Insurance services company Assurant (NYSE: AIZ) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 8.9% year on year to $3.23 billion. Its non-GAAP profit of $5.73 per share was 34% above analysts’ consensus estimates.

Is now the time to buy Assurant? Find out by accessing our full research report, it’s free for active Edge members.

Assurant (AIZ) Q3 CY2025 Highlights:

Company Overview

With roots dating back to 1892 when it was founded by a Civil War veteran, Assurant (NYSE: AIZ) provides specialized insurance products and services that protect major consumer purchases like mobile devices, vehicles, homes, and appliances.

Revenue Growth

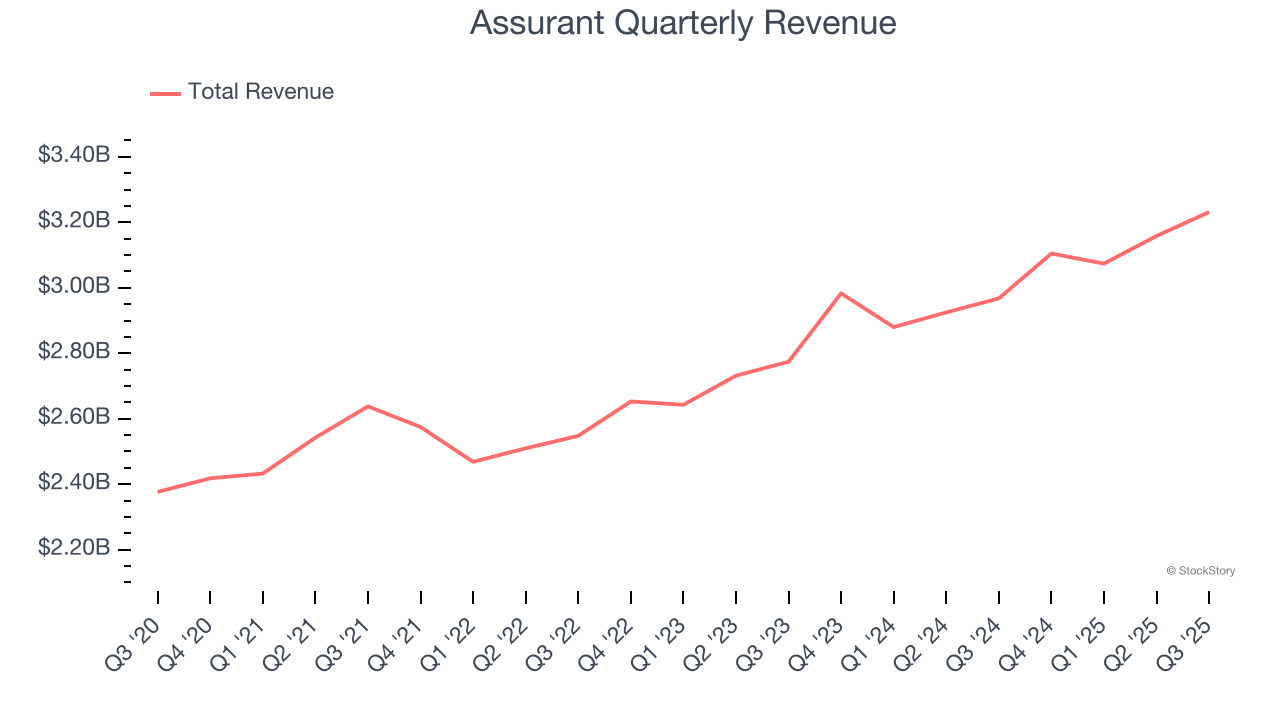

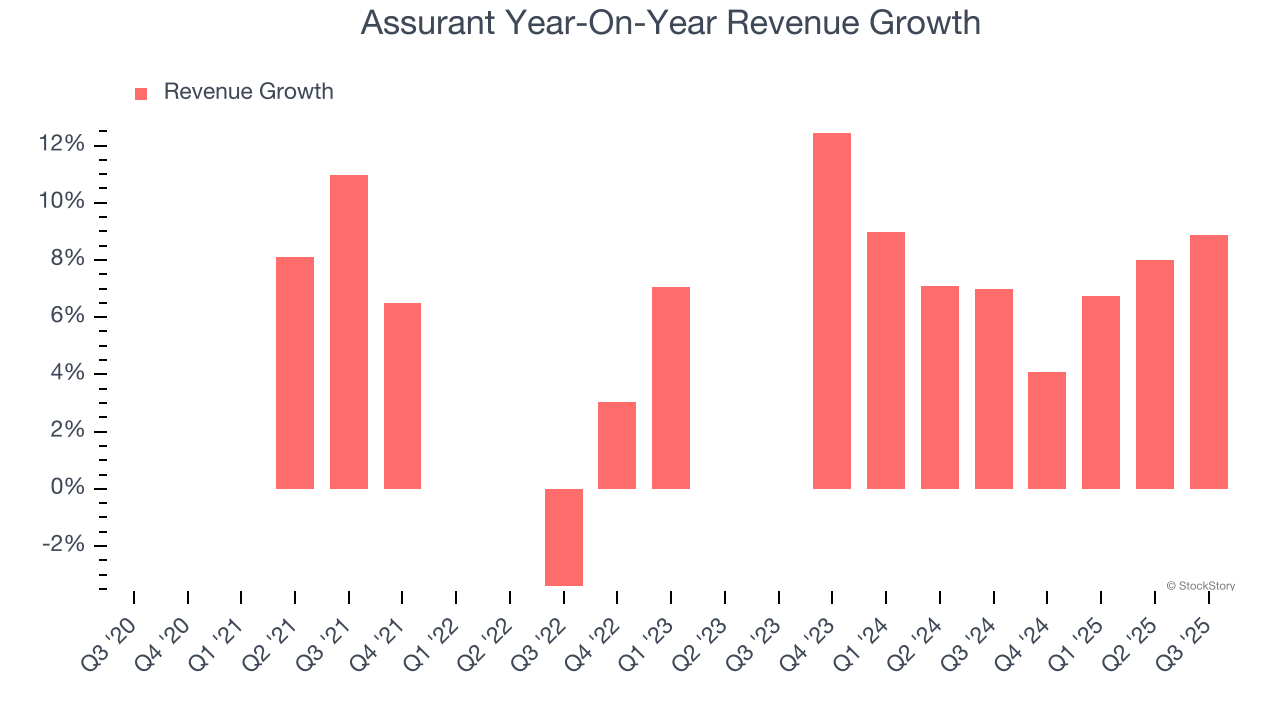

In general, insurance companies earn revenue from three primary sources. The first is the core insurance business itself, often called underwriting and represented in the income statement as premiums earned. The second source is investment income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from various sources such as policy administration, annuities, or other value-added services. Over the last five years, Assurant grew its revenue at a tepid 5.1% compounded annual growth rate. This fell short of our benchmark for the insurance sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Assurant’s annualized revenue growth of 7.9% over the last two years is above its five-year trend, suggesting some bright spots.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Assurant reported year-on-year revenue growth of 8.9%, and its $3.23 billion of revenue exceeded Wall Street’s estimates by 1.5%.

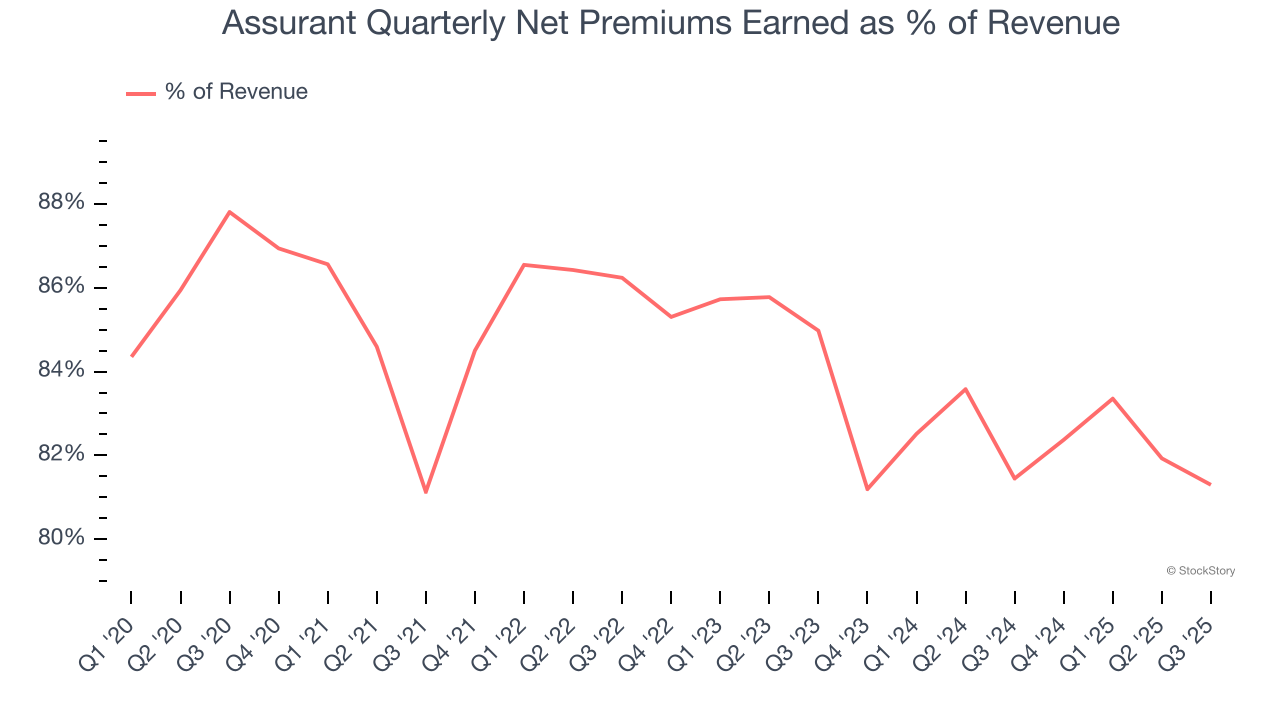

Net premiums earned made up 84% of the company’s total revenue during the last five years, meaning Assurant barely relies on non-insurance activities to drive its overall growth.

Our experience and research show the market cares primarily about an insurer’s net premiums earned growth as investment and fee income are considered more susceptible to market volatility and economic cycles.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Net Premiums Earned

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are therefore net of what’s ceded to reinsurers as a risk mitigation and transfer strategy.

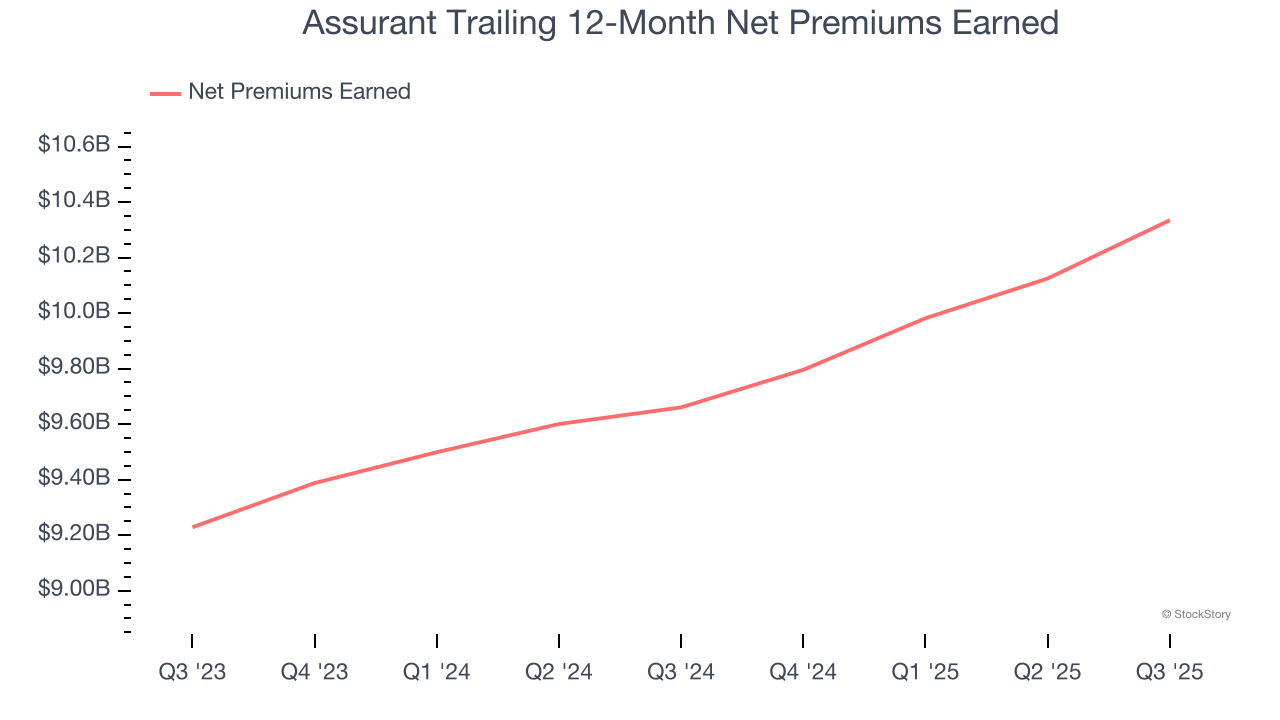

Assurant’s net premiums earned has grown at a 4.7% annualized rate over the last five years, worse than the broader insurance industry and in line with its total revenue.

When analyzing Assurant’s net premiums earned over the last two years, we can see that growth accelerated to 5.8% annually. Since two-year net premiums earned grew slower than total revenue over this period, it’s implied that other line items such as investment income grew at a faster rate. While these supplementary streams affect the bottom line, their contribution can fluctuate. Some firms have been more successful and consistent in investing their float over the long term, but sharp movements in the fixed income and equity markets can play a substantial role in short-term performance.

In Q3, Assurant produced $2.63 billion of net premiums earned, up 8.7% year on year and topping Wall Street Consensus estimates by 2.7%.

Key Takeaways from Assurant’s Q3 Results

It was good to see Assurant beat analysts’ EPS expectations this quarter. We were also excited its net premiums earned outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock traded up 1% to $216.79 immediately after reporting.

Sure, Assurant had a solid quarter, but if we look at the bigger picture, is this stock a buy? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.