Intel (INTC) is set to report its fourth-quarter and full-year 2025 earnings on Jan 22. After several challenging years in a market dominated by AI leaders like Nvidia (NVDA) and advanced manufacturers such as TSMC (TSM), Intel’s first three quarters of 2025 suggested that a long-awaited turnaround is finally gathering steam. Intel’s shares surged 82.5% last year, dramatically outperforming the S&P 500 Index ($SPX) gain of 16.6%. So far this year, the stock is already up 19%. The question now is will another great quarter propel the stock to carry forward this momentum into 2026?

Intel Heads Into Next Earnings With Momentum

In the third quarter, Intel reported revenue of $13.7 billion, comfortably beating Wall Street expectations and increasing 3% year on year. Improved supply chain execution, healthier inventory levels, and renewed customer demand drove this performance. Adjusted earnings swung back into positive territory at $0.23 versus a loss of $0.46 per share in the year-ago quarter. Adjusted gross margins increased to 40% due to a better product mix and fewer inventory-related headwinds.

Intel’s Data Center and AI segment delivered steady sequential growth of 5% to report revenue of $4.1 billion, driven by rising demand for AI servers, storage solutions, and host CPUs. Management maintained a cautiously bullish tone, citing ongoing CPU demand that might last well into 2026 as AI infrastructure expands. Management also stated that in the long run, some data center operators intend to establish strategic supply agreements for future capacity.

Intel spent years in restructuring mode, so these numbers and encouraging signs that Intel's products remain relevant in the face of tough competition indicate a positive turnaround. Intel Foundry remains central to the company’s long-term vision. Although performance dipped in the third quarter, management believes there is massive opportunity ahead. AI data center capacity is projected to grow dramatically by the end of the decade, driving substantial demand for wafers and advanced packaging.

Intel stands to benefit from both customer diversification efforts and government-backed incentives aimed at strengthening domestic chip production. One of the most notable developments last quarter was Intel's growing collaboration with Nvidia, which included efforts to integrate Intel's x86 CPUs with Nvidia's NVLink technology.

Beyond operational improvements, Intel is also strengthening its financial position. The company had more than $30 billion in cash and short-term investments at the end of Q3. This included government support, private investment from SoftBank Group, and proceeds from asset monetization. The company also reduced its debt load and reaffirmed its goal of continued deleveraging through 2026. Even after heavy capital spending, free cash flow turned positive at $900 million.

Analysts expect $13.38 billion in revenue for the fourth quarter alongside $0.08 in profit per share. For the full year, analysts anticipate revenue of $52.5 billion with $0.34 in earnings. Earnings are further expected to increase by 78.5% in 2026. If the company can sustain this momentum, 2026 may be remembered as the year Intel re-established itself as a serious force in the AI-driven semiconductor space.

What Is Wall Street Saying About Intel Stock?

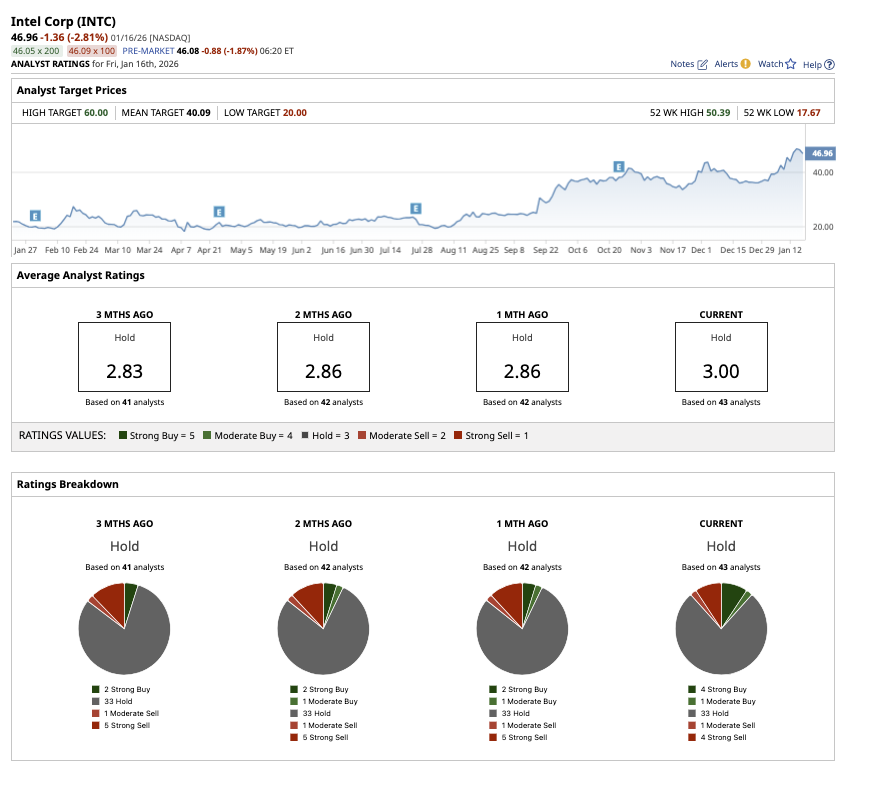

Analyst sentiment remains cautious but stable. Overall, Wall Street rates Intel stock a “Hold.” Of the 43 analysts covering the stock, four rate it a “Strong Buy,” one says it is a “Moderate Buy,” 33 rate it a “Hold,” one rates it as a “Moderate Sell,” and four suggest a “Strong Sell.” The stock has surpassed its average target price of $40.09. However, the Street-high estimate of $60 suggests the stock has upside potential of 28% over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy the Dip in 3M Stock Today?

- Is Ryanair Stock a Buy, Sell, or Hold as Elon Musk Proposes Buying the Discount Airline?

- This Little-Known Fertility Stock Is Up 215% in the Past 5 Days. Should You Chase the Mysterious Penny Stock Rally Here?

- Intel Stock Is Already Up 19% in 2026. Can Q4 Earnings Propel It Higher in 2026?