Warren Buffett's annual letters to Berkshire Hathaway (BRK.A) (BRK.B) shareholders have become legendary for their candid assessments of business performance and investment philosophy. In his 2020 letter, Buffett revealed that Berkshire Hathaway had returned an astounding 2,810,526% since he took control in 1965. The Oracle of Omaha attributed most of that value creation to four businesses he called “jewels.”

Five years later, Berkshire shares have returned another 115%, suggesting those crown jewels continue to generate exceptional returns. Among them, Apple (AAPL) stands out as both the largest holding and the most controversial recent position.

Berkshire's initial $40 billion stake in Apple has generated more than $100 billion in profits, making it one of the most successful investments on Wall Street. Yet Buffett has been aggressively selling AAPL stock. He has unloaded nearly 70% of his Apple shares since 2023, including a 49% reduction in Q2 2024.

Buffett initially attributed the sales to tax planning. However, the magnitude of selling over the last two years may have meant that Berkshire is wary of the iPhone maker’s slowing growth and steep valuation. Notably, Apple is also struggling to build a competitive moat in the artificial intelligence segment compared to tech peers such as Microsoft (MSFT), Nvidia (NVDA), and Alphabet (GOOG) (GOOGL).

At the end of fiscal 2025, Apple remains Berkshire’s largest holding, accounting for almost $65 billion and 21% of its equity portfolio. So, let’s see if you should own AAPL stock at the current valuation right now.

How Did Apple Perform in Fiscal Q4?

Apple reported fiscal fourth quarter (ended in September) results that crushed expectations and set the stage for what CEO Tim Cook called the company's best December quarter ever.

Revenue hit $102.5 billion, up 8% year-over-year (YoY) and a September quarter record, while earnings per share came in at $1.85, also a Q4 record. In fiscal 2025, Apple reported total revenue of $416 billion, setting all-time records across most product categories and geographic markets.

Apple’s iPhone revenue rose 6% YoY to $49 billion, despite supply constraints on several iPhone 16 and iPhone 17 models. Cook said the constraints weren't manufacturing-related but simply reflected demand outstripping what Apple had planned to build. The company currently faces constraints on multiple iPhone 17 models, though Cook declined to predict when supply and demand would balance.

Apple set a September quarter record for iPhone upgraders and expects double-digit iPhone growth in the December quarter, which would be the best iPhone quarter in company history.

Services delivered an all-time revenue record of $28.8 billion, growing 15% YoY. That's the fastest services growth rate in two years and pushed fiscal year services revenue past $100 billion for the first time.

The strength came from broad-based growth across both categories and geographies, with advertising, the App Store, cloud services, music, payment services, and video all setting new records. CFO Kevan Parekh emphasized the growth was entirely organic with no unusual tax impacts or one-time items.

China remains a focus area where Apple faced challenges. Greater China revenue declined 4% in Q4, primarily due to iPhone supply constraints. Cook visited the country recently and reported that store traffic is up significantly YoY, with strong reception for the iPhone 17 family. He expects Apple to return to growth in China during the December quarter, aided partly by government smartphone subsidies that apply to certain price ranges.

Apple guided to 10% to 12% revenue growth for the December quarter, which includes an estimated $1.4 billion in tariff-related costs. That tariff estimate reflects the recent reduction in tariffs on Chinese imports from 20% to 10%. Gross margins are expected to be between 47% and 48% despite higher costs from new product launches.

What Is the AAPL Stock Price Target?

Analysts tracking AAPL stock forecast the hardware giant to increase revenue from $416 billion in fiscal 2025 to $578 billion in fiscal 2030. In this period, adjusted earnings are forecast to grow from $7.46 per share to $13.64 per share, indicating an annual growth of 12.8%.

In the past 10 years, AAPL stock increased earnings by 12.5% YoY on average. During this period, its average price-to-earnings multiple was 22.6x. If the tech giant trades at its historical average, it will be priced around $308 in late 2028, which is above the current price of $272.

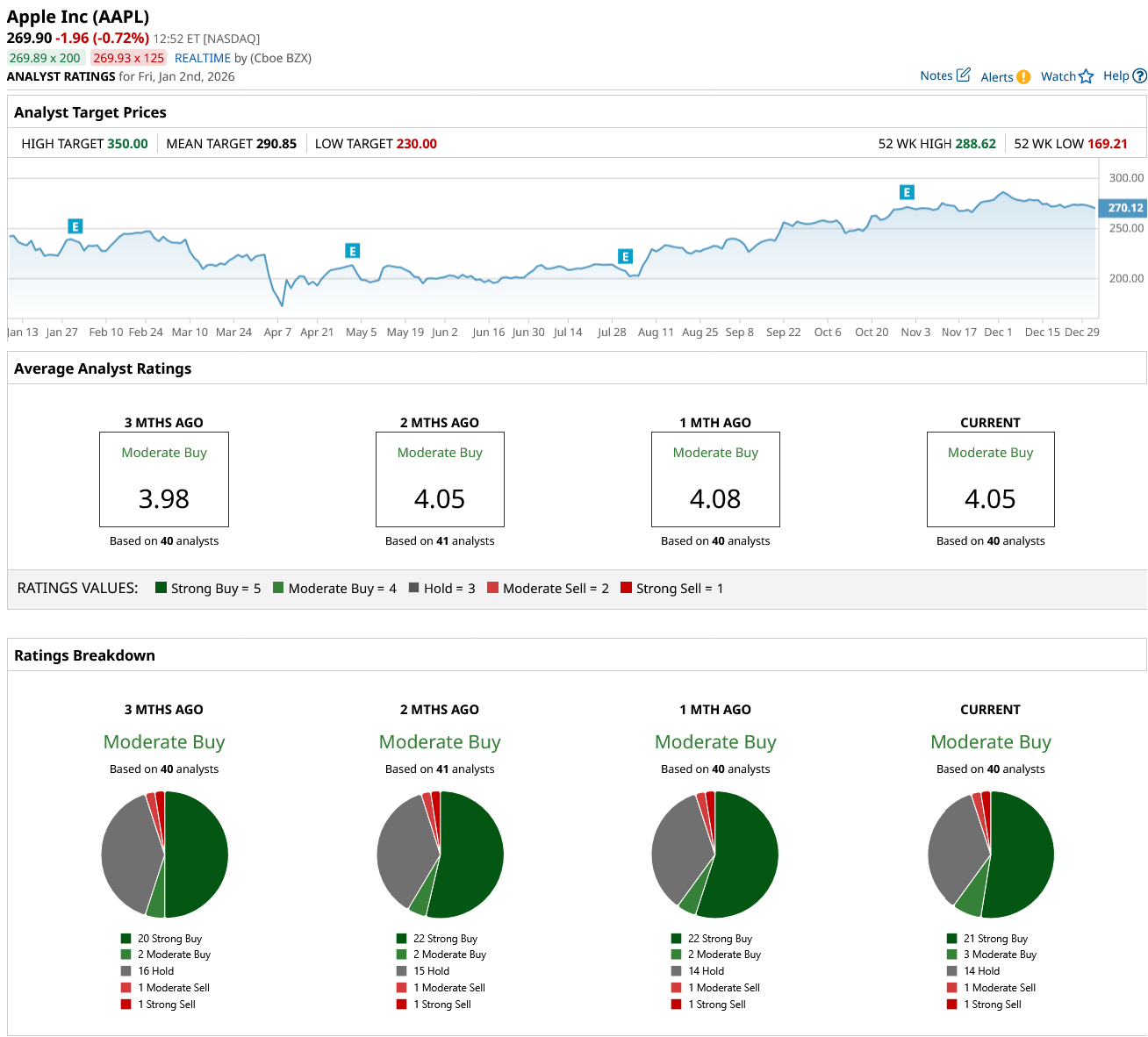

Out of the 40 analysts tracking AAPL stock, 21 recommend “Strong Buy,” three recommend “Moderate Buy,” 14 recommend “Hold,” one recommends “Moderate Sell,” and one recommends “Strong Sell.” The average AAPL stock price target is $291, above the current price of $272.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- China Is Backing EV Stocks Again. Does That Make Li Auto a Buy for 2026?

- As SpaceX Readies for Massive IPO, This Is the Space Stock You Should Be Buying

- Unusual Options Activity: Revisiting The Best and Worst Bets From Q4 2025

- This Stock Is One of Warren Buffett’s ‘Crown Jewels.’ Should You Buy It for 2026?