Shareholders of Merck would probably like to forget the past six months even happened. The stock dropped 20.3% and now trades at $79.30. This might have investors contemplating their next move.

Following the drawdown, is now a good time to buy MRK? Find out in our full research report, it’s free.

Why Does MRK Stock Spark Debate?

With roots dating back to 1891 and a portfolio that includes the blockbuster cancer immunotherapy Keytruda, Merck (NYSE: MRK) develops and sells prescription medicines, vaccines, and animal health products across oncology, infectious diseases, cardiovascular, and other therapeutic areas.

Two Things to Like:

1. Economies of Scale Give It Negotiating Leverage with Suppliers

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

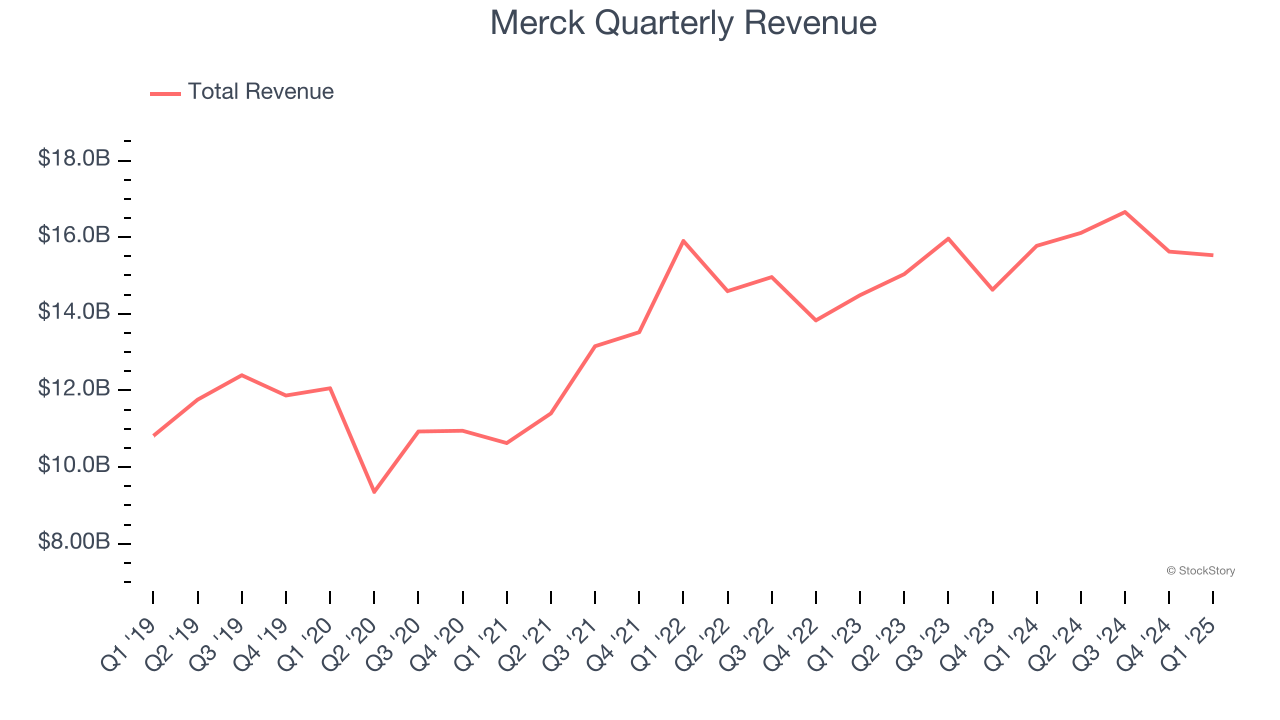

With $63.92 billion in revenue over the past 12 months, Merck is one of the most scaled enterprises in healthcare. This is particularly important because branded pharmaceuticals companies are volume-driven businesses due to their low margins.

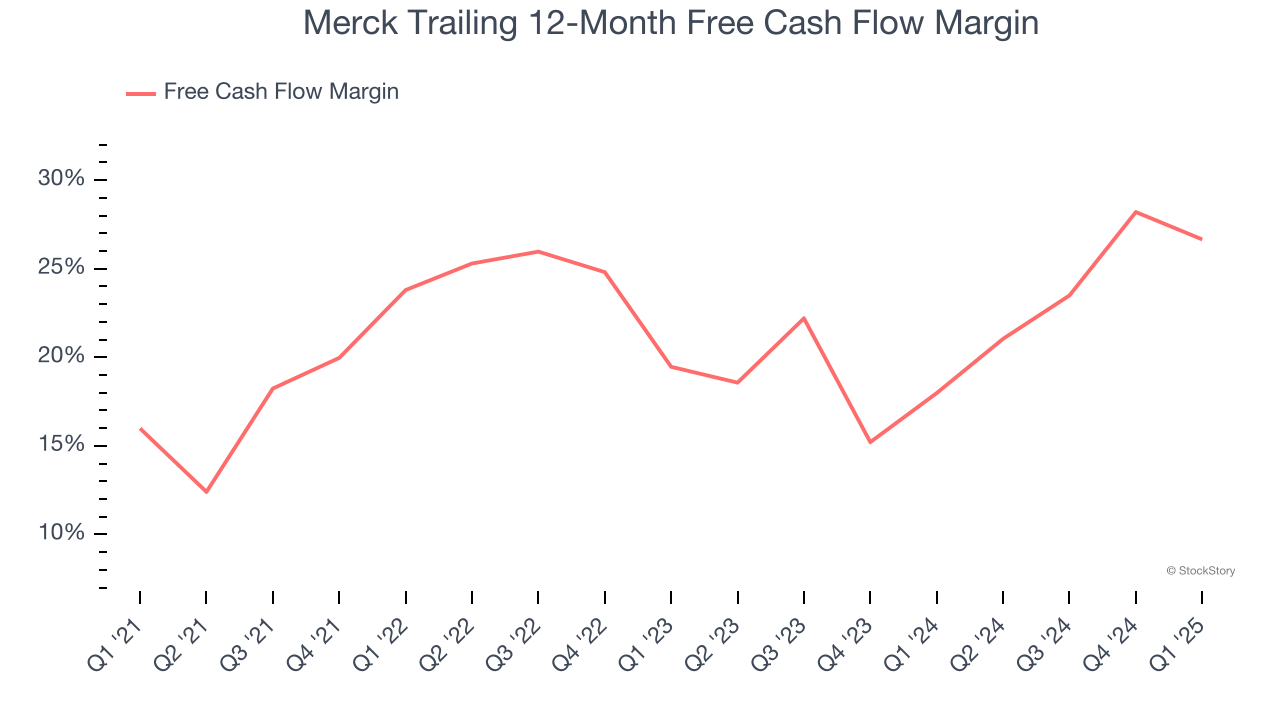

2. Increasing Free Cash Flow Margin Juices Financials

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Merck’s margin expanded by 10.7 percentage points over the last five years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. Merck’s free cash flow margin for the trailing 12 months was 26.7%.

One Reason to be Careful:

Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Merck’s 5.9% annualized revenue growth over the last five years was mediocre. This wasn’t a great result compared to the rest of the healthcare sector, but there are still things to like about Merck.

Final Judgment

Merck’s positive characteristics outweigh the negatives. With the recent decline, the stock trades at 8.7× forward P/E (or $79.30 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.