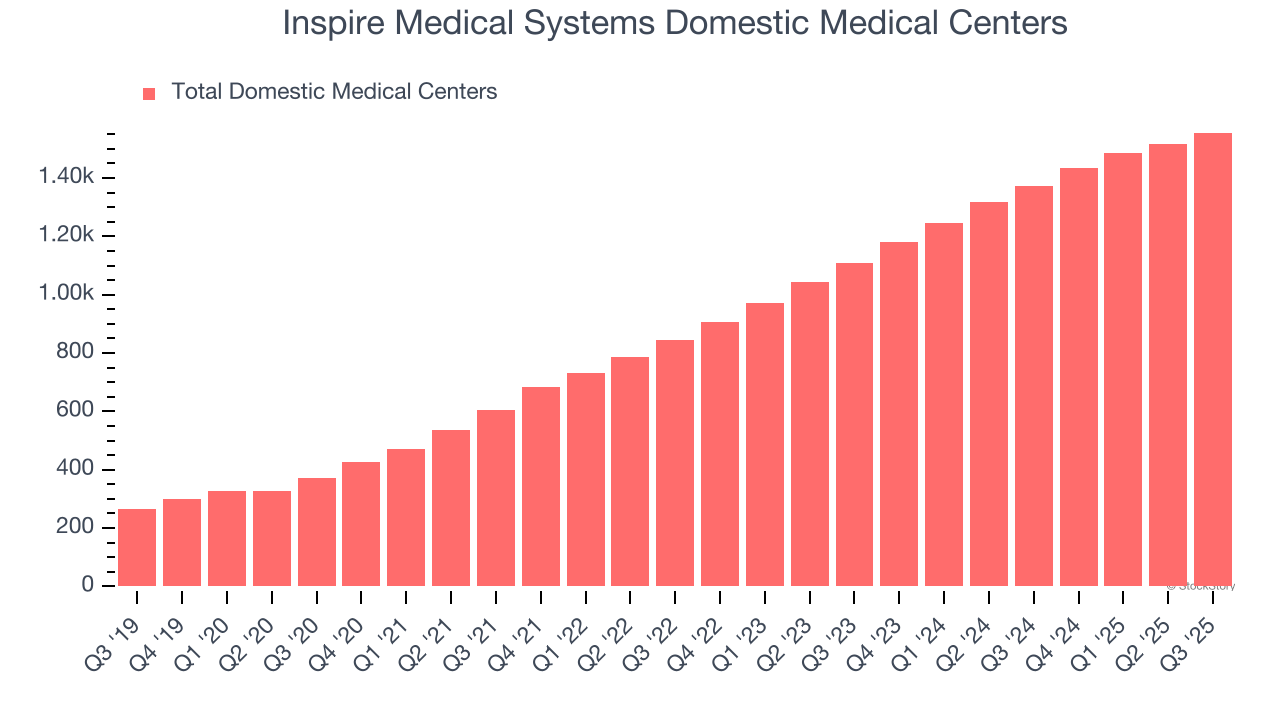

Inspire Medical Systems’s number of domestic medical centers punched in at 1,556 in the latest quarter, and over the last two years, averaged 22.2% year-on-year growth. This pace was fast and gives the company more opportunities to increase its revenue.

2. Increasing Free Cash Flow Margin Juices Financials

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

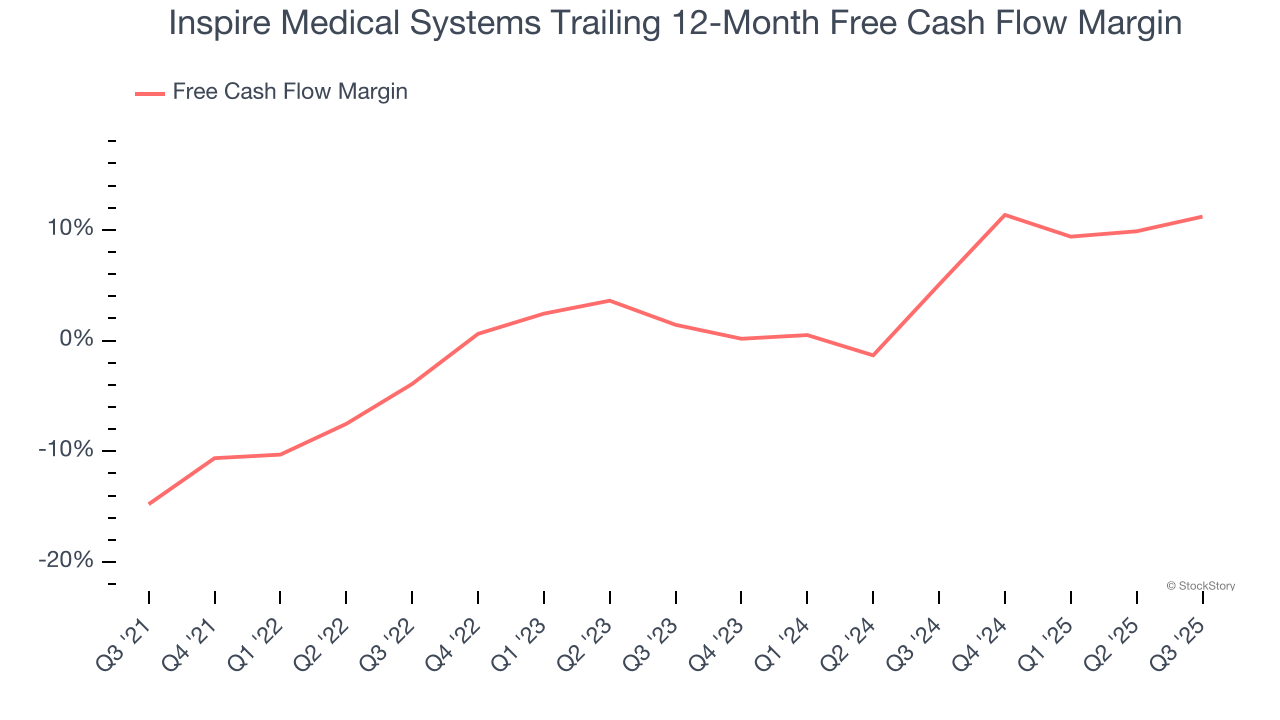

As you can see below, Inspire Medical Systems’s margin expanded by 26 percentage points over the last five years. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality. Inspire Medical Systems’s free cash flow margin for the trailing 12 months was 11.2%.

One Reason to be Careful:

Fewer Distribution Channels Limit its Ceiling

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $882.6 million in revenue over the past 12 months, Inspire Medical Systems is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive. On the bright side, Inspire Medical Systems’s smaller revenue base allows it to grow faster if it can execute well.

Final Judgment

Inspire Medical Systems’s positive characteristics outweigh the negatives. With the recent decline, the stock trades at 56.4× forward P/E (or $94.73 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.