Using stock options can help manage risk, providing you with different ways to trade an underlying stock in the direction you believe it will go. Most of the options spread strategies we’ve covered have been vertical spreads. Vertical spreads involve the two option legs, comprised of a long and short option, sharing the same expiration date.

With diagonal spreads, on the other hand, the two option legs have different expiration dates. The earlier expiration date is called the "front month," and the longer expiration date is called the "back month." In this article, we'll review how to play a bullish diagonal debit spread using calls, also referred to as a long call diagonal debit spread or a poor man’s covered call.

Evolving from a Covered Call Strategy

The simplest way to get a grasp on this is to think of a covered call strategy. This entails you owning the stock and then selling (also referred to as writing or shorting) a higher out-of-the-money (OTM) strike price. By doing this, you would receive a credit payment upfront (like rent). Ideally, you want to keep the credit by having the stock close below the strike price on expiration. Then, you keep your stock and the credit with the ability to write another covered call against it to collect more income.

Spend Less for a Covered Call with a Long Call Diagonal Debit Spread

A covered call strategy requires you to own the underlying stock. It’s an expensive strategy since you have to possess the shares. However, you can create a synthetic long position by buying an in-the-money (ITM) call on the underlying stock with a longer expiration. This enables you to collect the premiums like a covered call at a fraction of the price of a covered call trade, which is why it’s also referred to as a poor man’s covered call. Now you have a long call diagonal debit spread.

To review, here's the breakdown:

Buy an in-the-money (ITM) call at a lower price with a back-month expiration.

Sell an out-of-the-money (OTM) call at a higher strike price with a front-month expiration.

For example, XYZ stock is trading at $50, then buy 1 XYZ $45 call expiring in 90 days and sell 1 XYZ $55 call expiring in 30 days.

When to Consider a Diagonal Debit Spread?

Just like a covered call strategy, consider using a diagonal debit spread when you’re feeling neutral or moderately bullish on a stock to collect the credit premium or finance the long call. Ideally, you want the stock to close below the front month OTM higher price call strike price to keep the credit. If the stock rises through the strike price by expiration, you will start to take losses whereas your stock would be assigned in a covered call trade.

Example of a Long Call Diagonal Debit Spread with NVDA.

Let's use artificial intelligence (AI) chip leader NVIDIA (NASDAQ: NVDA) in the computer and technology sector as an example.

The candlestick chart on NVDA illustrates a pullback off its 52-week highs at $140.76. NVDA found support at the $118.00 level, where it bounced back up to $128.00 before sliding back down toward $121.46 on July 2, 2024.

Let’s assume you believe NVDA will hover between $121 and $124 for the next 2 weeks. You also believe that $118.00 is a solid support level. In this instance, you could consider a long call diagonal spread.

Executing the Trade

Depending on your brokerage platform, you may have the automated function of placing the long call debit spread simultaneously with one click. Otherwise, you’ll have to place it manually.

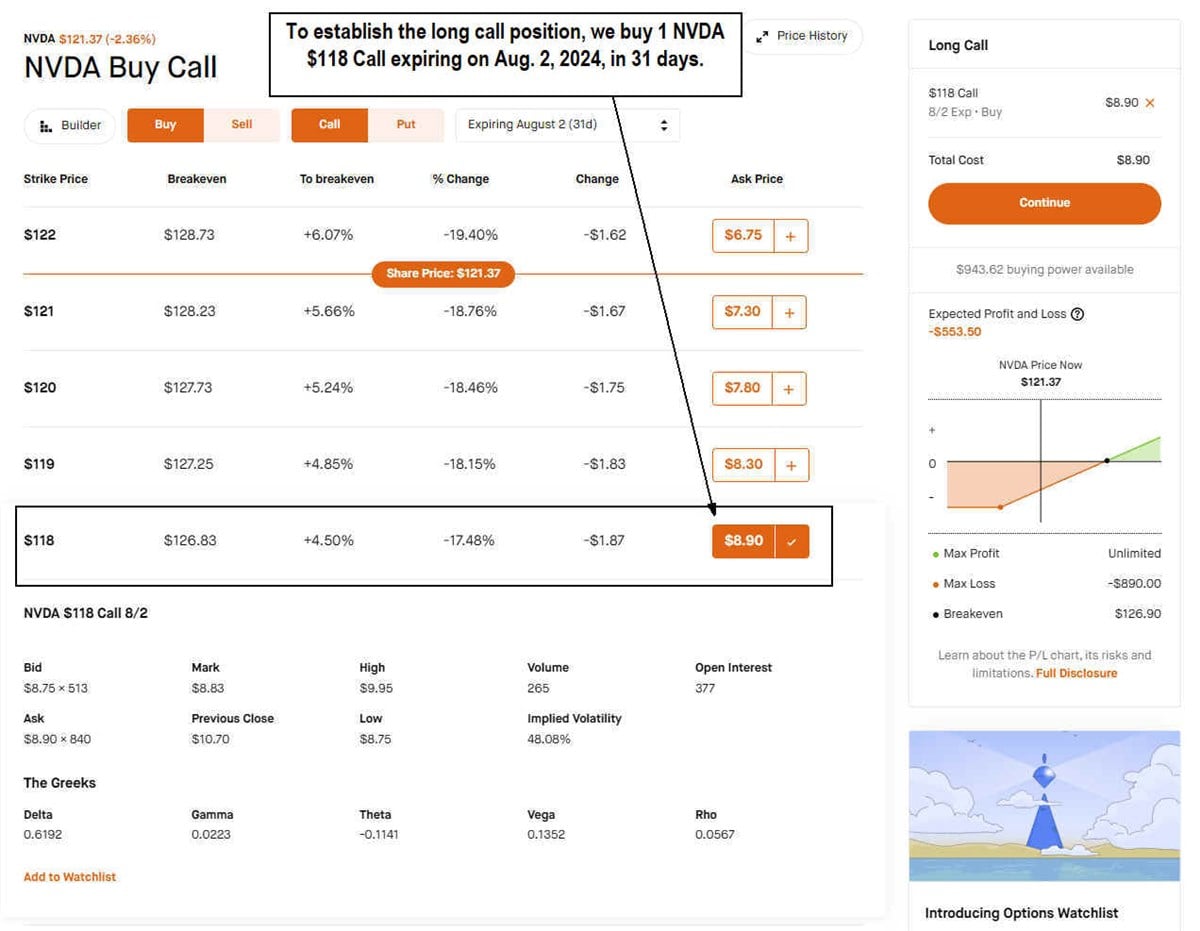

If you are placing the order manually, you'll first need to establish the ITM long call position and the back-month expiration.

Say you choose to buy a long 1 NVDA $118.00 strike call expiring Aug. 2, 2024, in 31 days for $8.90 per contract. This covers the long call in place for $890, which is cheaper than buying 100 shares of NVDA at $121.46 or putting up $12,146.00.

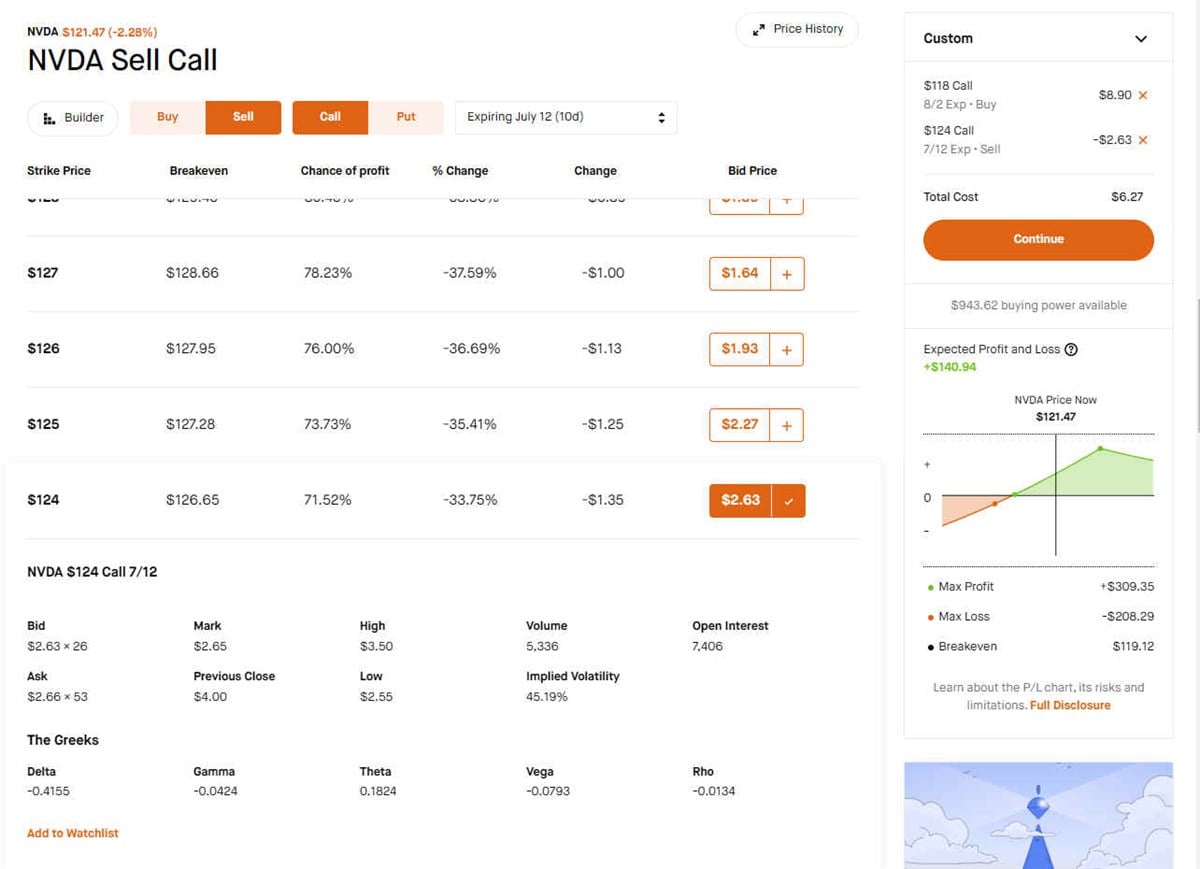

Next, you'll need to set up the credit by selling/shorting an OTM call at a higher strike price for the front month.

Say you choose to sell 1 NVDA $124.00 call expiring July 12, 2024, in 10 days for a credit of $2.63. This is like writing a covered call and collecting the premium, but without actually owning the stock. The $2.65 credit is applied to the cost of the $118.00 call at $8.90, resulting in a net debit of $6.27, which is the new cost of the trade.

Outcomes Will Vary

Unlike a covered call and owning the stock long, we are losing from time decay (Theta) on the ITM long call daily. However, since it is ITM and has a back-month expiration, the Theta decay on the long call is less than the Theta decay on the short call. This means Theta is still our friend up through the front month expiration. Remember that Theta loses value fastest in the last week of expiration.

The outcomes will vary depending on where NVDA closes on the July 2, 2024 expiration. If NVDA manages to expire at or under $124.00, then you keep the $2.65 credit. The price of NVDA also determines the price of your ITM back-month call. For this reason, you want NVDA to close near the $124.00 strike price to benefit from the underlying price appreciation of $121.46.

An at-the-money (ATM) close on July 2, 2024, would be the maximum profit on the trade. The short call would fall to zero. The value of the long call would have risen, just like when you write a covered call.

Or you can continue to hold the ITM back month call and sell another front month OTM call to continue to finance the long call.

There Are Many Options With These Options

A call diagonal debit spread or poor man's covered call has many moving parts. The value of the long call will adjust with the movement of the underlying stock, volatility and time decay. This strategy is best used when implied volatility (IV) is low and starts to rise. This helps increase the value of the long call. If the stock triggers a breakout, you could opt to hold the call and let it ride before selling a higher OTM call to restart the trade.