Shareholders of Snap would probably like to forget the past six months even happened. The stock dropped 26.5% and now trades at $11.51. This might have investors contemplating their next move.

Is there a buying opportunity in Snap, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why you should be careful with SNAP and a stock we'd rather own.

Why Is Snap Not Exciting?

Founded by Stanford University students Evan Spiegel, Reggie Brown, and Bobby Murphy, and originally called Picaboo, Snapchat (NYSE: SNAP) is an image centric social media network.

1. Customer Spending Decreases, Engagement Falling?

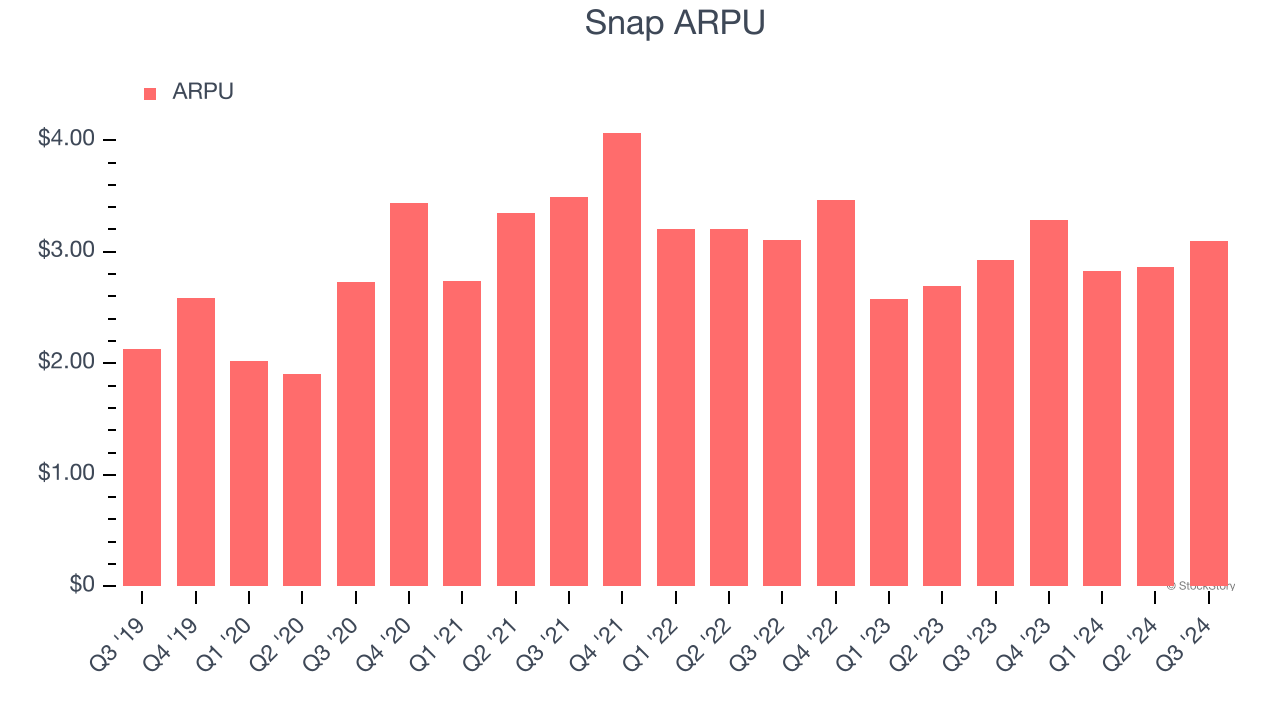

Average revenue per user (ARPU) is a critical metric to track for social networking businesses like Snap because it measures how much the company earns from the ads shown to its users. ARPU can also be a proxy for how valuable advertisers find Snap’s audience and its ad-targeting capabilities.

Snap’s ARPU fell over the last two years, averaging 4.9% annual declines. This isn’t great, but the increase in daily active users is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Snap tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

2. EBITDA Margin Falling

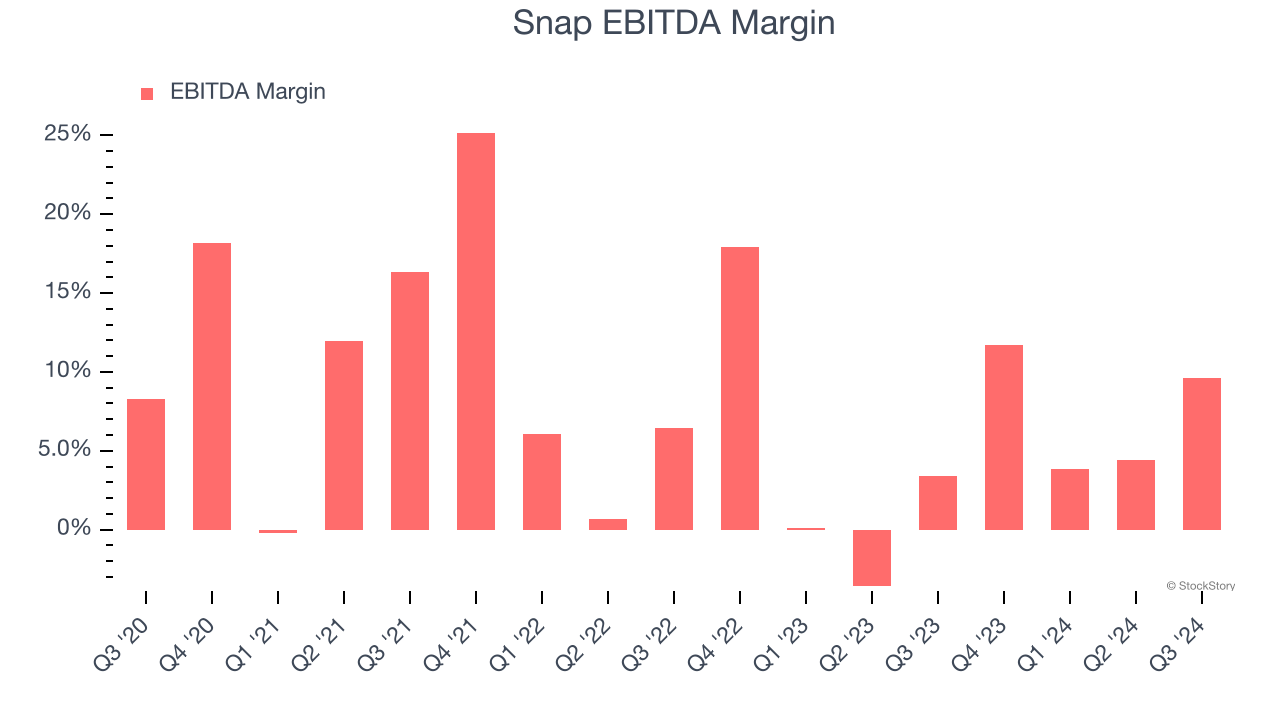

Investors regularly analyze operating income to understand a company’s profitability. Similarly, EBITDA is a common profitability metric for consumer internet companies because it excludes various one-time or non-cash expenses, offering a better perspective of the business’s profit potential.

Looking at the trend in its profitability, Snap’s EBITDA margin decreased by 4.6 percentage points over the last few years. Even though its historical margin is high, shareholders will want to see Snap become more profitable in the future. Its EBITDA margin for the trailing 12 months was 7.6%.

3. EPS Trending Down

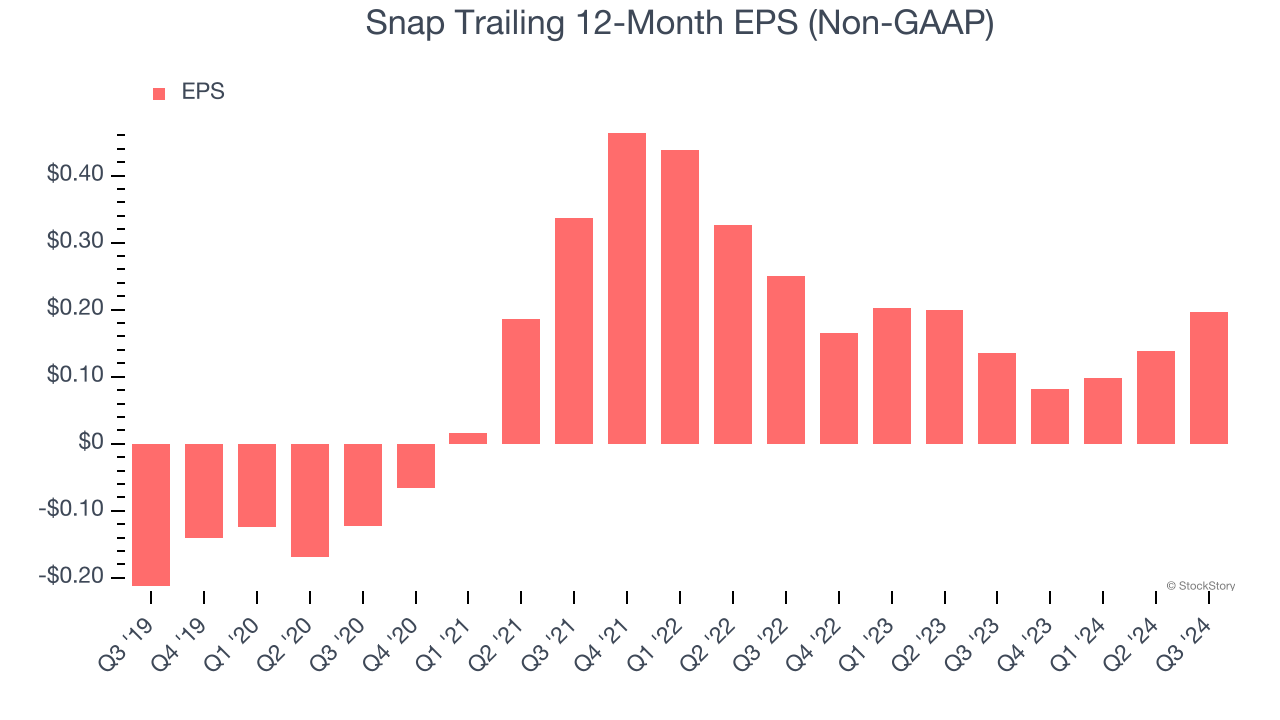

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Snap, its EPS declined by 16.5% annually over the last three years while its revenue grew by 11.5%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Snap’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 31.6× forward EV-to-EBITDA (or $11.51 per share). At this valuation, there’s a lot of good news priced in - we think there are better investment opportunities out there. We’d recommend looking at MercadoLibre, the Amazon and PayPal of Latin America.

Stocks We Would Buy Instead of Snap

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.