Rising tech name CoreWeave (CRWV) announced a partnership with foundation model firm Poolside on Oct. 15 to deliver an Nvidia (NVDA) GB300 NVL72 systems cluster, which contains more than 40,000 GPUs. This marks a significant step, particularly as CoreWeave is also set to provide Poolside with cloud solutions for Project Horizon, a two gigawatt artificial intelligence (AI) campus in West Texas.

The state-of-the-art data center will be developed over eight phases of 250 megawatts each, and is expected to generate its own power. The project underscores the demand for AI infrastructure providers and their accelerating potential.

CRWV stock climbed 3.9% on Oct. 15 following the news. Should you buy CoreWeave stock now?

About CoreWeave Stock

Based in Livingston, New Jersey, CoreWeave is a prominent AI cloud computing company specializing in high-performance GPU infrastructure tailored for AI workloads. The firm offers a cutting-edge cloud platform designed to streamline the deployment, management, and scalability of AI applications, including machine learning, reinforcement learning, and large-scale data processing.

The company supports industry-leading projects and partners with firms like Poolside, providing massive GPU clusters and scalable solutions. The company has a market capitalization of $56 billion.

CoreWeave went public in March 2025 following a successful initial public offering (IPO) that raised $1.5 billion, making it the largest tech IPO in the U.S. since 2021. The company has partnerships with notable AI giants like OpenAI and Nvidia (NVDA). Microsoft (MSFT), which provides cloud services to OpenAI, is one of CoreWeave’s biggest customers.

Over the past six months, CRWV stock has held up well, gaining 124%. However, its stock performance has been volatile. Over the past month, the stock is down 15%. Still, CoreWeave has benefited from continued demand for AI infrastructure services and bullish analyst sentiments.

CRWV stock is currently trading at a stretched valuation. Its price-to-sales ratio of 15.8 times is significantly higher compared to the industry average.

CoreWeave’s Solid Topline Growth

On Aug. 12, CoreWeave reported its second-quarter results for fiscal 2025, recording substantial revenue growth driven by unprecedented demand for AI. The company’s revenue increased 207% year-over-year (YOY) to $1.21 billion. This figure was higher than the $1.08 billion expected by Wall Street analysts.

The company also highlighted a $4 billion deal it struck with OpenAI, in addition to its preexisting $11.9 billion deal. CoreWeave also signed a new hyperscaler customer and expanded on the partnership during the quarter.

The company’s bottom-line losses have also declined significantly YOY. Net loss per share dropped from $1.62 in Q2 2024 to $0.60 in Q2 2025. However, analysts were expecting a smaller loss per share of $0.23. CoreWeave’s adjusted EBITDA also climbed by a staggering 201% from the prior year’s period to $753.17 million.

For the third quarter, CoreWeave expects its topline to be in the range of $1.26 billion to $1.3 billion, while for this year, the firm has a guidance range of $5.15 billion to $5.35 billion. Wall Street analysts project CoreWeave’s loss per share to improve by 67% annually in the next fiscal year to $0.86.

What Do Analysts Think About CoreWeave Stock?

Wall Street analysts have been bullish on CRWV stock. Recently, analysts at Evercore ISI reiterated their “Outperform” rating and a $175 price target after news of the Poolside deal. Evercore ISI analysts believe that the partnership could raise the company’s backlog by approximately $5 billion.

In September, analysts at Wells Fargo upgraded the stock from “Equal Weight” to “Overweight.” They raised the price target from $105 to $170, as they expect the company to benefit from the current AI build cycle and industry shortages, which are likely to persist well into next year. Melius Research analysts also upgraded the stock from “Hold” to “Buy” and set a price target of $165, citing their belief that CoreWeave stands to benefit from growing cloud demand.

Loop Capital analysts also initiated coverage on CoreWeave stock with a “Buy” rating and a $165 price target. Analysts stated that the company is “the largest of a handful of Neoclouds” that is being adopted by Nvidia, major AI labs, and hyperscalers. Analysts also believe that companies’ dedication to innovations surrounding AI is underestimated.

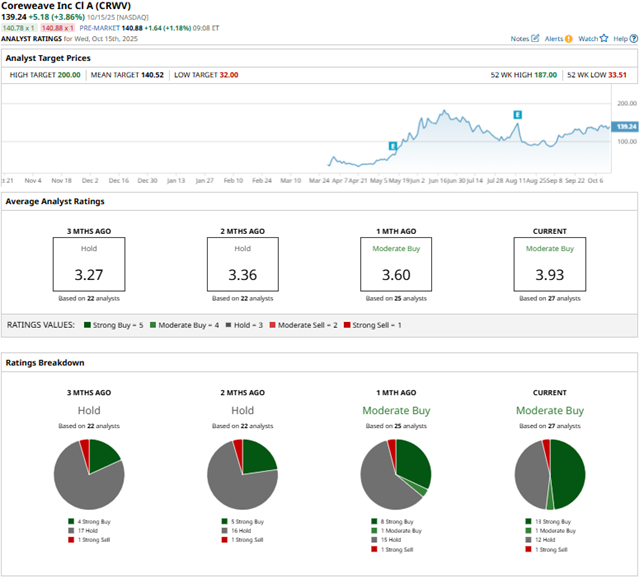

CoreWeave has come into the limelight on Wall Street, with analysts awarding it a consensus “Moderate Buy” rating overall. Of the 27 analysts rating the stock, 13 analysts rate it a “Strong Buy,” one analyst suggests a “Moderate Buy,” 12 analysts play it safe with a “Hold” rating, and one analyst gives a “Strong Sell” rating. The consensus price target of $141.84 represents potential upside of 24% from current levels. Meanwhile, the Street-high price target of $200 indicates potential upside of 75%.

Bottom Line

CoreWeave stands to gain market prominence through its strategic partnerships, including its support of Nvidia’s Blackwell infrastructure expansion. The Poolside deal shows just how in demand the company’s services are and, although bottom-line snags remain, CoreWeave's revenue growth remains robust. Therefore, it might be prudent to consider investing in CRWV stock now.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart