Burger restaurant chain Red Robin (NASDAQ: RRGB) announced better-than-expected revenue in Q1 CY2025, but sales were flat year on year at $392.4 million. On the other hand, the company’s full-year revenue guidance of $1.22 billion at the midpoint came in 0.9% below analysts’ estimates. Its non-GAAP profit of $0.19 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Red Robin? Find out by accessing our full research report, it’s free.

Red Robin (RRGB) Q1 CY2025 Highlights:

- Revenue: $392.4 million vs analyst estimates of $387.5 million (flat year on year, 1.3% beat)

- Adjusted EPS: $0.19 vs analyst estimates of -$0.49 (significant beat)

- Adjusted EBITDA: $27.9 million vs analyst estimates of $18.29 million (7.1% margin, 52.5% beat)

- The company dropped its revenue guidance for the full year to $1.22 billion at the midpoint from $1.24 billion, a 1.4% decrease

- EBITDA guidance for the full year is $62.5 million at the midpoint, above analyst estimates of $58.86 million

- Operating Margin: 2.3%, up from -0.5% in the same quarter last year

- Same-Store Sales rose 3.1% year on year (-6.5% in the same quarter last year)

- Market Capitalization: $58.85 million

David Pace, Red Robin's President and Chief Executive Officer said, "We are pleased with our strong start to the year as we delivered increases in both sales and profits during the first quarter. We have made significant investments in food quality and hospitality over the past two and a half years and the operational foundation of Red Robin is strong. Nevertheless, we are far from claiming victory. There is still more work to be done as we continue the comeback journey of this beloved brand and capture the significant opportunity in front of us."

Company Overview

Known for its bottomless steak fries, Red Robin (NASDAQ: RRGB) is a chain of casual restaurants specializing in burgers and general American fare.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $1.25 billion in revenue over the past 12 months, Red Robin is a mid-sized restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

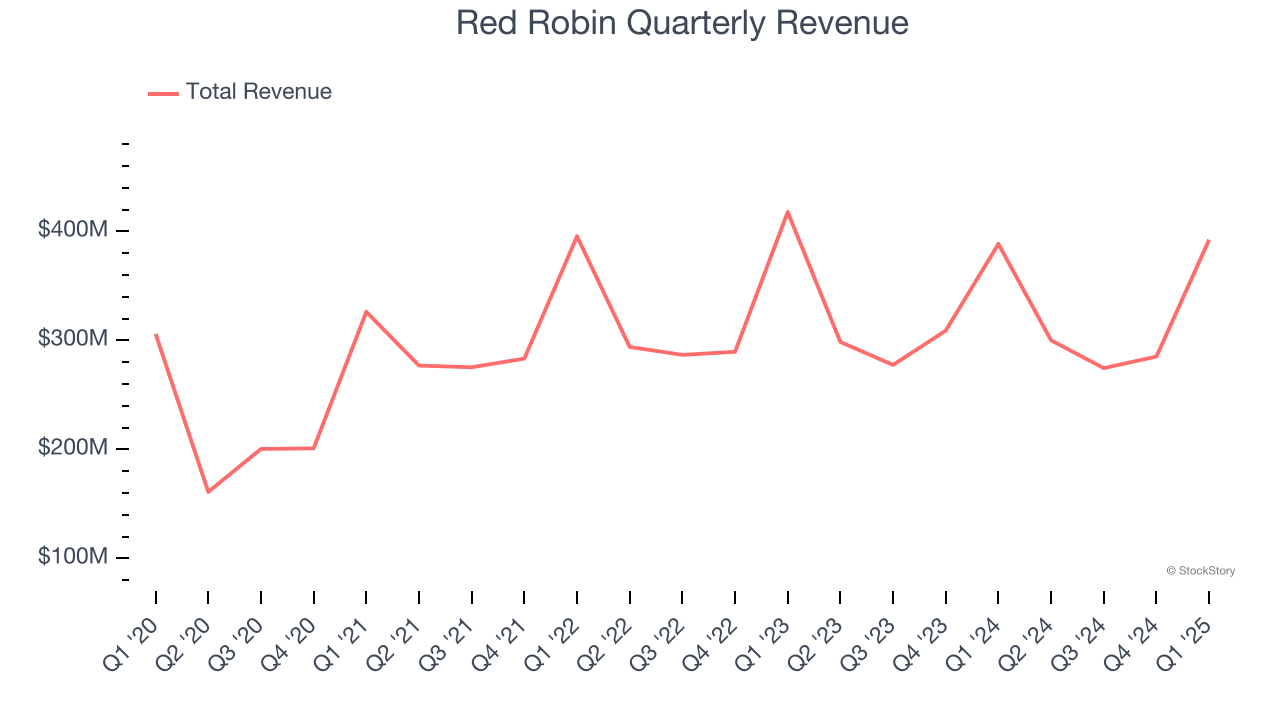

As you can see below, Red Robin struggled to increase demand as its $1.25 billion of sales for the trailing 12 months was close to its revenue six years ago (we compare to 2019 to normalize for COVID-19 impacts). This was mainly because it closed restaurants.

This quarter, Red Robin’s $392.4 million of revenue was flat year on year but beat Wall Street’s estimates by 1.3%.

Looking ahead, sell-side analysts expect revenue to decline by 2.4% over the next 12 months, similar to its six-year rate. This projection is underwhelming and indicates its menu offerings will face some demand challenges.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Restaurant Performance

Number of Restaurants

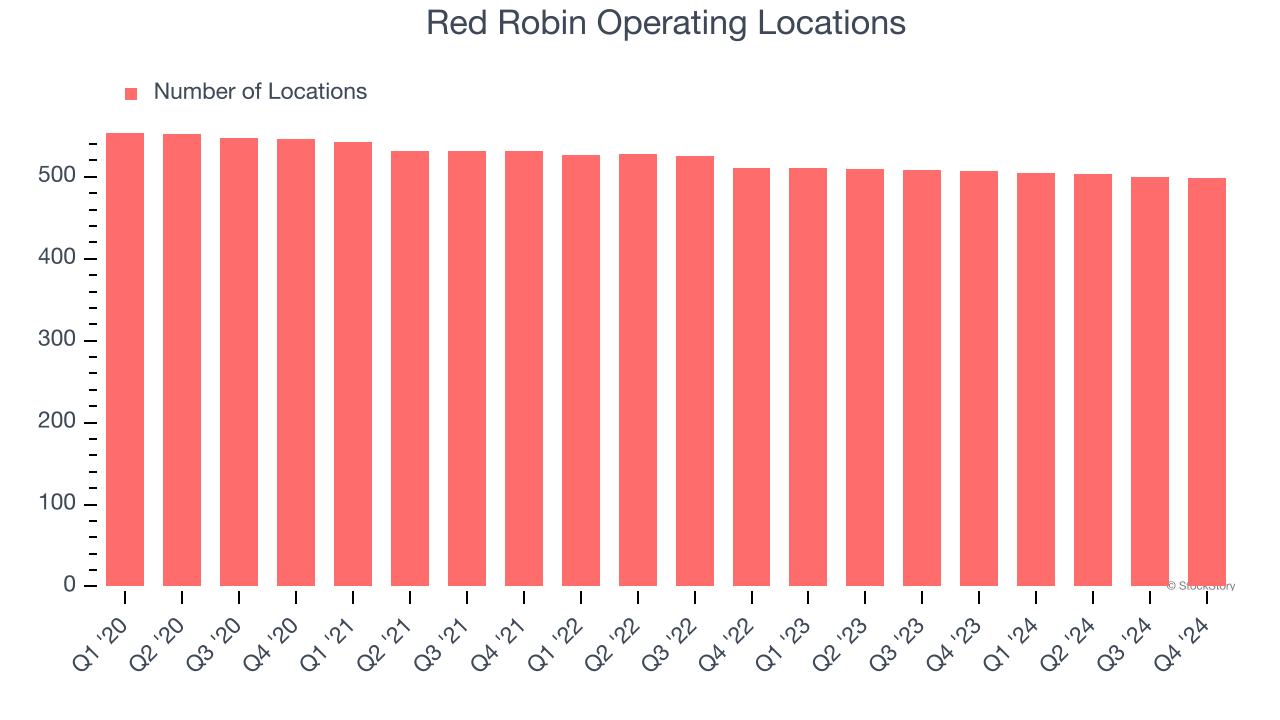

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

Over the last two years, Red Robin has generally closed its restaurants, averaging 1.9% annual declines.

When a chain shutters restaurants, it usually means demand for its meals is waning, and it is responding by closing underperforming locations to improve profitability.

Note that Red Robin reports its restaurant count intermittently, so some data points are missing in the chart below.

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing restaurants and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

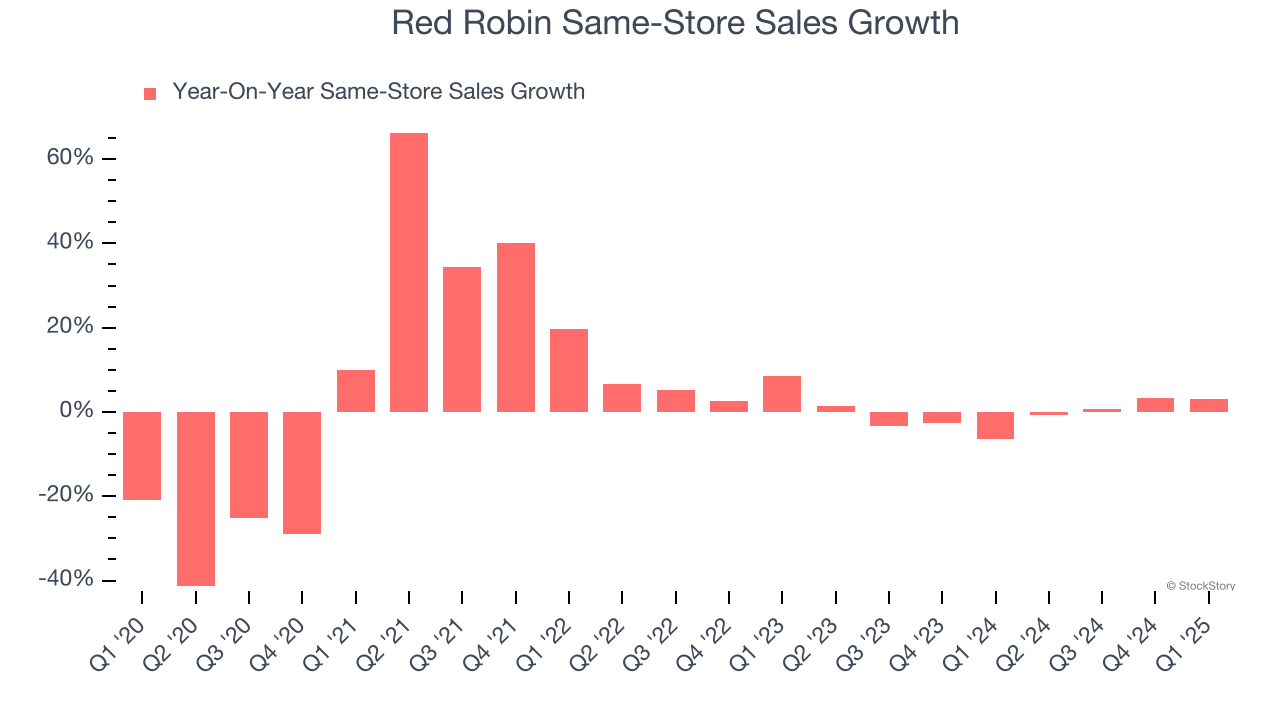

Red Robin’s demand within its existing dining locations has barely increased over the last two years as its same-store sales were flat. This performance isn’t ideal, and Red Robin is attempting to boost same-store sales by closing restaurants (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Red Robin’s same-store sales rose 3.1% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

Key Takeaways from Red Robin’s Q1 Results

We were impressed by how significantly Red Robin blew past analysts’ EPS and EBITDA expectations this quarter. We were also glad its full-year EPS guidance trumped Wall Street’s estimates. Zooming out, this was a blowout quarter as nearly all investors expected an earnings per share loss. The stock traded up 61.9% to $5.10 immediately following the results.

Red Robin had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.