John Wiley & Sons trades at $44.34 per share and has stayed right on track with the overall market, gaining 9.1% over the last six months. At the same time, the S&P 500 has returned 9.3%.

Is now the time to buy John Wiley & Sons, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.We're swiping left on John Wiley & Sons for now. Here are three reasons why there are better opportunities than WLY and a stock we'd rather own.

Why Do We Think John Wiley & Sons Will Underperform?

Established in 1807, John Wiley & Sons (NYSE: WLY) is a global leader in academic publishing, providing educational materials, scholarly research, and professional development resources.

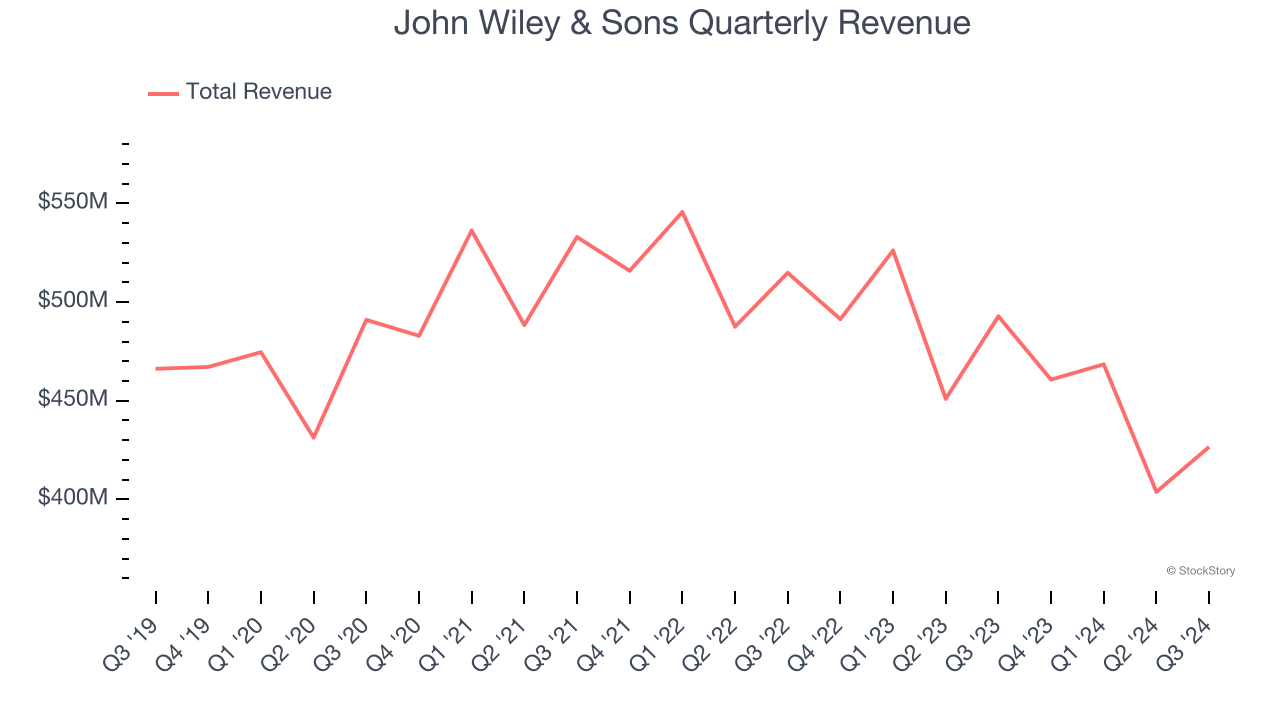

1. Long-Term Revenue Growth Flatter Than a Pancake

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Unfortunately, John Wiley & Sons struggled to consistently increase demand as its $1.76 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a sign of poor business quality.

2. EPS Barely Growing

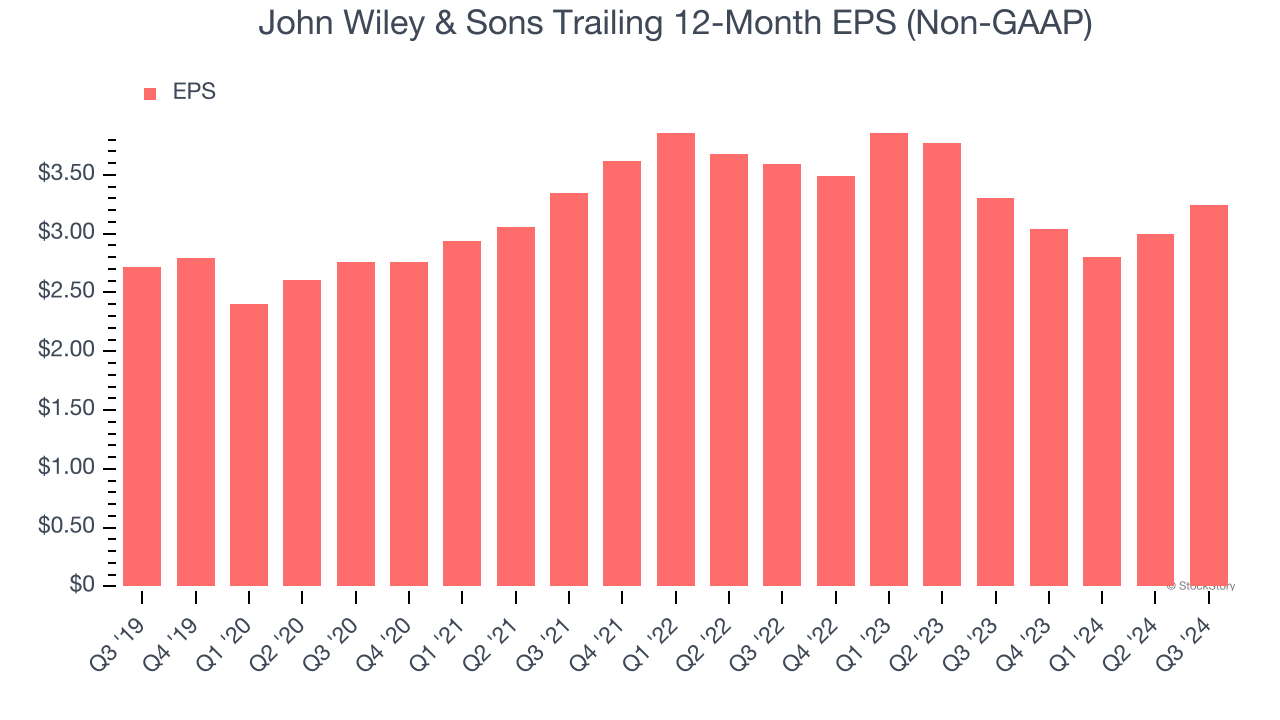

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

John Wiley & Sons’s EPS grew at an unimpressive 3.6% compounded annual growth rate over the last five years. On the bright side, this performance was better than its flat revenue and tells us management responded to softer demand by adapting its cost structure.

3. Previous Growth Initiatives Haven’t Paid Off Yet

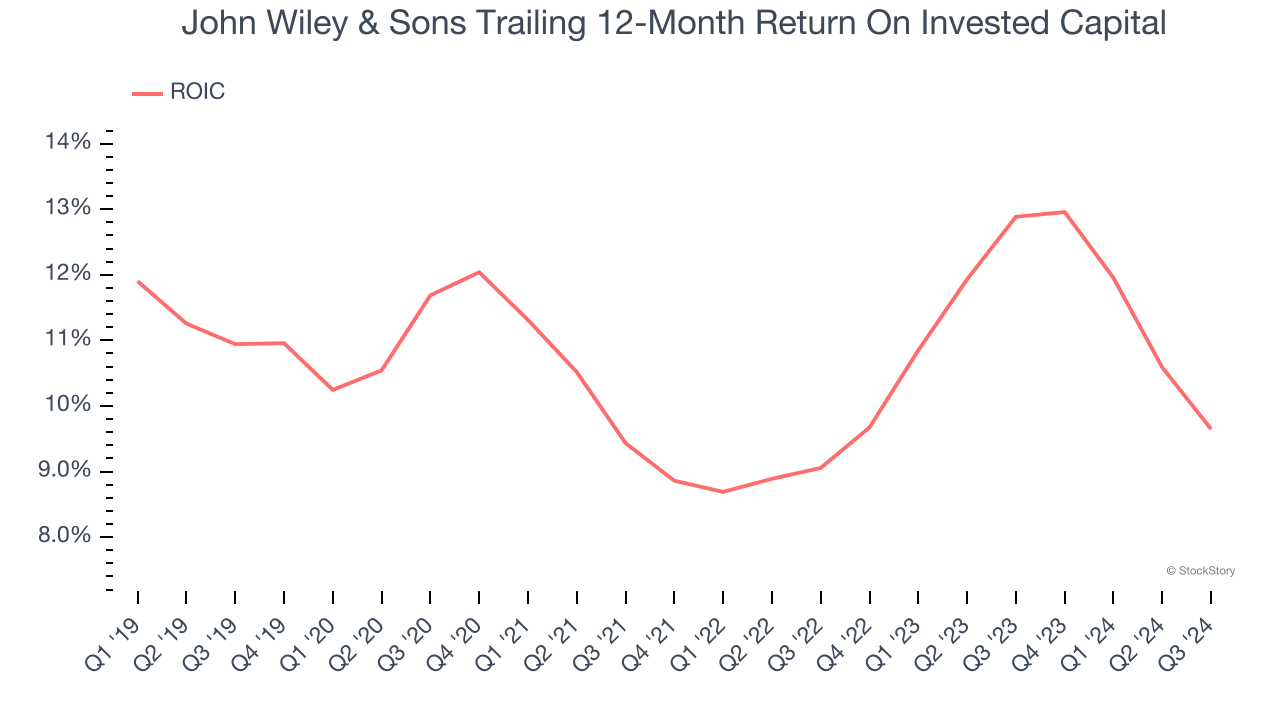

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

John Wiley & Sons historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 10.5%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

Final Judgment

John Wiley & Sons doesn’t pass our quality test. That said, the stock currently trades at 11× forward EV-to-EBITDA (or $44.34 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find better investment opportunities elsewhere. We’d recommend looking at KLA Corporation, a picks and shovels play for semiconductor manufacturing.

Stocks We Like More Than John Wiley & Sons

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.