Barclays elevated Dell Technologies (DELL) to an “Overweight” rating on Thursday. The investment firm cited the company's commanding position in AI server infrastructure and called its operational discipline “best in class” as the tech giant navigates surging demand for artificial intelligence hardware.

Analyst Tim Long maintained his $148 price target on DELL stock while expressing growing confidence in Dell's ability to balance rapid AI revenue growth with margin stability. The upgrade comes as Dell prepares to ship approximately $9.4 billion worth of AI servers in the fourth quarter alone, pushing full-year AI server revenue to around $25 billion. Long projects explosive growth continuing through fiscal 2027, modeling 155% expansion in AI orders for fiscal 2026, followed by 60% growth the following year.

Long acknowledged that concerns about AI servers compressing gross margins are well understood by the market, with these products generating high single-digit gross margins compared to Dell's traditional higher-margin businesses. However, the analyst emphasized that Dell has maintained operating margins in the mid-single digits in its AI server segment, indicating pricing power and operational efficiency.

Beyond AI, Barclays highlighted Dell's expanding position in recovering enterprise server and storage markets. Dell continues to increase the mix of proprietary intellectual property in its storage offerings. It is also poised to benefit from a substantial installed base of customers running older-generation servers that present meaningful upgrade potential.

Moreover, Long praised Dell's supply chain leadership as a key advantage as it navigates rising commodity costs, as memory prices continue their upward trajectory in an inflationary environment.

How Did Dell Perform in Q3 of 2025?

In Q3 of 2025, Dell reported record revenue of $27 billion and adjusted earnings per share of $2.59. The top-line growth was driven by AI server infrastructure as Dell gains traction in the AI hardware segment.

Notably, AI server orders reached an all-time high of $12.3 billion in Q3, bringing year-to-date (YTD) bookings to $30 billion and pushing the backlog to $18.4 billion. The AI momentum appears sustainable, as Dell shipped $5.6 billion in AI servers during the quarter and guided to roughly $9.4 billion in fourth-quarter shipments, which would bring full-year AI server revenue to approximately $25 billion. This represents a remarkable trajectory for a business that shipped just $1.5 billion two years ago and $10 billion last year.

Management emphasized that the five-quarter pipeline continues to grow across all customer segments, including neoclouds, sovereign governments, and enterprise clients. Dell's competitive advantage stems from forward-deployed engineering teams that work directly with hyperscale customers to optimize rack-scale architectures for power consumption and performance.

The Infrastructure Solutions Group grew 24% while operating margins in the segment improved by 360 basis points sequentially to 12.4%. Traditional server demand strengthened throughout Q3, growing in double digits as enterprises modernize aging infrastructure and consolidate workloads. Storage revenue declined just 1% overall, but Dell's proprietary IP portfolio, including PowerStore, achieved its seventh consecutive quarter of growth with six quarters of double-digit expansion.

The company faces headwinds from rising memory component costs but expressed confidence in its ability to pass through pricing increases given tight industry supply and strong customer demand. Dell returned $1.6 billion to shareholders via buybacks and dividends while maintaining a core leverage ratio of 1.6 times.

Is DELL Stock Undervalued?

Analysts covering DELL stock forecast revenue to increase from $95.6 billion in 2025 to $149 billion in 2029. In this period, adjusted earnings per share are forecast to grow from $8.14 to $17.50. Dell's stock trades at 10.3x forward FCF, which is similar to its five-year average. At a similar multiple, DELL stock should gain 50% over the next three years.

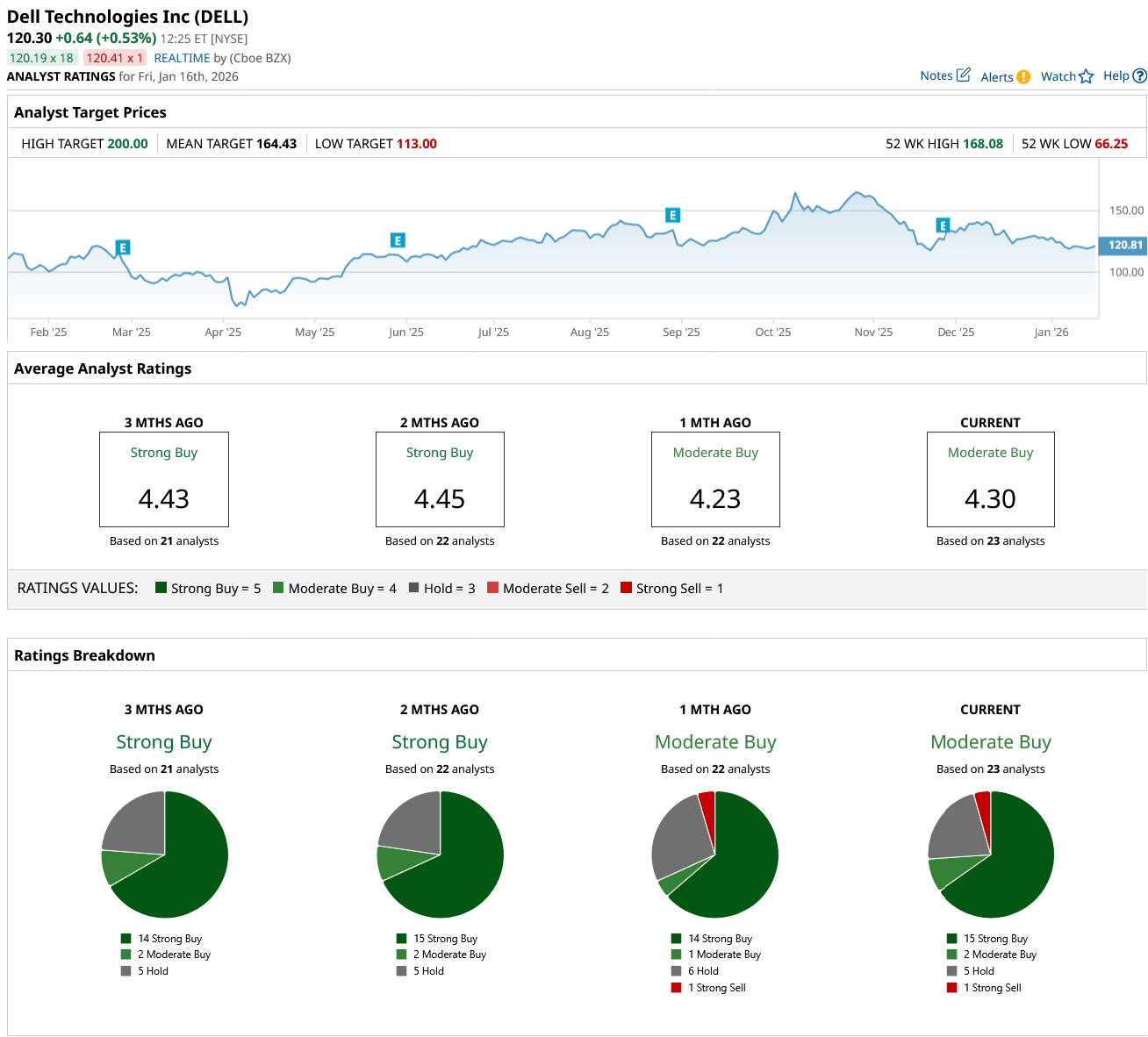

Out of the 23 analysts covering DELL, 15 recommend “Strong Buy,” two recommend “Moderate Buy,” five recommend “Hold,” and one recommends “Strong Sell.” The average DELL stock price target is $164.43, above the current price of $120.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- SoFi CEO Anthony Noto Says His Company Is Poised to Win if Trump Caps Credit Card Rates: Why Personal Loans Could Come Out on Top

- Hedge Funds Are Shorting This Classic Warren Buffett Stock. Should You Sell Shares Now?

- This Under-the-Radar Pet Stock Could Be the Biggest Meme Buy in January 2026

- Applied Materials Stock Just Hit a New All-Time High. Should You Buy AMAT Here?