Robust Black Friday and Cyber Monday shopping pushed five-day sales up 8% over last year’s long holiday weekend, Signifyd data shows

Cyber Five online sales doubled pre-holiday expectations, powered by a discount-fueled shopping frenzy on Black Friday and Cyber Monday, leaving retailers wondering whether more big days were ahead or if consumers had spent themselves out for the holiday season.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20231128840090/en/

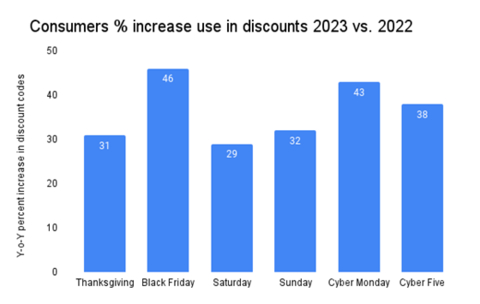

Consumers % Increase Use in Discounts 2023 vs. 2022 (Graphic: Business Wire)

Cyber Five sales increased 8% over a year ago, helped by a boost in buying on Cyber Monday, which saw sales up 7% over 2022, and Black Friday, during which sales increased 11% year over year, according to commerce protection provider Signifyd. Even Saturday and Sunday showed strong sales — up 7% and 8% respectively.

Deep discounts eased consumers’ inflation worries

Discounts drove the strong performance. Cyber Five shoppers increased their use of discounts by 38% over last year, Signifyd data showed, enjoying price reductions that were 14% higher than a year ago. On Cyber Monday, consumers increased their use of discounts by 43% over last year. The average discount over the five-day period was 27.4%, up from 24% in 2022.

“Consumers have been saying that value is especially important to them this holiday season,” Signifyd Chief Customer Officer J. Bennett said. “Merchants have heard that message and responded. And for their part consumers have said, ‘These discounts represent true value. Now is the time to buy.’”

The dramatic boost in sales — Signifyd had initially predicted Cyber Five sales would rise 4% this year — was led by strong performances in some traditional gift categories, including luxury goods, beauty and cosmetics, apparel, alcohol, tobacco and cannabis, and leisure and outdoor goods. Grocery also had a strong weekend. Electronics sales were down 2%.

Cyber Five 2023 sales vs. Cyber Five 2022 by vertical |

Alcohol, tobacco and cannabis |

+29% |

Grocery and household goods |

+20% |

Beauty and cosmetics |

+14% |

Luxury goods |

+13% |

Leisure and outdoor |

+12% |

Fashion, apparel and luggage |

+11% |

Home goods and decor |

+4% |

Electronics |

-2% |

Generous discounts and strategic pricing by online merchants effectively neutralized inflation. Prices during the long Cyber Five weekend were 11% lower than they were during the first half of 2023, a Signifyd analysis found. Signifyd compared the prices of 175,000 products that were selling in the first half of the year to their prices over the weekend.

Value-conscious consumers took advantage of lower prices all weekend. During the Cyber Five, 29% of orders were accompanied by a discount code. On Cyber Monday, consumers added discount codes to 30% of their orders.

Are consumers spent out or ready to buy?

With four weeks to go in the holiday season, the question remains: Was the breakout Cyber Five a sign of shopping to come or did discounts simply encourage consumers to finish their holiday shopping in November instead of December?

“I’ll be curious to see how much of the Cyber Five spending was a pull-forward from December,” Bennett said. “If I had to project right now, I’d say November is going to end stronger than we projected, and December will fall a little short of expectations. Consumers have said they have a set budget for the holidays. They’re just searching for the best value, the best place to spend that money.”

Among the weekend’s many bright spots: Fraud pressure — or the number of orders Signifyd deemed to be fraudulent — dropped by 20% over last year’s Cyber Five. The figure was notable, given that U.S. merchants faced a massive fraud attack during holiday 2022. An organized fraud ring last year made off with an estimated $660 million in goods from online retailers nationwide while attempting fraudulent purchases of more than an estimated $3 billion in products.

Methodology

Signifyd’s Holiday Season Pulse Tracker data is derived from transactions on Signifyd’s Commerce Network of thousands of ecommerce retailers and brands. Commerce Network intelligence also powers Signifyd’s Commerce Protection Platform, which leverages AI-driven machine learning models and data from millions of transactions to detect and block fraudulent activity. Signifyd has seen more than 600 million unique shopper wallets1 globally, meaning that 98% of the time when a shopper comes to a Signifyd-protected site, Signifyd’s machine-learning models recognize the shopper instantly. For a tutorial explaining the methods and meanings behind Signifyd’s Holiday Season Pulse Tracker visit Signifyd’s YouTube channel.

About Signifyd

Signifyd provides an end-to-end Commerce Protection Platform that leverages its Commerce Network to maximize conversion, automate customer experience and eliminate fraud and consumer abuse risk for retailers. Signifyd, which is the leading provider of payment security and fraud prevention for the Digital Commerce 360 Top 1000 Retailers, is headquartered in San Jose, CA, with locations in Denver, New York, Mexico City, São Paulo, Belfast and London.

______________

1 A digital wallet is a distinct combination of signals present in an online transaction.

View source version on businesswire.com: https://www.businesswire.com/news/home/20231128840090/en/

Robust Black Friday and Cyber Monday shopping pushed five-day sales up 8% over last year’s long holiday weekend, Signifyd data shows.

Contacts

Mike Cassidy

Signifyd head of PR & storytelling

mike.cassidy@signifyd.com