Shareholders of Azenta would probably like to forget the past six months even happened. The stock dropped 23.7% and now trades at $37.66. This might have investors contemplating their next move.

Is now the time to buy Azenta, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why we avoid AZTA and a stock we'd rather own.

Why Do We Think Azenta Will Underperform?

Serving as the guardian of some of medicine's most valuable materials, Azenta (NASDAQ: AZTA) provides biological sample management, storage, and genomic services that help pharmaceutical and biotechnology companies preserve and analyze critical research materials.

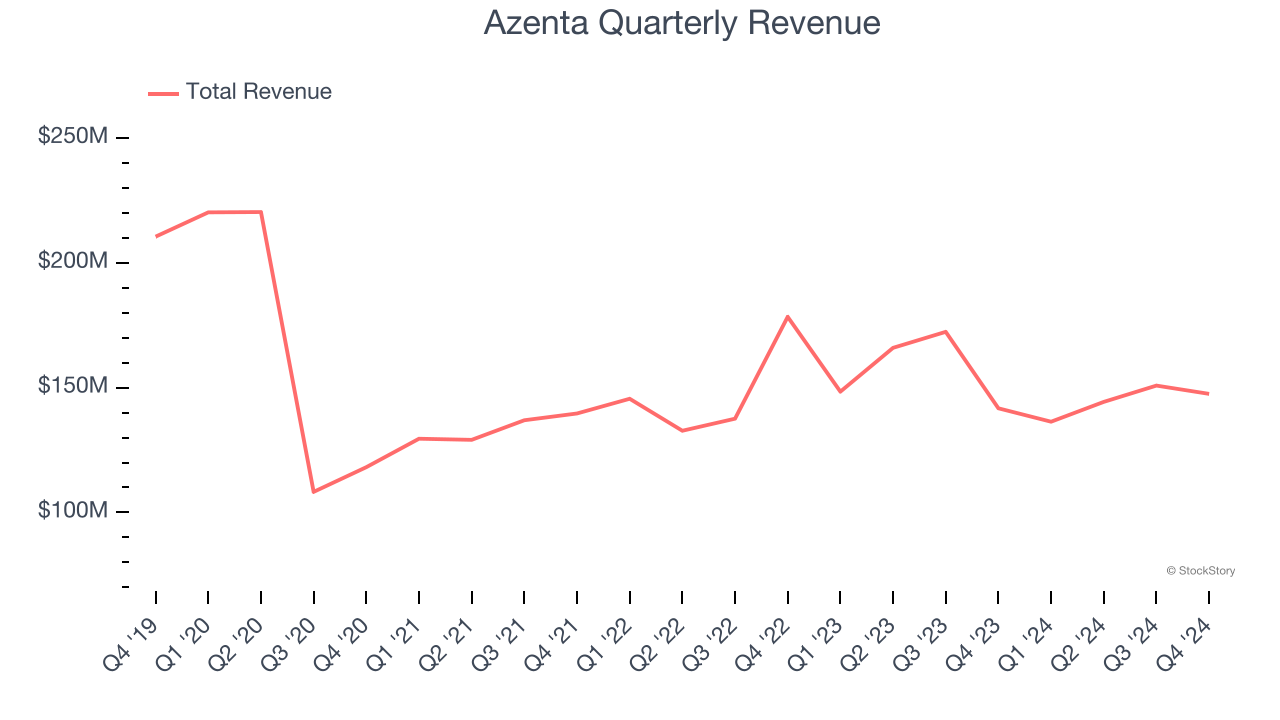

1. Revenue Spiraling Downwards

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Azenta’s demand was weak over the last five years as its sales fell at a 6.5% annual rate. This wasn’t a great result and is a sign of poor business quality.

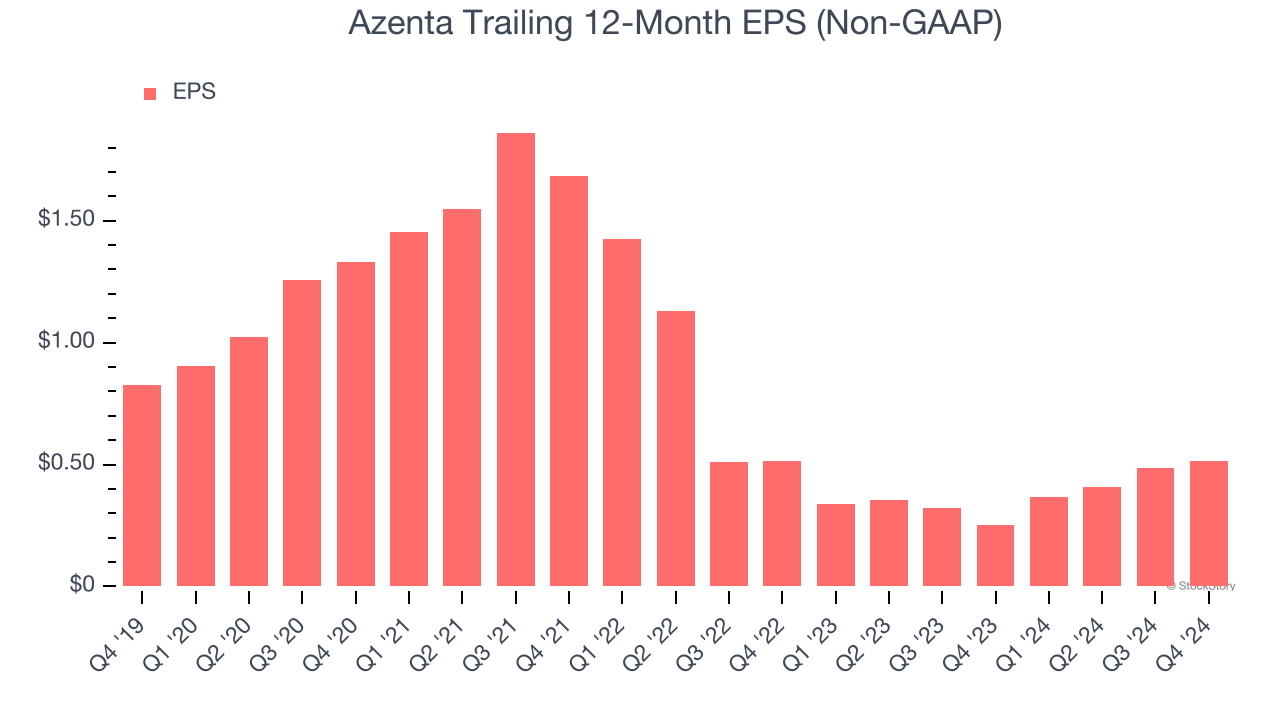

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Azenta, its EPS declined by 9% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

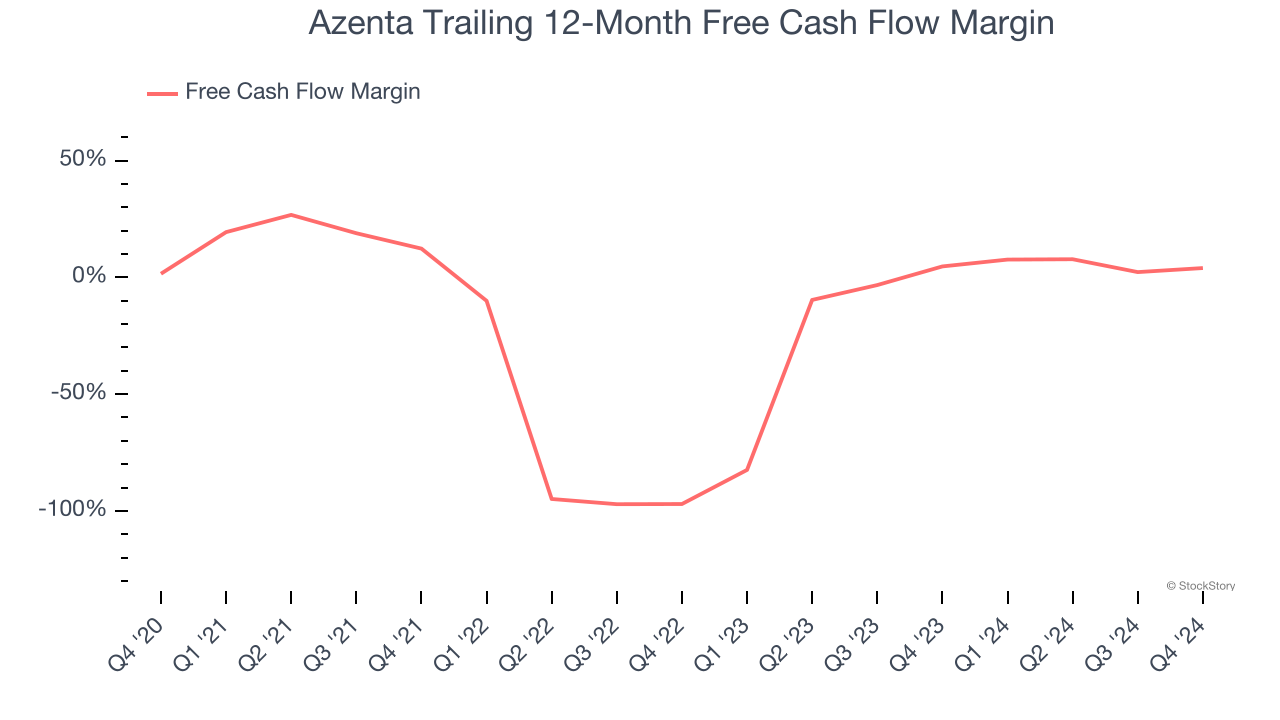

3. Cash Burn Ignites Concerns

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

While Azenta posted positive free cash flow this quarter, the broader story hasn’t been so clean. Azenta’s demanding reinvestments have consumed many resources over the last five years, contributing to an average free cash flow margin of negative 14.9%. This means it lit $14.91 of cash on fire for every $100 in revenue.

Final Judgment

Azenta falls short of our quality standards. After the recent drawdown, the stock trades at 70.7× forward price-to-earnings (or $37.66 per share). This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now. We’d suggest looking at one of our all-time favorite software stocks.

Stocks We Would Buy Instead of Azenta

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.