D.R. Horton has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 10% to $137.41 per share while the index has gained 13%.

Is there a buying opportunity in D.R. Horton, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Is D.R. Horton Not Exciting?

We're cautious about D.R. Horton. Here are three reasons why DHI doesn't excite us and a stock we'd rather own.

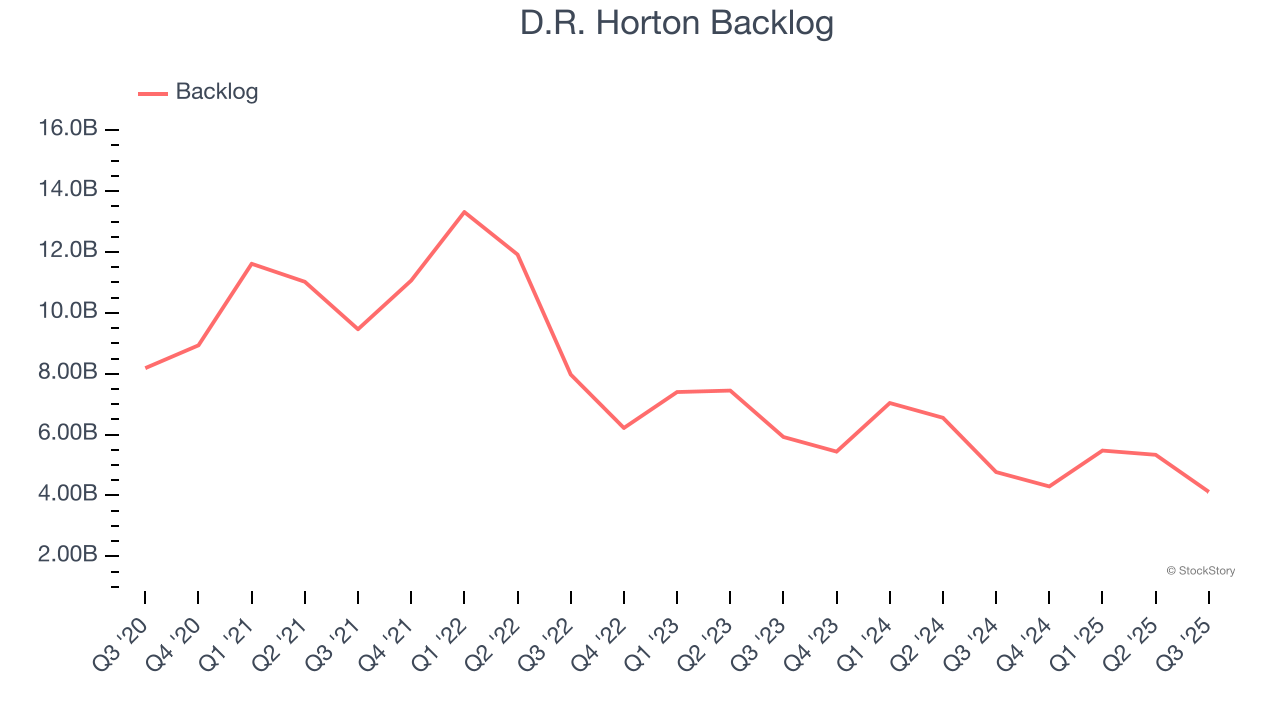

1. Backlog Declines as Orders Drop

In addition to reported revenue, backlog is a useful data point for analyzing Home Builders companies. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into D.R. Horton’s future revenue streams.

D.R. Horton’s backlog came in at $4.12 billion in the latest quarter, and it averaged 15.5% year-on-year declines over the last two years. This performance was underwhelming and shows the company is not winning new orders. It also suggests there may be increasing competition or market saturation.

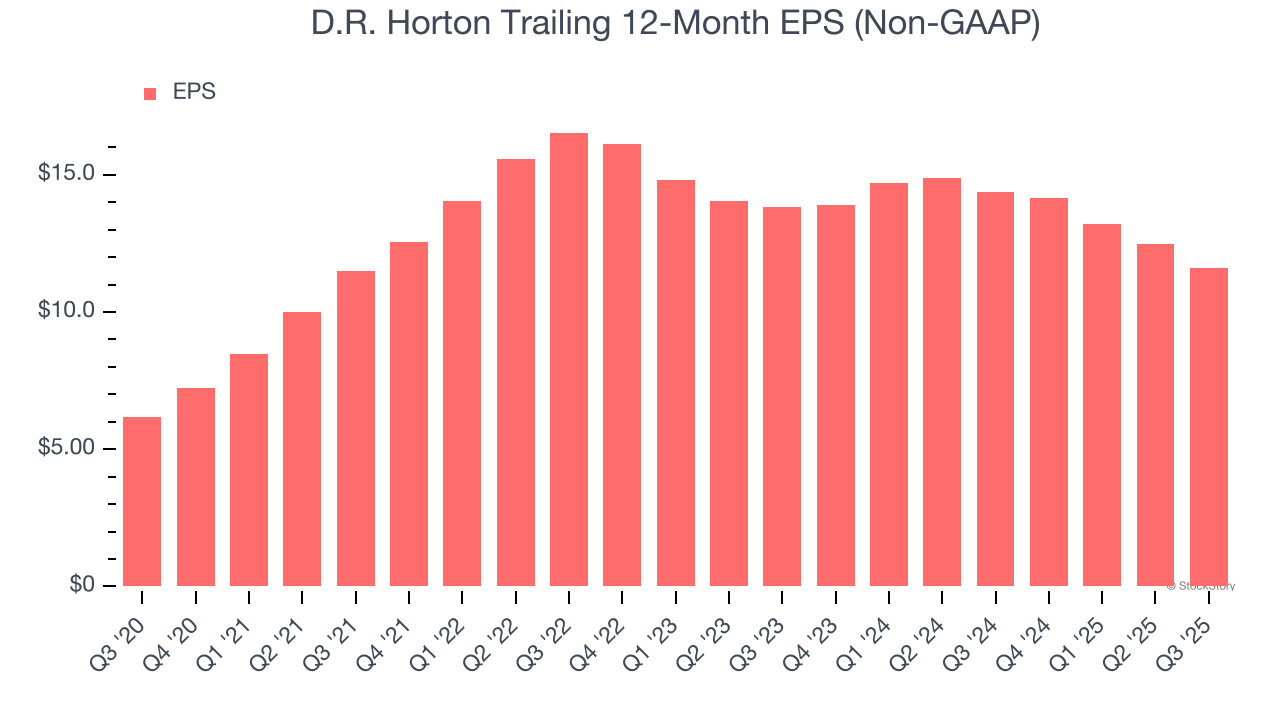

2. EPS Took a Dip Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for D.R. Horton, its EPS declined by more than its revenue over the last two years, dropping 8.5%. This tells us the company struggled to adjust to shrinking demand.

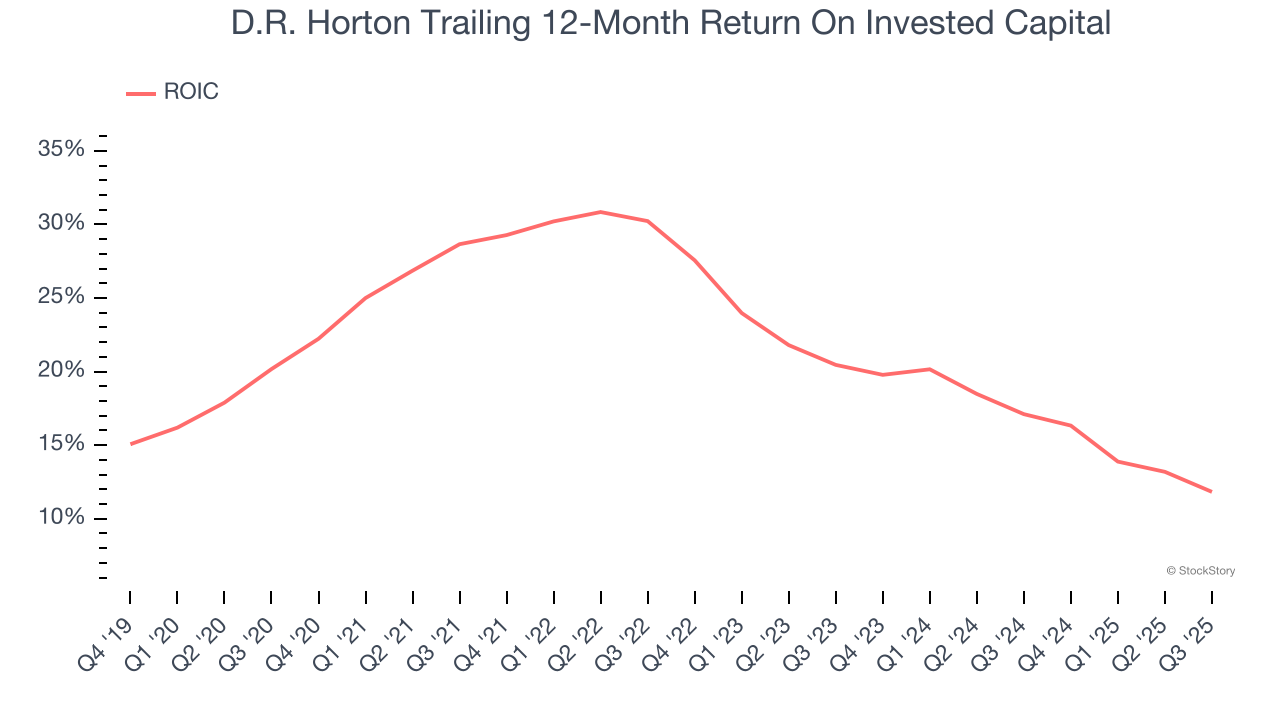

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, D.R. Horton’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

D.R. Horton isn’t a terrible business, but it doesn’t pass our quality test. That said, the stock currently trades at 12.5× forward P/E (or $137.41 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. We’d recommend looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Would Buy Instead of D.R. Horton

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.