The past six months have been a windfall for Tecnoglass’s shareholders. The company’s stock price has jumped 55.8%, hitting $78.89 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Following the strength, is TGLS a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Is Tecnoglass a Good Business?

The first-ever Colombian company to trade on the NASDAQ, Tecnoglass (NYSE: TGLS) is a manufacturer of architectural glass, windows, and aluminum products.

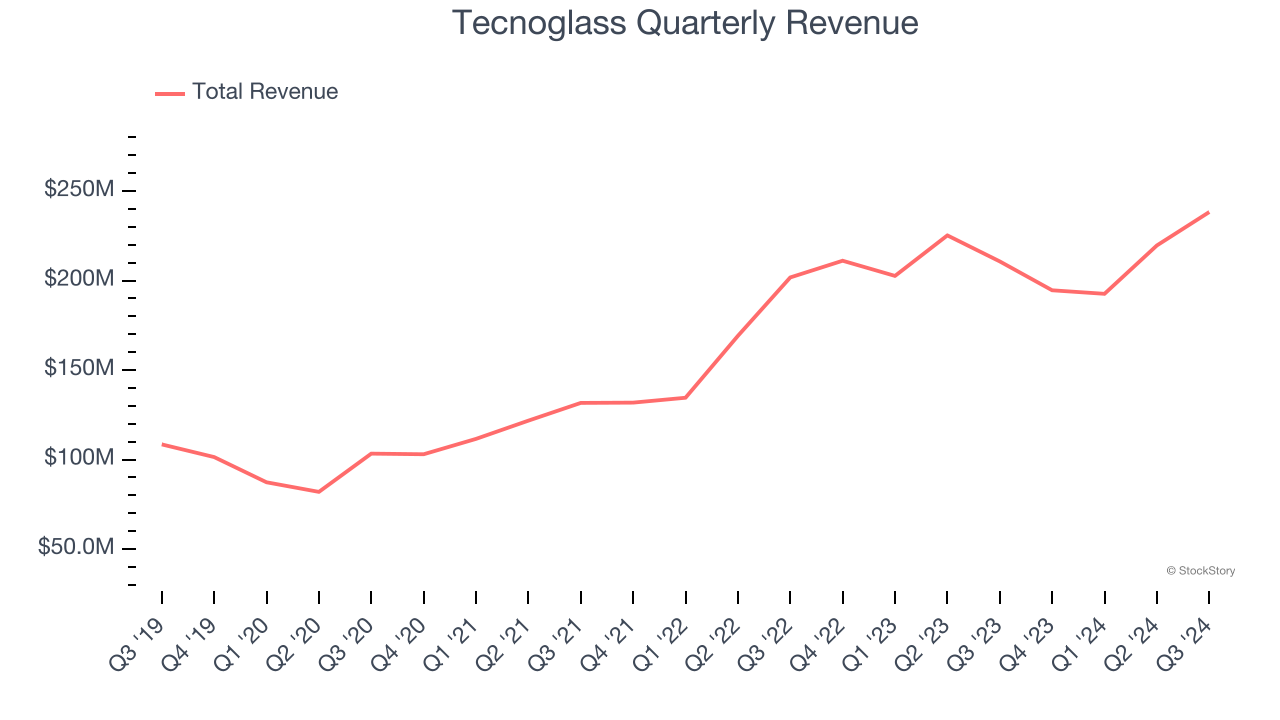

1. Skyrocketing Revenue Shows Strong Momentum

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Tecnoglass’s sales grew at an exceptional 14.6% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

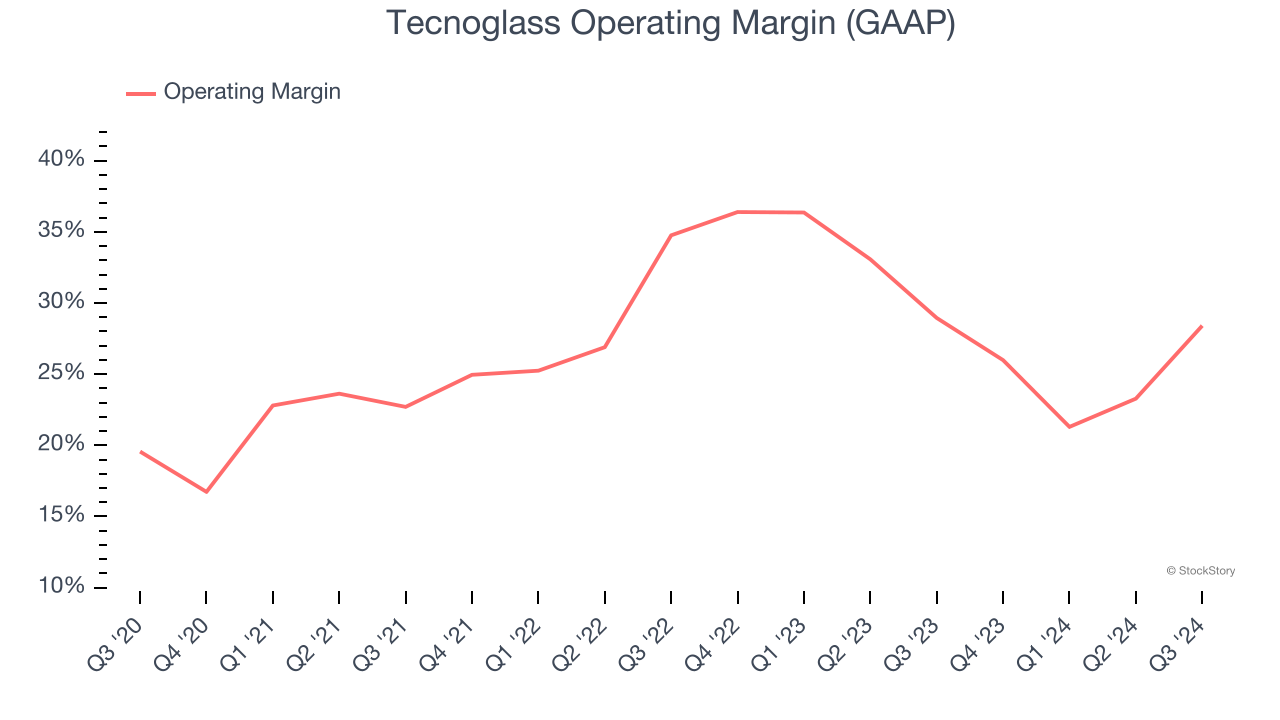

2. Operating Margin Reveals a Well-Run Organization

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Tecnoglass has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 26.5%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

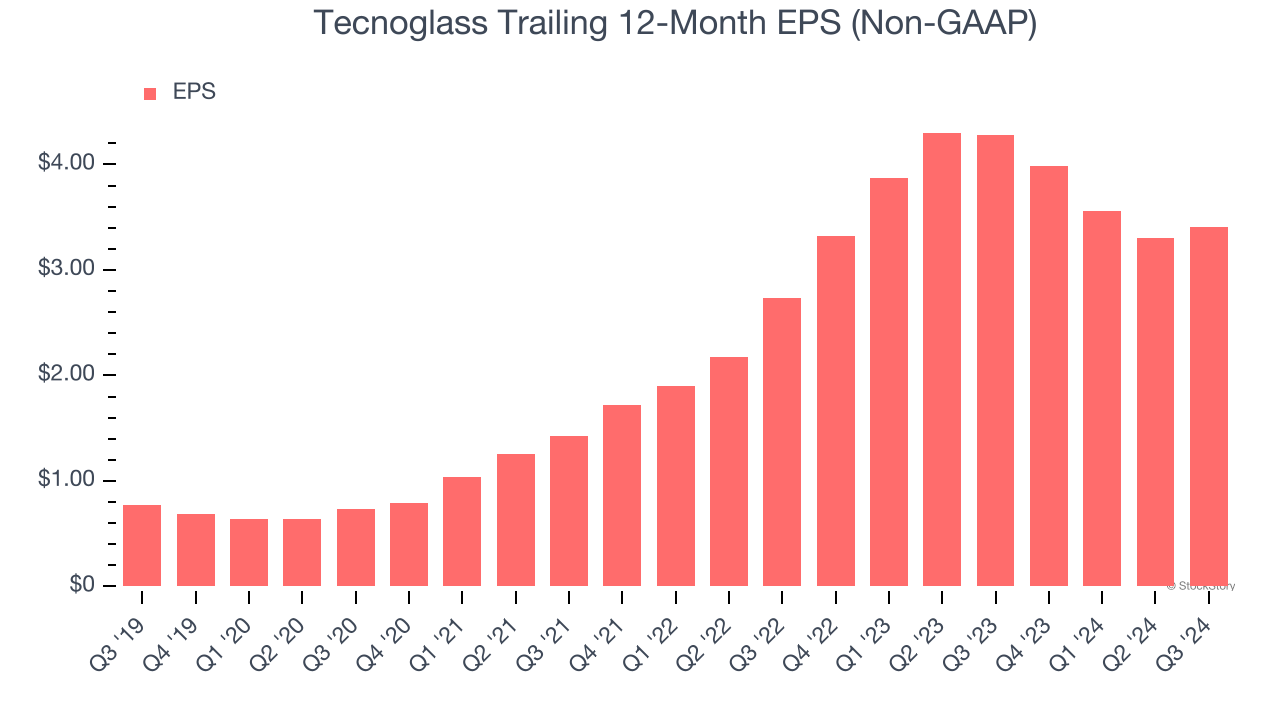

3. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Tecnoglass’s EPS grew at an astounding 34.4% compounded annual growth rate over the last five years, higher than its 14.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

These are just a few reasons why we're bullish on Tecnoglass, and after the recent surge, the stock trades at 19.2× forward price-to-earnings (or $78.89 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Tecnoglass

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.