Over the past six months, fuboTV’s shares (currently trading at $2.67) have posted a disappointing 18.3% loss, well below the S&P 500’s 14.4% gain. This might have investors contemplating their next move.

Is now the time to buy fuboTV, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Do We Think fuboTV Will Underperform?

Despite the more favorable entry price, we're swiping left on fuboTV for now. Here are three reasons there are better opportunities than FUBO and a stock we'd rather own.

1. Weak Growth in Domestic Subscribers Points to Soft Demand

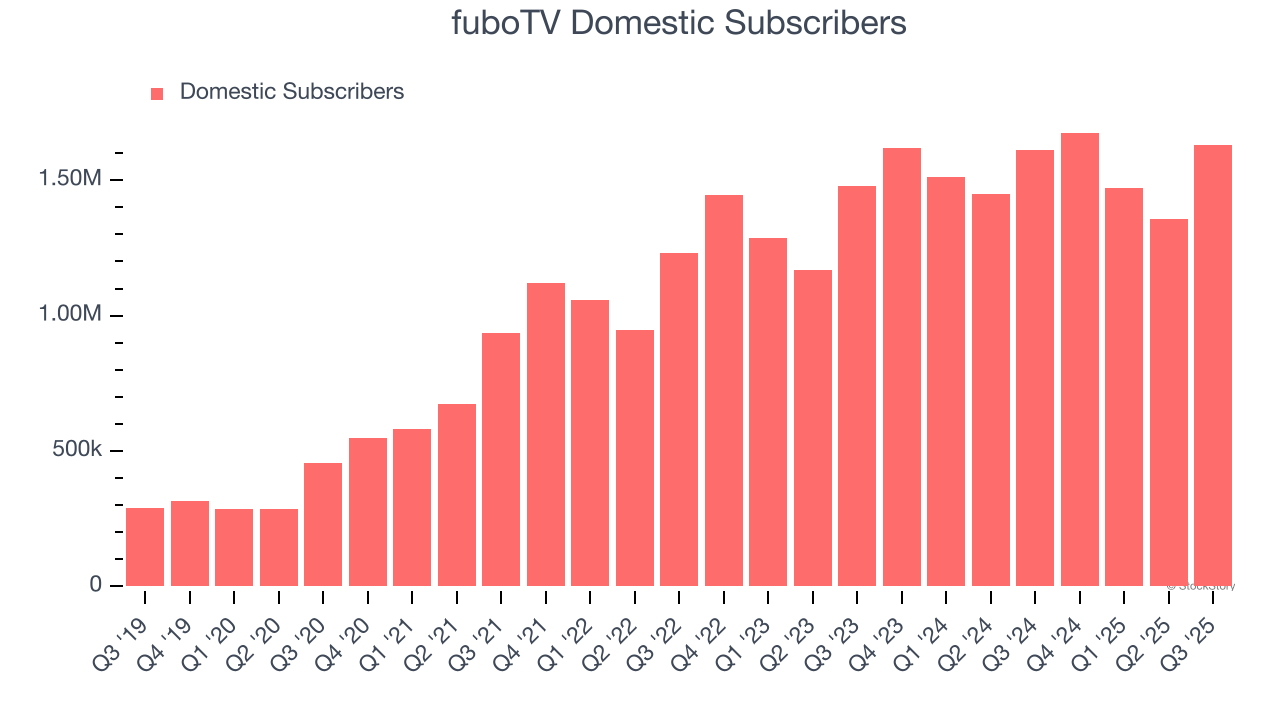

Revenue growth can be broken down into changes in price and volume (for companies like fuboTV, our preferred volume metric is domestic subscribers). While both are important, the latter is the most critical to analyze because prices have a ceiling.

fuboTV’s domestic subscribers came in at 1.63 million in the latest quarter, and over the last two years, averaged 7.3% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. Operating Losses Sound the Alarms

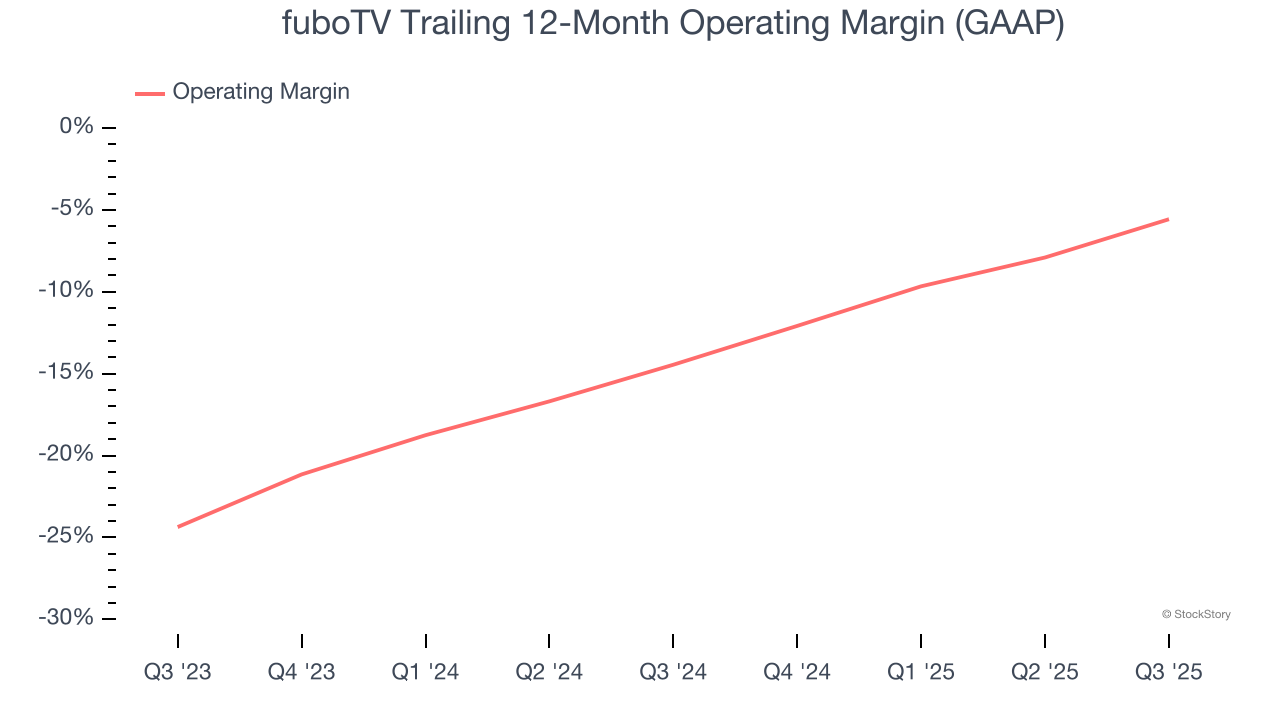

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

fuboTV’s operating margin has risen over the last 12 months, but it still averaged negative 10% over the last two years. This is due to its large expense base and inefficient cost structure.

3. Breakeven Free Cash Flow Limits Reinvestment Potential

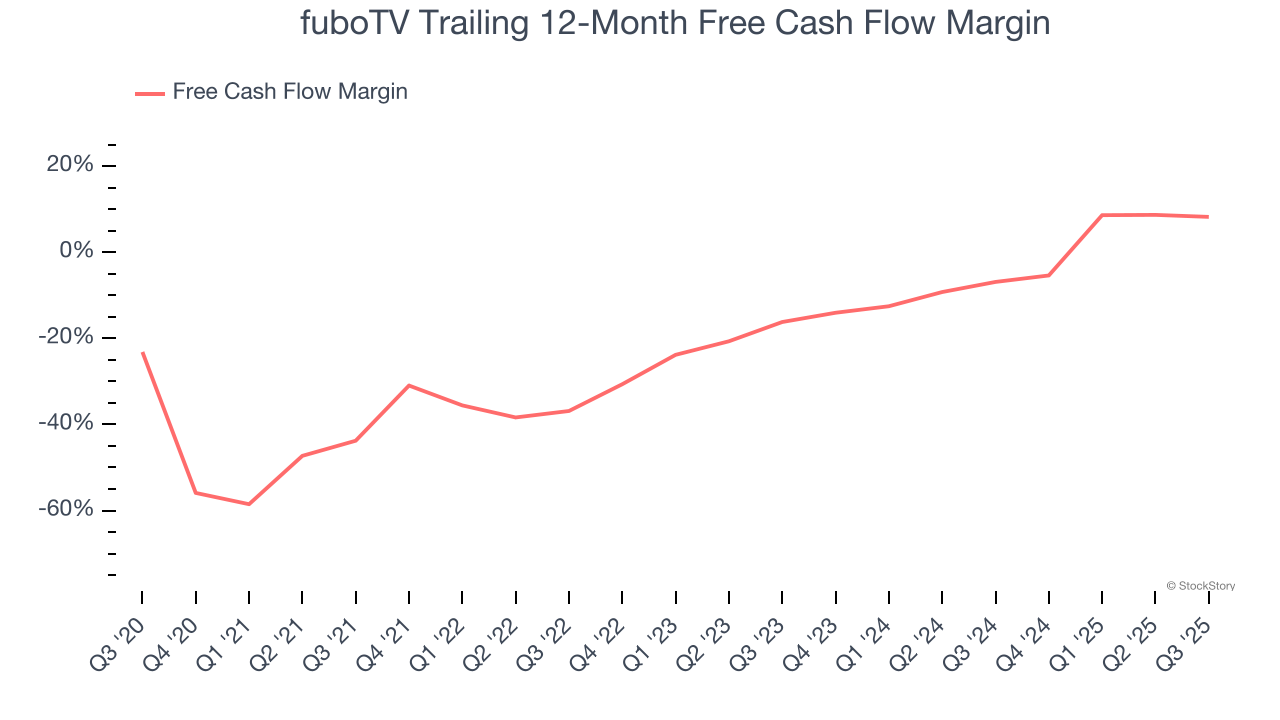

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

fuboTV broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of fuboTV, we’ll be cheering from the sidelines. After the recent drawdown, the stock trades at 91.3× forward P/E (or $2.67 per share). This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now. Let us point you toward the most entrenched endpoint security platform on the market.

Stocks We Would Buy Instead of fuboTV

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.