When it comes to storytelling, Netflix (NFLX) stands in a league of its own. On Tuesday, Jan. 20, the streaming giant reported strong fourth-quarter 2025 results, keeping investors engaged in more than just its hit shows and movies.

The biggest takeaway from the earnings report was scale. Netflix now boasts 325 million paid subscribers and a global audience approaching 1 billion viewers, marking a fresh milestone for the company. Looking to 2026, management aims to expand both the breadth and quality of its series and films, driving engagement, retention, and long-term pricing power.

However, the much-discussed pending Warner Bros. Discovery (WBD) deal could stretch Netflix beyond its core strengths, leading management to temporarily pause share buybacks to preserve cash for the transaction. With a competing Paramount (PSKY) bid raising the risk of a costly bidding war, investor caution remains justified.

To that end, co-CEOs Ted Sarandos and Greg Peters remain confident, arguing that the acquisition would accelerate streaming growth and broaden Netflix’s presence in television and theatrical films. With 325 million paying subscribers reaffirming Netflix’s vision each month, long-term believers have a compelling reason to stay invested.

About Netflix Stock

Headquartered in Los Gatos, California, Netflix is a global entertainment platform. With a market capitalization of nearly $361 billion, the company acquires, licenses, and produces original programming while offering paid memberships across more than 190 countries and countless genres.

The stock's momentum has faltered recently, with the stock down 29% over the past six months and 10% in the past month.

Sector comparisons add context. The State Street Communication Services Select Sector SPDR ETF (XLC) has gained nearly 8% over the past year and is down less than 1% in the past month.

NFLX stock is currently trading at 27x forward adjusted earnings, a premium to industry peers. Yet, relative to its own five-year average multiple, the stock now sits at a discount, suggesting a good entry point in the stock.

Netflix Surpasses Q4 Earnings

On Jan. 20, Netflix reported fourth-quarter fiscal 2025 results that narrowly topped Wall Street expectations on both revenue and earnings. Revenue climbed 17.6% year-over-year to $12.1 billion, beating the Street’s forecast of $11.97 billion, driven by subscriber growth, higher pricing, and expanding advertising revenue.

Net income reached $2.4 billion, rising 29.4% from the prior-year quarter, while earnings per share (EPS) increased 30.2% to $0.56, edging past the analyst estimates of $0.55.

Looking ahead, management expects 2026 revenue between $50.7 billion and $51.7 billion, supported by subscriber growth, pricing increases, and a roughly doubling of advertising revenue. Netflix also targets a 31.5% operating margin. On the other hand, analysts forecast fiscal year 2026 EPS to rise 26.9% year-over-year to $3.21.

What Do Analysts Expect for Netflix Stock?

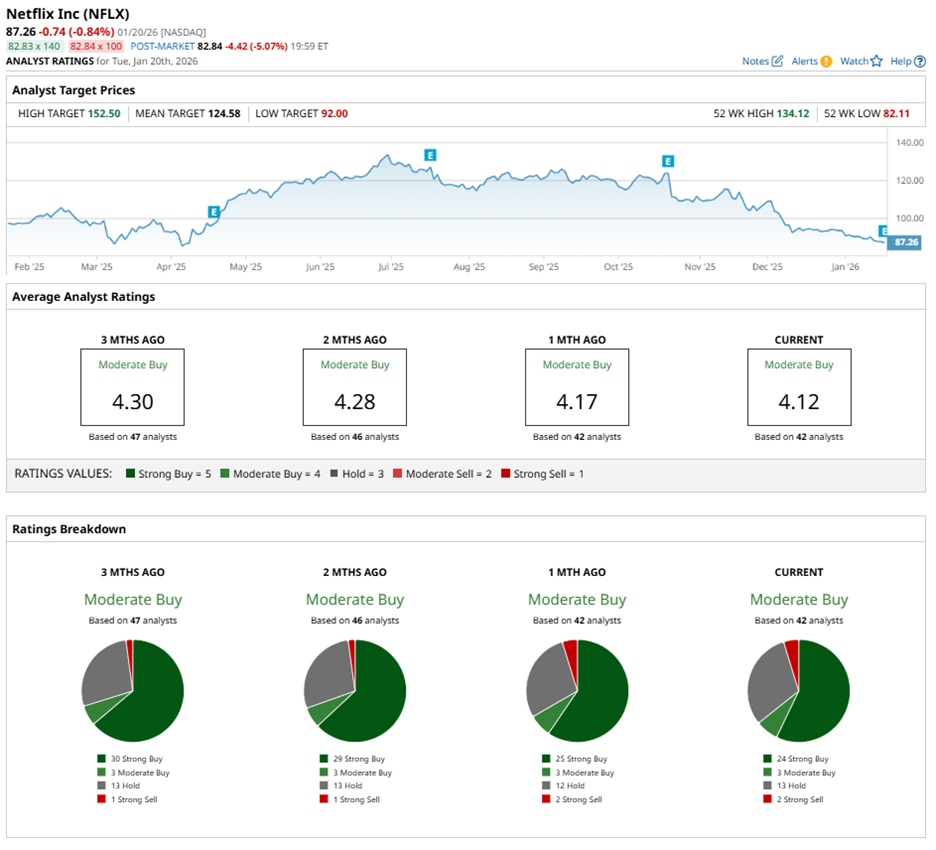

Wall Street’s overall stance on Netflix remains cautiously optimistic. NFLX stock carries a “Moderate Buy” consensus rating. Of 42 analysts, 24 rate the stock a “Strong Buy,” three rate it a “Moderate Buy,” 13 rate it a “Hold,” and two gave it “Strong Sell” ratings.

Price targets imply upside if execution holds. The stock’s mean price target of $124.58 represents potential upside of 42.8%. Meanwhile, the Street-high target of $152 suggests a gain of 74.8% from current levels, should Netflix execute cleanly on growth, advertising expansion, and strategic discipline in the year ahead.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 325 Million Reasons to Buy Netflix Stock Today

- Micron Insider Teyin Liu Just Bought $7.8 Million in MU Stock. Should You Buy Shares Too?

- Power Up for a Larger Rally in 1 of 2026’s Winning AI Stocks with a Bull Call Spread

- UnitedHealth Announces Plans to Rebate ACA Profits. What Does That Mean for UNH Stock as Trump Takes Aim at Insurers?