Retailer marketplace and technology applications behemoth Amazon (NASDAQ: AMZN) has grown into a juggernaut of commerce. Amazon is a paragon of the network effect as its ecosystem often induces the same customer to use multiple services simultaneously without a second thought. Amazon is the #1 Top Shopping Website, the #5 Top Beauty Destination among Gen-Z-ers and the #2 Most Trusted Brand in America according to Piper Sandler’s Generation Z Survey and Morning Consult. Familiarity with the brand and quality of services have become ingrained into the daily habits of consumers worldwide. It’s hard to fathom that a company that does over half a trillion dollars in annual sales once started from a garage selling books online in 1994. Amazon enjoys the massive economies of scale and dominance that gives them a halo effect when entering new industries or introducing new product services. It has over 300 million active customers and over 100 million Amazon Prime members. Shares have risen from single digits to over $3,000 per share in the past 27 years. A 30-for-1 stock split has made shares more accessible to retail investors. Here’s a breakdown of the many moving parts of the Amazon juggernaut.

Pioneer of E-commerce and Virtualization

It’s a fact that Amazon is one of the original pioneers of e-commerce and at one point had a 49% market share of the e-commerce industry. They have grown so massive that it’s hard to keep up with the innovations and numerous services they provide. Amazon segments its operations into three segments which are North America, International, and Amazon Web Services (AWS). AWS is the profit driver as it continues to grow at double digit pace responsible for most of the profits for the Company. AWS enables businesses to operate on the cloud without the need for on-premise investments in hardware and software. This results in asset light operations for a fee. It’s comparable to eating a well prepared meal at restaurant for one price as opposed to manually buying all the ingredients, cooking them up, serving them and washing the dishes afterwards. It’s cheaper, tastier, and more efficient. AWS provides every kind of business application under the sun as well. AWS is the market leader in virtualization platforms with Microsoft’s Azure (NASDAQ: MSFT) running at a distant second.

The Amazon Effect

Amazon has a history of disrupting and dominating market categories once they set their sights on entering. The mere rumor of Amazon’s interest in entering a market or industry results in the stocks of competitors taking an immediate plunge. Much like how Walmart (NYSE: WMT) is criticized for devastating small local retailers when they enter a strategic location for one of their massive superstores, Amazon carries an even more ominous reputation for trampling incumbent businesses. They are considered the great disruptor evidenced by their Kindle e-readers, Fire TV and tablets, and Alexa and Echo smart speakers to name a few examples. On the flipside, companies that do business with Amazon often see their stock prices get an immediate spike. This was the case on Aug. 22, 2022, when Peloton (NASDAQ: PTON) shares spiked 15% when they announced the launch of their Peloton store selling their fitness equipment and gear on Amazon.

Revenge of the Little Guys

However, the irony here is that unlike big warehouse clubs like Costco (NYSE: COST), or major retailers like Target (NYSE: TGT), and Walmart, Amazon derives 58% of all sales through its third-party sellers. Like eBay (NASDAQ: EBAY) and Etsy (NASDAQ: ETSY), Amazon empowers the little guy. Third-party sellers account for over half of all units sold in Amazon stores. Third-party sellers are comprised of over 1.9 million small and medium-sized businesses on Amazon. This is largely in part by its innovative Fulfillment By Amazon (FBA) program that will warehouse and ship products on behalf of the third-party sellers for a fee. Third-party sales are growing at 52% per year compared to 25% for first-party sales. Independent third-party sellers increased their sales by 55% from April 25,2020 to Jan. 15, 2021. The big box stores are a mom and pop’s nightmare, but Amazon is “America’s Corporate Nightmare” as labeled by Bloomberg.

If You Can’t Beat’em or Build’em then Just Buy’em

Their dominance and deep pockets have been criticized for stifling competition and If they can’t build it, they will buy it. Such is the case with Whole Foods Market for #13.7 billion in 2017, Zappos footwear for $1.2 billion in 2009, Kiva Systems for robotics for $775 million in 2012, PillPack online pharmacy services for $753 million in 2018, Twitch streaming video platform for $970 million in 2014. It’s MGM Holdings film and tv production and distribution acquisition for $8.5 billion in 2022 augments its content library its Prime Video streaming service as it takes the streaming wars directly to competing platforms owned by Netflix (NASDAQ: NFLX), Walt Disney’s Disney+ (NYSE: DIS), Comcast’s Peacock and NBCUniversal (NASDAQ: CMCSA), Paramount Global (NASDAQ: PARA), and Warner Brothers Discovery’s HBO Max platform (NYSE: WBD). Amazon announced the acquisition of consumer robot company iRobot (NASDAQ: IRBT) in a $1.6 billion all cash transaction in August 2022. It has since received scrutiny from members of Congress led Senator Elizabeth Warren (D-MA) with anti-competitive practice and privacy infringement concerns.

Slowing But Still Growing

Even at 27 years after its launch, Amazon continues to grow. Their fiscal Q2 2022 earnings report saw revenues rise 7.2% year-over-year (YoY) to $121.23 billion versus $119.16 billion consensus analyst estimates. While they reported a (-$0.20) loss per share, most of it was attributed to the $3.9 billion pre-tax valuation loss in its non-operating expense investment in electric truck maker Rivian (NASDAQ: RIVN). Operating income was $3.317 billion. Its AWS segment revenues grew 33% to $19.75 billion with improved operating margin of 29% versus 28.3% in the year ago period. Their Advertising Services business grew 18% YoY or 21% in constant currency to $8.76 billion. Amazon CEO Andy Jassy commented, “Despite continued inflationary pressures in fuel, energy, and transportation costs, we’re making progress on the more controllable costs we referenced last quarter, particularly improving the productivity of our fulfillment network. We’re also seeing revenue accelerate as we continue to make Prime even better for members, both investing in faster shipping speeds, and adding unique benefits such as free delivery from Grubhub for a year, exclusive access to NFL Thursday Night Football games starting September 15, and releasing the highly anticipated series The Lord of the Rings: The Rings of Power on September 2.” Amazon expects Q3 2022 revenues to come in between $125 billion to $130 billion versus $126.58 billion consensus analyst estimates but expects operating income between zero to $3.5 billion.

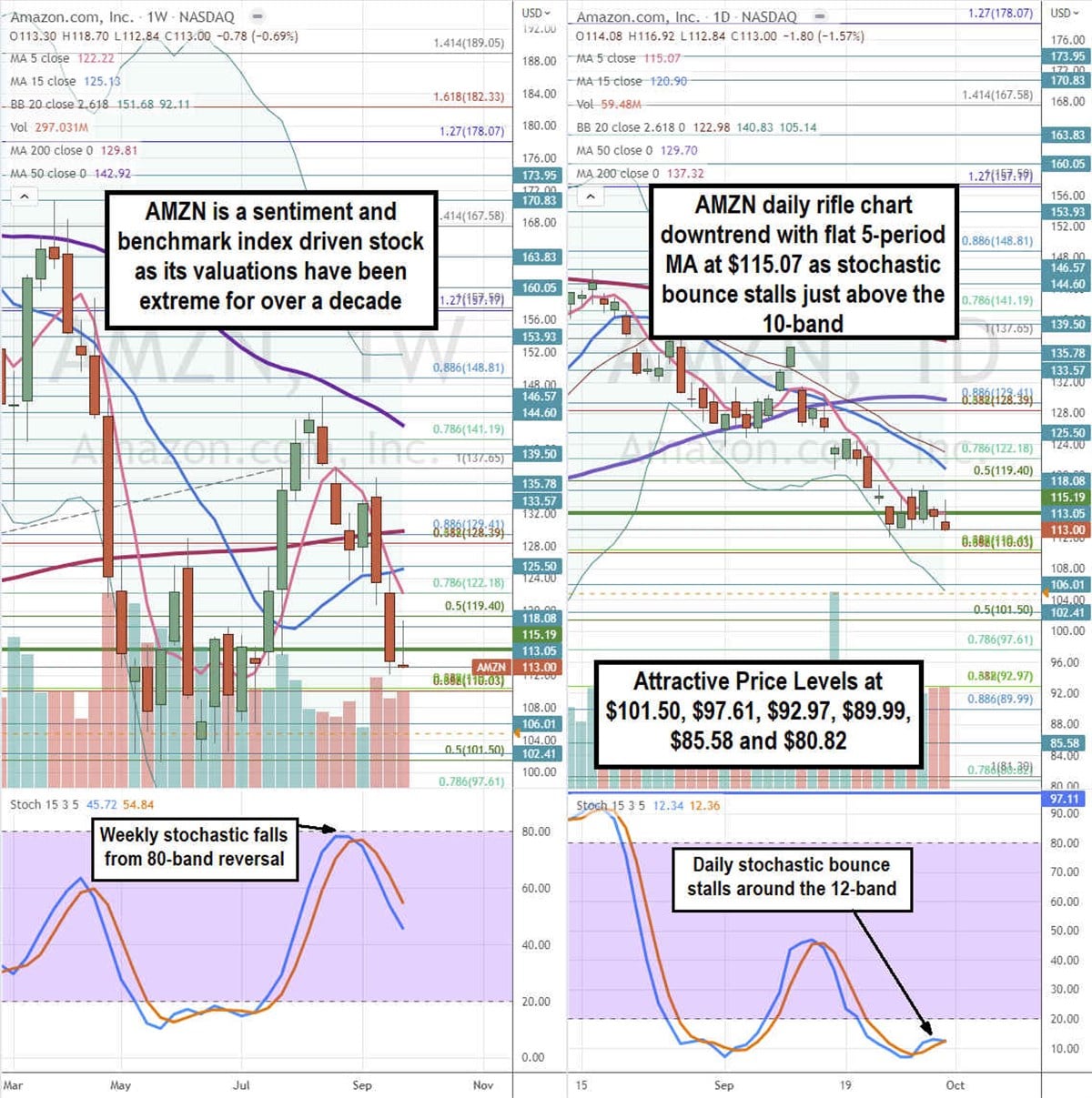

Here’s What the Charts Say

Using the rifle charts on a weekly and daily time frame provides a precision view of the landscape for AMZN stock. The weekly rifle chart is formed a breakdown at the $128.39 Fibonacci (fib) level. The weekly 5-period moving average (MA) at $122.22 fell through the weekly 200-period MA at $129.81 and just recently fell through the 15-period MA at $125.13. Shares fell below the weekly market structure low (MSL) buy trigger at $115.19. The weekly stochastic peaked at the 80-band and crossed back down. The weekly lower Bollinger Bands (BBs) sit at $92.11. The daily rifle chart is resuming a downtrend while the daily 5-period MA flattens at $115.07 as 15-period MA continues to fall at $120.90. The daily lower BBs sit at $105.14. The daily stochastic crossed up at the 10-band but is stalling on the make or break as the moving averages could form an inverse pup breakdown or the stochastic can spring higher with a mini pup. Attractive pullback levels sit at the $101.50 fib, $97.61 fib, $92.97 fib, $89.99 fib, $85.58, and the $80.82 fib.

Challenges Driving Second Prime Day

Amazon faces challenges on all sides of their businesses not just from competitors but also from the macroeconomic environment. So far, it has been fending off all comers. However, it isn’t immune to shifts in consumer sentiment. The Company saw a huge surge during the pandemic which pushed forward e-commerce adoption by a decade according to some estimates. Amazon gained 200,000 new third-party sellers in 2020, up 45% mostly driven by the pandemic. As a global retailer, it is not immune to FX pressures either, which is why they also include constant currency performance figures in their earnings report. The impact of high inflation, a strong U.S. dollar and tightening consumer spending habits will inevitably hit Amazon’s business. This may be the driving force behind the unprecedented decision to launch a second Amazon Prime Day called Prime Early Access on October 11th through 12th, 2022.