Business development company Oaktree Specialty Lending (NASDAQ: OCSL) reported Q3 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 18.3% year on year to $77.32 million. Its GAAP profit of $0.28 per share decreased from $0.45 in the same quarter last year.

Is now the time to buy Oaktree Specialty Lending? Find out by accessing our full research report, it’s free for active Edge members.

Oaktree Specialty Lending (OCSL) Q3 CY2025 Highlights:

“Our fourth quarter results demonstrate progress in stabilizing the investment portfolio despite an uneven market environment, and we fully covered our quarterly dividend with net investment income,” said Armen Panossian, Chief Executive Officer and Chief Investment Officer of Oaktree Specialty Lending.

Company Overview

Managed by Oaktree Capital Management, one of the world's premier alternative investment firms, Oaktree Specialty Lending (NASDAQ: OCSL) is a business development company that provides customized financing solutions to mid-market companies across various industries.

Revenue Growth

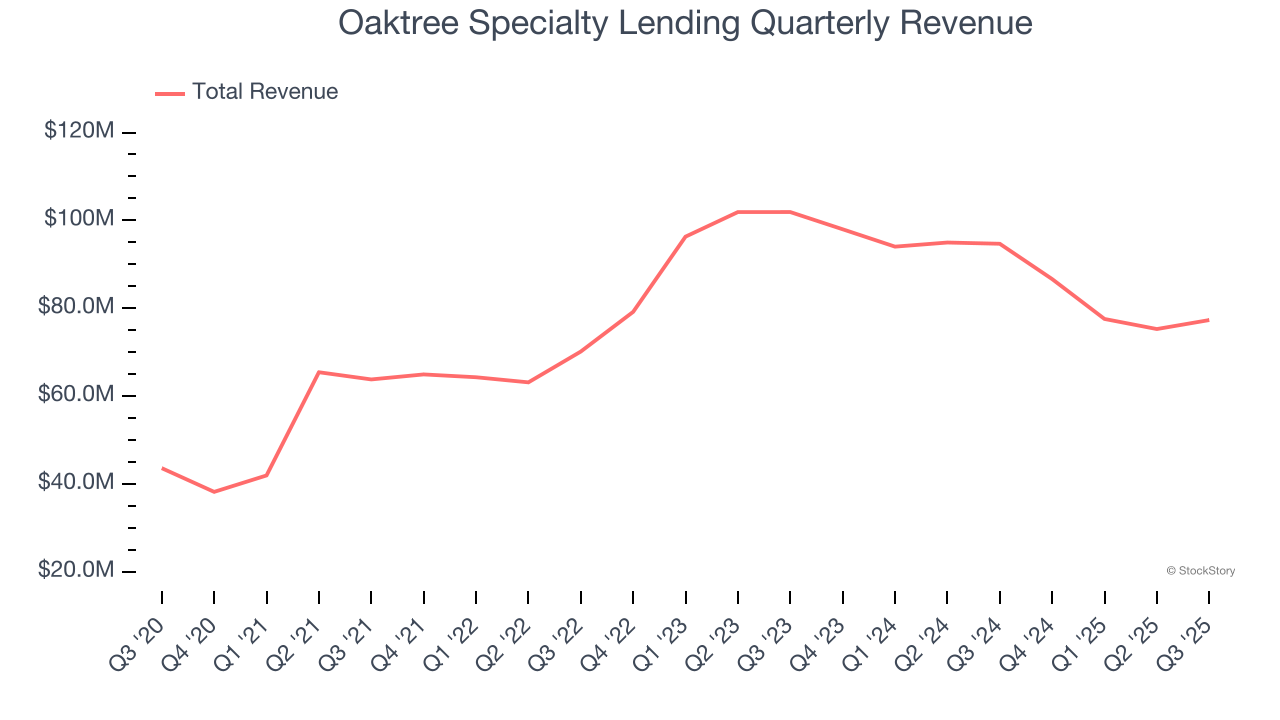

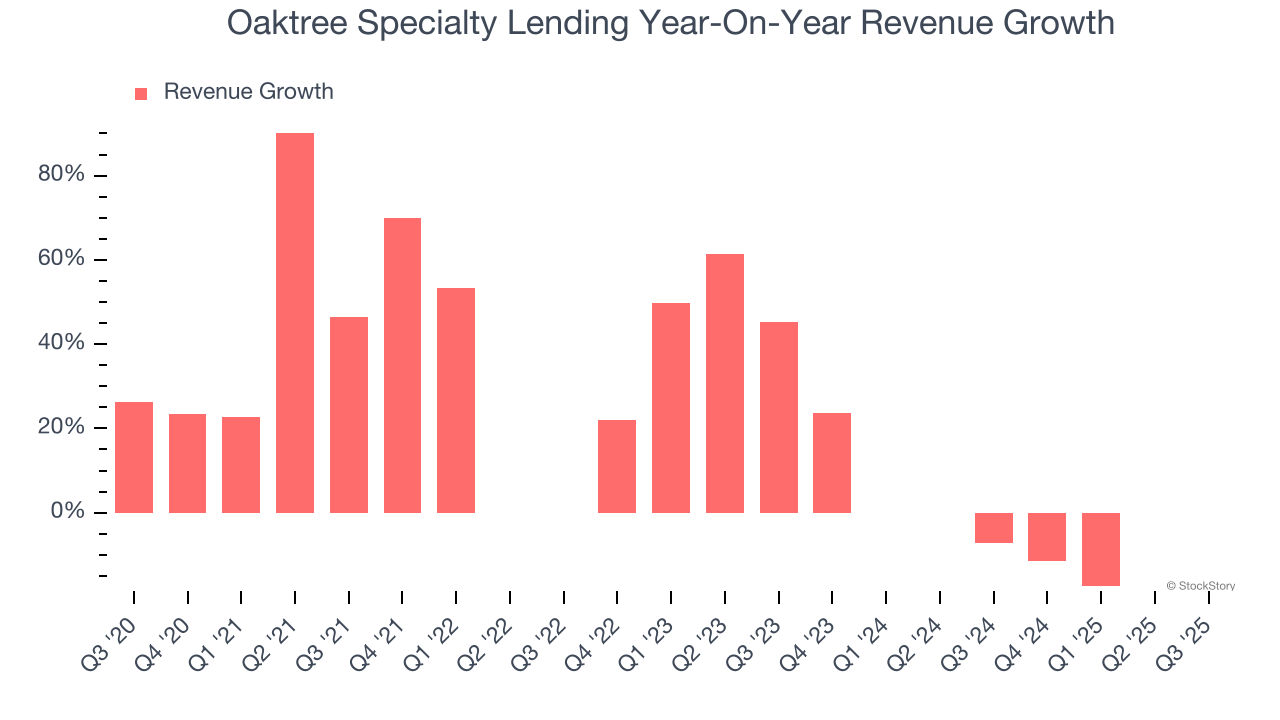

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Oaktree Specialty Lending’s revenue grew at an impressive 17.2% compounded annual growth rate over the last five years. Its growth beat the average financials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Oaktree Specialty Lending’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 8.6% over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Oaktree Specialty Lending’s revenue fell by 18.3% year on year to $77.32 million but beat Wall Street’s estimates by 1.1%.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

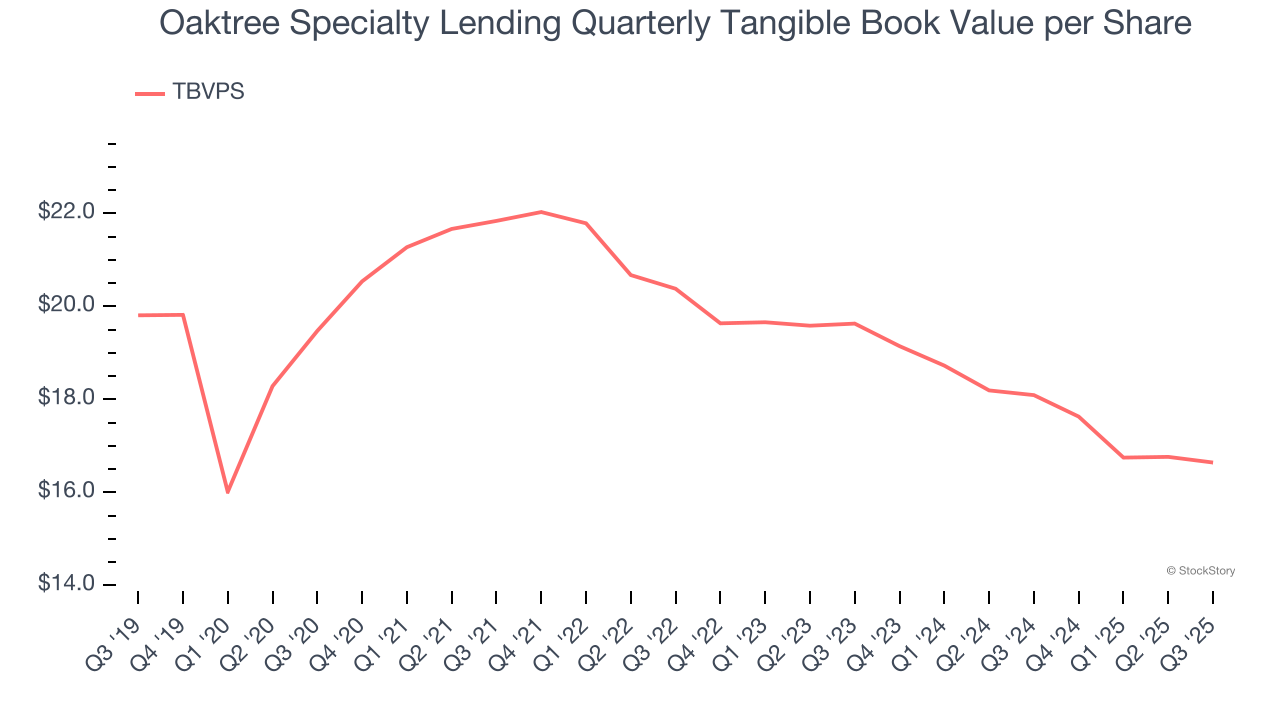

Tangible Book Value Per Share (TBVPS)

The balance sheet drives profitability for financial firms since earnings flow from managing diverse assets and liabilities across multiple business lines. As such, valuations for these companies concentrate on capital strength and sustainable equity accumulation potential across their varied operations.

This is why we consider tangible book value per share (TBVPS) an important metric for the sector. TBVPS represents the real net worth per share across all business segments, providing a clear measure of shareholder equity regardless of the complexity of operations. Other (and more commonly known) per-share metrics like EPS can sometimes be murky due to the complexity of multiple business lines, M&A activity, or accounting rules that vary across different financial services segments.

Oaktree Specialty Lending’s TBVPS declined at a 3.1% annual clip over the last five years. A turnaround doesn’t seem to be in sight as its TBVPS also dropped by 7.9% annually over the last two years ($19.63 to $16.64 per share).

Tangible Book Value Per Share (TBVPS)

Financial institutions manage complex balance sheets spanning various financial activities. Valuations reflect this complexity, emphasizing balance sheet quality and long-term book value compounding across multiple revenue streams.

When analyzing this sector, tangible book value per share (TBVPS) takes precedence over many other metrics. This measure isolates genuine per-share value and provides insight into the institution’s capital position across diverse operations. On the other hand, EPS is often distorted by the diverse nature of operations, mergers, and various accounting treatments across different business units. Book value provides clearer performance insights.

Oaktree Specialty Lending’s TBVPS declined at a 3.1% annual clip over the last five years. A turnaround doesn’t seem to be in sight as its TBVPS also dropped by 7.9% annually over the last two years ($19.63 to $16.64 per share).

Key Takeaways from Oaktree Specialty Lending’s Q3 Results

It was good to see Oaktree Specialty Lending narrowly top analysts’ revenue expectations this quarter. On the other hand, its AUM slightly missed. Overall, this print was mixed. The stock remained flat at $13.33 immediately after reporting.

So should you invest in Oaktree Specialty Lending right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.