As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the online retail industry, including Revolve (NYSE: RVLV) and its peers.

Consumers ever rising demand for convenience, selection, and speed are secular engines underpinning ecommerce adoption. For years prior to Covid, ecommerce penetration as a percentage of overall retail would grow 1-2% annually, but in 2020 adoption accelerated by 5%, reaching 25%, as increased emphasis on convenience drove consumers to structurally buy more online. The surge in buying caused many online retailers to rapidly grow their logistics infrastructures, preparing them for further growth in the years ahead as consumer shopping habits continue to shift online.

The 5 online retail stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 3.5% while next quarter’s revenue guidance was 0.8% below.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Slowest Q3: Revolve (NYSE: RVLV)

Launched in 2003 by software engineers Michael Mente and Mike Karanikolas, Revolve (NASDAQ: RVLV) is a fashion retailer leveraging social media and a community of fashion influencers to drive its merchandising strategy.

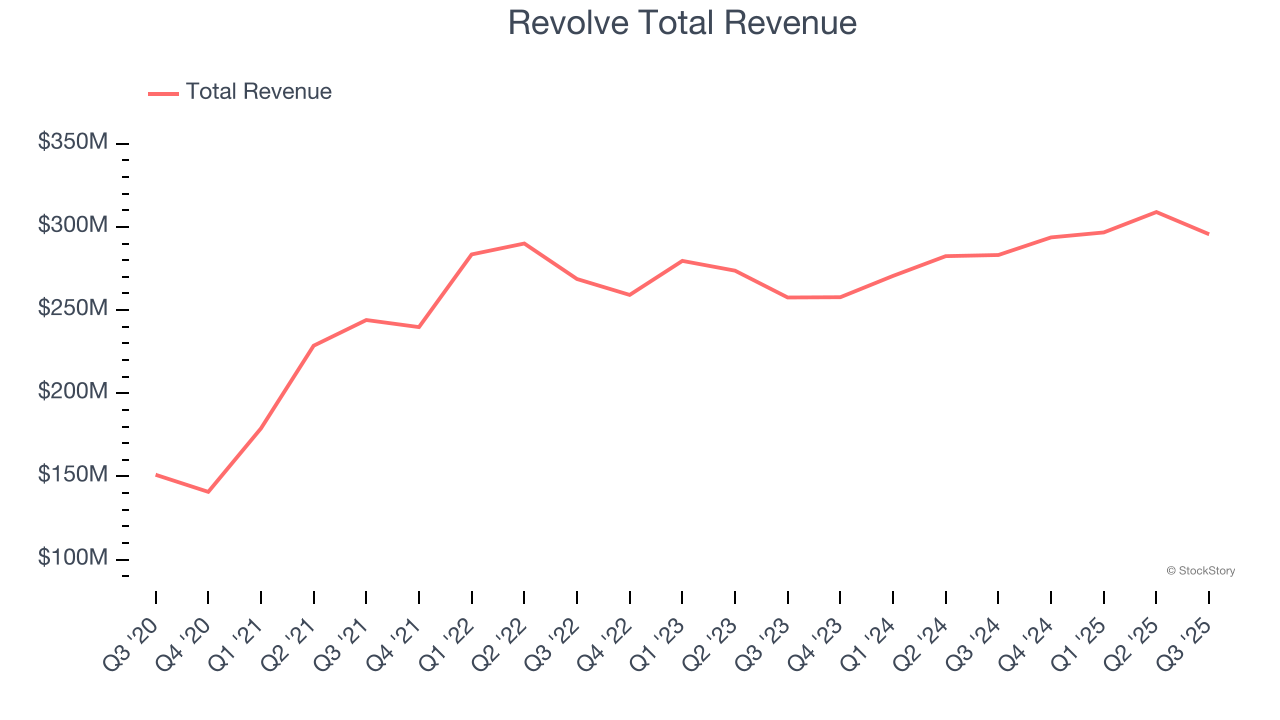

Revolve reported revenues of $295.6 million, up 4.4% year on year. This print fell short of analysts’ expectations by 0.8%. Overall, it was a slower quarter for the company with a slight miss of analysts’ revenue estimates and a slight miss of analysts’ number of active customers estimates.

"We had a very solid third quarter, highlighted by exceptional gross margin performance that drove an 11% increase in gross profit year-over-year and a 45% increase in Adjusted EBITDA to $25 million, our highest ever for a third quarter," said co-founder and co-CEO Mike Karanikolas.

Revolve delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. The company reported 2.75 million active buyers, up 4.5% year on year. Interestingly, the stock is up 2.8% since reporting and currently trades at $20.53.

Read our full report on Revolve here, it’s free for active Edge members.

Best Q3: Carvana (NYSE: CVNA)

Known for its glass tower car vending machines, Carvana (NYSE: CVNA) provides a convenient automotive shopping experience by offering an online platform for buying and selling used cars.

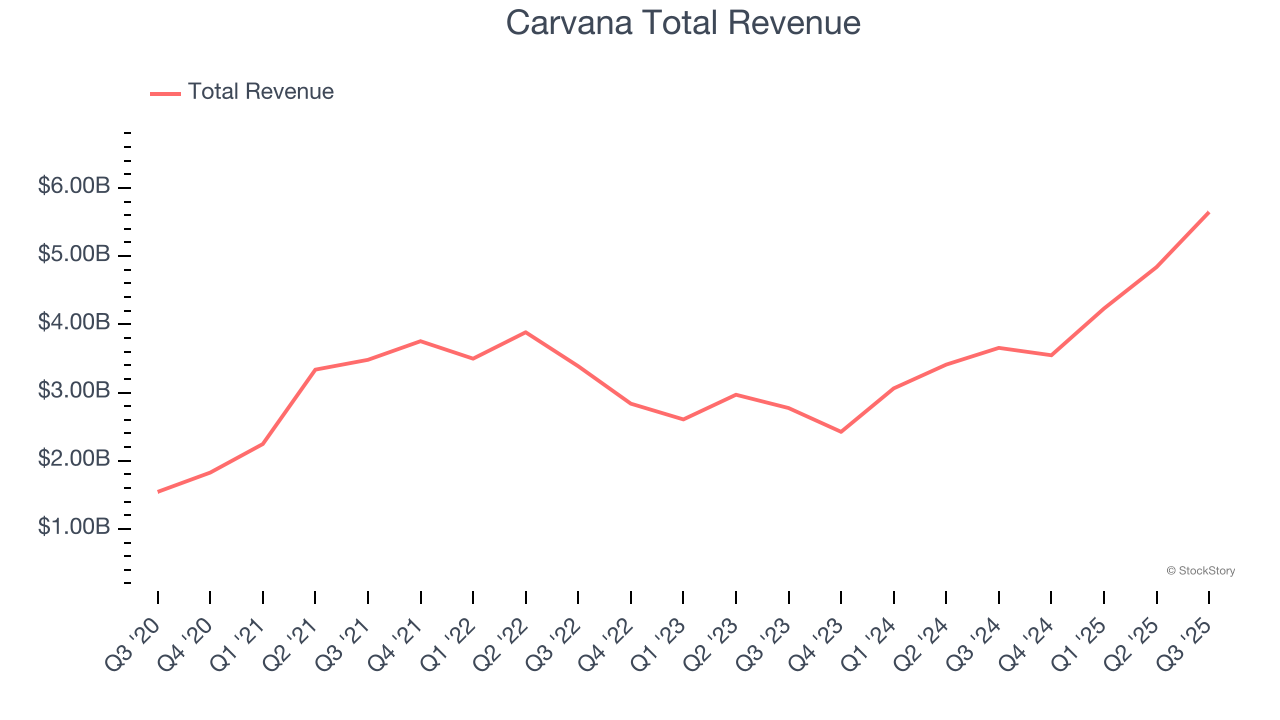

Carvana reported revenues of $5.65 billion, up 54.5% year on year, outperforming analysts’ expectations by 11.1%. The business had an exceptional quarter with a solid beat of analysts’ revenue estimates and impressive growth in its units.

Carvana pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. The company reported 155,941 units sold, up 43.5% year on year. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 8.9% since reporting. It currently trades at $322.50.

Is now the time to buy Carvana? Access our full analysis of the earnings results here, it’s free for active Edge members.

Amazon (NASDAQ: AMZN)

Founded by Jeff Bezos after quitting his stock-picking job at D.E. Shaw, Amazon (NASDAQ: AMZN) is the world’s largest online retailer and provider of cloud computing services.

Amazon reported revenues of $180.2 billion, up 13.4% year on year, exceeding analysts’ expectations by 1.2%. It may have had the worst quarter among its peers, but its results were still good as it also locked in a solid beat of analysts’ EPS estimates and a narrow beat of analysts’ revenue estimates, as Amazon Web Services and North America all beat.

Interestingly, the stock is up 3.9% since the results and currently trades at $231.99.

Read our full analysis of Amazon’s results here.

Coupang (NYSE: CPNG)

Founded in 2010 by Harvard Business School student Bom Kim, Coupang (NYSE: CPNG) is an e-commerce giant often referred to as the "Amazon of South Korea".

Coupang reported revenues of $9.27 billion, up 17.8% year on year. This number beat analysts’ expectations by 2.7%. It was a very strong quarter as it also put up a solid beat of analysts’ EBITDA estimates and a decent beat of analysts’ revenue estimates.

The company reported 24.9 million active buyers, up 9.8% year on year. The stock is down 12.7% since reporting and currently trades at $28.05.

Read our full, actionable report on Coupang here, it’s free for active Edge members.

Wayfair (NYSE: W)

Founded in 2002 by Niraj Shah, Wayfair (NYSE: W) is a leading online retailer of mass-market home goods in the US, UK, Canada, and Germany.

Wayfair reported revenues of $3.12 billion, up 8.1% year on year. This print topped analysts’ expectations by 3.4%. Overall, it was a strong quarter as it also produced an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ revenue estimates.

The company reported 21.2 million active buyers, down 2.3% year on year. The stock is up 15.8% since reporting and currently trades at $100.17.

Read our full, actionable report on Wayfair here, it’s free for active Edge members.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.