Even during a down period for the markets, Kratos has gone against the grain, climbing to $28.94. Its shares have yielded a 15.4% return over the last six months, beating the S&P 500 by 26%. This run-up might have investors contemplating their next move.

Is now the time to buy Kratos, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

We’re happy investors have made money, but we're swiping left on Kratos for now. Here are three reasons why we avoid KTOS and a stock we'd rather own.

Why Is Kratos Not Exciting?

Established with a commitment to supporting national security, Kratos (NASDAQ: KTOS) is a provider of advanced engineering, technology, and security solutions tailored for critical national security applications.

1. Cash Burn Ignites Concerns

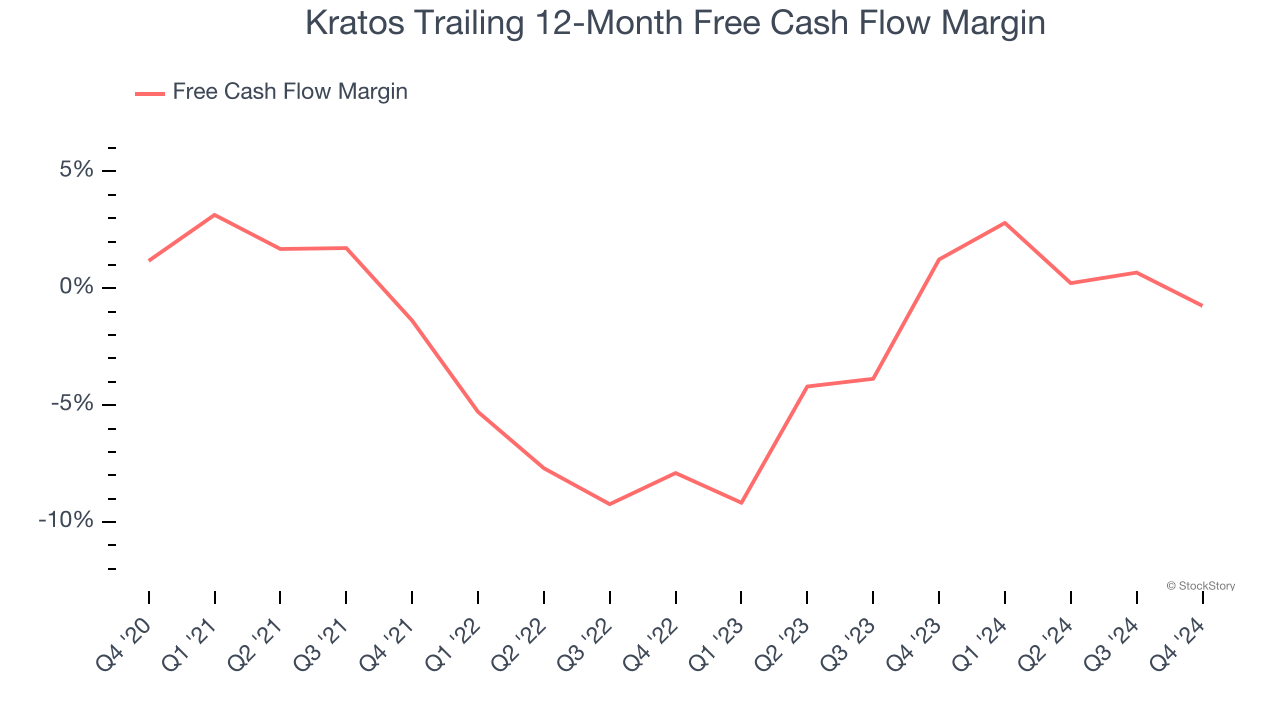

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

While Kratos posted positive free cash flow this quarter, the broader story hasn’t been so clean. Kratos’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 1.5%, meaning it lit $1.49 of cash on fire for every $100 in revenue.

2. Previous Growth Initiatives Haven’t Impressed

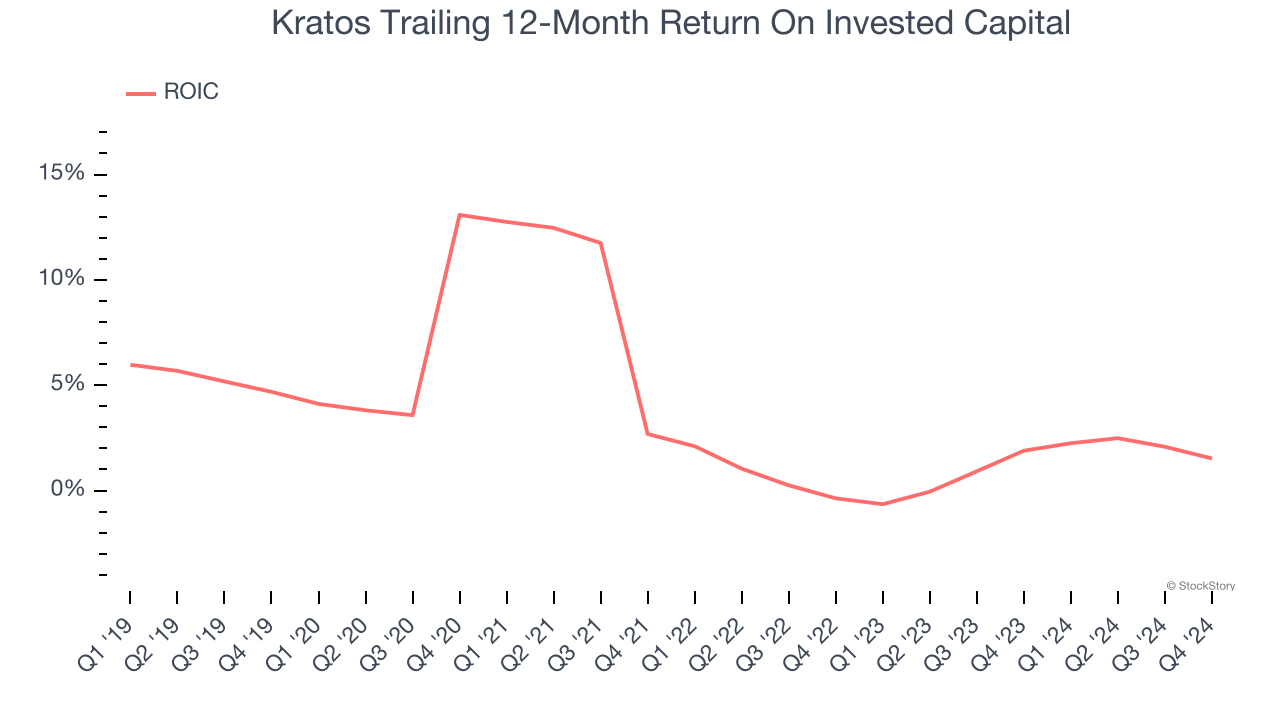

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Kratos historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3.8%, lower than the typical cost of capital (how much it costs to raise money) for industrials companies.

3. New Investments Fail to Bear Fruit as ROIC Declines

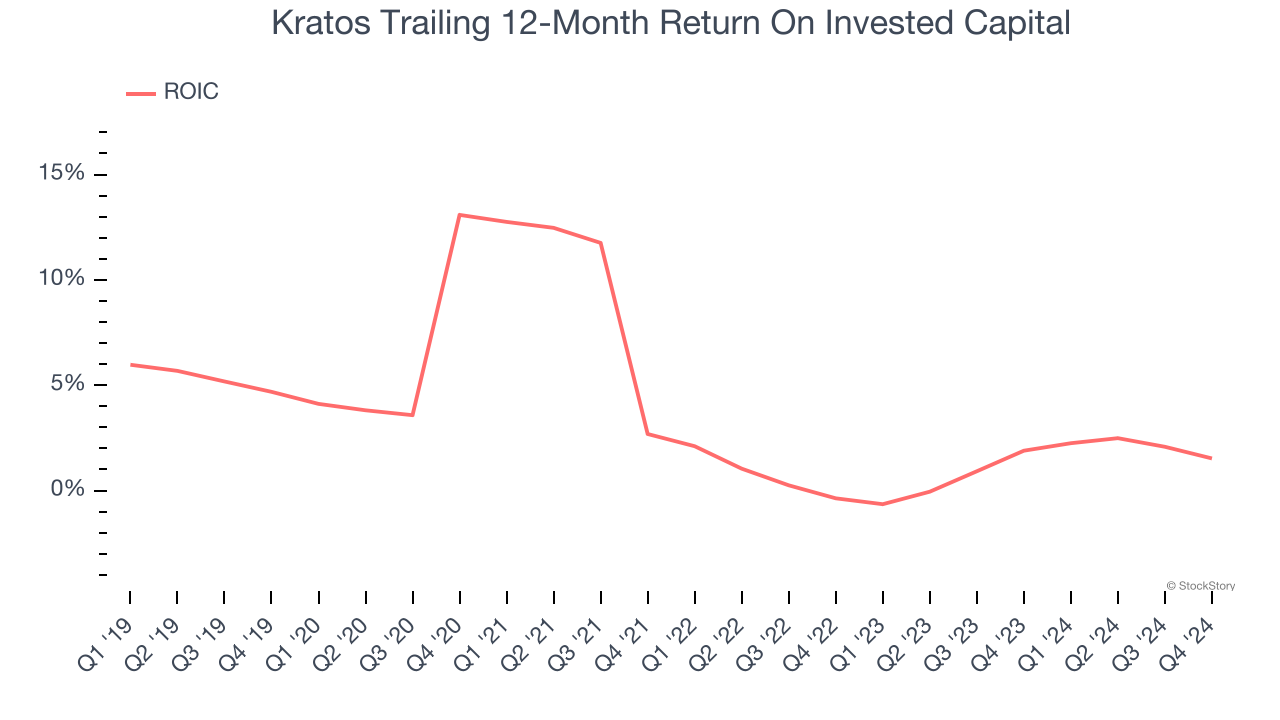

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Kratos’s ROIC has unfortunately decreased. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

Kratos isn’t a terrible business, but it isn’t one of our picks. With its shares beating the market recently, the stock trades at 48.8× forward price-to-earnings (or $28.94 per share). This valuation tells us a lot of optimism is priced in - we think there are better investment opportunities out there. We’d recommend looking at the most dominant software business in the world.

Stocks We Would Buy Instead of Kratos

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.