ON24 trades at $4.99 per share and has moved almost in lockstep with the market over the last six months. The stock has lost 17.9% while the S&P 500 is down 13.5%. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy ON24, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Even though the stock has become cheaper, we're swiping left on ON24 for now. Here are three reasons why we avoid ONTF and a stock we'd rather own.

Why Do We Think ON24 Will Underperform?

Started in 1998 as a platform to broadcast press conferences, ON24’s (NYSE: ONTF) software helps organizations organize online webinars and other virtual events and convert prospects into customers.

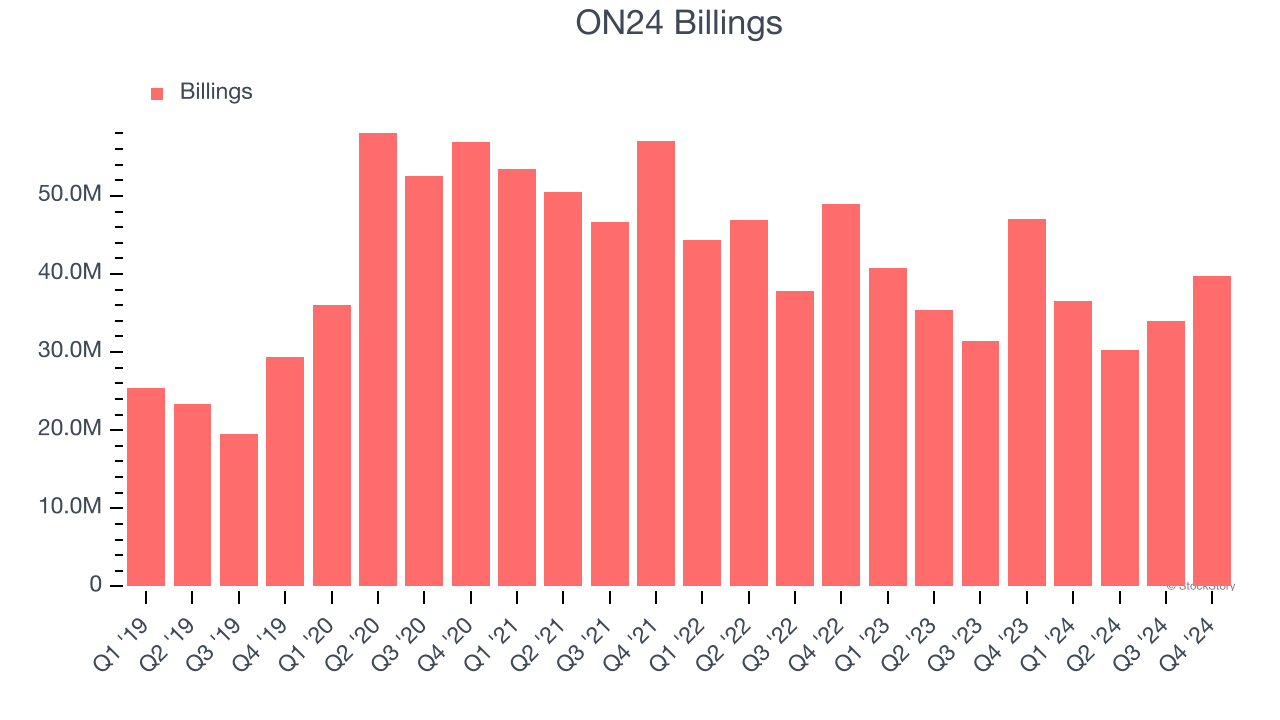

1. Declining Billings Reflect Product and Sales Weakness

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

ON24’s billings came in at $39.74 million in Q4, and it averaged 8.1% year-on-year declines over the last four quarters. This performance was underwhelming and shows the company faced challenges in acquiring and retaining customers. It also suggests there may be increasing competition or market saturation.

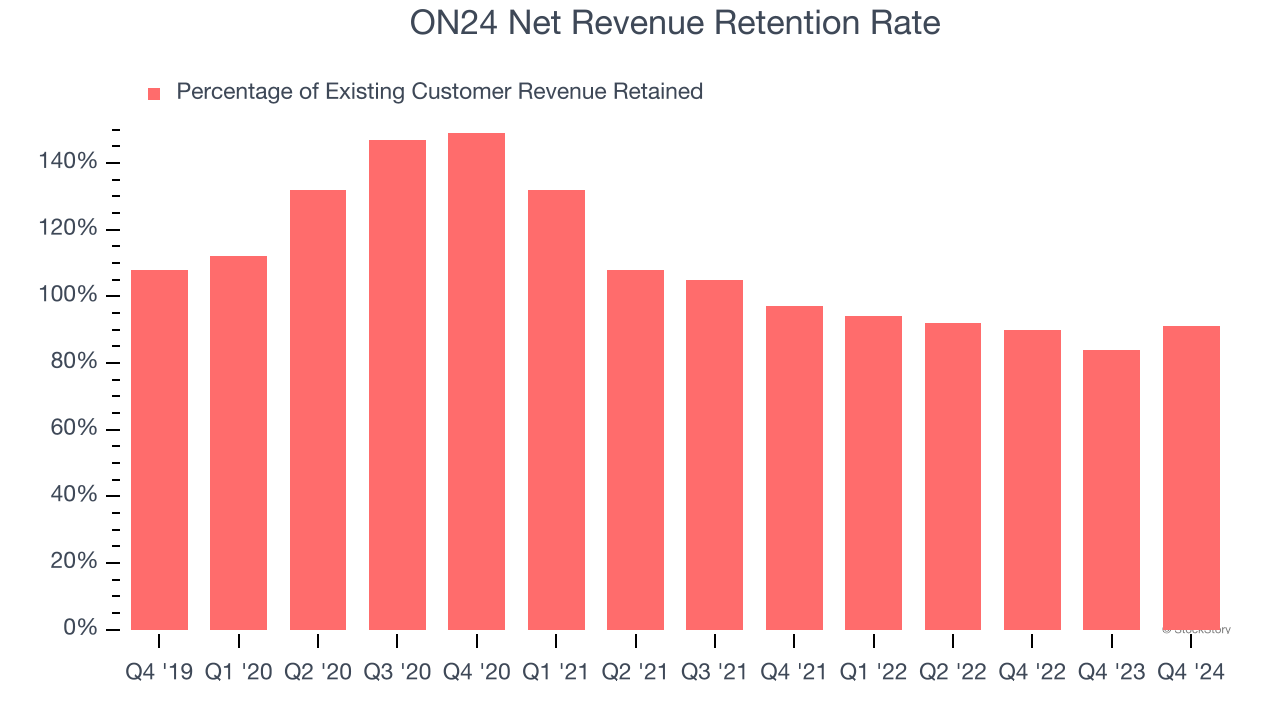

2. Customer Churn Hurts Long-Term Outlook

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

ON24’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 91% in Q4. This means ON24’s revenue would’ve decreased by 9% over the last 12 months if it didn’t win any new customers.

ON24 has a poor net retention rate, warning us that its customers are churning and that its products might not live up to expectations.

3. Long Payback Periods Delay Returns

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

ON24’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between ON24’s products and its peers.

Final Judgment

We see the value of companies addressing major business pain points, but in the case of ON24, we’re out. Following the recent decline, the stock trades at 1.4× forward price-to-sales (or $4.99 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better stocks to buy right now. Let us point you toward an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than ON24

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.