Five9 has gotten torched over the last six months - since May 2025, its stock price has dropped 31.2% to $18.75 per share. This may have investors wondering how to approach the situation.

Is now the time to buy Five9, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Is Five9 Not Exciting?

Even though the stock has become cheaper, we're swiping left on Five9 for now. Here are three reasons there are better opportunities than FIVN and a stock we'd rather own.

1. Weak Billings Point to Soft Demand

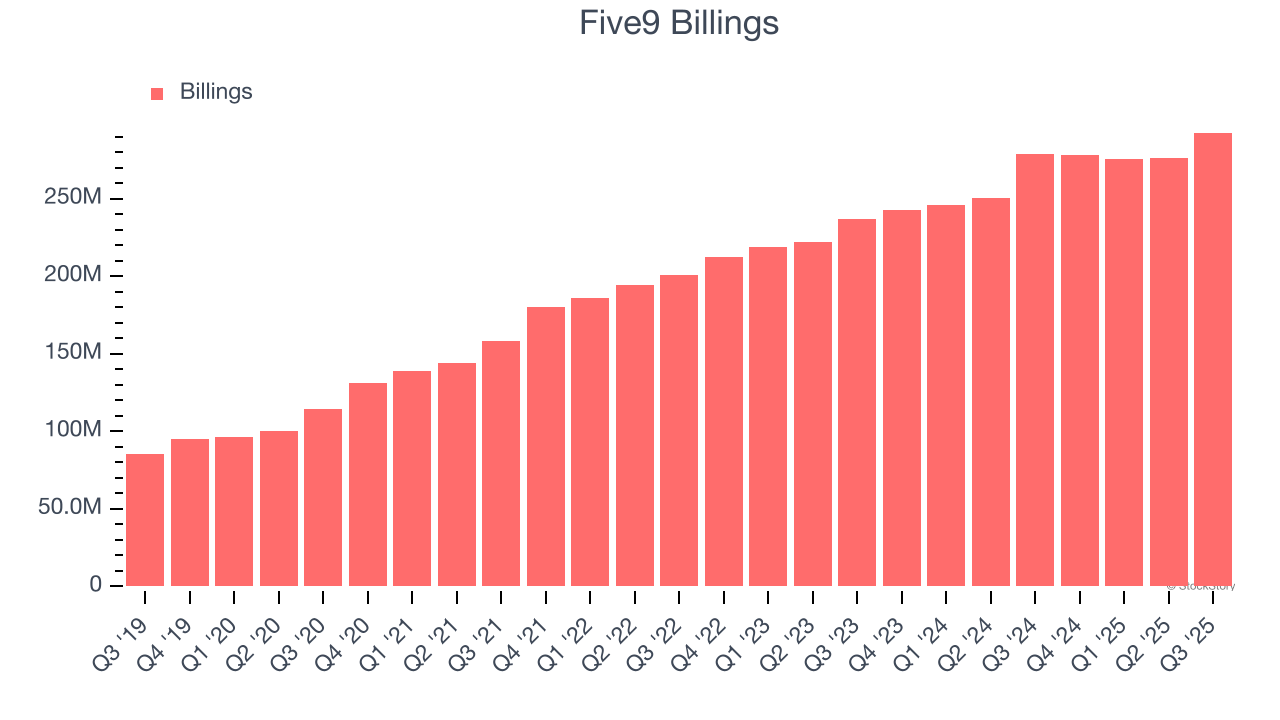

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Five9’s billings came in at $292.6 million in Q3, and over the last four quarters, its year-on-year growth averaged 10.5%. This performance was underwhelming and suggests that increasing competition is causing challenges in acquiring/retaining customers.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Five9’s revenue to rise by 8.2%, a deceleration versus its 23.1% annualized growth for the past five years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

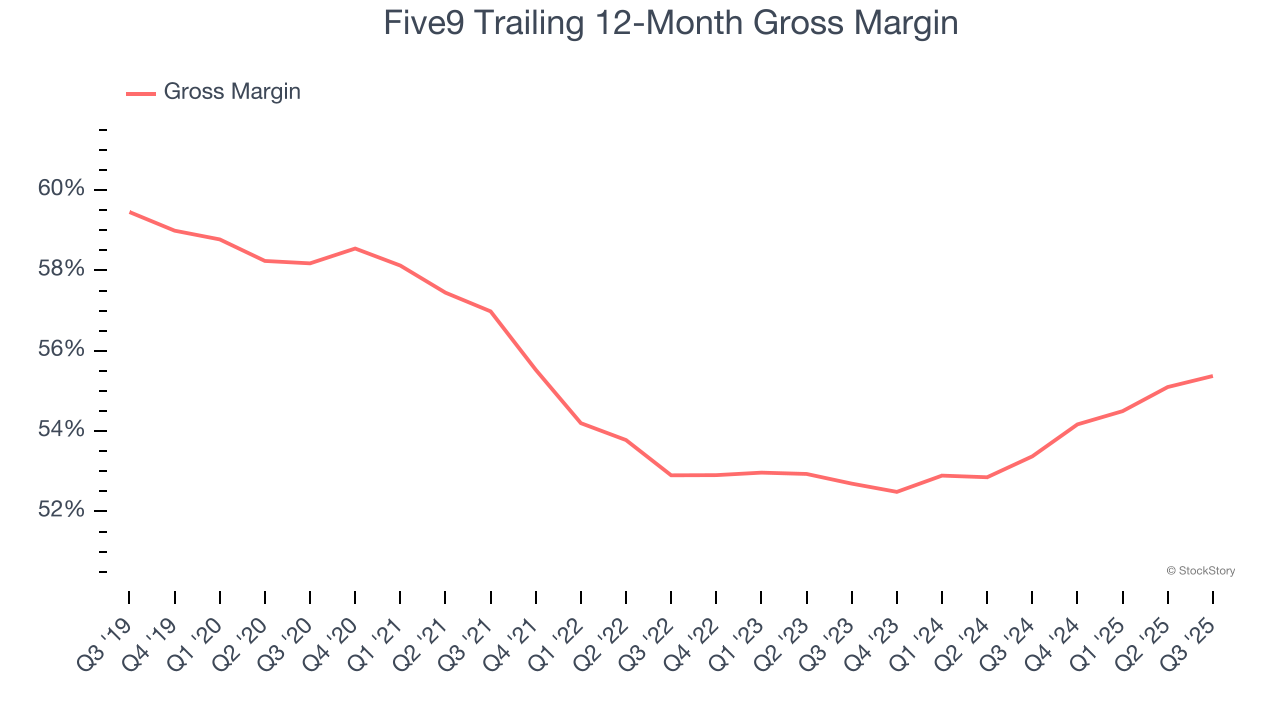

3. Low Gross Margin Reveals Weak Structural Profitability

For software companies like Five9, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Five9’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 55.4% gross margin over the last year. That means Five9 paid its providers a lot of money ($44.63 for every $100 in revenue) to run its business.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Five9 has seen gross margins improve by 2.7 percentage points over the last 2 year, which is very good in the software space.

Final Judgment

Five9’s business quality ultimately falls short of our standards. Following the recent decline, the stock trades at 1.5× forward price-to-sales (or $18.75 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at our favorite semiconductor picks and shovels play.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.