As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at industrial & environmental services stocks, starting with Pitney Bowes (NYSE: PBI).

Growing regulatory pressure on environmental compliance and increasing corporate ESG commitments should buoy the sector for years to come. On the other hand, environmental regulations continue to evolve, and this may require costly upgrades, volatility in commodity waste and recycling markets, and labor shortages in industrial services. As for digitization, a theme that is impacting nearly every industry, the increasing use of data, analytics, and automation will give rise to improved efficiency of operations. Conversely, though, the benefits of digitization also come with challenges of integrating new technologies into legacy systems.

The 8 industrial & environmental services stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 3.7% on average since the latest earnings results.

Pitney Bowes (NYSE: PBI)

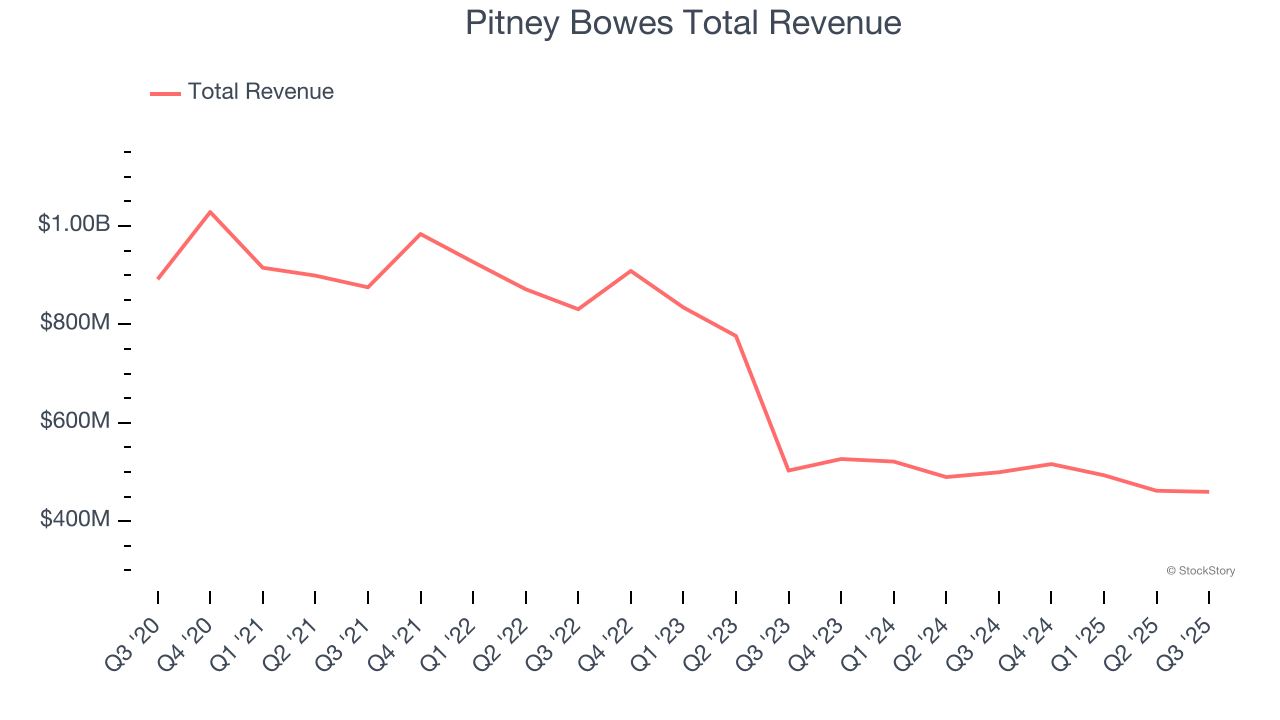

With a century-long history dating back to 1920 and processing over 15 billion pieces of mail annually, Pitney Bowes (NYSE: PBI) provides shipping, mailing technology, logistics, and financial services to businesses of all sizes.

Pitney Bowes reported revenues of $459.7 million, down 8% year on year. This print fell short of analysts’ expectations by 1.7%. Overall, it was a slower quarter for the company with a miss of analysts’ revenue estimates and EPS in line with analysts’ estimates.

Pitney Bowes achieved the highest full-year guidance raise but had the slowest revenue growth of the whole group. Still, the market seems discontent with the results. The stock is down 5.4% since reporting and currently trades at $10.64.

Read our full report on Pitney Bowes here, it’s free for active Edge members.

Best Q3: Tetra Tech (NASDAQ: TTEK)

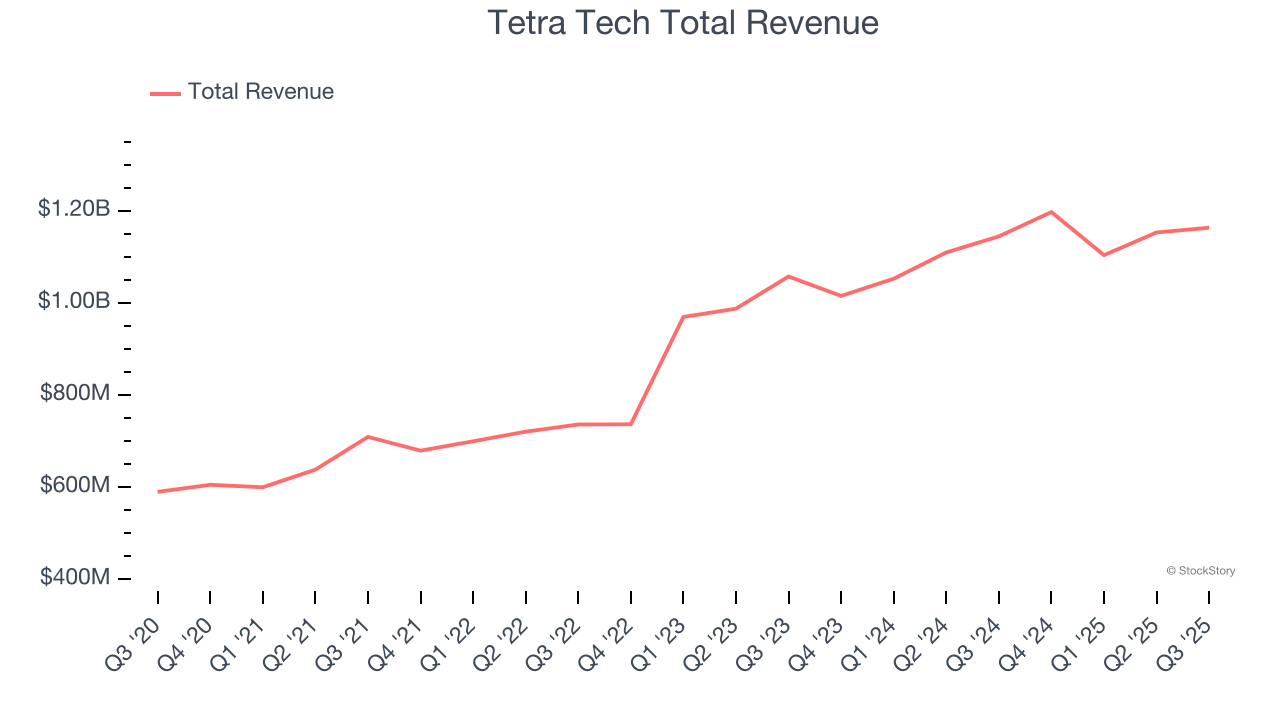

With a 50-year legacy of "Leading with Science" and operations on all seven continents, Tetra Tech (NASDAQ: TTEK) provides high-end consulting and engineering services focused on water management, environmental solutions, and sustainable infrastructure for government and commercial clients worldwide.

Tetra Tech reported revenues of $1.16 billion, up 1.6% year on year, outperforming analysts’ expectations by 10.7%. The business had a strong quarter with a beat of analysts’ EPS and revenue estimates.

Tetra Tech achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 5.4% since reporting. It currently trades at $34.19.

Is now the time to buy Tetra Tech? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Vestis (NYSE: VSTS)

Operating a network of more than 350 facilities with 3,300 delivery routes serving customers weekly, Vestis (NYSE: VSTS) provides uniform rentals, workplace supplies, and facility services to over 300,000 business locations across the United States and Canada.

Vestis reported revenues of $686.2 million, flat year on year, exceeding analysts’ expectations by 2.1%. Still, it was a softer quarter as it posted a significant miss of analysts’ EPS estimates.

As expected, the stock is down 1.2% since the results and currently trades at $6.64.

Read our full analysis of Vestis’s results here.

UniFirst (NYSE: UNF)

With a fleet of trucks making weekly deliveries to over 300,000 customer locations, UniFirst (NYSE: UNF) provides, rents, cleans, and maintains workplace uniforms and protective clothing for businesses across various industries.

UniFirst reported revenues of $614.4 million, down 4% year on year. This print surpassed analysts’ expectations by 1.1%. More broadly, it was a slower quarter as it recorded a significant miss of analysts’ full-year EPS guidance estimates and full-year revenue guidance slightly missing analysts’ expectations.

The stock is up 14.8% since reporting and currently trades at $199.08.

Read our full, actionable report on UniFirst here, it’s free for active Edge members.

ABM (NYSE: ABM)

With roots dating back to 1909 as a window washing company, ABM Industries (NYSE: ABM) provides integrated facility management, infrastructure, and mobility solutions across various sectors including commercial, manufacturing, education, and aviation.

ABM reported revenues of $2.30 billion, up 5.4% year on year. This number beat analysts’ expectations by 1%. Aside from that, it was a slower quarter as it logged a significant miss of analysts’ EPS estimates and full-year EPS guidance in line with analysts’ estimates.

The stock is down 7.9% since reporting and currently trades at $42.12.

Read our full, actionable report on ABM here, it’s free for active Edge members.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.