Shareholders of TransUnion would probably like to forget the past six months even happened. The stock dropped 32.3% and now trades at $71.53. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy TransUnion, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Even with the cheaper entry price, we don't have much confidence in TransUnion. Here are three reasons why we avoid TRU and a stock we'd rather own.

Why Is TransUnion Not Exciting?

One of the three major credit bureaus in the United States alongside Equifax and Experian, TransUnion (NYSE: TRU) is a global information and insights company that provides credit reports, fraud prevention tools, and data analytics to help businesses make decisions and consumers manage their financial health.

1. EPS Barely Growing

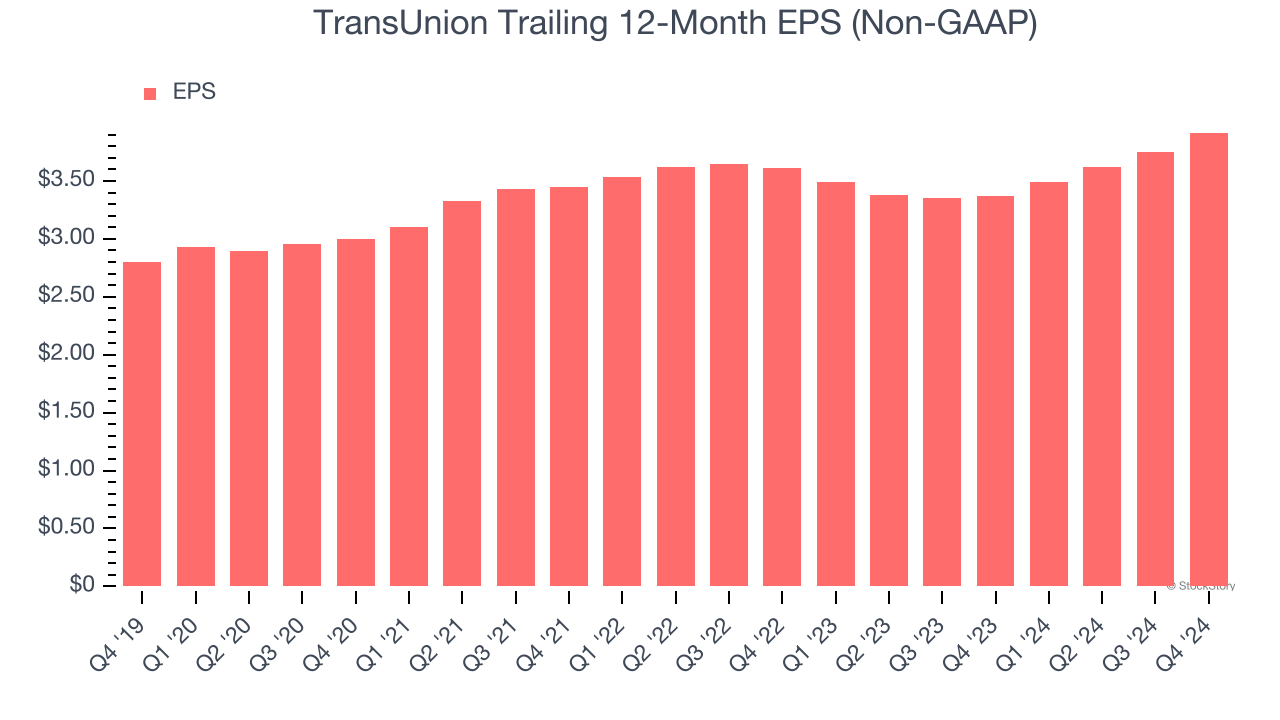

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

TransUnion’s EPS grew at an unimpressive 7% compounded annual growth rate over the last five years, lower than its 9.5% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

2. Free Cash Flow Margin Dropping

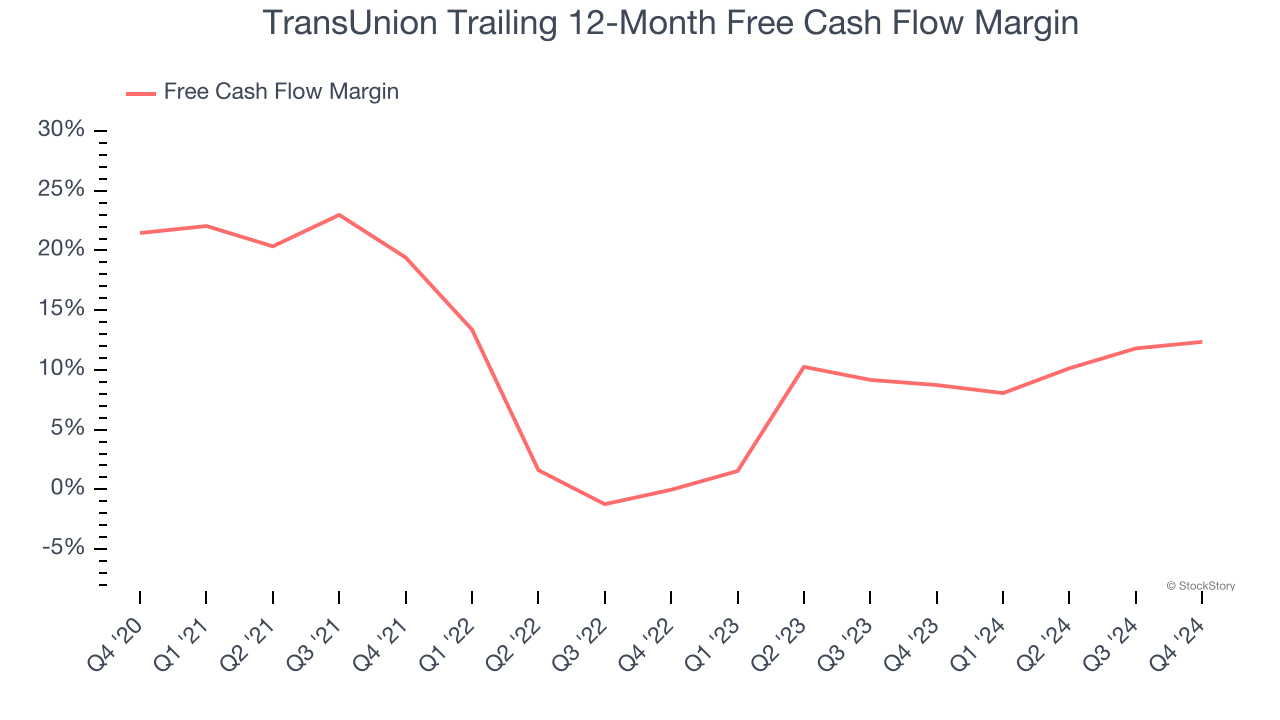

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, TransUnion’s margin dropped by 9.1 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity. TransUnion’s free cash flow margin for the trailing 12 months was 12.4%.

3. New Investments Fail to Bear Fruit as ROIC Declines

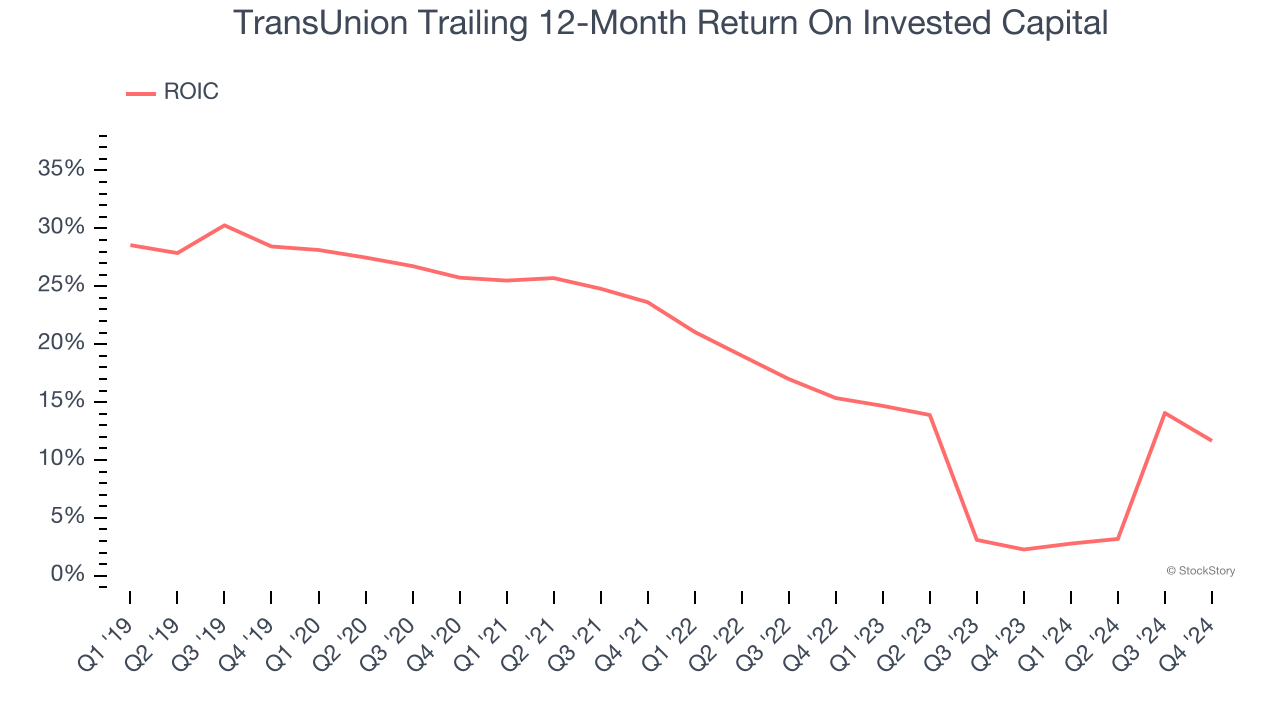

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, TransUnion’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

TransUnion isn’t a terrible business, but it isn’t one of our picks. After the recent drawdown, the stock trades at 16.5× forward price-to-earnings (or $71.53 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. Let us point you toward the most dominant software business in the world.

Stocks We Would Buy Instead of TransUnion

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.