As we head into 2026, one thing remains: the market is sending mixed signals. Uncertainty continues, valuations are stretched, and investors are becoming more cautious about where they put their capital. During times like this, companies that pay a steady and increasing income- at reasonable valuations, matter more than hype. That is exactly where a small group of overlooked dividend growers begins to stand out.

Dividend Aristocrats are S&P 500 listed companies that have increased their dividends for at least 25 consecutive years. This elite group represents resilient businesses with durable cash flows, disciplined capital allocation, and management with a proven track record of rewarding shareholders across every economic cycle.

Now, heads up: Dividend Aristocrats are usually boring, at least in terms of yield and potential price appreciation. But when these companies trade at attractive valuations and show earnings growth, they stop looking “boring” and become opportunities. So here are three cheap Dividend Aristocrats to watch out for in 2026.

How I came up with the following stocks

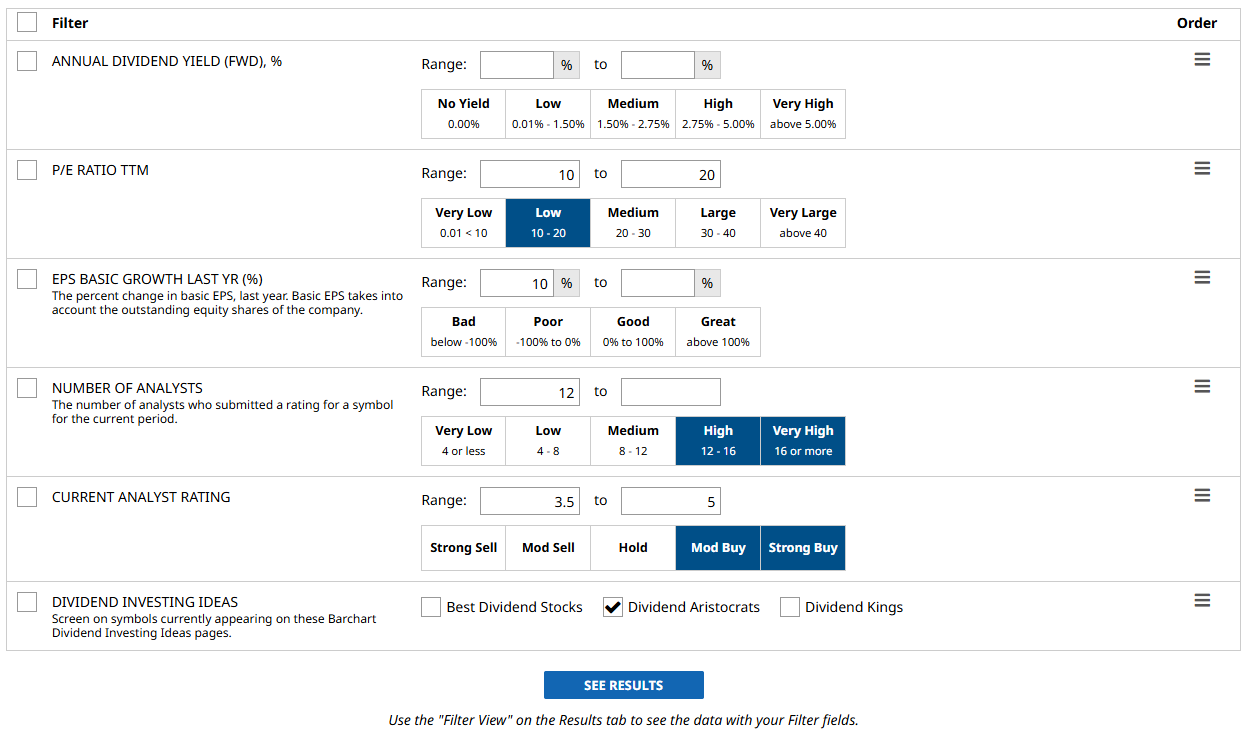

Using Barchart’s Stock Screener, I selected the following filters to get my list:

- Annual Dividend Yield (FWD) %: Left blank so I can sort it from highest to lowest dividend yield.

- P/E Ratio TTM: 10 to 20: This is a metric that compares the stock's earnings per share to its current market price to determine if it is over- or undervalued. A lower P/E ratio than the sector average likely suggests it is undervalued.

- EPS Basic Growth Last Year (%): 10% or higher. This filters the results with companies whose net profit increased over the past year.

- Number of Analysts: 12 or more. The higher the number, the stronger the confidence.

- Analyst Ratings: 3.5 (Moderate Buy) to 5 (Strong Buy).

- Dividend Investing Ideas: Dividend Aristocrats.

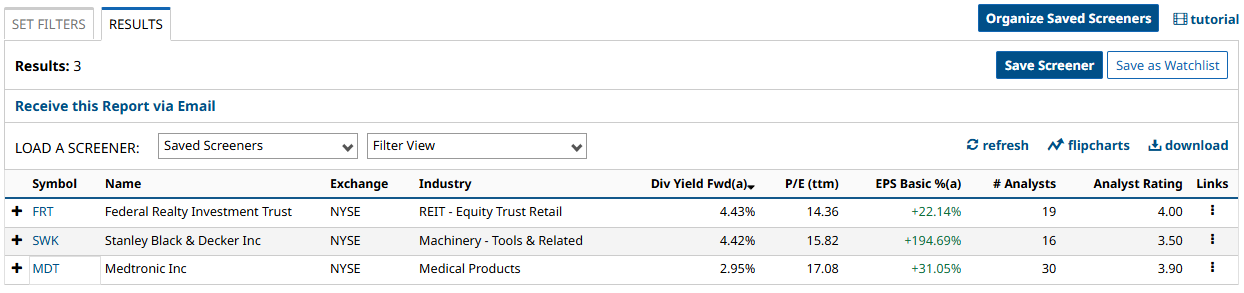

I ran the screen and got exactly three results - exactly what I am looking for.

Let’s start with the first Dividend Aristocrat:

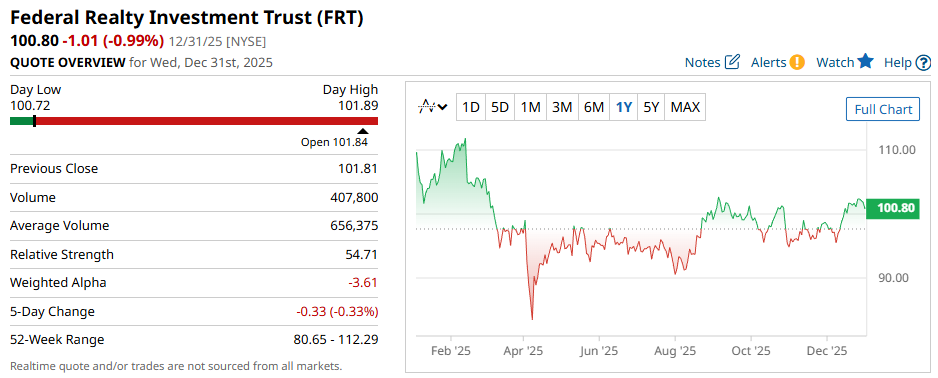

Federal Realty Investment Trust (FRT)

Federal Realty focuses on managing retail properties, generating revenue through leasing residential spaces, and managing land assets. The company is a leader in the world of real estate investment trusts and continues to strengthen its portfolio by acquiring dominant, high-income retail centers in strategic markets.

In its recent annual report, basic EPS grew around 22%, from $2.80 to $3.42 per share. Federal Realty also currently has a P/E ratio of 14.32, below the sector average of 18.16, suggesting the stock is undervalued. The company also pays a forward annual dividend of $4.52, translating to a yield of around 4.44%, making it an attractive investment for income-focused investors.

Meanwhile, a consensus among 19 analysts rates the stock a “Moderate Buy”, with a high target of $120, suggesting as much as 19% upside over the next year.

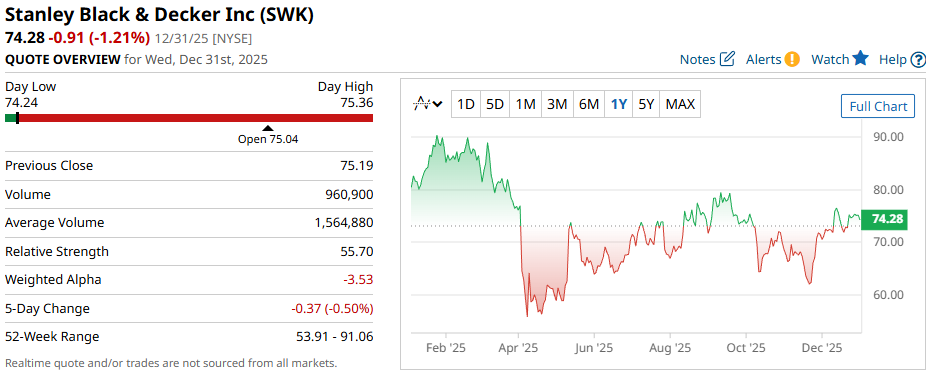

Stanley Black & Decker Inc (SWK)

Next on my list is Stanley Black & Decker Inc., a global leader in tools and storage-related products. The company has a diversified portfolio of construction, manufacturing, and infrastructure equipment.

Swinging from a loss to profit- its basic EPS was up 195% last year. Right now, the stock trades at a P/E ratio of 15.83, lower than the sector average of 26. The company also pays a forward annual dividend of $3.32, translating to a yield of around 4.42%, making it a stock with a great bargain while maintaining solid dividends.

A consensus of 16 analysts rates the stock a “Moderate Buy,” with a potential upside of 41% if it reaches the projected high target price of $105.

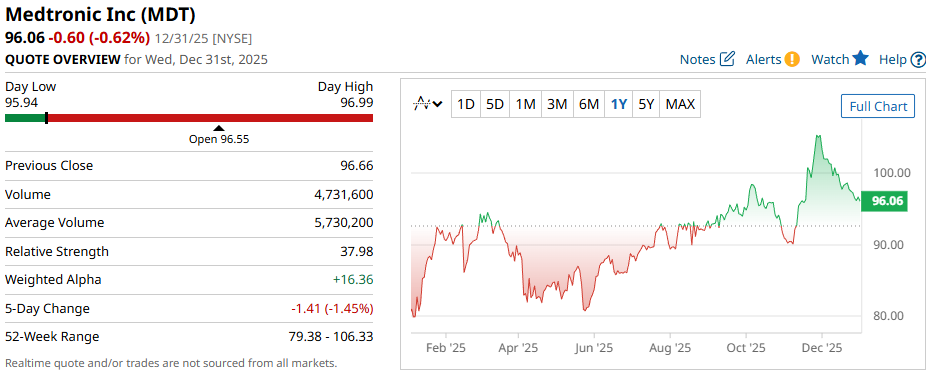

Medtronic Inc (MDT)

The last Dividend Aristocrat on my list is Medtronic Inc., a global leader in medical technology. Its mission is to improve patient care by integrating modern technology and medical knowledge.

Last year, the company’s basic EPS grew 31% from $2.77 to $3.63 per share. Today, MDT stock trades at a P/E ratio of 17.17, lower than the sector average of 26.28. The company also pays a forward annual dividend of $2.84, yielding around 2.94%.

A consensus among 30 analysts rates the stock a “Moderate Buy”, a rating consistent over the past three months. It also has a high target price of $125, suggesting there’s as much as 30% upside in the stock over the next year.

Final Thoughts

These three Dividend Aristocrats offer some of the best value and income going into the new year. Their solid income growth history, coupled with their consistent dividend increases, makes them even more attractive to investors expecting volatility in 2026.

That being said, your mileage may vary. Wall Street buy ratings are all well and good, but performance will always depend on market sentiment, broader economic conditions, and company-specific metrics. So, always keep your eyes peeled for further developments.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart