The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how energy products and services stocks fared in Q3, starting with MDU Resources (NYSE: MDU).

Areas like the energy transition and emission reduction are thematic and front of mind today. This can be a double-edged sword for the energy products and services industry. Those who innovate and build new expertise can jolt demand while those who cling to legacy technologies or fall behind in the trending areas could see their market shares diminish. Bigger picture, energy products and services companies are still at the whim of construction and infrastructure project volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

The 4 energy products and services stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 0.8%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 10.3% since the latest earnings results.

MDU Resources (NYSE: MDU)

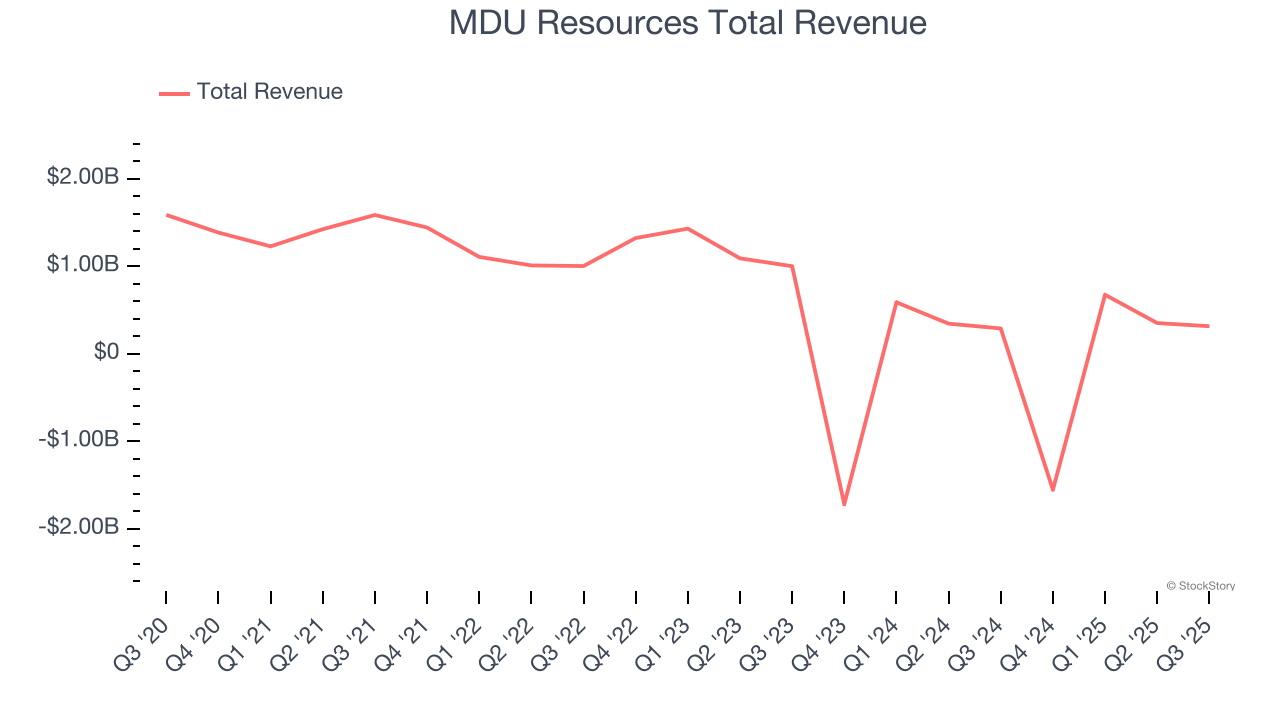

Founded to provide electricity to towns in Minnesota, MDU Resources (NYSE: MDU) provides products and services in the utilities and construction materials industries.

MDU Resources reported revenues of $315 million, up 8.7% year on year. This print exceeded analysts’ expectations by 3.3%. Despite the top-line beat, it was still a slower quarter for the company with a significant miss of analysts’ EBITDA estimates and full-year EPS guidance missing analysts’ expectations.

"We continue to execute on our long-term strategy as a regulated energy delivery company, with results that demonstrate the strength of our diversified utility and pipeline portfolio," said Nicole A. Kivisto, president and CEO of MDU Resources.

MDU Resources pulled off the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 3.8% since reporting and currently trades at $20.45.

Read our full report on MDU Resources here, it’s free for active Edge members.

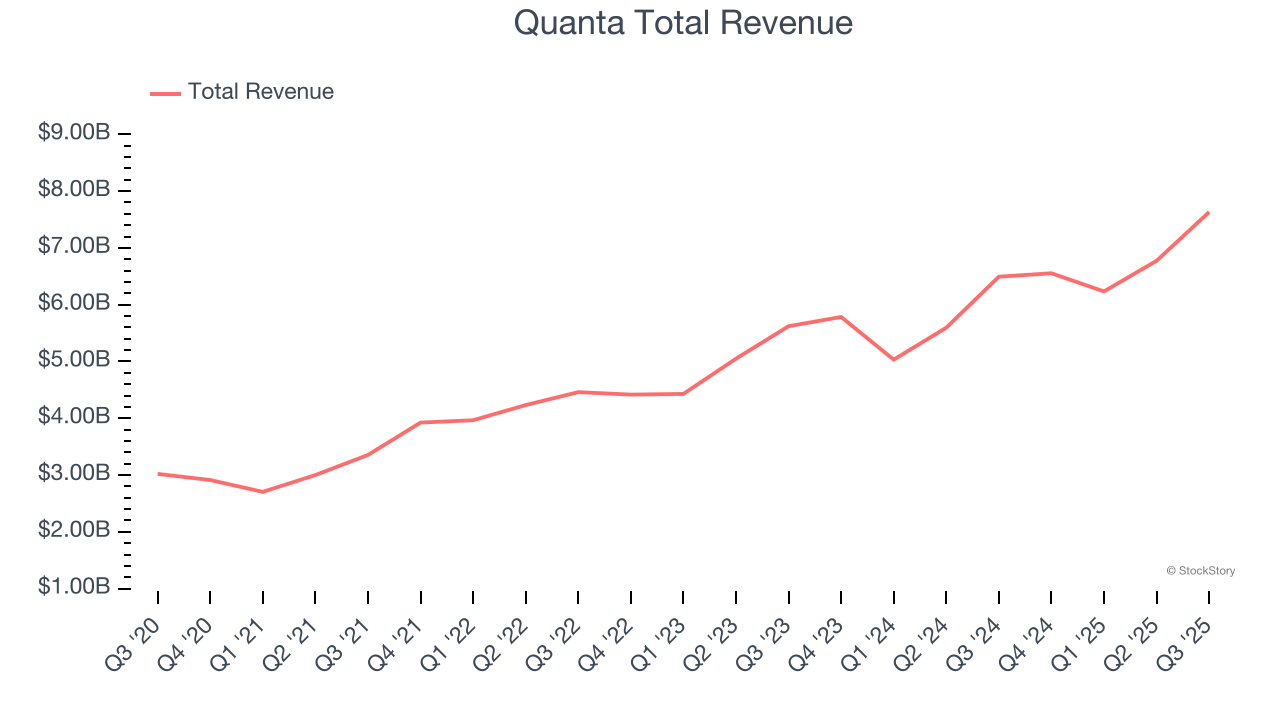

Best Q3: Quanta (NYSE: PWR)

A construction engineering services company, Quanta (NYSE: PWR) provides infrastructure solutions to a variety of sectors, including energy and communications.

Quanta reported revenues of $7.63 billion, up 17.5% year on year, outperforming analysts’ expectations by 2.8%. The business had a very strong quarter with an impressive beat of analysts’ backlog estimates and a solid beat of analysts’ adjusted operating income estimates.

Quanta scored the highest full-year guidance raise among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 5% since reporting. It currently trades at $426.29.

Is now the time to buy Quanta? Access our full analysis of the earnings results here, it’s free for active Edge members.

FTAI Infrastructure (NASDAQ: FIP)

Spun off from FTAI Aviation in 2021, FTAI Infrastructure (NASDAQ: FIP) invests in and operates infrastructure and related assets across the transportation and energy sectors.

FTAI Infrastructure reported revenues of $140.6 million, up 68.7% year on year, falling short of analysts’ expectations by 4%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue estimates and a significant miss of analysts’ EPS estimates.

FTAI Infrastructure delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. As expected, the stock is down 17.7% since the results and currently trades at $4.21.

Read our full analysis of FTAI Infrastructure’s results here.

Ameresco (NYSE: AMRC)

Having played a role in upgrading the energy solutions of Alcatraz Island, Ameresco (NYSE: AMRC) provides energy and renewable energy solutions for various sectors.

Ameresco reported revenues of $526 million, up 5% year on year. This number topped analysts’ expectations by 1%. It was a strong quarter as it also put up a solid beat of analysts’ adjusted operating income estimates and an impressive beat of analysts’ EBITDA estimates.

Ameresco had the slowest revenue growth and weakest full-year guidance update among its peers. The stock is down 22.3% since reporting and currently trades at $31.08.

Read our full, actionable report on Ameresco here, it’s free for active Edge members.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.