Grocery store chain Sprouts Farmers Market (NASDAQ: SFM) will be announcing earnings results tomorrow afternoon. Here’s what to look for.

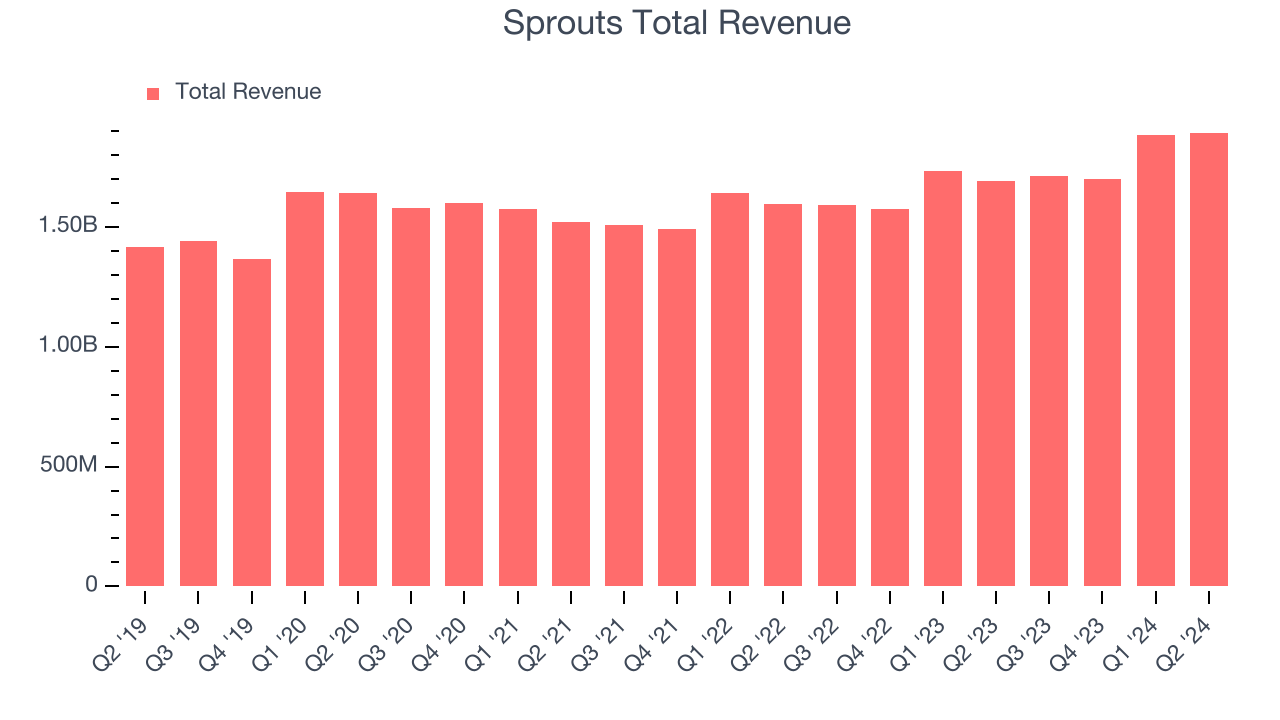

Sprouts beat analysts’ revenue expectations by 3.2% last quarter, reporting revenues of $1.89 billion, up 11.9% year on year. It was an exceptional quarter for the company, with an impressive beat of analysts’ EBITDA estimates and optimistic earnings guidance for the full year.

Is Sprouts a buy or sell going into earnings? Read our full analysis here, it’s free.

This quarter, analysts are expecting Sprouts’s revenue to grow 9.4% year on year to $1.87 billion, improving from the 7.7% increase it recorded in the same quarter last year. Adjusted earnings are expected to come in at $0.76 per share.

The majority of analysts covering the company have reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. Sprouts has a history of exceeding Wall Street’s expectations, beating revenue estimates every single time over the past two years by 1.2% on average.

Looking at Sprouts’s peers in the non-discretionary retail segment, only Costco has reported results so far. It met analysts’ revenue estimates and delivered flat year-on-year revenue. The stock was down 1.8% on the results.

Read our full analysis of Costco’s earnings results here.Growth stocks have seen elevated volatility as investors debate the Fed’s monetary policy, and while some of the non-discretionary retail stocks have fared somewhat better, they have not been spared, with share prices down 5% on average over the last month. Sprouts is up 9.1% during the same time and is heading into earnings with an average analyst price target of $106.67 (compared to the current share price of $120.43).

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.