New York-based BlackRock, Inc. (BLK) is the world’s largest asset manager, overseeing trillions of dollars in assets across equities, fixed income, multi-asset strategies, alternatives, and cash management. The firm is best known for its iShares ETF franchise and its Aladdin risk-management and analytics platform, serving institutional investors, governments, corporations, and individual clients globally. It is currently valued at a market cap of $164.5 billion.

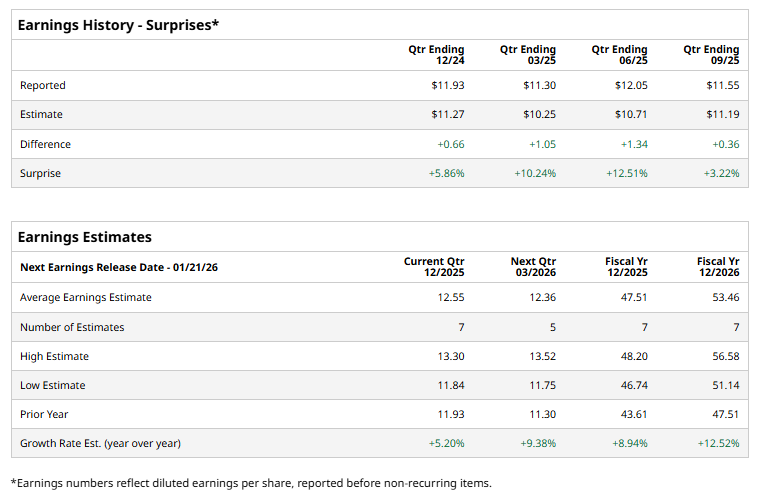

The asset management giant is expected to report its fourth-quarter results next month. Ahead of the event, analysts expect BLK to deliver an adjusted EPS of $12.55, up 5.2% from $11.93 reported in the year-ago quarter. The company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For fiscal 2025, analysts expect BlackRock’s EPS to rise 8.9% year over year to $47.51 from $43.61 reported in 2024. Meanwhile, in fiscal 2026, its earnings are expected to increase 12.5% year over year to $53.46 per share.

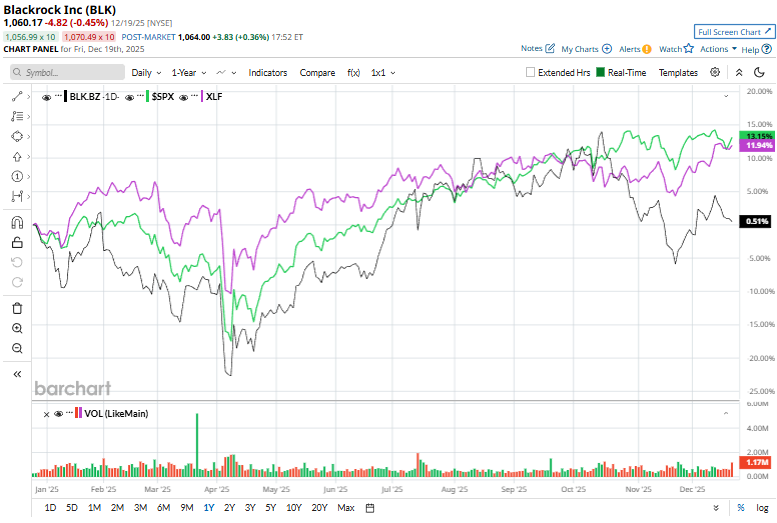

BlackRock’s stock prices have climbed 4.3% over the past 52 weeks, trailing the S&P 500 Index’s ($SPX) 16.5% gains and the Financial Select Sector SPDR Fund’s (XLF) 14.7% surge during the same time frame.

BlackRock shares gained 1.7% on Dec. 11 after the firm launched the iShares Total USD Fixed Income Market ETF (BTOT), the first index ETF designed to provide broad exposure to the entire taxable U.S. bond market. The new ETF expands beyond traditional benchmarks by including additional fixed-income sectors, offering investors a more diversified and resilient fixed-income solution amid evolving bond market dynamics and higher interest rate volatility.

Analysts remain optimistic about the stock’s prospects, and BLK maintains a consensus “Strong Buy” rating overall. Of the 18 analysts covering the stock, opinions include 12 “Strong Buys,” three “Moderate Buys,” and three “Holds.” BLK’s mean price target of $1,301 suggests a 22.7% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Google Launches Gemini 3 Flash, Should You Buy, Sell, or Hold GOOGL Stock?

- Amazon Could Invest $10 Billion in OpenAI. Should You Invest in AMZN Stock First?

- Holiday Trading, Inflation Data and Other Key Things to Watch this Week

- Analysts Are Hot on the Foldable iPhone. Should You Buy AAPL Stock Before Apple’s Next Big Product Launch?