Personal care company Nu Skin (NYSE: NUS) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 13.8% year on year to $430.1 million. Next quarter’s revenue guidance of $427.5 million underwhelmed, coming in 6.2% below analysts’ estimates. Its non-GAAP profit of $0.17 per share was also 13.5% below analysts’ consensus estimates.

Is now the time to buy Nu Skin? Find out by accessing our full research report, it’s free.

Nu Skin (NUS) Q3 CY2024 Highlights:

- Revenue: $430.1 million vs analyst estimates of $441 million (2.5% miss)

- Adjusted EPS: $0.17 vs analyst expectations of $0.20 (13.5% miss)

- Revenue Guidance for Q4 CY2024 is $427.5 million at the midpoint, below analyst estimates of $455.8 million

- Management lowered its full-year Adjusted EPS guidance to $0.70 at the midpoint, a 17.6% decrease

- Gross Margin (GAAP): 70.1%, up from 58.6% in the same quarter last year

- Operating Margin: 4.2%, up from -5.3% in the same quarter last year

- Market Capitalization: $322.1 million

“During the third quarter, we achieved results within our previous guidance range with challenges in the core business partially offset by continued strong growth in our Rhyz segment,” said Ryan Napierski, Nu Skin president and CEO.

Company Overview

With person-to-person marketing and sales rather than selling through retail stores, Nu Skin (NYSE: NUS) is a personal care and dietary supplements company that engages in direct selling.

Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Sales Growth

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years.

Nu Skin is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from economies of scale.

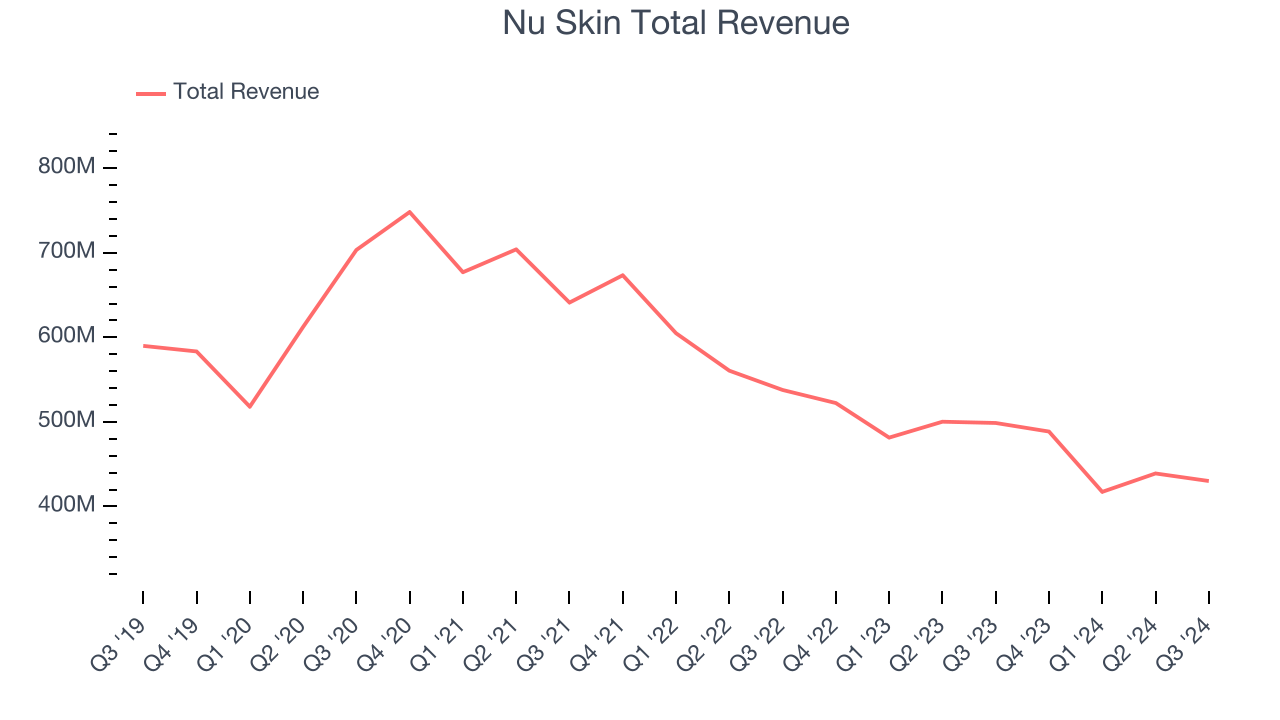

As you can see below, Nu Skin’s demand was weak over the last three years. Its sales fell by 13.8% annually, showing demand was weak. This is a rough starting point for our analysis.

This quarter, Nu Skin missed Wall Street’s estimates and reported a rather uninspiring 13.8% year-on-year revenue decline, generating $430.1 million of revenue. Management is currently guiding for a 12.5% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months, an improvement versus the last three years. Although this projection shows the market believes its newer products will catalyze better performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

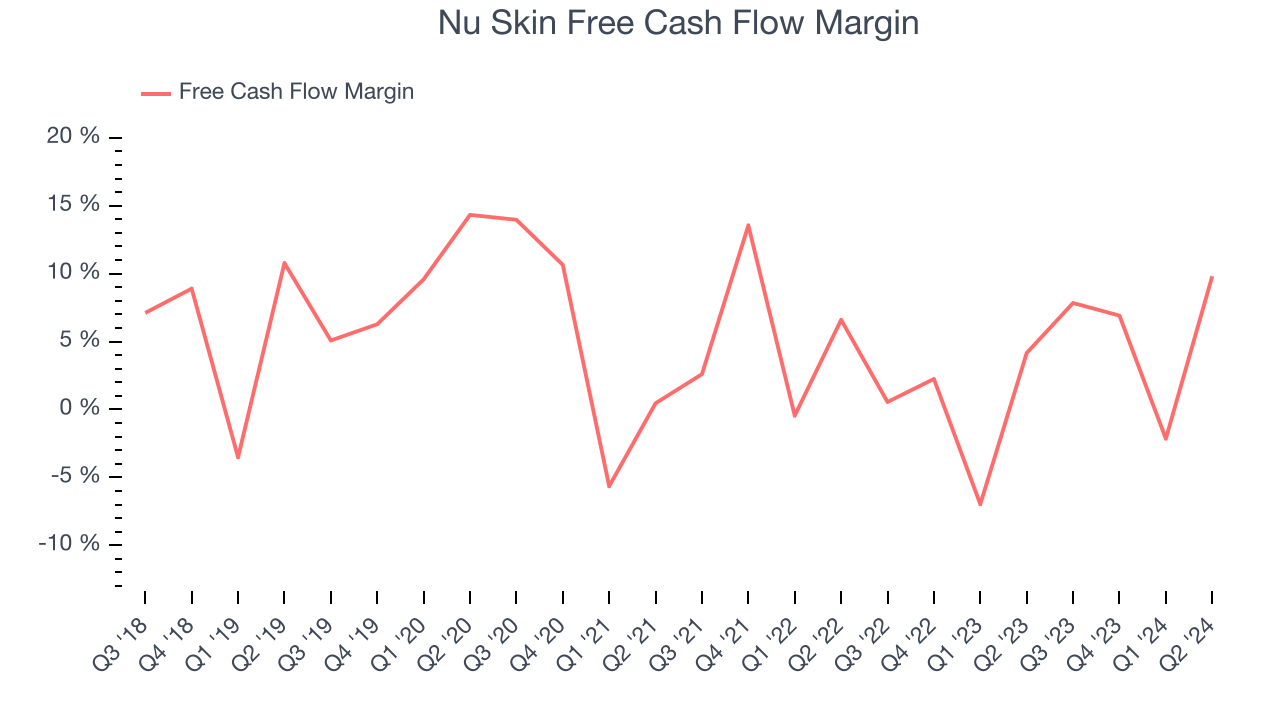

Nu Skin has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.2%, subpar for a consumer staples business.

Key Takeaways from Nu Skin’s Q3 Results

Revenue and EPS both missed, and guidance was disappointing as well. Specifically, revenue guidance for next quarter missed and full-year EPS guidance was lowered. Overall, this was a weaker quarter. The stock remained flat at $6.40 immediately after reporting.

The latest quarter from Nu Skin’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.