Wrapping up Q3 earnings, we look at the numbers and key takeaways for the branded pharmaceuticals stocks, including Bristol-Myers Squibb (NYSE: BMY) and its peers.

Looking ahead, the branded pharmaceutical industry is positioned for tailwinds from advancements in precision medicine, increasing adoption of AI to enhance drug development efficiency, and growing global demand for treatments addressing chronic and rare diseases. However, headwinds include heightened regulatory scrutiny, pricing pressures from governments and insurers, and the looming patent cliffs for key blockbuster drugs. Patent cliffs bring about competition from generics, forcing branded pharmaceutical companies back to the drawing board to find the next big thing.

The 10 branded pharmaceuticals stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 2.3%.

Thankfully, share prices of the companies have been resilient as they are up 6.3% on average since the latest earnings results.

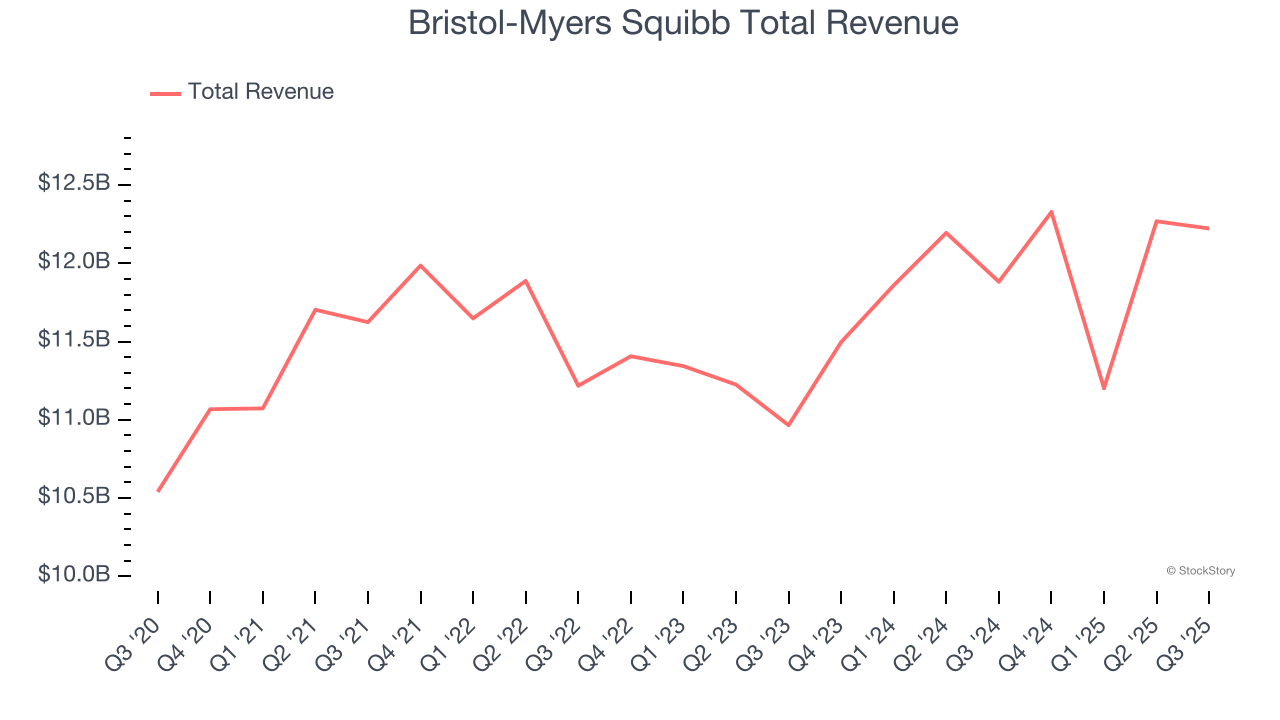

Bristol-Myers Squibb (NYSE: BMY)

With roots dating back to 1887 and a transformative merger in 1989 that gave the company its current name, Bristol-Myers Squibb (NYSE: BMY) discovers, develops, and markets prescription medications for serious diseases including cancer, blood disorders, immunological conditions, and cardiovascular diseases.

Bristol-Myers Squibb reported revenues of $12.22 billion, up 2.9% year on year. This print exceeded analysts’ expectations by 3.7%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ revenue estimates and a solid beat of analysts’ full-year EPS guidance estimates.

Interestingly, the stock is up 9.9% since reporting and currently trades at $46.84.

Is now the time to buy Bristol-Myers Squibb? Access our full analysis of the earnings results here, it’s free for active Edge members.

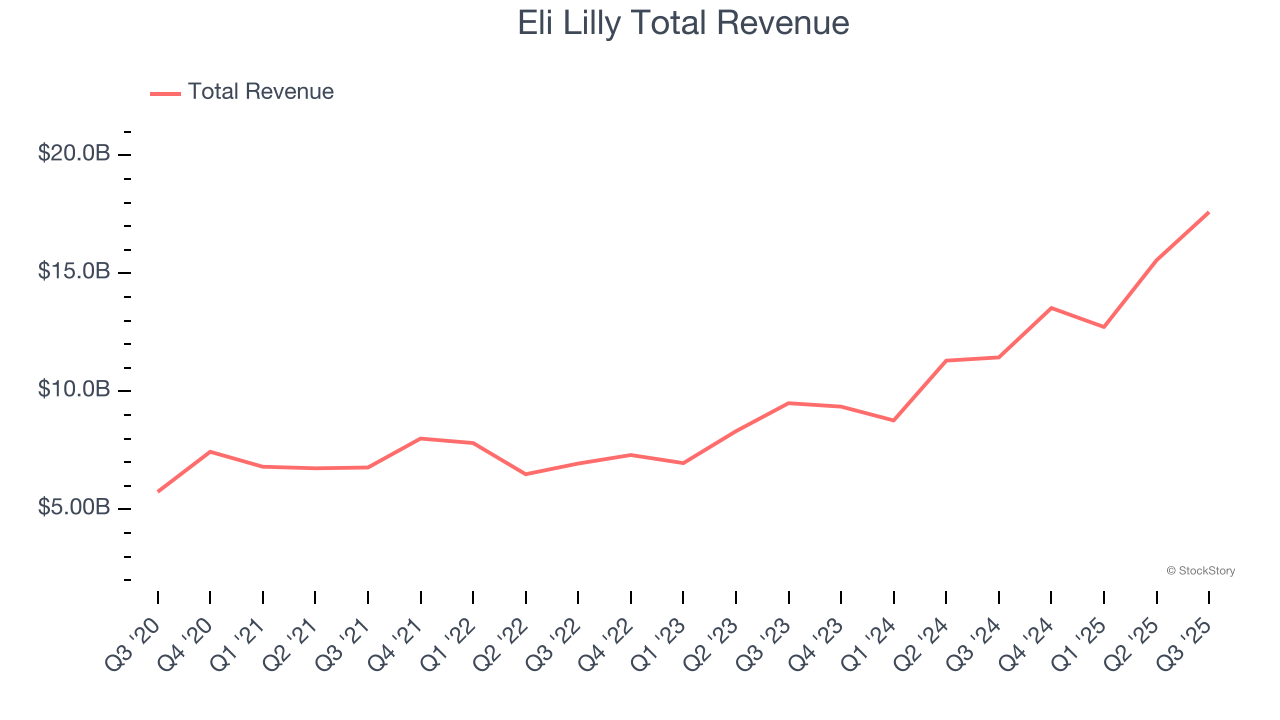

Best Q3: Eli Lilly (NYSE: LLY)

Founded in 1876 by a Civil War veteran and pharmacist frustrated with the poor quality of medicines, Eli Lilly (NYSE: LLY) discovers, develops, and manufactures pharmaceutical products for conditions including diabetes, obesity, cancer, immunological disorders, and neurological diseases.

Eli Lilly reported revenues of $17.6 billion, up 53.9% year on year, outperforming analysts’ expectations by 9.6%. The business had a stunning quarter with an impressive beat of analysts’ revenue estimates and full-year revenue guidance exceeding analysts’ expectations.

Eli Lilly pulled off the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 25.8% since reporting. It currently trades at $1,021.

Is now the time to buy Eli Lilly? Access our full analysis of the earnings results here, it’s free for active Edge members.

Corcept (NASDAQ: CORT)

Focusing on the powerful stress hormone that affects everything from metabolism to immune function, Corcept Therapeutics (NASDAQ: CORT) develops and markets medications that modulate cortisol to treat endocrine disorders, cancer, and neurological diseases.

Corcept reported revenues of $207.6 million, up 13.7% year on year, falling short of analysts’ expectations by 5%. It was a softer quarter as it posted full-year revenue guidance missing analysts’ expectations significantly and a significant miss of analysts’ revenue estimates.

Corcept delivered the highest full-year guidance raise but had the weakest performance against analyst estimates in the group. Interestingly, the stock is up 14% since the results and currently trades at $81.05.

Read our full analysis of Corcept’s results here.

Pfizer (NYSE: PFE)

With roots dating back to 1849 when two German immigrants opened a fine chemicals business in Brooklyn, Pfizer (NYSE: PFE) is a global biopharmaceutical company that discovers, develops, manufactures, and sells medicines and vaccines for a wide range of diseases and conditions.

Pfizer reported revenues of $16.65 billion, down 5.9% year on year. This print was in line with analysts’ expectations. Zooming out, it was a mixed quarter as it also produced a beat of analysts’ EPS estimates but a significant miss of analysts’ organic revenue estimates.

Pfizer had the slowest revenue growth among its peers. The stock is up 1.7% since reporting and currently trades at $25.08.

Read our full, actionable report on Pfizer here, it’s free for active Edge members.

Zoetis (NYSE: ZTS)

Originally spun off from Pfizer in 2013 as the world's largest pure-play animal health company, Zoetis (NYSE: ZTS) discovers, develops, and sells medicines, vaccines, diagnostic products, and services for pets and livestock animals worldwide.

Zoetis reported revenues of $2.4 billion, flat year on year. This number met analysts’ expectations. However, it was a slower quarter as it logged full-year revenue guidance slightly missing analysts’ expectations and revenue in line with analysts’ estimates.

The stock is down 16.7% since reporting and currently trades at $120.19.

Read our full, actionable report on Zoetis here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.