The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how sit-down dining stocks fared in Q2, starting with Dine Brands (NYSE: DIN).

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

The 12 sit-down dining stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1% while next quarter’s revenue guidance was 5.4% below.

While some sit-down dining stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.8% since the latest earnings results.

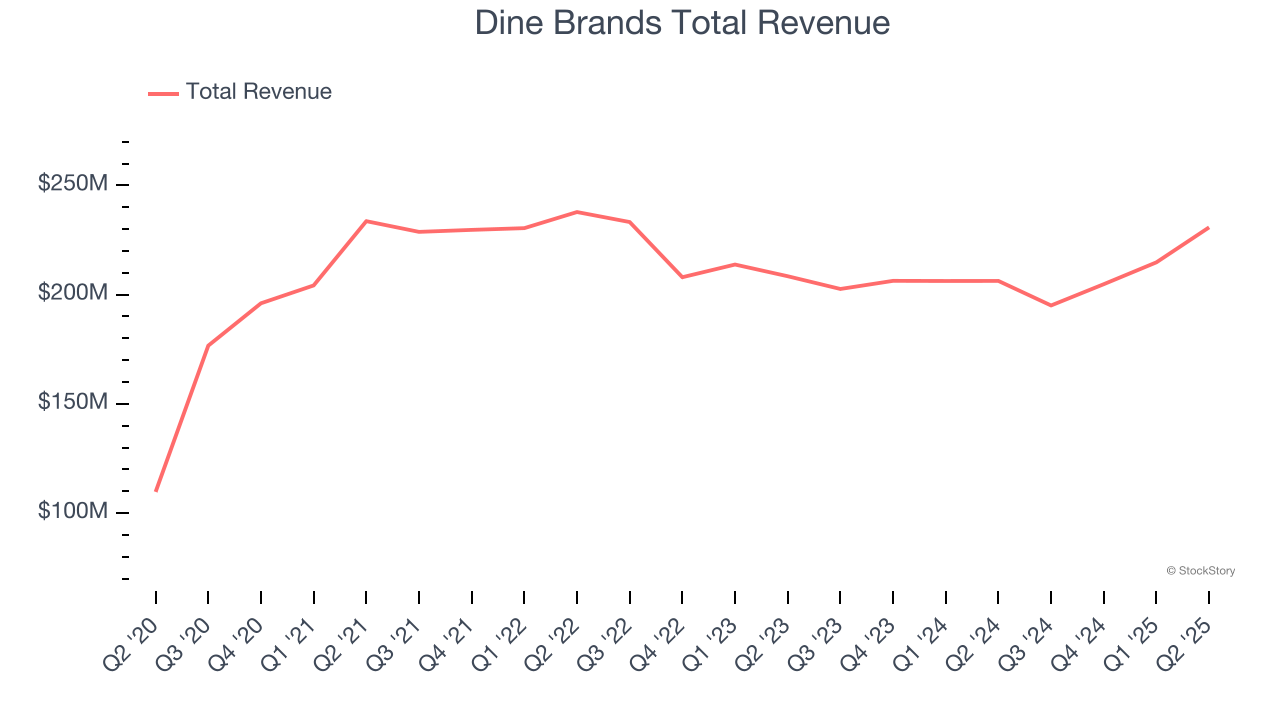

Dine Brands (NYSE: DIN)

Operating a franchise model, Dine Brands (NYSE: DIN) is a casual restaurant chain that owns the Applebee’s and IHOP banners.

Dine Brands reported revenues of $230.8 million, up 11.9% year on year. This print exceeded analysts’ expectations by 3.3%. Despite the top-line beat, it was still a mixed quarter for the company with a solid beat of analysts’ same-store sales estimates but a significant miss of analysts’ EBITDA estimates.

“In the second quarter, we continued to build positive momentum across both Applebee’s and IHOP, with notable improvements in sales and traffic. Applebee’s benefited from strong consumer response to our value-driven promotions and continued innovation in menu and marketing, while IHOP saw growth fueled by its refreshed brand positioning and value strategy. At the same time, our Dual Brands initiative is building traction with our franchisees as our second domestic unit also opened with strong economics. We remain confident that our ongoing investments will generate sustainable value for our shareholders and franchisees based on these results,” said John Peyton, Chief Executive Officer of Dine Brands.

Dine Brands pulled off the biggest analyst estimates beat of the whole group. Still, the market seems discontent with the results. The stock is down 11% since reporting and currently trades at $21.38.

Read our full report on Dine Brands here, it’s free.

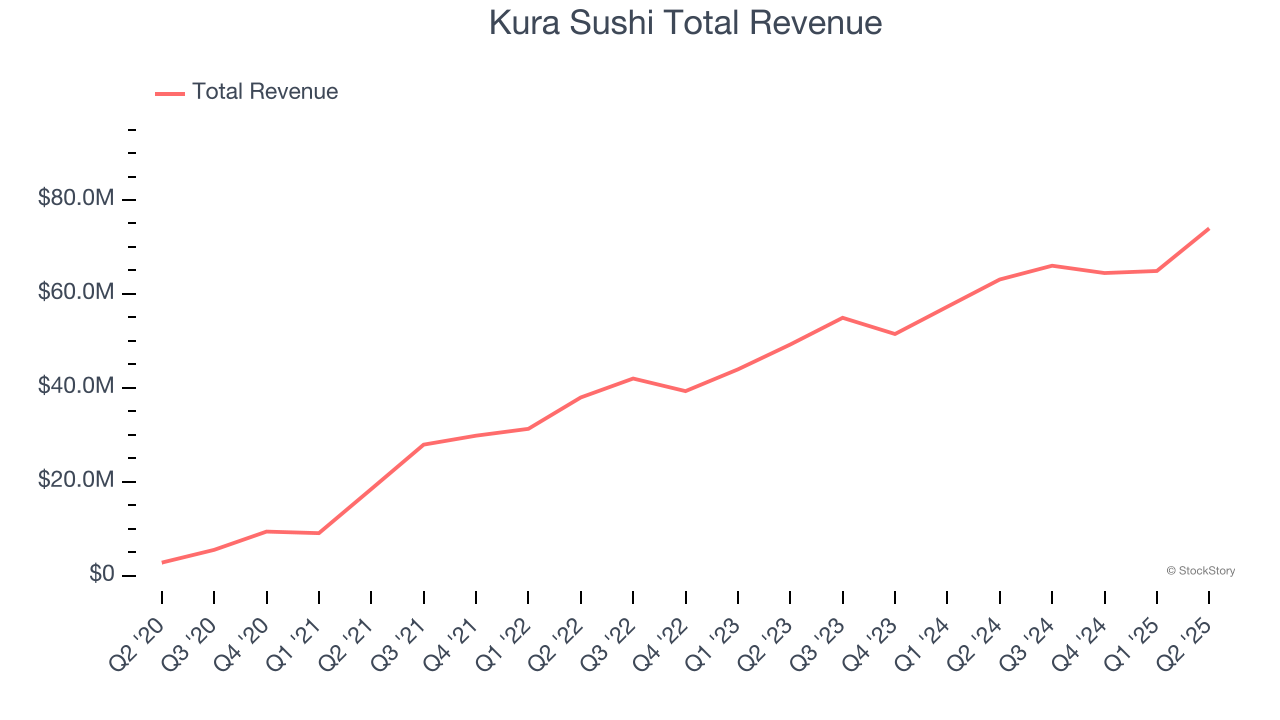

Best Q2: Kura Sushi (NASDAQ: KRUS)

Known for its conveyor belt that transports dishes to diners, Kura Sushi (NASDAQ: KRUS) is a chain of sushi restaurants serving traditional Japanese fare with a touch of modernity and technology.

Kura Sushi reported revenues of $73.97 million, up 17.3% year on year, outperforming analysts’ expectations by 2.5%. The business had a very strong quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Kura Sushi achieved the highest full-year guidance raise among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 11% since reporting. It currently trades at $77.23.

Is now the time to buy Kura Sushi? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Bloomin' Brands (NASDAQ: BLMN)

Owner of the iconic Australian-themed Outback Steakhouse, Bloomin’ Brands (NASDAQ: BLMN) is a leading American restaurant company that owns and operates a portfolio of popular restaurant brands.

Bloomin' Brands reported revenues of $1.00 billion, down 10.4% year on year, exceeding analysts’ expectations by 1.4%. Still, it was a softer quarter as it posted full-year EPS guidance missing analysts’ expectations significantly and EPS guidance for next quarter missing analysts’ expectations significantly.

Bloomin' Brands delivered the slowest revenue growth in the group. As expected, the stock is down 21.5% since the results and currently trades at $7.05.

Read our full analysis of Bloomin' Brands’s results here.

The Cheesecake Factory (NASDAQ: CAKE)

Celebrated for its delicious (and free) brown bread, gigantic portions, and delectable desserts, Cheesecake Factory (NASDAQ: CAKE) is an iconic American restaurant chain that also owns and operates a portfolio of separate restaurant brands.

The Cheesecake Factory reported revenues of $955.8 million, up 5.7% year on year. This print topped analysts’ expectations by 0.8%. It was a strong quarter as it also logged a solid beat of analysts’ EBITDA estimates and a beat of analysts’ EPS estimates.

The stock is flat since reporting and currently trades at $63.27.

Read our full, actionable report on The Cheesecake Factory here, it’s free.

Denny's (NASDAQ: DENN)

Open around the clock, Denny’s (NASDAQ: DENN) is a chain of diner restaurants serving breakfast and traditional American fare.

Denny's reported revenues of $117.7 million, up 1.5% year on year. This number came in 0.5% below analysts' expectations. Overall, it was a slower quarter as it also logged a significant miss of analysts’ EBITDA estimates and a significant miss of analysts’ EPS estimates.

The stock is up 7.8% since reporting and currently trades at $3.94.

Read our full, actionable report on Denny's here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.