Secondhand luxury marketplace The RealReal (NASDAQ: REAL) beat Wall Street’s revenue expectations in Q2 CY2025, with sales up 14% year on year to $165.2 million. On top of that, next quarter’s revenue guidance ($168.5 million at the midpoint) was surprisingly good and 5.1% above what analysts were expecting. Its non-GAAP loss of $0.06 per share was $0.02 above analysts’ consensus estimates.

Is now the time to buy The RealReal? Find out by accessing our full research report, it’s free.

The RealReal (REAL) Q2 CY2025 Highlights:

- Revenue: $165.2 million vs analyst estimates of $159.5 million (14% year-on-year growth, 3.6% beat)

- Adjusted EPS: -$0.06 vs analyst estimates of -$0.08 ($0.02 beat)

- Adjusted EBITDA: $6.84 million vs analyst estimates of $3.46 million (4.1% margin, 97.5% beat)

- The company lifted its revenue guidance for the full year to $670.5 million at the midpoint from $652.5 million, a 2.8% increase

- EBITDA guidance for the full year is $30.5 million at the midpoint, above analyst estimates of $28.21 million

- Operating Margin: -6%, up from -13% in the same quarter last year

- Free Cash Flow was -$11.37 million compared to -$32.98 million in the previous quarter

- Active Buyers : 1 million, up 620,000 year on year

- Market Capitalization: $623.2 million

"The second quarter was a breakout performance for The RealReal, further validating the success of our strategic roadmap as strong execution fueled top-line momentum and margin expansion. We delivered record GMV and total revenue, both up 14% year-over-year, alongside Adjusted EBITDA ahead of expectations,” said Rati Levesque, Chief Executive Officer of The RealReal.

Company Overview

Founded by consignment store aficionado Julie Wainwright, The RealReal (NASDAQ: REAL) is an online marketplace for buying and selling secondhand luxury goods.

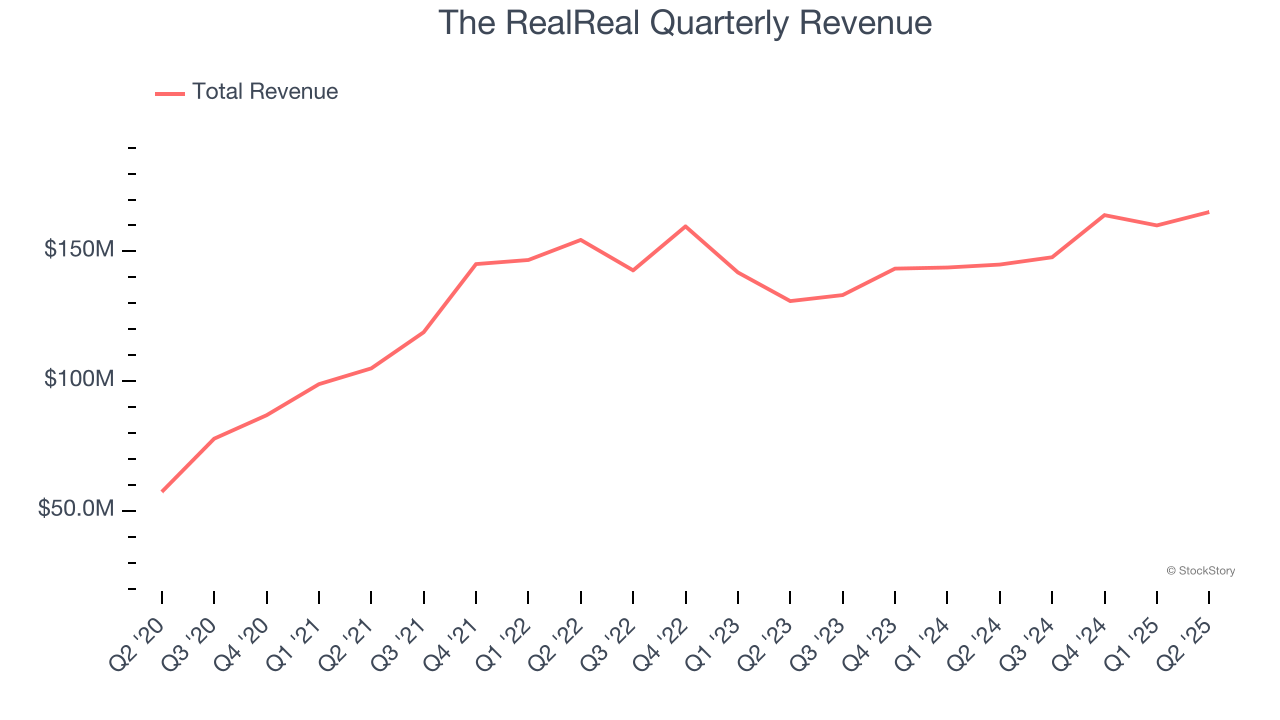

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, The RealReal grew its sales at a sluggish 4.1% compounded annual growth rate. This was below our standard for the consumer internet sector and is a poor baseline for our analysis.

This quarter, The RealReal reported year-on-year revenue growth of 14%, and its $165.2 million of revenue exceeded Wall Street’s estimates by 3.6%. Company management is currently guiding for a 14% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10.1% over the next 12 months, an acceleration versus the last three years. This projection is above the sector average and implies its newer products and services will catalyze better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Active Buyers

User Growth

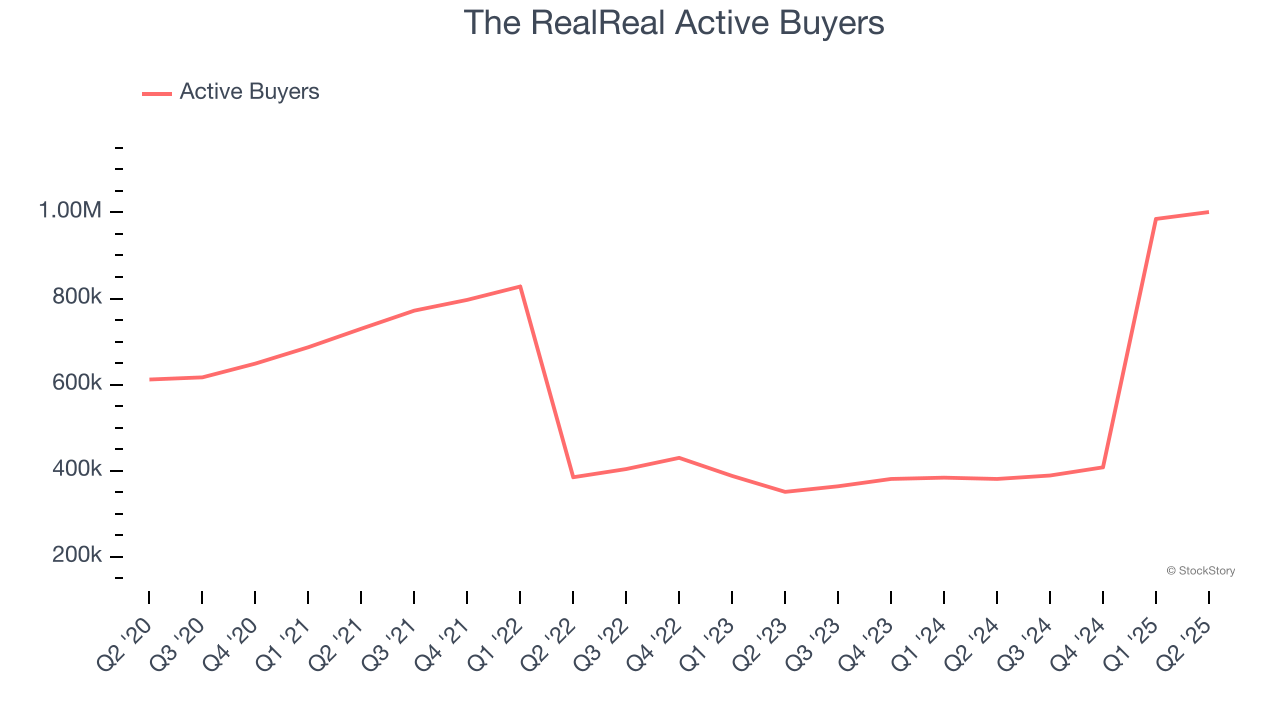

As an online marketplace, The RealReal generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Over the last two years, The RealReal’s active buyers , a key performance metric for the company, increased by 39.9% annually to 1 million in the latest quarter. This growth rate is among the fastest of any consumer internet business and indicates its offerings have significant traction.

In Q2, The RealReal added 620,000 active buyers , leading to 163% year-on-year growth. The quarterly print was higher than its two-year result, suggesting its new initiatives are accelerating user growth.

Revenue Per User

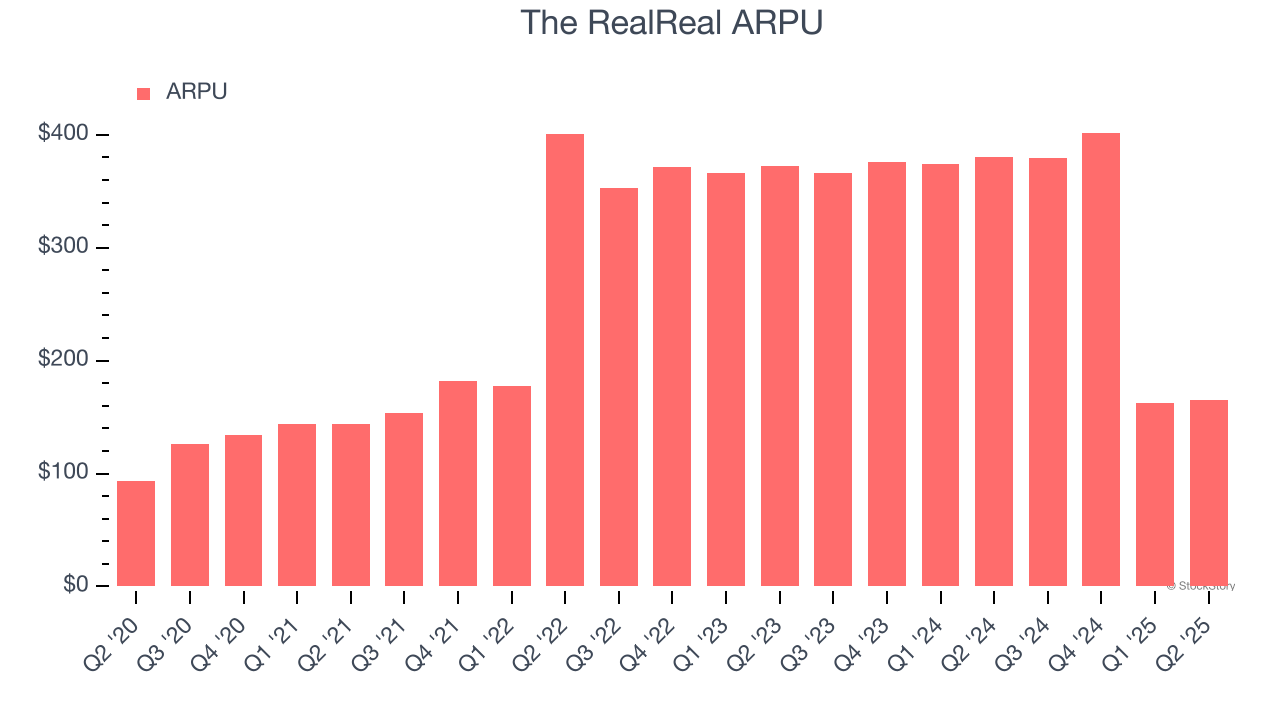

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns in transaction fees from each user. ARPU also gives us unique insights into a user’s average order size and The RealReal’s take rate, or "cut", on each order.

The RealReal’s ARPU fell over the last two years, averaging 11.7% annual declines. This isn’t great, but the increase in active buyers is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if The RealReal tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

This quarter, The RealReal’s ARPU clocked in at $165.02. It declined 56.6% year on year, worse than the change in its active buyers .

Key Takeaways from The RealReal’s Q2 Results

We were impressed by The RealReal’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its number of active buyers slightly missed. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 27.1% to $7.03 immediately after reporting.

The RealReal put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.