Telecom software provider Amdocs (NASDAQ: DOX) reported Q3 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 9% year on year to $1.15 billion. Guidance for next quarter’s revenue was better than expected at $1.16 billion at the midpoint, 0.6% above analysts’ estimates. Its non-GAAP profit of $1.83 per share was in line with analysts’ consensus estimates.

Is now the time to buy Amdocs? Find out by accessing our full research report, it’s free for active Edge members.

Amdocs (DOX) Q3 CY2025 Highlights:

- Revenue: $1.15 billion vs analyst estimates of $1.14 billion (9% year-on-year decline, 0.6% beat)

- Adjusted EPS: $1.83 vs analyst estimates of $1.82 (in line)

- Adjusted EBITDA: $290.5 million vs analyst estimates of $290.7 million (25.3% margin, in line)

- Revenue Guidance for Q4 CY2025 is $1.16 billion at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for Q4 CY2025 is $1.76 at the midpoint, below analyst estimates of $1.87

- Operating Margin: 11.5%, up from 8.9% in the same quarter last year

- Free Cash Flow Margin: 17.3%, up from 15.2% in the same quarter last year

- Backlog: $4.19 billion at quarter end, up 3.2% year on year

- Market Capitalization: $9.40 billion

"Fiscal 2025 was another important year as we delivered financial results consistent with our expectations while serving our global telecommunications customers with cutting-edge cloud, digital and AI-driven solutions designed to meet their strategic imperatives. Cloud-related activities delivered double-digit growth, reaching over 30% of total revenue, and we achieved significantly better profitability while maintaining our commitment to R&D. The year finished with very strong sales momentum. We secured Google Cloud migration awards at TELUS in Canada and Lumen Technologies in US and signed a digital transformation and IT operations agreement with Fidium, a new fiber customer in the US. Our international footprint expanded with modernization awards at British Telecom, or BT-EE in the UK, Altice SFR in France, Telia in Finland, PLDT in Philippines and Claro Brazil. Additionally, Telefónica Germany chose Amdocs to implement new GenAI use cases using the amAIz Sales Agent. This latest win extends our momentum following recent GenAI-related deals with Altice Optimum, e& UAE, and Consumer Cellular, and further demonstrates Amdocs' pivotal role in accelerating generative AI adoption in the telecom industry," said Shuky Sheffer, president and chief executive officer of Amdocs Management Limited.

Company Overview

Powering the digital experiences of approximately 400 communications companies worldwide, Amdocs (NASDAQ: DOX) provides software and services that help telecommunications and media companies manage customer relationships, monetize services, and automate network operations.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $4.53 billion in revenue over the past 12 months, Amdocs is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

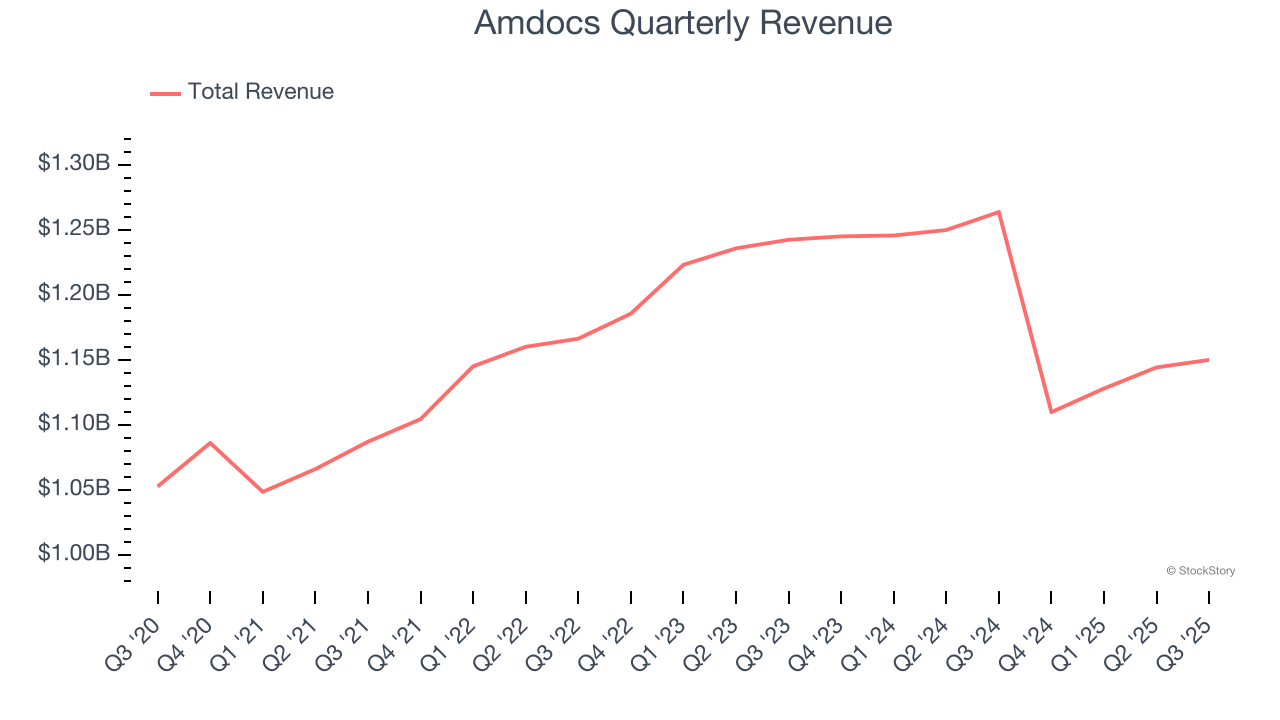

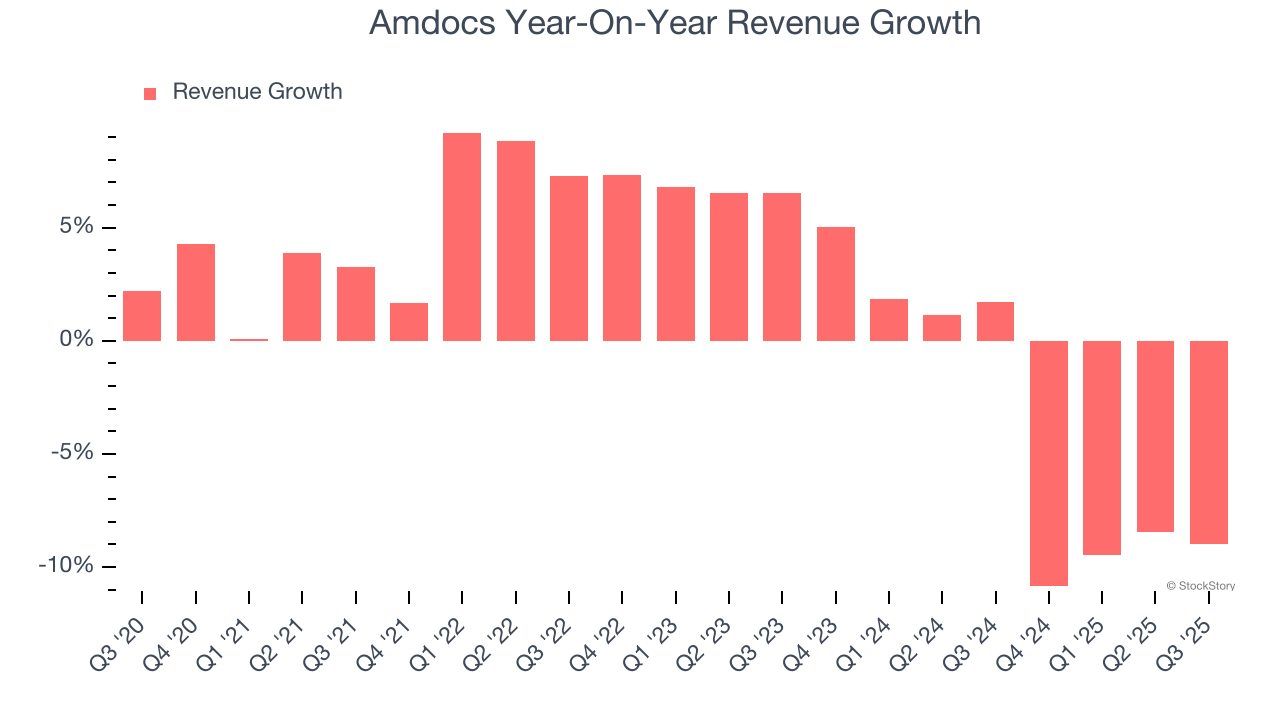

As you can see below, Amdocs’s 1.7% annualized revenue growth over the last five years was sluggish. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Amdocs’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 3.7% annually.

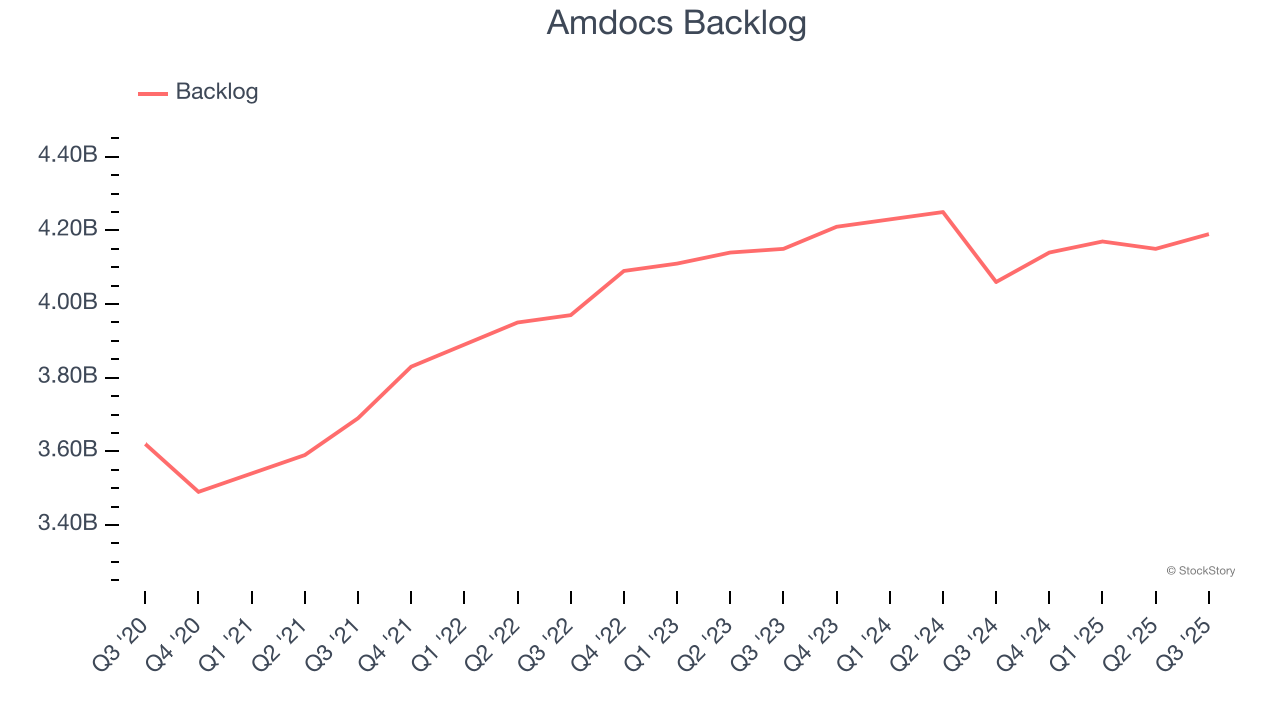

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Amdocs’s backlog reached $4.19 billion in the latest quarter and was flat over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for Amdocs’s products and services but raises concerns about capacity constraints.

This quarter, Amdocs’s revenue fell by 9% year on year to $1.15 billion but beat Wall Street’s estimates by 0.6%. Company management is currently guiding for a 4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.8% over the next 12 months. Although this projection implies its newer products and services will spur better top-line performance, it is still below average for the sector.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

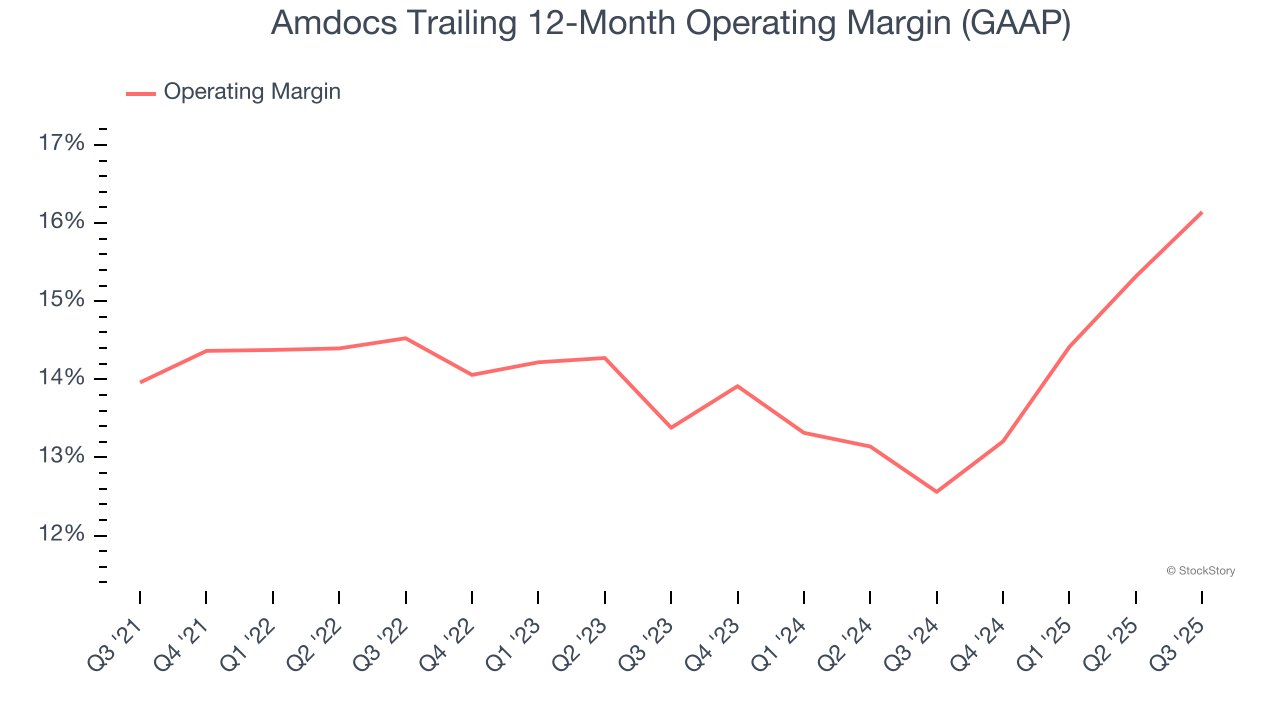

Amdocs has been an efficient company over the last five years. It was one of the more profitable businesses in the business services sector, boasting an average operating margin of 14.1%.

Looking at the trend in its profitability, Amdocs’s operating margin rose by 2.2 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q3, Amdocs generated an operating margin profit margin of 11.5%, up 2.6 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

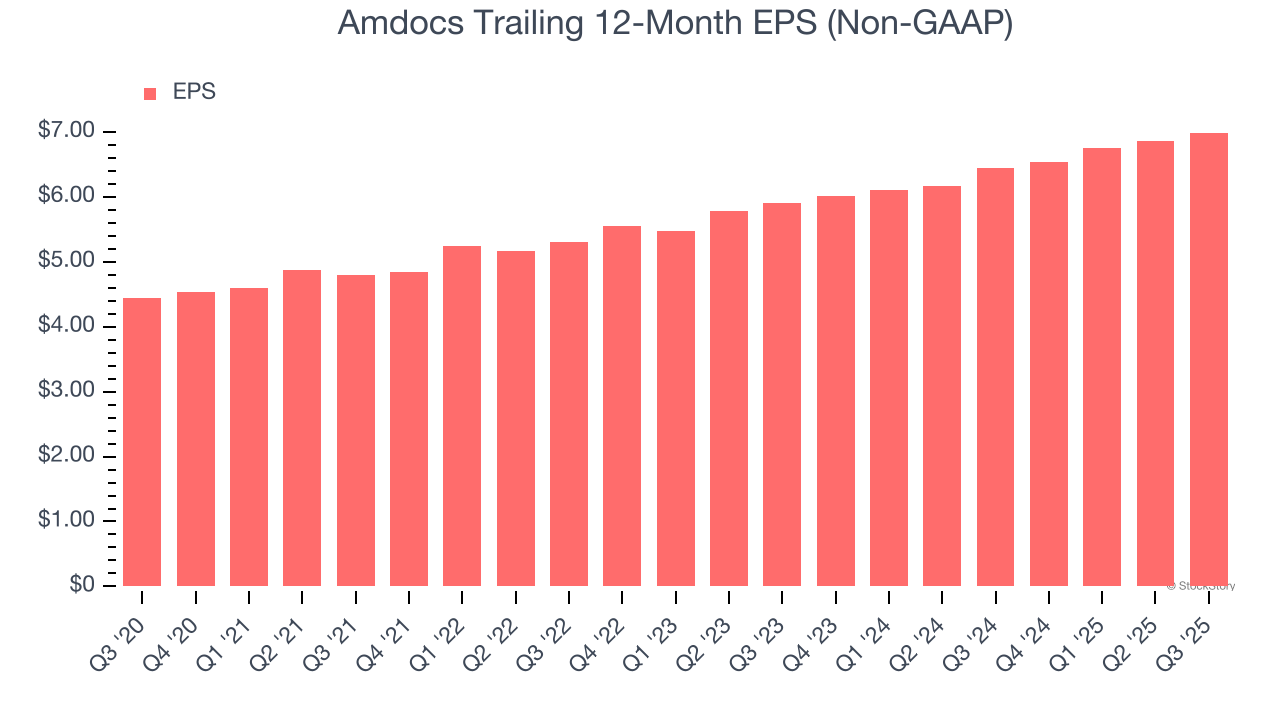

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

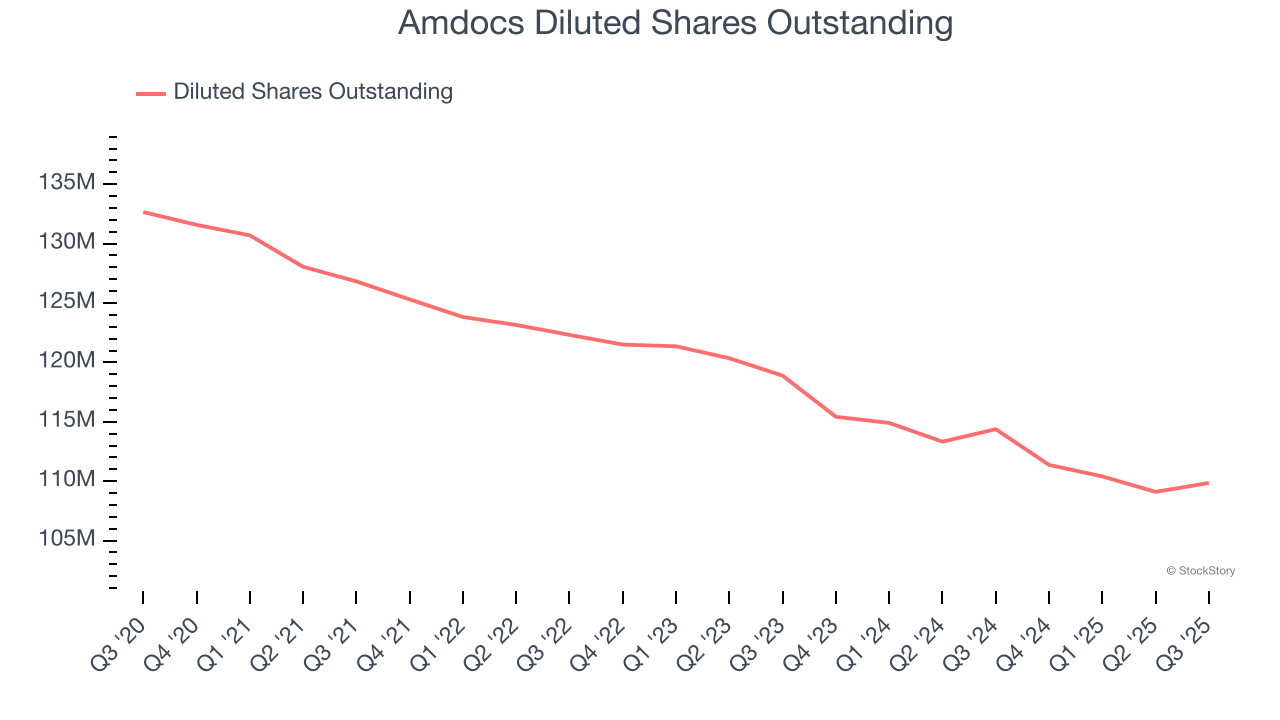

Amdocs’s EPS grew at a solid 9.5% compounded annual growth rate over the last five years, higher than its 1.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Amdocs’s earnings can give us a better understanding of its performance. As we mentioned earlier, Amdocs’s operating margin expanded by 2.2 percentage points over the last five years. On top of that, its share count shrank by 17.2%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Amdocs, its two-year annual EPS growth of 8.8% is similar to its five-year trend, implying stable earnings.

In Q3, Amdocs reported adjusted EPS of $1.83, up from $1.70 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Amdocs’s full-year EPS of $6.99 to grow 9.6%.

Key Takeaways from Amdocs’s Q3 Results

It was good to see Amdocs narrowly top analysts’ backlog expectations this quarter. We were also glad its revenue guidance for next quarter slightly exceeded Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed. Overall, this was a weaker quarter. The stock remained flat at $83.99 immediately after reporting.

Should you buy the stock or not? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.