Utilizing stock options can help you hedge against risks, generate additional income, and potentially enhance returns. For example, writing covered calls can generate income on stocks you own long in your portfolio. Strategies and methodologies in the financial markets are linear and can work inversely, and the flip side of writing covered calls on long positions is writing covered puts on short positions.

Short Selling Has Unlimited Risk and Isn’t For Everyone

Right off the bat, you should be weary and aware of the “unlimited” risk that comes with any strategy that incorporates short selling. While stocks can only go to zero, short selling has unlimited loss potential because stocks have no ceiling when they rise, which means your losses have no ceiling if you're caught short. The only way to mitigate this is to cut your losses before they get too large. Strict discipline is the only way to survive a short squeeze. As they say, it's better to lose a toe than your whole foot or leg. This strategy is only for seasoned traders, not beginners.

What is a Covered Put?

With a covered call, you would sell/short/write a call option on a stock you are holding a long position in. With a covered put, you would sell/short a put option on a stock you are holding a short position in. It’s a covered position because you already have a position in the underlying stock. To execute a covered put, you would short sell an out-of-the-money (OTM) put on the stock that you have a short position in.

For example, if you have a short position at $27 on XYZ and it is trading at $26, then you could sell a put option at $25. This would result in receiving a credit from the short put up front, which can be income or used as a buffer on the short stock position if the stock rises.

What are the Advantages of a Covered Put?

A covered put allows you to receive a credit upfront on the put, which can add to your total profit or be used as a buffer against losses if the stock price rises against your short stock position. Like a covered call, you can make income from the premium as well as from the stock position. However, the stock profits are capped at the strike price.

Therefore, even if XYZ falls below $25, the max profit is capped at the $25 strike price for $2; even if it falls to $20, the max profit is capped at $2 on the stock since the short put would start to rise in value to offset the gains on the underlying short stock position. A covered put strategy is effective when you’re bearish on a stock. Profits can be made when the stock falls or even moves sideways and closes above the put option strike price and preferably below your short stock entry price into expiration.

Example of Covered Put on AMD Stock.

Let’s use an example with a computer and technology sector stock Applied Micro Devices Inc. (NASDAQ: AMD).

AMD failed to break out of a daily bullish ascending triangle pattern. Upon breaking down below the ascending trendline and the RSI falling to the 40-band, let's assume you took a short AMD trade at $155. The next support level is around the $150 area.

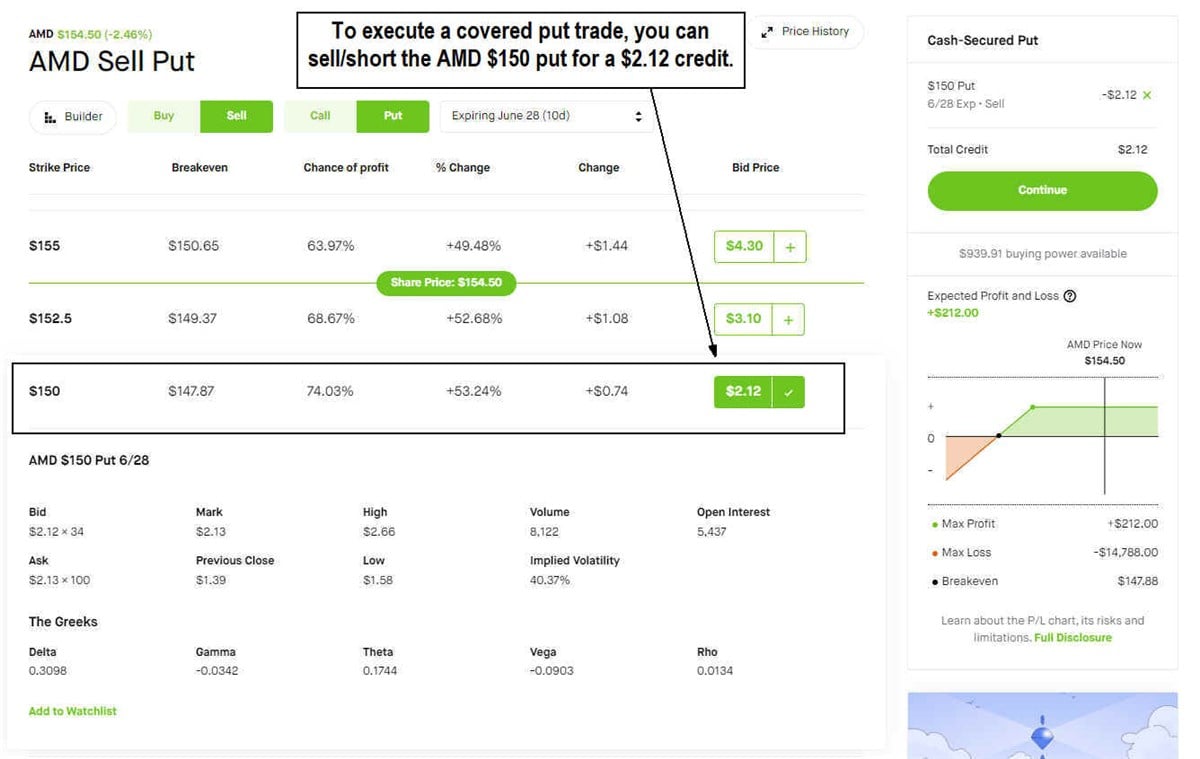

Executing the Covered Put

With the short position in tow at $155, AMD is trading around $154.50. The position is 50 cents in the money. You feel there is more downside to the trade, so you decide to execute a covered put.

The AMD $150 put option is expiring in 10 days on June 28, 2024. This trade will provide a $2.12 credit upon execution. The $2.12 can be considered income if AMD stock falls. If AMD stock rises, it provides a loss cushion of $2.12, which means you are protected on the stock short position up to $157.12.

The Potential Outcomes

Assuming you hold the position into the options expiration on June 28, 2024, in 10 days. Here are the potential outcomes.

The breakeven price level would be $157.12 on AMD. A close at $157.12 would result in a $2.12 loss on the short stock position offset by the $2.12 credit received on a short $150 put option since it would expire worthless.

The maximum profit occurs at $150 or below on AMD. A close at $150 on AMD would result in a $5 profit on the short stock position (assuming you covered on the close) and the $2.12 credit you received upfront on the put option (which would expire worthless) for a total of $7.12 maximum profit.

If AMD falls below $150, then the short stock position profit would increase, but the rise in the value of the short put position would offset that. This negates any extra profits being made on a further drop in the stock price under $150.

For example, if AMD closed at $148, your short position would have a $7 profit. However, the option position would have a $2 loss. This would still result in a $5 profit on the short position, along with the $2.12 premium collected on the short option for a maximum profit of $7.12.

The maximum loss is unlimited. Yes, unlimited. You would be protected if AMD stock rises to $157.12, but beyond that, your losses continue to mount. While the short 150 put option would expire worthless, enabling you to keep the $2.12 credit, your short stock position would continue to lose money as AMD shares continue to rise. This is where the trouble can begin and continue to get worse.

Be Disciplined and Be Proactive with Stop Losses

As you can see, there are many benefits to using a covered put strategy, as it can protect your short position by the amount of the premium and enable you to profit from the short stock position. On the other hand, your losses will mount higher if you continue to hold either position if the stock goes into a short squeeze.

For this reason alone, it's crucial to make sure you're aware of the resistance levels and be disciplined in executing stop-losses on the trade. It's also prudent to only execute this strategy in very liquid stocks that don't have a high short interest (above 20%) and are not on the hard-to-borrow (HTB) lists, which are prone to short squeezes. Covered puts, like covered calls, are a useful income-generating strategy if you can maintain your discipline and be proactive when it comes to risk management.