Bark trades at $1.83 and has moved in lockstep with the market. Its shares have returned 6.4% over the last six months while the S&P 500 has gained 8.9%.

Is now the time to buy Bark, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

We're swiping left on Bark for now. Here are three reasons why you should be careful with BARK and a stock we'd rather own.

Why Is Bark Not Exciting?

Making a name for itself with the BarkBox, Bark (NYSE: BARK) specializes in subscription-based, personalized pet products.

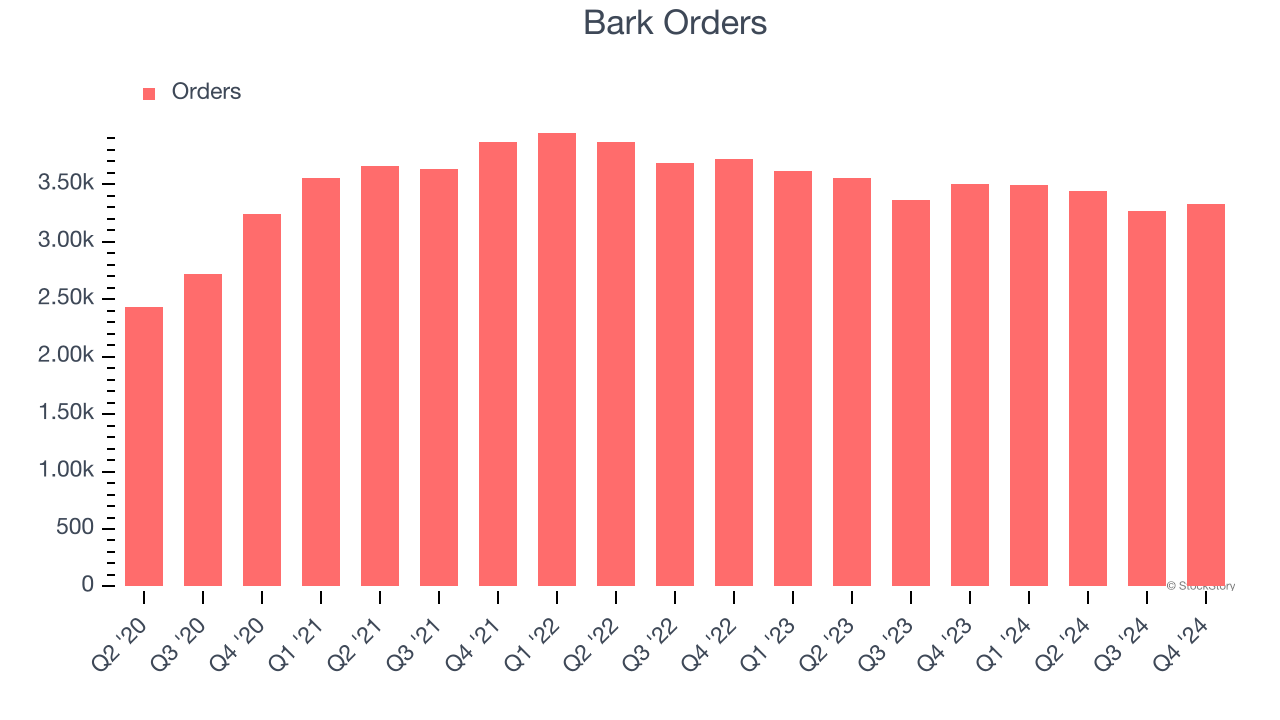

1. Decline in Orders Points to Weak Demand

Revenue growth can be broken down into changes in price and volume (for companies like Bark, our preferred volume metric is orders). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Bark’s orders came in at 3,332 in the latest quarter, and over the last two years, averaged 5.7% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Bark might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

2. Operating Losses Sound the Alarms

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Bark’s operating margin has risen over the last 12 months, but it still averaged negative 8.8% over the last two years. This is due to its large expense base and inefficient cost structure.

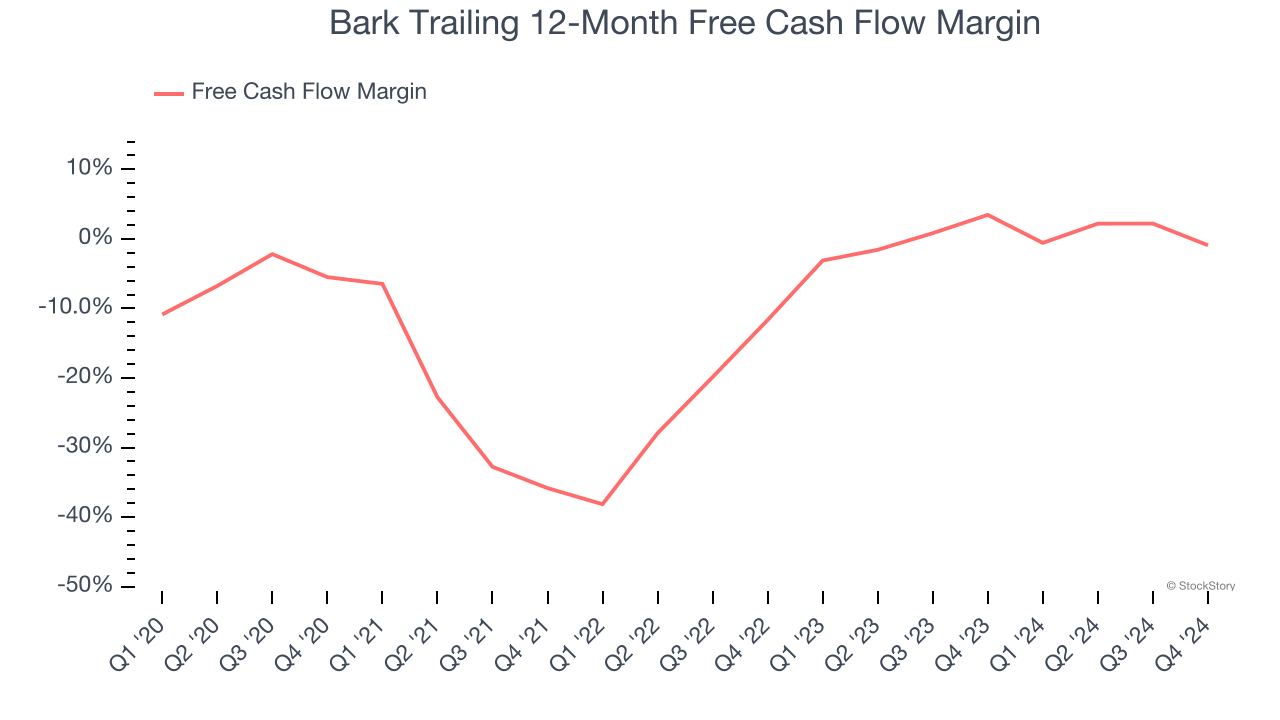

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Bark has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.3%, lousy for a consumer discretionary business.

Final Judgment

Bark’s business quality ultimately falls short of our standards. That said, the stock currently trades at 140.3× forward price-to-earnings (or $1.83 per share). This valuation tells us a lot of optimism is priced in - we think there are better investment opportunities out there. Let us point you toward a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than Bark

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.