Warren Buffett's Berkshire Hathaway (BRK.A) (BRK.B) has compounded at roughly 20% annually over six decades, beating the S&P 500's returns by almost 100%. Valued at a market cap of $1 trillion, Berkshire Hathaway is among the most prominent companies globally.

Its extraordinary track record has inspired a cohort of insurance-based conglomerates attempting to replicate Berkshire’s business model. Berkshire uses property and casualty insurance to generate low-cost float, which is then deployed into public equities and wholly owned businesses.

According to a recent report from Barron’s, Fairfax Financial (FRFHF) could be the next Berkshire Hathaway. Fairfax operates a diversified portfolio spanning insurance, reinsurance, restaurants, hospitality, sports equipment manufacturing, and agricultural technology.

The Canada-based insurance giant has returned more than 350% to shareholders over the past decade after adjusting for dividend reinvestments. Whether Fairfax can scale anywhere close to Berkshire's magnitude remains the trillion-dollar question.

Is Fairfax Financial Stock a Good Buy?

Fairfax Financial delivered another strong quarter, reinforcing why investors are starting to view it as a legitimate Berkshire Hathaway alternative. It reported net earnings of $1.2 billion in the third quarter, bringing year-to-date (YTD) earnings to $3.5 billion. Book value per share climbed to $1,204, representing a 15.1% increase for the first nine months after adjusting for the $15 dividend.

The insurance segment continues to fire on all cylinders. Fairfax posted a combined ratio of 92% in the quarter, producing an underwriting profit of $540 million. That's only the third-best quarter in company history, with the top two both being fourth quarters that benefited from reserve releases.

Every insurance segment generated underwriting profit, which is rare across such a diversified portfolio. The company wrote $8.2 billion in gross premiums during the quarter, up 3.1% excluding Gulf Insurance.

Rating agencies are taking notice of this consistent performance. Standard & Poor's upgraded the financial strength rating of Fairfax's core operating companies to AA- in the second quarter. A.M. Best followed by upgrading Allied World, Crum & Forster, and Northbridge to A+, with Odyssey already at that level.

The investment portfolio continues to build value that doesn't show up in reported book value. Fairfax holds $2.5 billion in unrealized gains on equity-accounted investments and consolidated holdings not marked to market.

That represents $117 per share in pretax unrealized gains, up roughly $1 billion for the year, primarily driven by Eurobank. Fairfax announced it will sell its 80% stake in Eurolife's life insurance operations to Eurobank for approximately $940 million, generating an expected pretax gain of approximately $250 million upon closing in early 2026.

Fairfax also made a takeover offer for Kennedy-Wilson at $10.25 per share alongside CEO Bill McMorrow, representing a 38% premium. It repurchased 541,794 shares during the first nine months at an average price of $1,581 per share and continues to purchase shares in the fourth quarter.

Is FRFHF Stock Undervalued?

Management emphasized that it expects annual operating income of approximately $5 billion to remain sustainable over the next three to four years, with $2.5 billion from interest and dividends, $1.5 billion from underwriting profit, and $1 billion from associates and noninsurance companies.

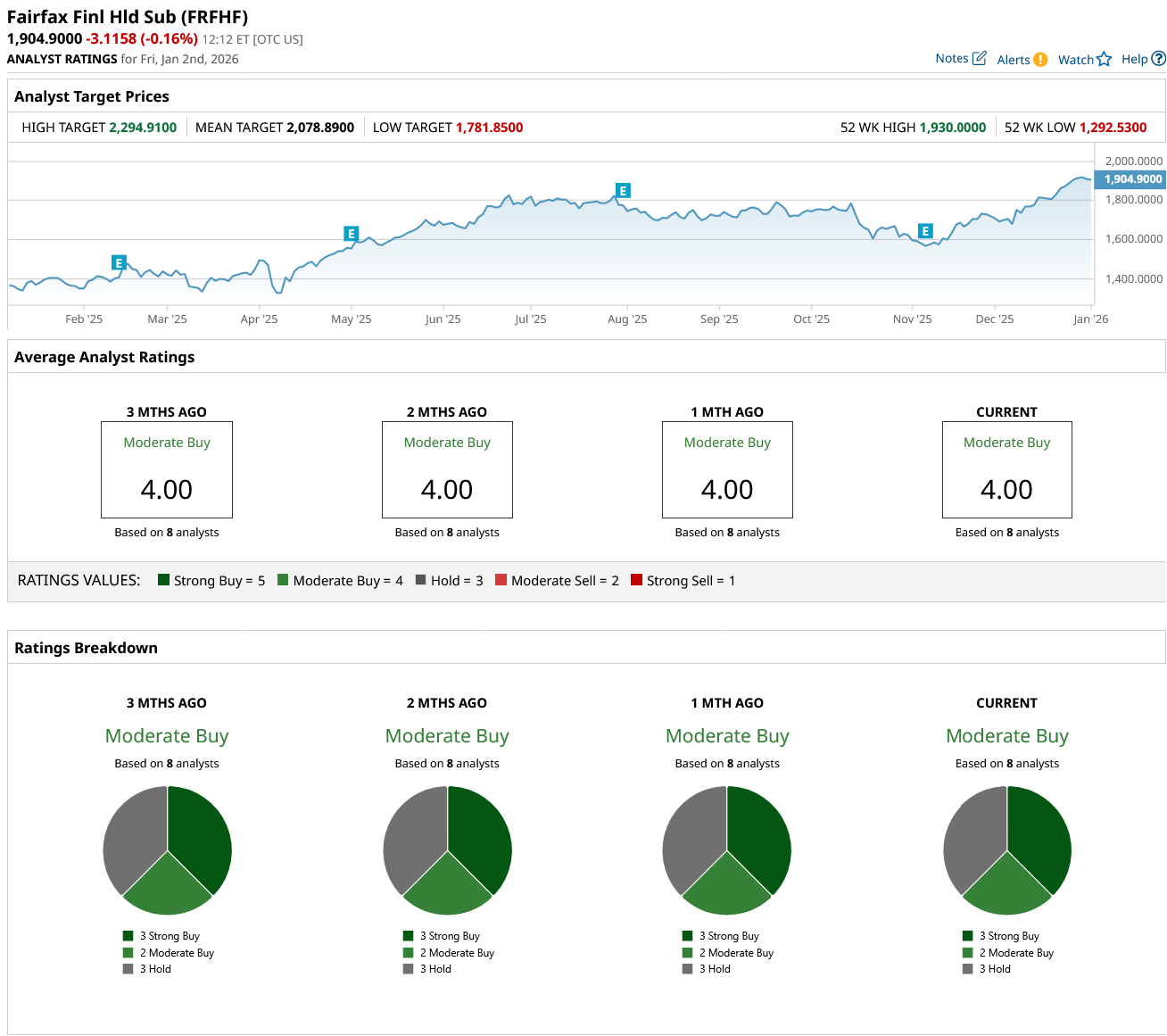

Fairfax currently pays shareholders an annual dividend of $15 per share, yielding 0.6%, which is not very attractive. However, these payouts have risen from $1.40 per share in 2006. Out of the eight analysts covering FRFHF stock, three recommend “Strong Buy,” two recommend “Moderate Buy,” and three recommend “Hold.” The average Fairfax stock price target is $2,079, above the current price of $1,905.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart