Xponential Fitness has gotten torched over the last six months - since October 2024, its stock price has dropped 39.6% to $7.43 per share. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Xponential Fitness, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Despite the more favorable entry price, we're cautious about Xponential Fitness. Here are three reasons why there are better opportunities than XPOF and a stock we'd rather own.

Why Is Xponential Fitness Not Exciting?

Owner of CycleBar, Rumble, and Club Pilates, Xponential Fitness (NYSE: XPOF) is a boutique fitness brand offering diverse and specialized exercise experiences.

1. Lackluster Revenue Growth

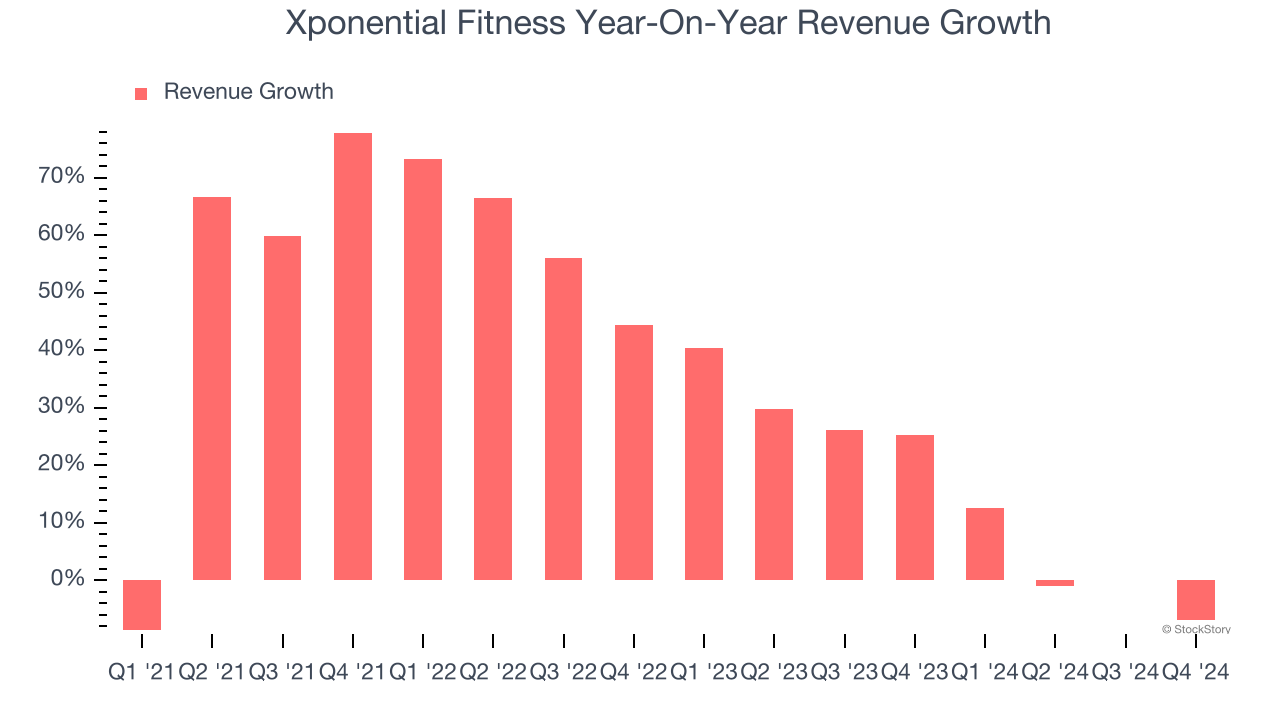

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Xponential Fitness’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 14.3% over the last two years was well below its four-year trend. Note that COVID hurt Xponential Fitness’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

2. Operating Losses Sound the Alarms

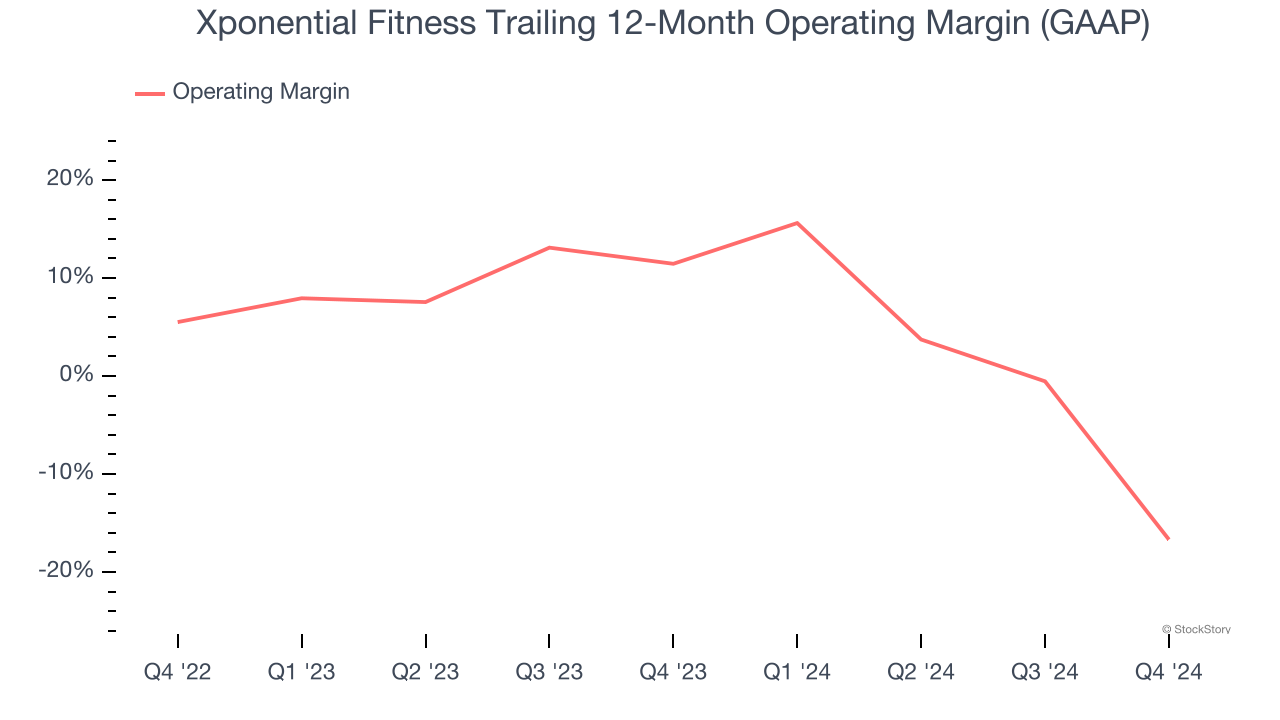

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Xponential Fitness’s operating margin has shrunk over the last 12 months and averaged negative 2.7% over the last two years. Unprofitable, high-growth companies warrant extra scrutiny, especially if their margins fall because they’re spending loads of money to stay relevant, an unsustainable practice.

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Xponential Fitness’s five-year average ROIC was negative 16.9%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

Final Judgment

Xponential Fitness’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 4.2× forward price-to-earnings (or $7.43 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better investments elsewhere. We’d suggest looking at an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than Xponential Fitness

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.