VANCOUVER, BC / ACCESSWIRE / February 23, 2023 / Guanajuato Silver Company Ltd. (the "Company" or "GSilver") (TSXV:GSVR)(AQUIS:GSVR)(OTCQX:GSVRF) is pleased to provide drill results from the Company's wholly owned San Ignacio mine ("San Ignacio") in Guanajuato, Mexico.

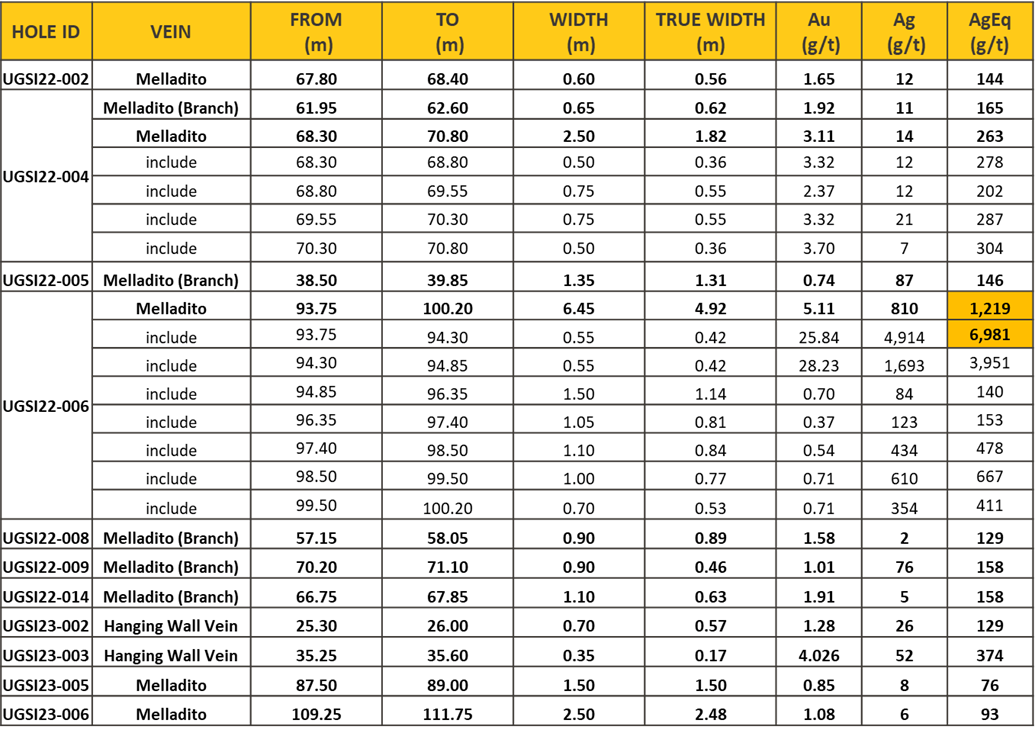

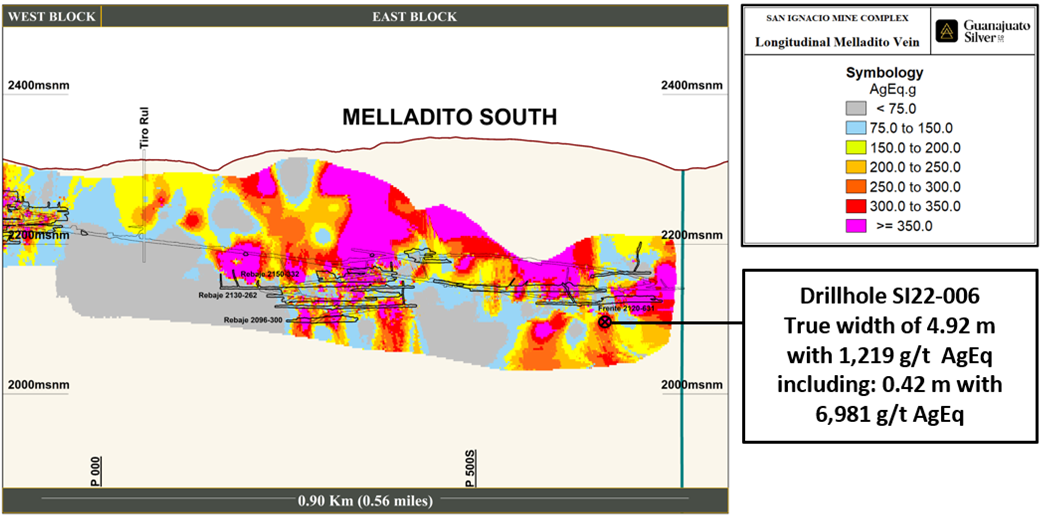

James Anderson, Chairman and CEO said, "SI22-006 is the best drill hole the Company has drilled at any of its mines recently acquired from Great Panther Mining in August of 2022. With almost five meters of true width intersecting 1,219 g/t AgEq, which includes 0.42m true width of 6,981 g/t AgEq, this may represent a game changing result for the mine. The primary focus of our most recent San Ignacio drill program was to target the Melladito vein system with the goal of extending silver and gold mineralization in the south and north areas of the mine. This outstanding result will be followed up with additional drill holes attempting to follow the down dip extension of the vein within the Company's 2023 drill campaign. In parallel, we are in the midst of driving a 400-metre access ramp from Melladito to the analogous Purisima vein, which offers the potential for expanded production at San Ignacio."

The Melladito vein dips to the east, with a true width ranging from 0.25 m to over 19 m; the vein has been delineated to a depth of 350 metres but retains deeper potential. Additionally, the vein often returns proportionately higher gold with lesser silver values. Current production from San Ignacio comes mostly from the Melladito and the Nombre de Dios vein systems.

Note: All silver equivalent (AgEq) values are calculated based on a long-term gold to silver price ratio of 80:1. Abbreviations used in this news release include the following: g/t: grams per tonne; Au: gold; Ag: silver; m: metre, AgEq: silver equivalent.

New Ramp to Purisima Vein

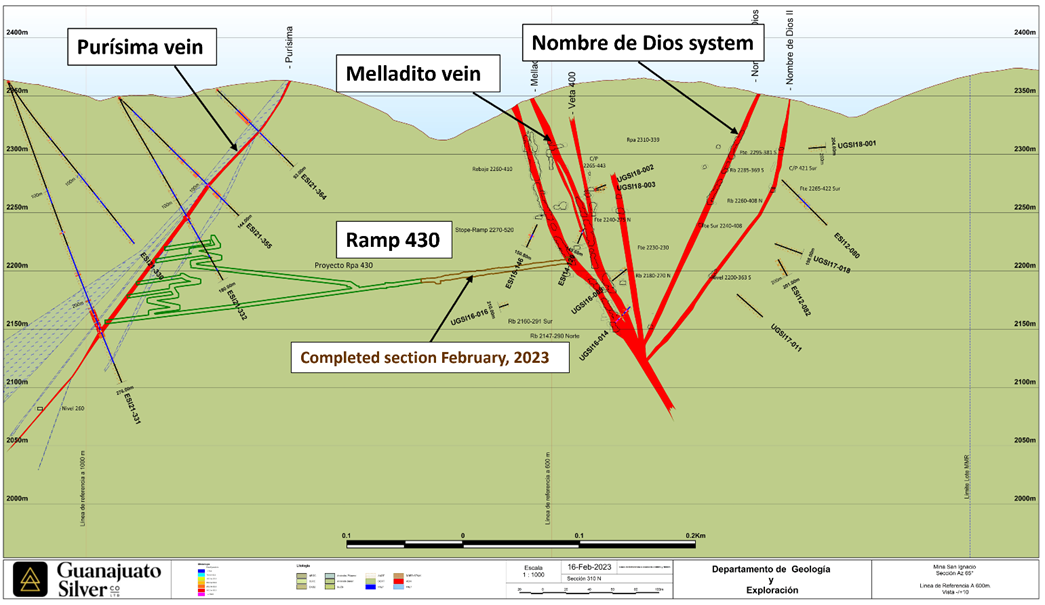

As part of the Company's 2023 development program, GSilver is currently developing Ramp 430, which will allow for development and production from the Purisima vein located approximately 400 metres to the east of the Melladito vein; approximately 40% of Ramp 430 has been completed (see Figure 1 below). The Purisima vein mirrors the Melladito vein system and has the potential to considerably impact production as well as overall mine life once the vein is encountered. The new ramp is expected to be finished within six months, which will facilitate production of mineralized material from San Ignacio at an expanded rate of over 12,000 tonnes per month.

Figure 1 - Cross Section of the Ramp 430 Project

Figure 2 - Long Section Melladito Vein - Drillhole SI22-006 Highlighted

About the San Ignacio Mine

Mineralization at San Ignacio is consistent with high-grade epithermal vein systems that are common within the Guanajuato Mining District; silver and gold mineralization is contained within vein stockworks and breccias. To date, eighteen veins have been defined at San Ignacio. Once mined, mineralization is transported using 20-tonne trucks approximately 20km for processing at the Company's wholly-owned Cata mill at the Valenciana Mines Complex.

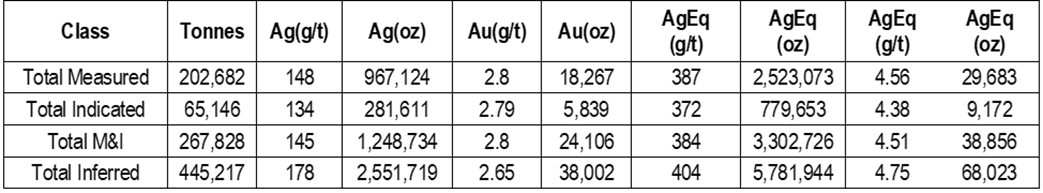

New Resource Calculation Initiated

The Company also confirms that APEX Geoscience Ltd. of Edmonton, Alberta, Canada ("Apex"), has been engaged to provide a current mineral resource estimate for San Ignacio; the new mineral calculation is expected to be completed by Q3, 2023. A historical resource estimate at San Ignacio was completed by Robert F. Brown and Mohammad Noupour on behalf of Great Panther Mining Limited effective July 31, 2021 as part of a "NI 43-101 Mineral Resource Update Technical Report on the Guanajuato Mine Complex, Guanajuato and San Ignacio Operations, Guanajuato State, Mexico" dated February 28, 2022 (the ‘Great Panther Report") and is summarized below:

- Notes:

- Cut-offs were based on the marginal operating costs per mining area being USD$127.40/tonne for San Ignacio.

- Block model grades converted to USD$ value using plant recoveries of 87.15% Ag, 86.70% Au, and net smelter terms negotiated for concentrates.

- Rock Density for San Ignacio is 2.64t/m³,

- Totals may not agree due to rounding.

- Grades in metric units.

- Contained silver and gold in troy ounces.

- Minimum true width 0.5m.

- Metal Prices USD$20.00/oz silver, and USD$1,650.00/oz gold.

- AgEq oz were calculated using 85:1 Ag:Au ratio.

- Inferred Mineral Resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or part of the Inferred Mineral Resources will ever be upgraded to a higher category.

- Mineral Resources that are not Mineral Reserves have no demonstrated economic viability. The potential quantity and grade is conceptual in nature, there has been insufficient exploration to define a Mineral Resource and it is uncertain if further exploration will result in the target being delineated as a Mineral Resource.

GSilver is not treating this historical estimate as current mineral resources, as a qualified person on behalf of GSilver has not done sufficient work to classify these estimates as current mineral resources. A thorough review by Apex of all historic data as well as additional production (mining depletion), drilling and underground sampling completed at San Ignacio since July 31, 2021, along with additional exploration and validation work to confirm results and estimation parameters, will be required in order to produce a current mineral resource estimate for San Ignacio. See the Great Panther Report, a copy of which is available for review under Great Panther's profile on SEDAR, for details of the key assumptions, parameters, and methods used to prepare the above historical resource estimate.

Sampling and quality assurance/quality control

Drill core was first reviewed by a Company geologist, who identified and marked intervals for sampling. The marked sample intervals were then cut in half with a diamond saw; half of the core was left in the core box and the other half was removed, placed in plastic bags, sealed and labeled. Intervals and unique sample numbers are recorded on the drill logs and the samples are sequenced with standards and blanks inserted according to a predefined QA/QC procedure. The samples are maintained under security on site until they are shipped to the analytical lab. The analytical work reported on herein was performed by Corporacion Quimica Platinum S.A de C.V., Silao, Guanajuato, Mexico. To validate our assay results and our preparation procedures, GSilver sends additional random samples representing approximately 20% of all analytical samples to Bureau Veritas in Hermosillo, Sonora, Mexico. Bureau Veritas is an ISO/IEC (International Organization for Standardization/International Electrotechnical Commission) geo-analytical laboratory and is independent of GSilver and its "qualified person". In order to further validate our assay results and our preparation procedures GSilver sent additional random samples representing approximately 10% of all analytical samples to SGS Mexico, S.A de C.V, Durango, Mexico. SGS is also an ISO/IEC geo-analytical laboratory and is independent of GSilver and its "qualified person". Core samples were subject to crushing at a minimum of 70 per cent passing two millimeters, followed by pulverizing of a 250-gram split to 85 per cent passing 75 microns. Gold determination was via standard atomic absorption (AA) finish 30-gram fire assay (FA) analysis, in addition to silver and 34-element using fire assay and gravimetry termination. Following industry-standard procedures, blank and standard samples were inserted into the sample sequence and sent to the laboratory for analysis. Data verification of the analytical results included a statistical analysis of the standards and blanks that must pass certain parameters for acceptance to ensure accurate and verifiable results. GSilver detected no significant QA/QC issues during review of the data and is not aware of any sampling, recovery or other factors that could materially affect the accuracy or reliability of the drilling data referred to herein.

About Guanajuato Silver

GSilver is a precious metals producer engaged in reactivating past producing silver and gold mines in central Mexico. The Company produces silver and gold concentrates from the El Cubo Mine, Valenciana Mines Complex, and the San Ignacio mine; all three mines are located within the state of Guanajuato, which has an established 480-year mining history. Additionally, the Company produces silver, gold, lead, and zinc concentrates from the Topia mine in northwestern Durango. With four operating mines and three processing facilities, Guanajuato Silver is one of the fastest growing silver producers in Mexico.

Technical Information

Reynaldo Rivera, VP of Exploration of GSilver, has approved the scientific and technical information contained in this news release. Mr. Rivera is a member of the Australasian Institute of Mining and Metallurgy (AusIMM - Registration Number 220979) and a "qualified person" as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects.

ON BEHALF OF THE BOARD OF DIRECTORS

"James Anderson"

Chairman and CEO

For further information regarding Guanajuato Silver Company Ltd., please contact:

JJ Jennex, Gerente de Comunicaciones, T: 604 723 1433

E: jjj@GSilver.com

Gsilver.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains certain forward-looking statements and information, which relate to future events or future performance including, but not limited to, the identification of the Melladito vein system as a gold and silver rich vein system with the potential for deeper mineralization, the potential of the Purisima vein as an analogue to the Melladito vein system with the ability to expand production at San Ignacio to more than 12,000 tonnes per month and extend the existing mine life, the estimated timetable for completion of Ramp 430 to connect the Purisima and Melladito veins and the anticipated increase in production resulting therefrom, the ability of the Company to quickly assess the deeper mineralization and characteristics of the Melladito vein system and the timing and quantity of production therefrom, the Company's current and projected mined output from San Ignacio for 2023 and the Company's status as one of the fasting growing silver producers in Mexico, the ability of the Company to continue to increase production, tonnage and recoveries of mineralized material at San Ignacio, Valenciana, El Cubo and Topia in accordance with its objectives and timetable including increasing silver and gold grades, improving metallurgical recovery rates, increasing revenues, and reducing production costs (including AISC) consistent with the Company's expectations and production model, the Company's future development and production activities; estimates of mineral resources and mineralized material at the Company's mining projects and the accessibility, attractiveness, mineral content and metallurgical characteristics thereof; the opportunities for future exploration, development and production at the Company's mines including the Melladito, Nombre de Dios and Purisima veins at San Ignacio and the proposed exploration, development and production programs therefor and the timing and costs thereof; and the success related to any future exploration, development and/or production programs.

Such forward-looking statements and information reflect management's current beliefs and are based on information currently available to and assumptions made by the Company; which assumptions, while considered reasonable by the Company, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include: the potential quantity, grade and metal content of the mineralized material at the Melladito, Nombre de Dios and Purisima veins, the geotechnical and metallurgical characteristics of such material conforming to sampled results and metallurgical performance; available tonnage of mineralized material to be mined and processed; resource grades and recoveries; assumptions and discount rates being appropriately applied to production estimates; prices for silver, gold and other metals remaining as estimated; currency exchange rates remaining as estimated; availability of funds for the Company's projects and to satisfy current liabilities and obligations including debt repayments; capital, decommissioning and reclamation estimates; prices for energy inputs, labour, materials, supplies and services (including transportation) and inflation rates remaining as estimated; no labour-related disruptions; no unplanned delays or interruptions in scheduled construction and production; all necessary permits, licenses and regulatory approvals are received in a timely manner; and the ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

Readers are cautioned that such forward-looking statements and information are neither promises nor guarantees, and are subject to risks and uncertainties that may cause future results, level of activity, production levels, performance or achievements of GSilver to differ materially from those expected including, but not limited to, market conditions, availability of financing, currency rate fluctuations, rising inflation and interest rates, geopolitical conflicts including wars, actual results of exploration, development and production activities, actual resource grades and recoveries of silver, gold and other metals from the Melladito, Nombre de Dios and Purisima veins or otherwise, availability of third party mineralized material for processing, unanticipated geological or structural formations and characteristics, environmental risks, future prices of gold, silver and other metals, operating risks, accidents, labor issues, equipment or personnel delays, delays in obtaining governmental or regulatory approvals and permits, inadequate insurance, and other risks in the mining industry. There are no assurances that GSilver will be able to continue to increase production, tonnage milled and recoveries rates, improve grades and reduce costs at San Ignacio to process mineralized materials to produce silver, gold and other concentrates in the amounts, grades, recoveries, costs and timetable anticipated. In addition, GSilver's decision to process mineralized material from San Ignacio including the Melladito and Nombre de Dios vein systems and newly discovered Purisima vein is not based on a feasibility study of mineral reserves demonstrating economic and technical viability and therefore is subject to increased uncertainty and risk of failure, both economically and technically. Mineral resources and mineralized material that are not Mineral Reserves do not have demonstrated economic viability, are considered too speculative geologically to have the economic considerations applied to them, and may be materially affected by environmental, permitting, legal, title, socio-political, marketing, and other relevant issues. There are no assurances that the Company's projected grades of gold and silver at the Melladito, Nombre de Dios and Purisima veins and the anticipated level of production therefrom will be realized. In addition, there are no assurances that the Company will meet its production forecasts or generate the anticipated cash flows from operations to satisfy its scheduled debt payments or other liabilities when due or meet financial covenants to which the Company is subject or to fund its exploration programs and corporate initiatives as planned. There is also uncertainty about the continued spread and severity of COVID-19, the ongoing war in Ukraine and rising inflation and interest rates and the impact they will have on the Company's operations, supply chains, ability to access mining projects or procure equipment, contractors and other personnel on a timely basis or at all and economic activity in general. Accordingly, readers should not place undue reliance on forward-looking statements or information. All forward-looking statements and information made in this news release are qualified by these cautionary statements and those in our continuous disclosure filings available on SEDAR at www.sedar.com including the Company's annual information form for the fiscal year ended December 31, 2021. These forward-looking statements and information are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances save as required by law.

SOURCE: Guanajuato Silver Company Ltd.

View source version on accesswire.com:

https://www.accesswire.com/740449/Guanajuato-Silver-Drills-6981-gt-AgEq-at-San-Ignacio-and-Prepares-to-Expand-Production