With a year-to-date (YTD) loss of nearly 5%, Apple (AAPL) is underperforming the average S&P 500 Index ($SPX) peer this year. The story is not different from last year, when it gained a mere 8%, which was less than half of what the broad-based index delivered.

Adding insult to injury is the fact that Alphabet (GOOG) (GOOGL)—which was the best-performing Magnificent 7 stock in 2025—has surpassed Apple to become the world’s second-biggest company after Nvidia (NVDA). If not for Microsoft’s (MSFT) underperformance over the last year, the iPhone maker might have been pushed to the fourth position.

Apple became the world’s most valuable company in 2011, when it surpassed ExxonMobil (XOM), which was then holding the title. It was a key moment as a tech company took the crown from an energy giant, which was a play on the “old economy.”

Alphabet's Market Cap Has Surpassed Apple

Until 2024, the Tim Cook-led company held on to the position of being the world’s largest company for the most part, aside from a few brief incursions. Things, however, changed in 2024 when both Nvidia and Microsoft surpassed Apple, leading to a churn at the top. While Nvidia is off its highs and lost its $5 trillion market cap, it is still well ahead of Apple.

The change in pecking order is not that difficult to explain and is a reflection of how markets are valuing artificial intelligence (AI) plays. Nvidia, whose chips lay the foundation of AI infrastructure, is unsurprisingly the world’s most valuable company. Microsoft, however, has been out of favor with markets, which I believe is in part due to concerns over OpenAI. Microsoft is the ChatGPT parent’s biggest investor and is a play on the company’s fortunes.

Alphabet, which, like Apple, was considered an AI laggard, stepped up its game with Gemini, which reportedly prompted Sam Altman to declare a “code red” at OpenAI. Alphabet’s Tensor Processing Units (TPUs) are also seeing demand from third parties. While Anthropic has agreed to buy up to a million of these in what’s a deal valued at tens of billions, Meta Platforms (META) is also reportedly in talks to buy these. While Nvidia still has a lead over other chipmakers, companies have been trying to diversify their chip sourcing to reduce reliance on the Jensen Huang-led company.

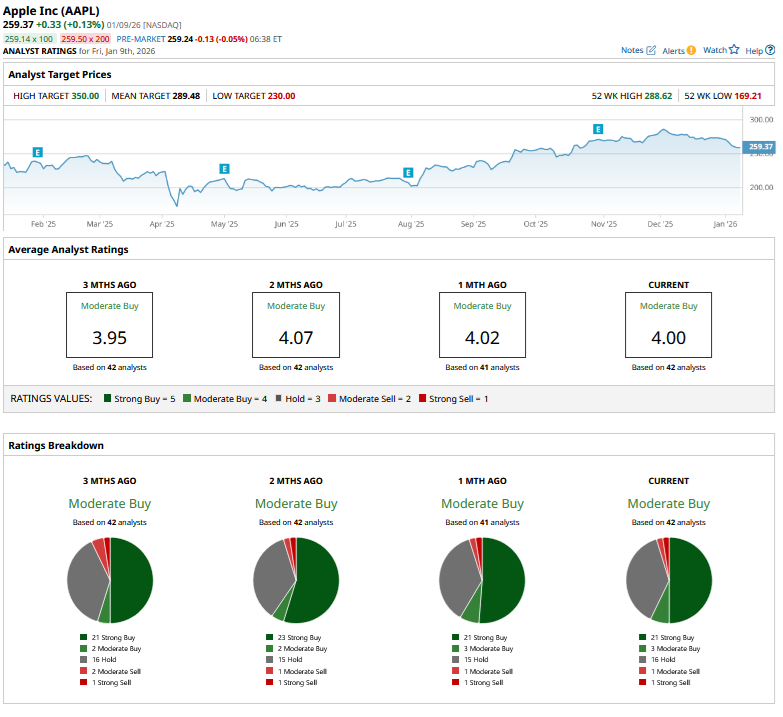

AAPL Stock Forecast

Meanwhile, it appears to be déjà vu for AAPL stock this year, as it received a downgrade from Raymond James at the start of the year. The brokerage sees Apple’s valuations as stretched and believes that the strength in iPhone 17 sales is priced into the stock. This is, incidentally, the third consecutive year that Apple has been hit with downgrades at the beginning of the year.

Apple has a consensus rating of “Moderate Buy” from the 42 analysts covering the stock. The stock’s mean target price of $289.48 is 11.6% higher than the Jan. 9 closing price. Clearly, the average sell-side analyst does not see much in the way of gains from the Cupertino-based company this year.

Will Apple Stock Go Back Up?

As I noted in a previous article, Apple might outperform tech peers if the feared AI bubble bursts. The stock never really benefited from the AI rally and is therefore at the least risk in a crash. Moreover, Apple could be a bastion of safety and could see buying interest if the long-feared AI bubble bursts.

The second scenario could be Apple stepping up its game in AI substantially. The company is expected to release the updated Siri this year while adding more “Apple Intelligence” features to its phones. The company would, however, need to come up with pathbreaking features, as the gradual improvements haven't struck a chord with markets. All said, given Apple’s forward price-to-earnings (P/E) multiple of nearly 32x, I don’t see the stock jumping sharply this year unless it can come up with something really interesting. As for Apple becoming the biggest company again this year, I believe it would rely more on NVDA stock falling instead of AAPL stock bridging the gap by itself.

On the date of publication, Mohit Oberoi had a position in: AAPL , NVDA , GOOG , MSFT , META . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart