According to an analysis by Emperador, any disruption in energy exports through this strategic checkpoint may result in a 25% to 40% rise in crude oil prices. Consequently, the global bitumen market would face severe disruptions, including sharp increases in bitumen prices and a halt in supply from the Middle East. This would significantly impact not only producers but also major importers of crude oil and bitumen, including Europe, China, India, African countries, and East Asia.

NEW YORK CITY, NY / ACCESS Newswire / August 6, 2025 / The Strait of Hormuz, through which 18 million barrels of crude oil pass daily and 10 million tons of bitumen annually, is one of the most critical energy arteries in the world. Its closure due to escalating political tensions especially if Iran responds to the reimposition of UN sanctions by three European countries could cause a deep global economic crisis.

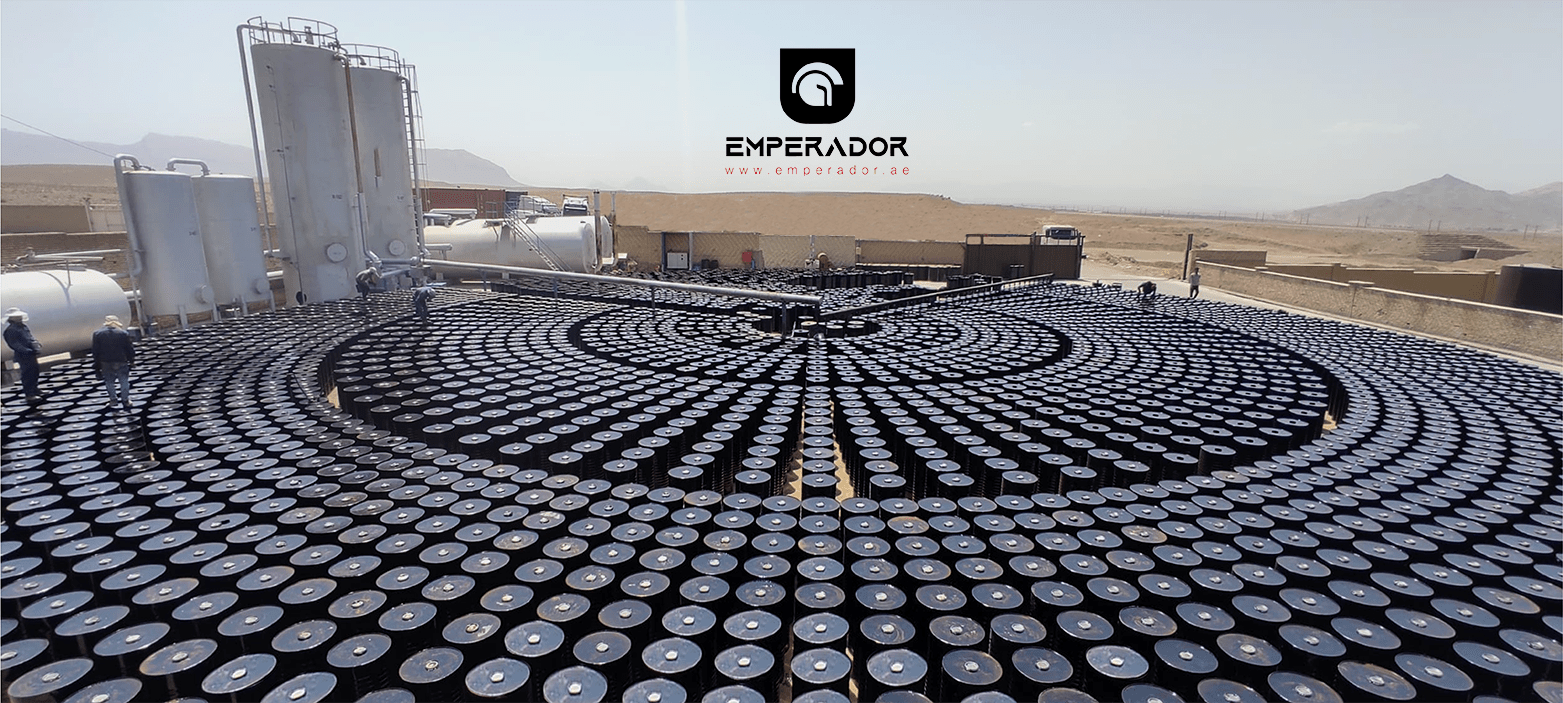

Emperador Bitumen Factory

According to an analysis by Emperador, any disruption in energy exports through this strategic checkpoint may result in a 25% to 40% rise in crude oil prices. Consequently, the global bitumen market would face severe disruptions, including sharp increases in bitumen prices and a halt in supply from the Middle East. This would significantly impact not only producers but also major importers of crude oil and bitumen, including Europe, China, India, African countries, and East Asia.

In East Asia, countries such as South Korea, the Philippines, Malaysia, Vietnam, and Japan, which partially rely on Middle Eastern sources for their energy and bitumen imports, would encounter serious supply shortages. The closure of the Strait would increase the costs of road construction, transportation, and production throughout this region. It would deal a major blow to both the infrastructure and petrochemical sectors. East Asian governments would likely respond quickly by entering multilateral negotiations and, simultaneously, seek to increase imports from alternative suppliers. However, no single source has the capacity to fill this enormous gap.

The international response to this crisis would involve a combination of diplomatic, military, and economic strategies. The United States might attempt to stabilize the market through military threats and the release of oil from its strategic reserves. Europe would explore alternative routes and may even negotiate with Russia. India, which imports around 1.5 million tons of bitumen annually and 5 million barrels of crude oil daily, would face significant challenges in implementing its infrastructure and road construction projects. Arab countries bordering the Persian Gulf would likely position themselves as mediator and would remain deeply concerned about regional stability and the long-term consequences of such tensions.

China, which consumes approximately 10 million tons of bitumen annually, nearly 90 percent of it for road construction, would also be heavily impacted. Around 40% of its bitumen requirements are sourced from Iran and the Middle East. Given China's vital dependence on Middle Eastern crude oil for its refineries and bitumen for large-scale road projects, Beijing would likely engage to resolve the tension. At the same time, China would pivot toward purchasing oil from Russia and Venezuela to partially cover its oil demands.

Ultimately, Emperador notes that the consequences of any disruption in the Strait of Hormuz, from the reshaping of global trade routes to accelerated investment in alternative energy sources, could fundamentally change the world's geopolitical and economic landscape.

Read Emperador's weekly reports of bitumen market trends on Emperador-ae.com, Also, Visit the Bitumen Price page to see the current bitumen price or get information at info@Emperador.ae

Contact Information

Tina TAGHAVINik

Marketing Specialist

se.asia@emperador.ae

+971568134728

Alireza Chegini

CEO

info@emperador.ae

+971504868892

SOURCE: Emperador

View the original press release on ACCESS Newswire