Calls on Stockholders to Vote on your BLUE Proxy Card

First Foundation Inc. (NASDAQ: FFWM) (“First Foundation” or the “Company”), a financial services company with two wholly-owned operating subsidiaries, First Foundation Advisors and First Foundation Bank, today filed definitive proxy materials with the U.S. Securities and Exchange Commission in connection with its 2023 Annual Meeting of Stockholders, which is scheduled to be held on June 27, 2023.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230515005773/en/

(Graphic: Business Wire)

In conjunction with the definitive proxy filing, First Foundation is mailing the following letter from the First Foundation Board of Directors to First Foundation’s Stockholders.

+++

Dear Fellow Stockholders,

Thank you for your investment in First Foundation Inc. (“First Foundation,” “we,” “our,” or “us”). Over the past year, First Foundation has navigated a volatile regional banking environment by taking decisive actions to protect the bank’s strengths and preserve the ability to continue to create long term stockholder value. As a publicly traded financial services company, First Foundation has maintained a resilient core business, remains well-capitalized and continues to generate solid, sustainable results with a strong liquidity position. We are committed to the hard work required to navigate the challenging interest rate environment and continue to evaluate ways we can increase deposits, improve our loan-to-deposit ratio, reduce expenses, and enhance operational efficiency.

At First Foundation’s Annual Meeting of Stockholders on June 27, 2023, there is an important decision to be made. Abbott Cooper’s Driver Management (“Driver” or “Mr. Cooper”), an activist hedge fund who has claimed to own approximately 0.6% of First Foundation stock1, has launched a proxy contest in an effort to add a member to the First Foundation Board of Directors (the “Board”). Similar to prior campaigns launched by Mr. Cooper against other small and mid-size banks, his engagement to date has been plagued by short-sighted initiatives that exhibit both a blatant disregard for stockholders’ time and resources and a total lack of understanding of our business. Further, he has made no effort to work constructively with the Board to learn about our strategy, educate himself on our plans to navigate the volatile market, or propose a coherent plan that would benefit First Foundation stockholders.

We appreciate engaging with our stockholders, and we attempted to treat Mr. Cooper as we would any other stockholder despite Mr. Cooper’s history. First Foundation has made significant efforts to engage directly with Mr. Cooper to understand his ideas to enhance long-term value for all stockholders. We were disappointed in our one and only meeting because we did not meet someone willing to engage with constructive feedback or ideas. Instead, we met a showman demanding a settlement.

We write to you today to ask for your support to protect First Foundation by voting “FOR” Ulrich E. Keller, Jr., Scott F. Kavanaugh, Max A. Briggs, John A. Hakopian, David G. Lake, Elizabeth A. Pagliarini, Mitchell M. Rosenberg, Ph.D, Diane M. Rubin, Jacob P. Sonenshine, and Gabriel V. Vazquez and selecting “WITHHOLD” for the Driver Nominee on your BLUE Proxy Card. We need to unite against the disruptive and unqualified nominee Mr. Cooper has selected.

We want to emphasize the resiliency of First Foundation in the face of the current economic headwinds. As a carefully diversified regional bank with scale and a proven business model, our core strategy and the fundamentals of our business remain strong.

________________________

1 This number was calculated by dividing Driver’s reported holdings of 354,000 shares (as of filing dated May 12, 2023) by First Foundation’s outstanding shares of 56,424,276 (as of May 1, 2023).

Decisive Actions Taken by First Foundation

The impact of the interest rate increases made by the Federal Reserve (the “Fed”) came to a dramatic head during the first quarter. We witnessed a crisis that led to the second largest failure of a financial institution in U.S. history. Regional banks, in particular, have had to re-evaluate every aspect of their business while also attempting to maintain client confidence in deposits, liquidity, security portfolios, and risk management.

Looking back on the fourth quarter of 2022, when continued signs of the Fed’s interest rate increases were apparent, we took proactive steps to mitigate the effects on our business model. Beginning in October of 2022, we implemented a liquidity funding strategy where members of management met regularly to discuss ways the organization could increase deposits, reduce our loan-to-deposit ratio, and suspend almost all lending activities. We are grateful that these strategic moves allowed us to be a step ahead in actively positioning our bank for long-term stability and success.

Despite the uncertainty the regional banking crisis has caused, we are proud to report that our deposits have stabilized. Following the collapse of Silicon Valley Bank and others, a significant portion of the deposits that left First Foundation Bank have returned. Additionally, during this time, several clients moved money from their First Foundation Bank accounts to First Foundation Advisors, our wealth advisory arm. This illustrates the value of our business model and enterprise-wide offerings that ensure the stickiness of our client base. Our resilience is also attributable to the exceptional efforts of our entire organization and the unwavering commitment of the First Foundation team to deliver incredible client service when their support was needed most.

We now see net positive days from our deposit channels, and retail and online banking have performed particularly well. Since March 21st, our deposit levels have markedly improved.

Over the past several months, our team has helped clients navigate uncertainties and restoring confidence in our bank and banking system. We have worked closely with each deposit relationship to ensure clients understand the options available to them, such as pairing their deposit balances, adding beneficiaries, utilizing products such as insured cash sweeps (“ICS”) accounts and strategically repositioning accounts to ensure full FDIC insurance coverage.

We have also taken a number of actions to ensure the strength and resiliency of our business, including:

- Stabilizing and growing our deposits, including adding $138 million in total deposits as of May 12, 2023;

- Significantly decreasing our uninsured deposits to approximately 13% of our total deposits as of May 12, 2023, putting our performance on this metric well above industry standards, and continuing to make improvements since we reported this number during our recent earnings call;

- Maintaining a strong liquidity position, with liquidity remaining at $3.5 billion as of our recent earnings call and reporting $1.3 billion in cash and securities as of March 31, 2023;

- Ensuring our high underwriting standards, as evidenced by our Loan-to-Value (“LTV”) ratios of 55.3% for multifamily loans and 54.9% for single-family loans as of May 12, 2023, continuing this same underwriting discipline that helped propel us during the Great Recession; and

- Preserving our pristine credit quality and Non-Performing Assets (“NPA”) ratio of 13 basis points as of March 31, 2023.

We remain committed to prepare for and face the changing interest rate environment. Our leadership across the organization is dedicated to ensuring the long-term success of our business, and we are confident in our ability to continue providing exceptional financial services to our clients.

Mr. Cooper’s Distraction Campaign

It is important for us to recognize the recent extraordinary events and how we are positioned amid the current banking environment. But we believe it is important to look at the whole picture. It is widely understood that the challenges facing the entire regional banking sector have caused near-term share price disruption. Mr. Cooper is self-servingly using this disruption to criticize First Foundation’s performance in an attempt to justify nominating a completely unqualified candidate to the Board.

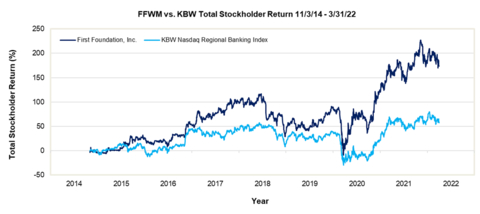

There is a reason why Mr. Cooper only references total return over the near-term with little to no additional insights or context. In reality, since our IPO in 2014, First Foundation was one of the best performing regional bank stocks. The chart included shows that from our IPO until the Fed began its tightening cycle in March of 2022, First Foundation’s total stockholder return was 174% while the KBW Nasdaq Regional Banking Index rose just 58%. During 2021, FFWM’s net interest margin was 3.15%, in line with peers, while its efficiency ratio was below that of peers. Overall, prior to the Fed tightening cycle, a move that shifted the ground under all regional banks, First Foundation was outperforming peers.

Since then, and specifically in the first quarter of 2023, we experienced a volatile banking environment. After the Fed raised interest rates, First Foundation Bank moved swiftly to raise rates on its deposits. We intentionally did this in line with the Fed to keep pace with the rate of increases, while some others in the industry did not. As a result, we are no longer seeing a rapid increase in the cost of deposits, as we have already absorbed that increase.

Why you should continue to have confidence in our Board of Directors

Your Board has the right experience, skillsets, and deep knowledge of regional banking and First Foundation to continue overseeing the successful execution of our strategy and deliver value to our stockholders. This knowledge and experience have been invaluable in shaping our long-term strategy and executing it successfully over the years, as well as ensuring the bank’s stability during these tumultuous times for the industry.

Our directors bring expertise in areas such as finance, banking, real estate, human resources, and risk management. Among their ranks are the Founder and President of a successful restaurant franchise, the President and CEO of an international consulting firm, the Co-Founder and current President and CEO of a wealth management company, and the COO and CFO for a publicly registered, non-traded REIT. This diversity allows the Board to approach challenges and opportunities from multiple angles, leading to more robust decision-making and better outcomes for our stockholders.

More importantly, the Board proactively looks to add new, independent directors who can add fresh perspectives that will ultimately bring value to our stockholders. This was demonstrated with our most recent director appointment, Gabriel Vazquez. Mr. Vazquez is the Vice President and Associate General Counsel for Operations of Vistra Corp., a Fortune 500 integrated power company based in Irving, Texas. Mr. Vazquez’s extensive experience as a leader in the legal group of a large, highly regulated entity is an important and timely addition to the Board, as risks and regulations in the regional banking space continue to evolve. His experience will provide immediate value for stockholders as the bank seeks to anticipate and navigate potential regulatory developments.

Our experienced leadership is especially necessary during today’s banking sector challenges. As has been true since our founding, your Board remains committed to stockholder value creation. We ask for your support to protect First Foundation by voting “FOR” Ulrich E. Keller, Jr., Scott F. Kavanaugh, Max A. Briggs, John A. Hakopian, David G. Lake, Elizabeth A. Pagliarini, Mitchell M. Rosenberg, Ph.D, Diane M. Rubin, Jacob P. Sonenshine, and Gabriel V. Vazquez and selecting “WITHHOLD” for the Driver Nominee on your BLUE Proxy Card. We need to unite against the disruptive and unqualified nominee Mr. Cooper has selected.

Mr. Cooper’s unqualified nominee, Allison Ball

Mr. Cooper’s proposed change will be detrimental to creating value for you, our stockholders.

First Foundation believes that Mr. Cooper’s candidate, Allison Ball, does not possess the necessary experience, qualifications, and decorum required of a director of a publicly traded financial services institution. Specifically, the Company is concerned about Ms. Ball’s lack of experience in a highly regulated business and executive experience in any relevant industry. Additionally, Ms. Ball has exhibited a penchant for making inflammatory, insulting, and degrading comments that would reflect negatively on First Foundation, its clients and its stockholders. We believe that Ms. Ball's election to the Board could pose significant risks to First Foundation’s reputation and performance, as well as client retention and recruitment.

Ms. Ball failed to be fully transparent regarding her employment history and her ownership of a business through which she operated a podcast. During our due diligence, we discovered that Mr. Cooper’s nomination materials omitted key facts even though our questionnaire required the missing information. These critical omissions included Ms. Ball’s service as the Chief Product Officer of Grata, an online recognition platform, and her ownership of Hell or High Ranch Water LLC (the “LLC”), through which she co-hosted a podcast series titled, “Hell or High Ranch Water.” During some episodes of this podcast, Ms. Ball and her business partner made numerous inappropriate, ill-considered comments that reflect a level of judgment and professionalism far below the standard expected of a First Foundation Board member. Further, by not revealing the existence of the LLC, Ms. Ball concealed significant issues related to her independence as a Board member.2

In short, Mr. Cooper has mischaracterized First Foundation in a deliberate attempt to divert attention away from what is important: selecting the most qualified director nominees to oversee the execution of First Foundation’s strategy to enhance stockholder value. Your Board and management team are committed to delivering substantial and enduring value for our stockholders.

We urge you to support us in this by voting “FOR” Ulrich E. Keller, Jr., Scott F. Kavanaugh, Max A. Briggs, John A. Hakopian, David G. Lake, Elizabeth A. Pagliarini, Mitchell M. Rosenberg, Ph.D, Diane M. Rubin, Jacob P. Sonenshine, and Gabriel V. Vazquez and selecting “WITHHOLD” for the Driver Nominee on your BLUE Proxy Card.

For more information about Mr. Cooper’s reckless campaign against First Foundation, please visit www.truthfirstfoundationinc.com.

Sincerely,

The First Foundation Board of Directors

___________________________

2 Mr. Cooper originally submitted a second purported nominee in this proxy contest: the co-owner of the LLC with Ms. Ball, who also did not disclose the LLC’s existence. First Foundation was unaware that the nominees/co-owners had any relationship with each other, whether personally or professionally, until it learned of the LLC. Ms. Ball’s partner withdrew herself from consideration after First Foundation, in a letter to Mr. Cooper, raised its concerns regarding his purported nominees’ independence.

+++

About First Foundation

First Foundation Inc. (NASDAQ: FFWM) and its subsidiaries offer personal banking, business banking, and private wealth management services, including investment, trust, insurance, and philanthropy services. This comprehensive platform of financial services is designed to help clients at any stage in their financial journey. The broad range of financial products and services offered by First Foundation are more consistent with those offered by larger financial institutions, while its high level of personalized service, accessibility, and responsiveness to clients is more aligned with community banks and boutique wealth management firms. This combination of an integrated platform of comprehensive financial products and personalized service differentiates First Foundation from many of its competitors and has contributed to the growth of its client base and business. Learn more at firstfoundationinc.com or connect with us on LinkedIn and Twitter.

Forward-Looking Statements

This press release includes forward-looking statements within the meaning of the “Safe-Harbor” provisions of the Private Securities Litigation Reform Act of 1995, including forward-looking statements regarding our expectations and beliefs about our future financial performance and financial condition, as well as trends in our business and markets. Forward-looking statements often include words such as "believe," "expect," "anticipate," "intend," "plan," "estimate," "project," "outlook," or words of similar meaning, or future or conditional verbs such as "will," "would," "should," "could," or "may." The forward-looking statements in this press release are based on current information and on assumptions that we make about future events and circumstances that are subject to a number of risks and uncertainties that are often difficult to predict and beyond our control. As a result of those risks and uncertainties, our actual financial results in the future could differ, possibly materially, from those expressed in or implied by the forward-looking statements contained in this press release and could cause us to make changes to our future plans.

Additional information regarding these and other risks and uncertainties to which our business and future financial performance are subject is contained in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as amended, our Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2023, and other documents we file with the SEC from time to time. We urge readers of this press release to review those reports and other documents we file with the SEC from time to time. Also, our actual financial results in the future may differ from those currently expected due to additional risks and uncertainties of which we are not currently aware or which we do not currently view as, but in the future may become, material to our business or operating results. Due to these and other possible uncertainties and risks, readers are cautioned not to place undue reliance on the forward-looking statements contained in this press release, which speak only as of today's date, or to make predictions based solely on historical financial performance. We also disclaim any obligation to update forward-looking statements contained in this press release or in the above-referenced reports, whether as a result of new information, future events or otherwise, except as may be required by law or NASDAQ rules.

Important Additional Information

The Company, its directors and certain of its executive officers are participants in the solicitation of proxies from the Company’s stockholders in connection with its upcoming 2023 Annual Meeting of Stockholders (the “2023 Annual Meeting”). The Company has filed a definitive proxy statement and a BLUE universal proxy card with the Securities and Exchange Commission (the “SEC”) in connection with its solicitation of proxies from the Company’s stockholders. STOCKHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH PROXY STATEMENT, ACCOMPANYING BLUE UNIVERSAL PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY AS THEY CONTAIN IMPORTANT INFORMATION. Information regarding the identity of the participants and their direct and indirect interests, by security holdings or otherwise is set forth in the definitive proxy statement and other materials filed with the SEC in connection with the 2023 Annual Meeting. Stockholders can obtain the definitive proxy statement, any amendments or supplements to the proxy statement and other documents filed by the Company with the SEC at no charge at the SEC’s website at www.sec.gov. Copies are also available at no charge on the Company’s website at www.ff-inc.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230515005773/en/

Contacts

Investor and Media Contact:

Shannon Wherry

Director of Corporate Communications

swherry@ff-inc.com

(469) 638-9642