Recent announcements by OpenAI – maker of ChatGPT – are set to transform the workings of the financial industry. Financial services providers, who thrive on helping customers improve their businesses, now have to deal with a new threat in the form of ChatGPT. The AI chatbot will soon help individuals and businesses get personalized answers related to tax, business, and cash flow management, among other things. This can easily be extended to finding suitable loans and mortgages with AI helping find the right ones for the right people, thus improving the acceptance rate.

In such a scenario, the best business plan for any financial company is full integration with ChatGPT, a feat Intuit (INTU) has now achieved. The company will power apps within the ChatGPT interface to help people make better financial decisions, unlocking new growth areas for both companies.

The deal between the two firms is worth over $100 million, and on a very basic level, it combines OpenAI’s LLM expertise with Intuit’s financial prowess. Some of Intuit’s most famous applications include TurboTax, QuickBooks, and Credit Karma, and by setting up strong privacy protocols, both companies will be able to provide these renowned solutions within the ChatGPT interface.

About Intuit Stock

Based in Mountain View, California, Intuit is a fintech company that is best known for helping people manage their finances effectively. The company serves over 100 million customers, offering them financial solutions that are now becoming even more popular thanks to AI integrations.

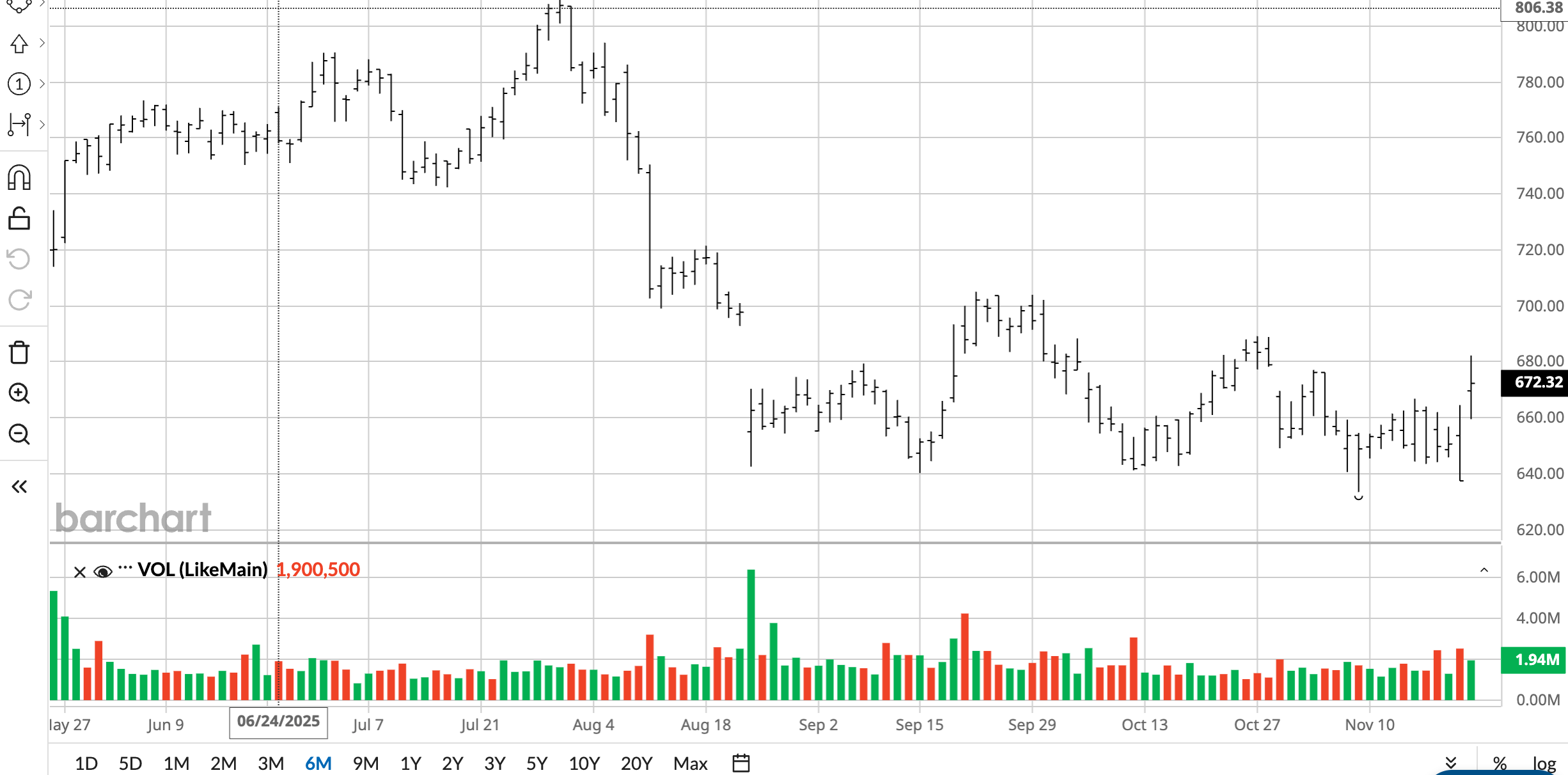

The company’s stock has not had a great year so far, with only 7.6% returns that have underperformed the S&P 500 Index ($SPX)'s 13.2% year-to-date (YTD) gains. After touching $800 per share in July this year, the stock has now fallen below $675.

One would think that a stock that has fallen 20% in about half a year would now be available at an attractive valuation. However, that is not the case wth INTU. It still trades at a forward price-earnings of 103.35x, well above its 5-year average of 46.02x. Its price-sales ratio of 3.19x is nearly 27% above its 5-year average, despite being exactly the same as the IT sector median. It is only the price-cash flow of 24.89x where the stock still trades below the sector median of 19.32x.

One could argue that the stock’s high valuation is justified, especially after the OpenAI deal. However, the stock price continues to follow the typical case of overvaluation, where the stock had clearly run ahead of its fundamentals and is now coming down to more reasonable levels.

What Can Investors Expect From Intuit Stock

Prior to the Aug. 21 Q4 earnings report, Intuit stock had already started falling. While the software industry itself was experiencing negative investor sentiment, Intuit also had some internal issues. For example, Mailchimp was dragging down the company’s growth numbers, with customer retention numbers and revenue both declining. For an acquisition that cost the company $12 billion five years ago, this was alarming.

Similarly, its tax filing offering TurboTax also experienced a lower number of users, especially with more free tax-filing options now available. These worries were baked into earnings, so by the time the earnings arrived, everyone was more concerned about the guidance rather than the earnings.

The integration with ChatGPT will naturally provide a boost as it opens a new growth opportunity, introducing ChatGPT users to the company’s technology. This will also help the company fight off peers like FreshBooks and NerdWallet (NRDS), or Klaviyo (KVYO) in the case of Mailchimp. Analysts will be pressing the company management for details on these in all future earnings, and if investors want to stay on the right side of any volatility, they would be wise to follow any earnings call closely.

What Are Analysts Saying About Intuit Stock?

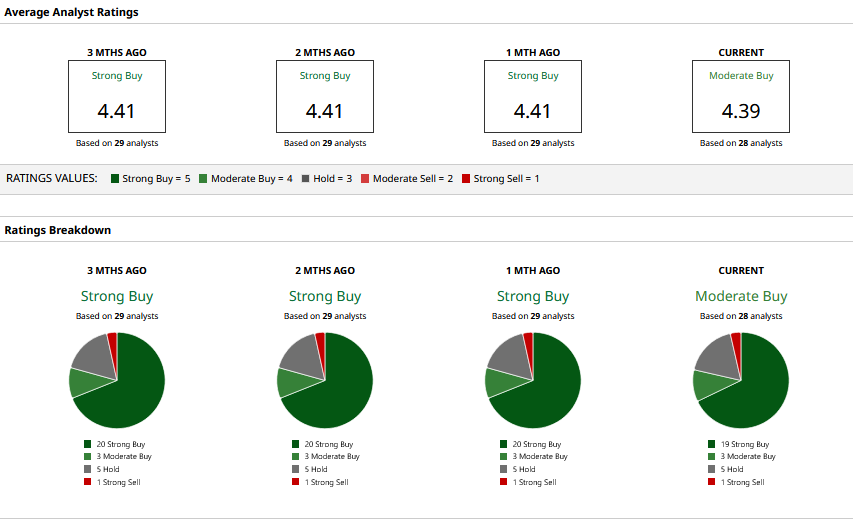

Of the 28 analysts that cover the stock, 19 have a “Strong Buy” rating. This is only going to increase as more analysts digest the potential of the OpenAI deal and come out with their latest estimates and price targets. For now, even the mean target price of $835.46 offers 24% upside. The highest price target of $971 suggests 44% upside. Don’t be surprised if these price targets are revised upward in the coming days.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Ross Stores Stock Had Its Best Week Ever. Here's Why.

- Is Intuit Stock a Buy, Sell, or Hold on New OpenAI Partnership?

- 3 High-Yield Dividend Gambles Paying Up to 9%- And Wall Street Says ‘Buy’

- Elon Musk Says the Job of the Future is No Longer Coding, It’s ‘No Job’ At All. Here’s How Investors Can Prepare.