Lab services company Charles River Laboratories (NYSE: CRL) reported Q2 CY2025 results beating Wall Street’s revenue expectations, but sales were flat year on year at $1.03 billion. Its non-GAAP profit of $3.12 per share was 24.6% above analysts’ consensus estimates.

Is now the time to buy Charles River Laboratories? Find out by accessing our full research report, it’s free.

Charles River Laboratories (CRL) Q2 CY2025 Highlights:

- Revenue: $1.03 billion vs analyst estimates of $986.9 million (flat year on year, 4.6% beat)

- Adjusted EPS: $3.12 vs analyst estimates of $2.50 (24.6% beat)

- Adjusted EBITDA: $236.7 million vs analyst estimates of $241.5 million (22.9% margin, 2% miss)

- Management raised its full-year Adjusted EPS guidance to $10.10 at the midpoint, a 5.8% increase

- Operating Margin: 9.7%, down from 14.8% in the same quarter last year

- Free Cash Flow Margin: 16.4%, up from 15% in the same quarter last year

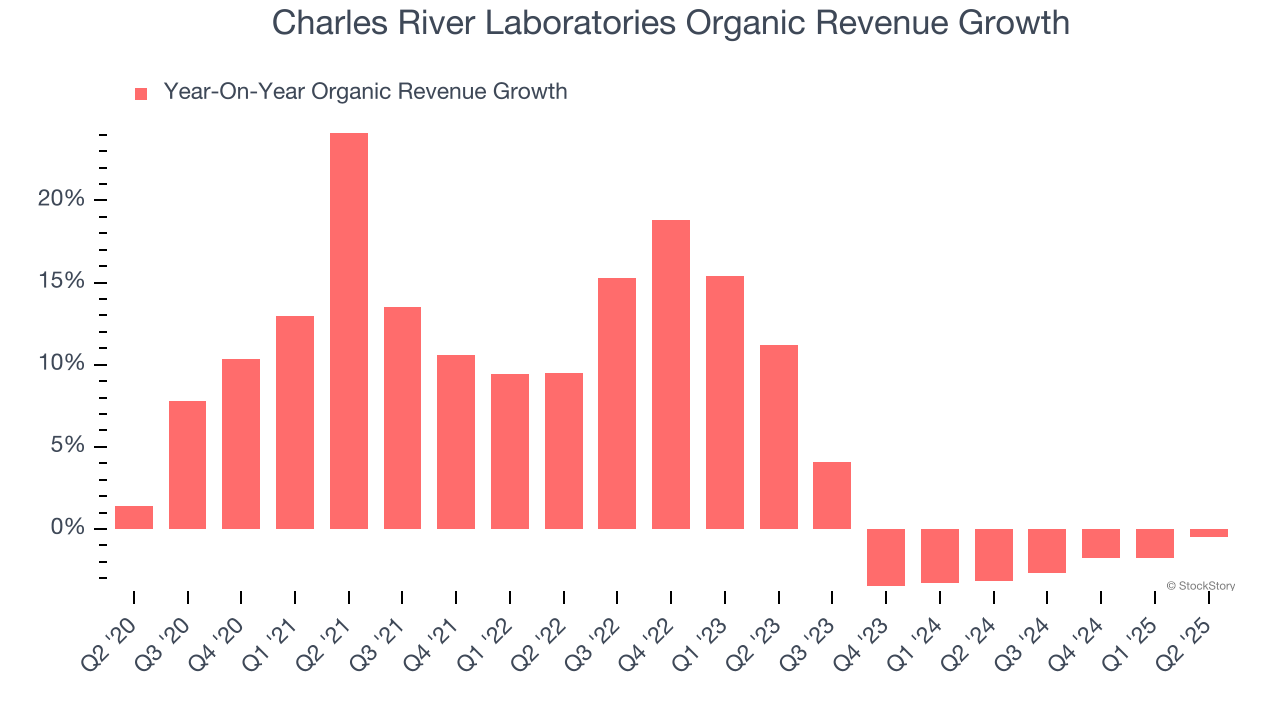

- Organic Revenue was flat year on year (-3.2% in the same quarter last year)

- Market Capitalization: $8.23 billion

James C. Foster, Chair, President and Chief Executive Officer, said, “We are continuing to see clear signs that the biopharmaceutical demand is stabilizing, and in this environment, we are making gradual progress to return to organic revenue growth. This progress was demonstrated in our solid second-quarter financial performance, driven principally by favorable results in our DSA segment.”

Company Overview

Named after the Massachusetts river where it was founded in 1947, Charles River Laboratories (NYSE: CRL) provides non-clinical drug development services, research models, and manufacturing support to pharmaceutical and biotechnology companies.

Revenue Growth

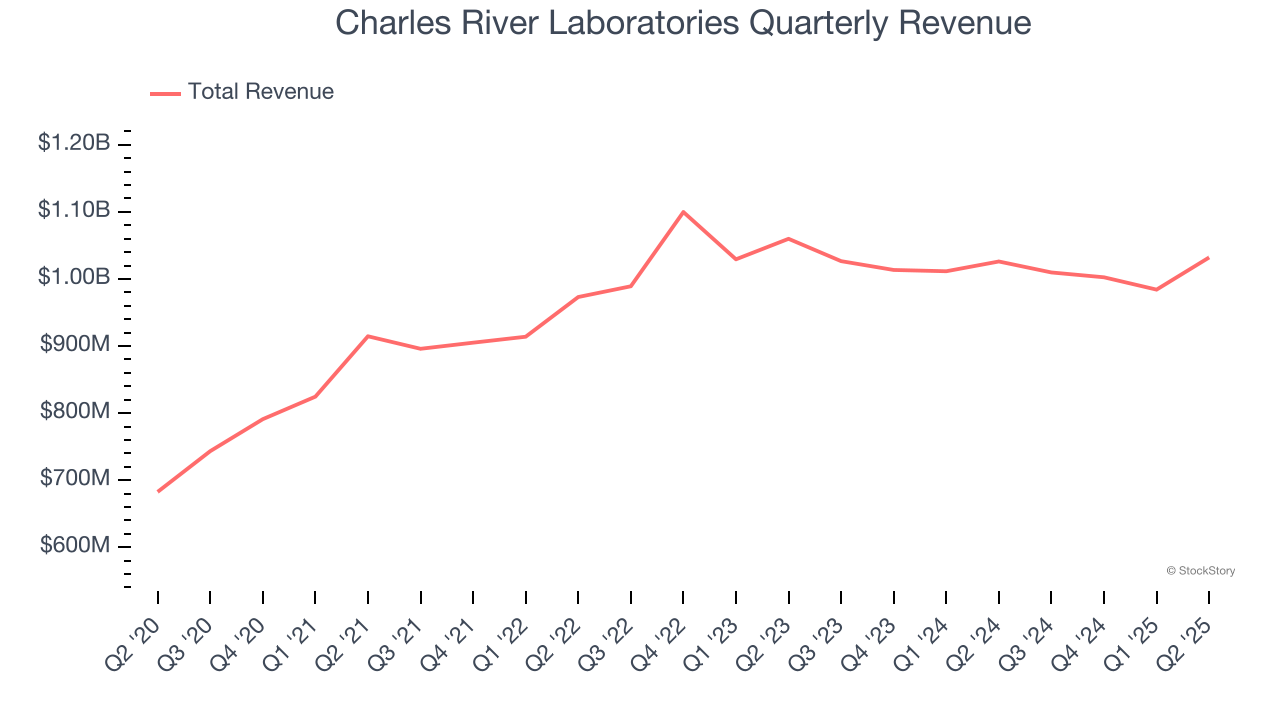

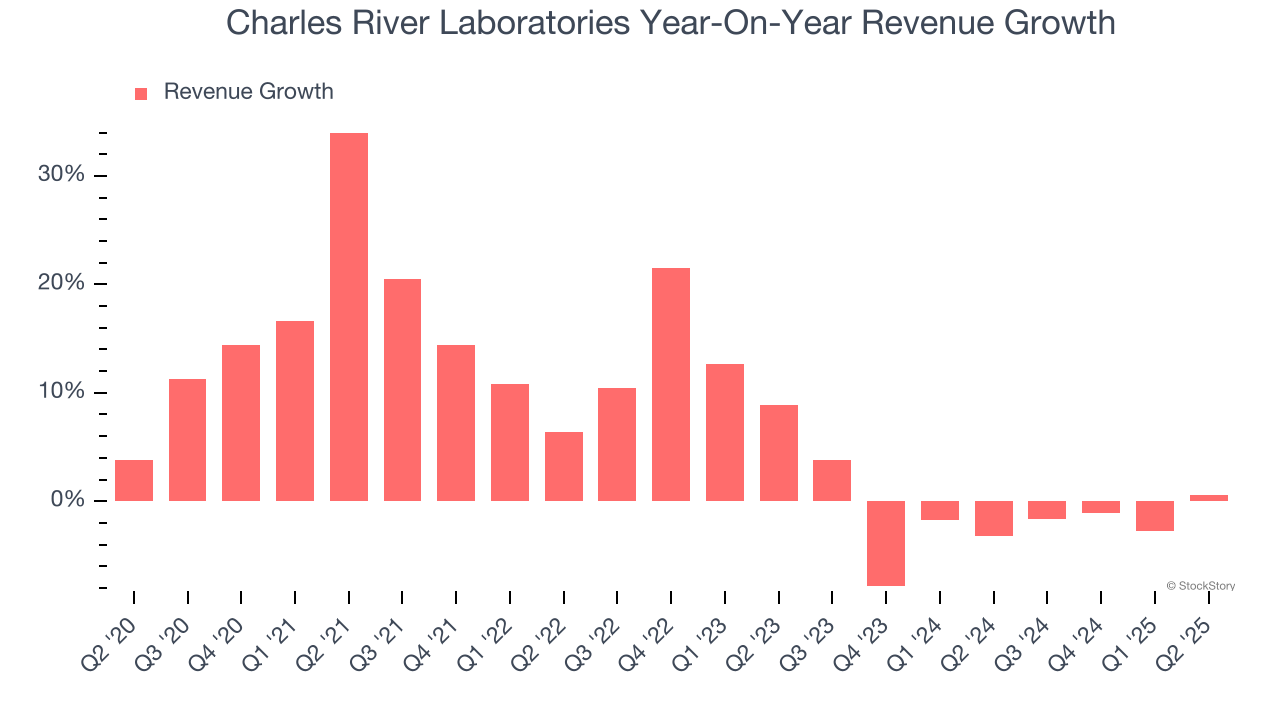

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Charles River Laboratories’s 7.9% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Charles River Laboratories’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 1.8% over the last two years.

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Charles River Laboratories’s organic revenue averaged 1.6% year-on-year declines. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Charles River Laboratories’s $1.03 billion of revenue was flat year on year but beat Wall Street’s estimates by 4.6%.

Looking ahead, sell-side analysts expect revenue to decline by 2.2% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and suggests its newer products and services will not catalyze better top-line performance yet.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

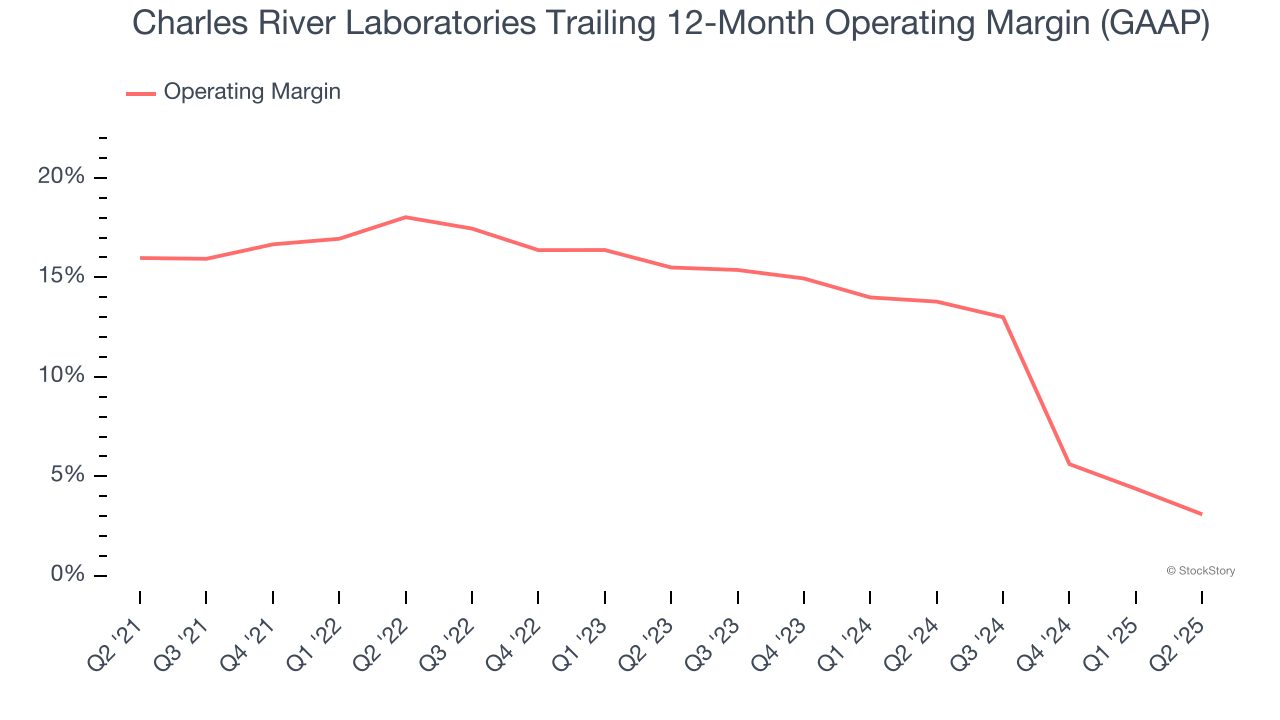

Charles River Laboratories has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 13.1%, higher than the broader healthcare sector.

Analyzing the trend in its profitability, Charles River Laboratories’s operating margin decreased by 12.9 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 12.4 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

In Q2, Charles River Laboratories generated an operating margin profit margin of 9.7%, down 5.1 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

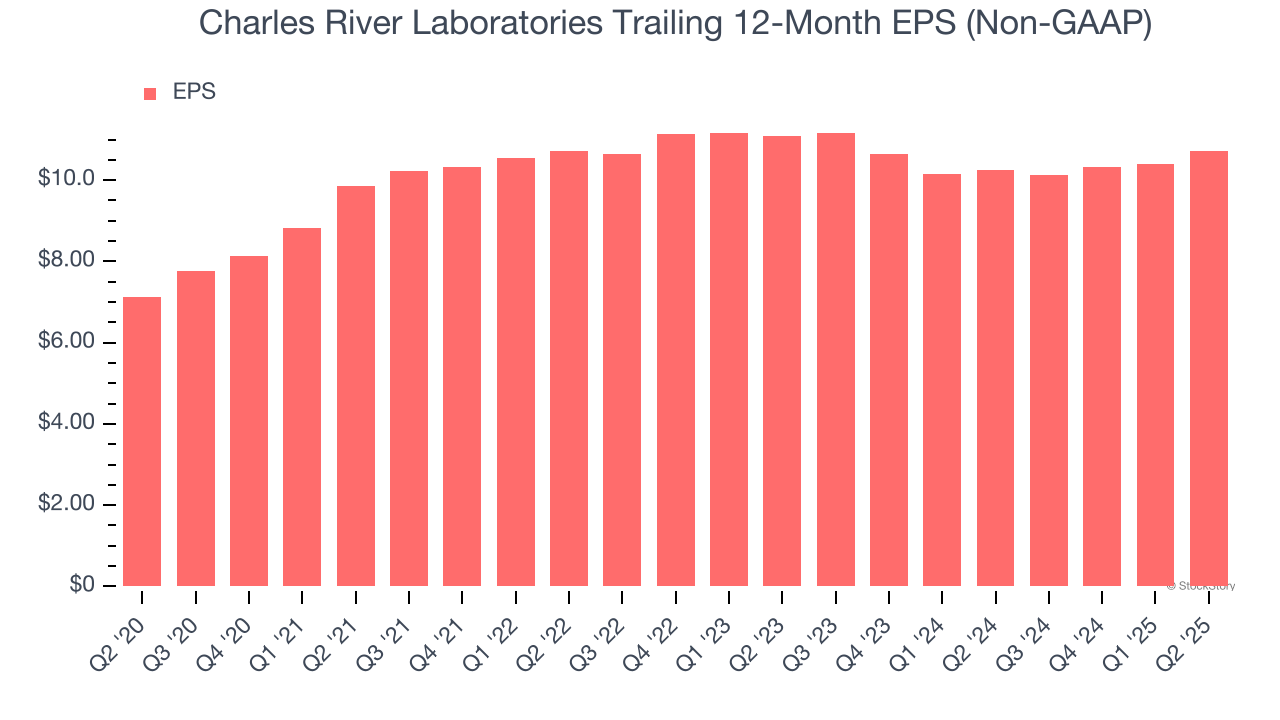

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Charles River Laboratories’s solid 8.5% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q2, Charles River Laboratories reported adjusted EPS at $3.12, up from $2.80 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Charles River Laboratories’s full-year EPS of $10.71 to shrink by 7.2%.

Key Takeaways from Charles River Laboratories’s Q2 Results

We were impressed by how significantly Charles River Laboratories blew past analysts’ organic revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. Investors were likely hoping for more, and shares traded down 1.5% to $165.01 immediately after reporting.

So should you invest in Charles River Laboratories right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.