Taiwan Semiconductor Manufacturing Company (TSM) sits at the very center of the global artificial intelligence (AI) boom, supplying the advanced chips that power everything from data centers to consumer devices. As demand for AI chips continues to grow rapidly, so too has TSMC’s role as the indispensable backbone of the semiconductor ecosystem. But with that position comes enormous responsibility and risk, especially as capital spending reaches historic levels.

This year, TSMC is preparing to deploy an eye-watering $52 billion to $56 billion in capital expenditures, much of it aimed at expanding AI-related manufacturing capacity. It’s a bold bet that the AI boom will prove durable, not fleeting. Still, even as customers clamor for more advanced chips, the company is acutely aware of the danger of getting the timing wrong. Overbuild too aggressively, and TSMC could be left with underutilized factories and compressed margins. Move too cautiously, and it risks ceding ground in the most important technology race of the decade. That tension was on full display when CEO C.C. Wei candidly admitted, “I’m also very nervous,” when discussing AI demand.

Let's unpack what’s behind TSMC’s massive capex plans as it navigates one of the most consequential periods in its history.

About Taiwan Semiconductor Manufacturing Co. Stock

Founded in 1987 by former Texas Instruments executive Morris Chang, along with Taiwan’s government and other partners, Taiwan Semiconductor Manufacturing Company has grown into the world’s leading manufacturer of high-performance chips, particularly those used in AI data centers, vehicles, and mobile devices. TSMC is Nvidia’s (NVDA) main chip supplier. Notably, the Taiwan-based company currently commands more than 95% of the global market for AI chip manufacturing. TSMC also manufactures the core processors used in Apple’s (AAPL) iPhones, Qualcomm’s (QCOM) mobile chipsets, and processors designed by Advanced Micro Devices (AMD). With a market cap of $1.78 trillion, it ranks as the world’s sixth-largest publicly traded company.

Shares of the Taiwanese chip manufacturer started the new year with a bang, climbing 8% year-to-date (YTD). The latest burst of positive momentum was driven by its upbeat Q4 results and guidance.

TSMC Stock Pops After Record Quarter

Last Thursday, U.S.-listed shares of Taiwan Semiconductor Manufacturing jumped over +4% after the company posted a record Q4 profit, projected faster-than-expected 2026 revenue growth, and provided blockbuster capital expenditure guidance for this year.

TSMC reported a record net profit of $505.74 billion New Taiwan dollars ($16.02 billion), up 35% from the same period a year earlier and well above analysts’ estimates. The company’s revenue rose 20.5% year-over-year (YoY) to NT$1.046 trillion, slowing from the prior quarter’s pace but still coming in within its guidance. In U.S. dollar terms, TSMC said revenue totaled $33.73 billion, up 26% YoY. The company’s high-performance computing segment, which includes AI and 5G applications, accounted for the majority of quarterly sales at 55%. Demand from smartphones accounted for 32% of total sales. Notably, its 2025 revenue stood at $122.4 billion, marking the first time the company has surpassed $100 billion in annual sales.

Meanwhile, TSMC’s gross margin for the quarter came in at 62.3%, well above expectations. Zavier Wong, a market analyst at eToro, described the figure as “impressive,” particularly as the company continues to scale while transitioning to more advanced and margin-dilutive nodes. Separately, Bernstein analyst David Dai said, “Margin is the real surprise.”

“Our business in the fourth quarter was supported by strong demand for our leading-edge process technologies,” said TSMC Chief Financial Officer Wendell Huang in a statement. “Moving into first quarter 2026, we expect our business to be supported by continued strong demand for our leading-edge process technologies.”

Looking ahead, TSMC said it expects current-quarter revenue to range between $34.6 billion and $35.8 billion in U.S. dollar terms, up 4% sequentially and 38% YoY at the midpoint. For 2026, TSMC executives told analysts they anticipate revenue growth of about 30%, surpassing the average analyst estimate. Moreover, on a conference call, TSMC CEO C.C. Wei raised the company’s AI-related chip revenue growth forecast to a mid-to-high 50% annual rate for 2024–2029, up from the prior mid-40% outlook. He said TSMC is seeing growing AI adoption across consumers, enterprises, and sovereign governments, adding that major cloud providers are requesting additional capacity to meet customer demand.

The $56 Billion ‘Disaster’ TSMC Wants to Avoid in 2026

The biggest surprise in TSMC’s earnings report was its capital expenditure outlook for this year, set at $52 billion to $56 billion, well above its $40.9 billion capex in 2025. Moreover, TSMC executives said the company expects capex to remain elevated over the next three years. That signals that the company is prepared to make substantial investments in expanding its chip-manufacturing capacity.

On the one hand, TSMC’s blockbuster capex guidance signaled its strong confidence in the durability of the global AI boom. In other words, the company plans to invest heavily to expand capacity to meet relentless chip demand, suggesting it does not anticipate any slowdown in orders from customers like Nvidia, Alphabet (GOOG) (GOOGL), and Apple. That essentially helped reignite momentum in the AI trade at the end of last week, sparking a global rally in chip stocks. On the other hand, with the company caught in the middle of a trade agreement between Taiwan and the U.S., some investors began to question how much of the blowout capex forecast reflects its confidence in a long-term AI boom versus the need to build manufacturing facilities in the U.S. under the deal. Well, let’s take a closer look.

TSMC CEO C.C. Wei said on the earnings call that the decision to ramp up spending came after months of checks with major customers and reflects confirmed AI-driven demand. J.P. Morgan analyst Gokul Hariharan supported that view, writing in a research note, “We believe that TSMC has been quite prudent in its capacity planning, with sufficient checks built in for the typically overenthusiastic forecasting from customers at this stage of the upcycle.” During the Q&A session, Wei said TSMC’s aggressive spending is not reckless speculation but a measured response to what the company sees as a multi-year growth engine. “You’re trying to ask us whether AI demand is real or not. I’m also very nervous about it,” Wei said in response to an analyst’s question. He added, “We’re investing $52 billion to $56 billion in capex, right? If we don’t do it carefully, that’d be a big disaster for TSMC.” TSMC plans to allocate roughly 10% of its capex to specialty technologies, 10% to 20% to advanced packaging, and about 70% to advanced equipment purchases and the construction of new advanced logic fabs.

Now, let’s move on to the U.S.-Taiwan trade deal and TSMC’s role in it. One explanation for at least part of the blockbuster capex plans could lie in the terms of the agreement. Last week, Taiwan pledged to invest at least $250 billion in semiconductor and technology manufacturing in the U.S. in exchange for a reduction of tariffs on Taiwanese goods to 15%. The deal also includes an additional $250 billion in credit guarantees from Taiwan to drive further investment in the U.S. That sum includes the $165 billion TSMC has already pledged to build six new logic-chip manufacturing facilities.

Meanwhile, Bloomberg reported that TSMC is considering building at least four additional chipmaking facilities in the U.S. beyond the six already planned, a move that could require roughly $100 billion in extra capital. That implies TSMC will need to have elevated capex over the coming years to meet those commitments. Essentially, expanding manufacturing in the U.S. allows the company to reduce the risk of semiconductor tariffs and ease investor concerns surrounding China’s ambitions toward Taiwan. And coupled with Wei’s assurances of “confirmed AI-driven demand,” this is expected to bode well for the company’s long-term growth prospects.

What Do Analysts Expect For TSM Stock?

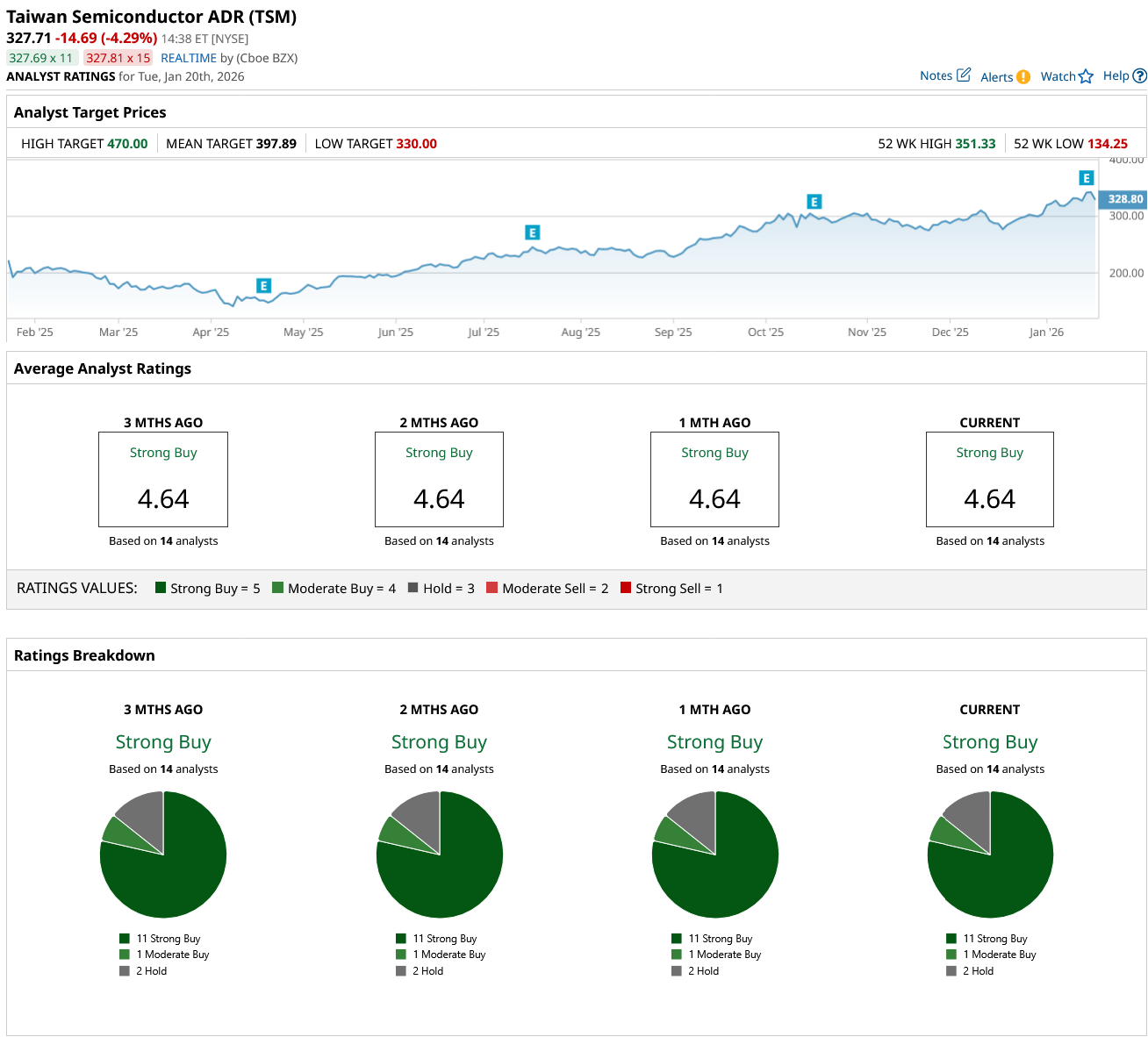

Wall Street analysts have a consensus rating of “Strong Buy” on TSM stock, reflecting strong optimism about the company’s growth prospects. Out of the 14 analysts covering the stock, 11 recommend a “Strong Buy,” one suggests a “Moderate Buy,” and two advise holding. The average price target for TSMC stock stands at $382.33, implying an 17% upside potential from current levels.

On the date of publication, Oleksandr Pylypenko did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Intel Stock Is Already Up 19% in 2026. Can Q4 Earnings Propel It Higher in 2026?

- TSLA Stock Falls 3% as Musk Spats with Ryanair CEO Michael O’Leary. How Should You Play Tesla Here?

- ‘I’m Also Very Nervous’ TSMC CEO C.C. Wei says on AI Demand. Here’s the $56 Billion ‘Disaster’ Taiwan Semi Wants to Avoid in 2026.

- 3 Software Stocks to Sell Before AI Replaces Them Entirely